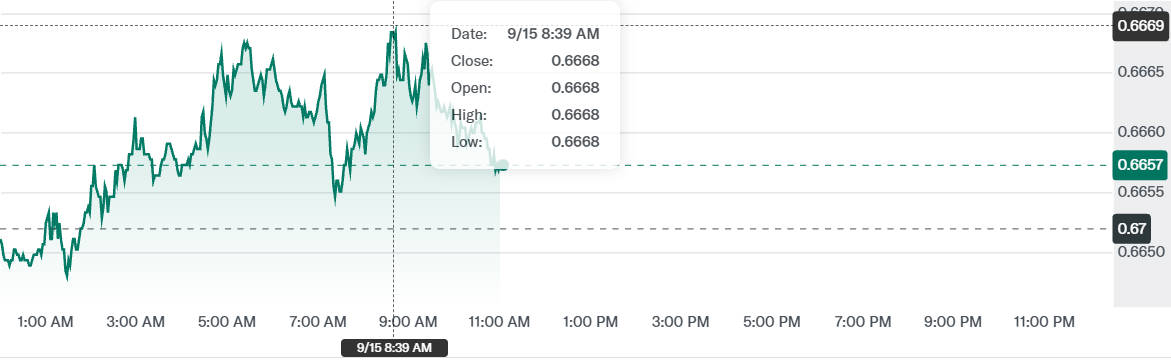

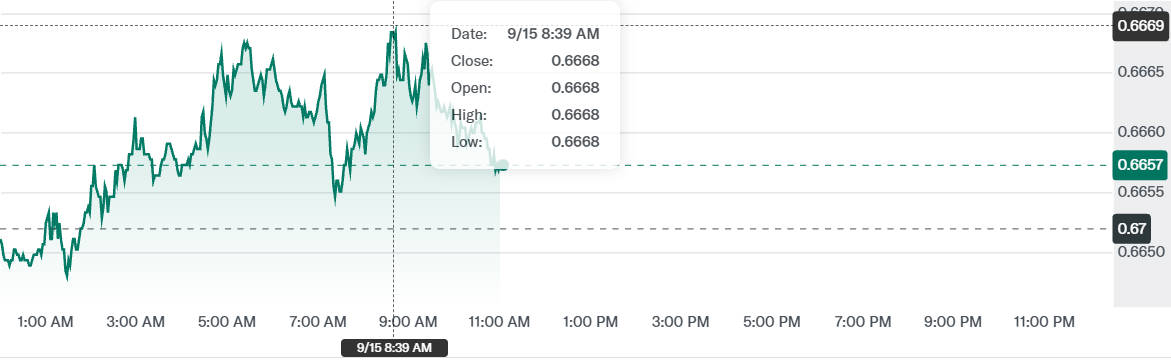

As of 15 September 2025. the Australian dollar (AUD) reached a 10-month high against the US dollar (USD), trading at 0.6669.

This surge has prompted hedge funds to significantly increase their bullish positions on the AUD, particularly through call options, indicating strong market confidence in the currency's continued strength.

Factors Driving the AUD's Appreciation

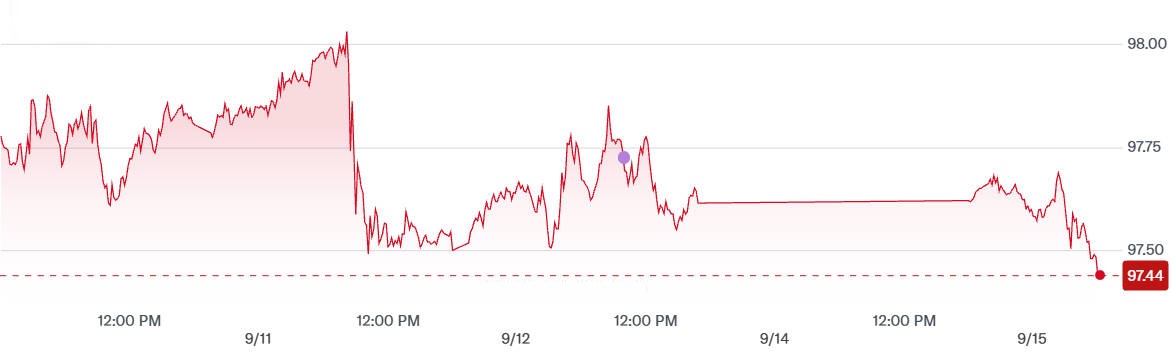

1. Weakening US Dollar

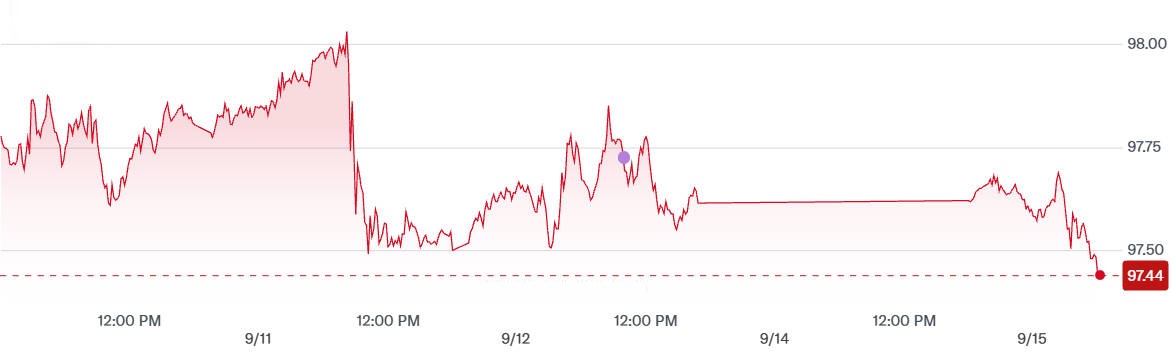

The USD has experienced a decline due to a combination of factors, including rising jobless claims and moderate inflation data. These developments have reinforced expectations of a Federal Reserve interest rate cut, which has diminished the USD's appeal among investors.

2. Robust Australian Economic Indicators

Australia's economic performance has outpaced expectations, with strong household consumption and economic growth. Additionally, the Reserve Bank of Australia's (RBA) hawkish stance on monetary policy has bolstered investor confidence in the AUD.

3. Commodity Price Strength

The prices of key Australian exports, such as iron ore and gold, have remained strong. This has supported the AUD, as higher commodity prices typically lead to increased export revenues and a stronger currency.

Hedge Fund Activity and AUD Options

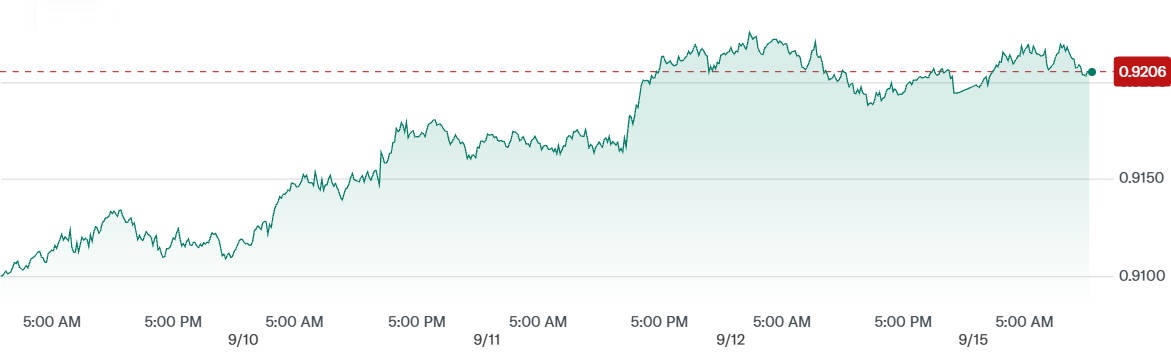

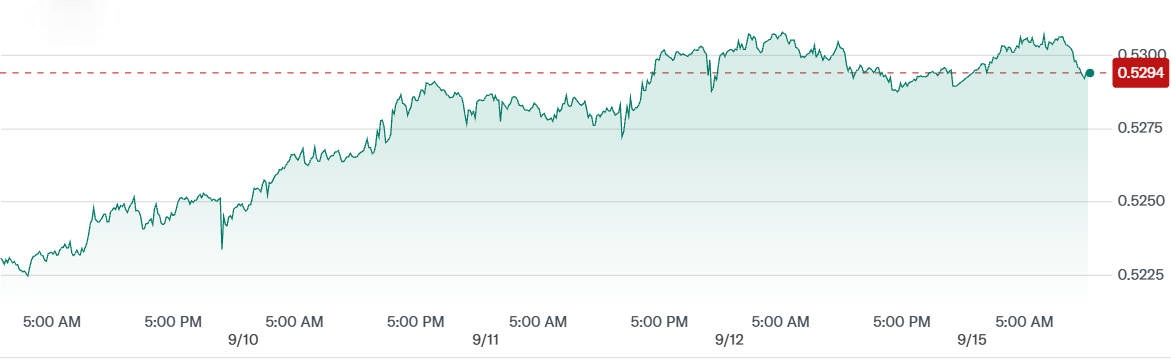

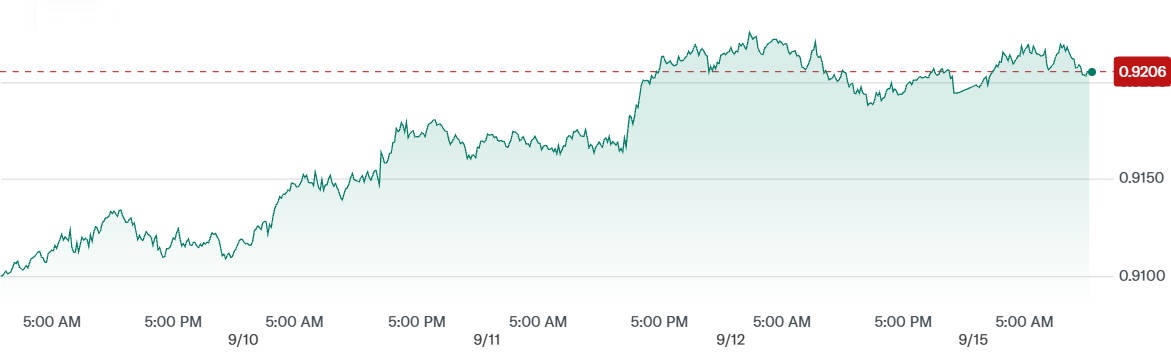

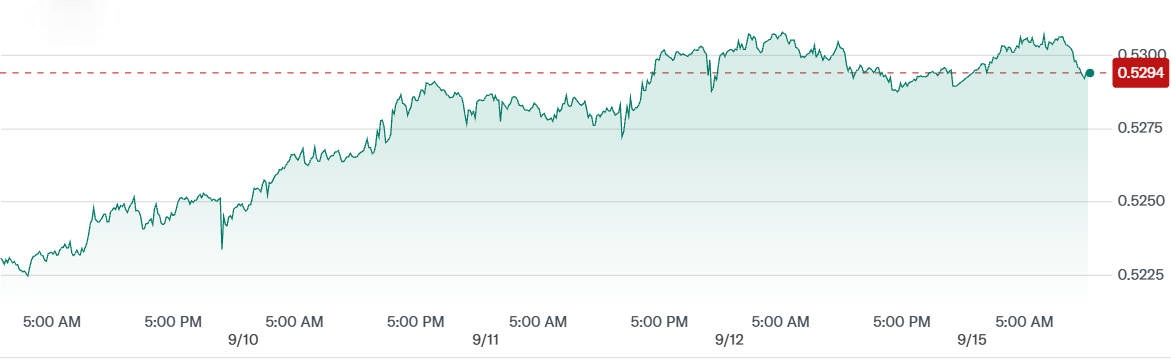

Hedge funds have actively increased bullish positions in AUD, particularly through call options on AUD/USD, AUD/CAD, and AUD/CHF.

Data from the Depository Trust & Clearing Corporation (DTCC) indicates that during the week of 12 September, AUD/USD call option volumes were three times higher than put options, with transactions exceeding A$150 million (approx. US$100 million).

Market analysts suggest that hedge funds are positioning for continued appreciation of the AUD, leveraging options strategies to capitalise on potential short-term gains.

Performance of AUD Against Major Currencies

1) AUD/USD:

As of 15 September, 0.6652 USD, the AUD reached 0.6669 USD, its highest since November 2024.

2) AUD/CAD:

The AUD has strengthened against the Canadian dollar, aided by weaker-than-expected Canadian economic growth and employment data. Markets are pricing in a higher probability of a 25-basis-point interest rate cut by the Bank of Canada.

3) AUD/CHF:

The AUD has risen to a multi-month high versus the Swiss franc, following statements from the Swiss National Bank indicating potential rate reductions if economic conditions require.

Near-Term Outlook for the Australian Dollar

Economists expect the AUD to remain supported in the near term. Key factors include:

Ongoing robust Australian economic performance

Continued strength in commodity prices

Potential USD weakness due to anticipated Federal Reserve policy adjustments

However, investors should remain cautious. Global economic uncertainties, sudden shifts in commodity markets, or unexpected policy changes by central banks could affect the AUD's trajectory.

Conclusion

The Australian dollar's recent surge, coupled with increased hedge fund bullishness, underscores a positive outlook for the currency. While the current trend is favourable, ongoing monitoring of economic indicators and global market conditions is essential for assessing the sustainability of the AUD's strength.

Frequently Asked Questions

1. What is driving the recent surge in the AUD?

The AUD has risen due to a combination of a weakening US dollar, strong Australian economic data, rising commodity prices, and the Reserve Bank of Australia's hawkish monetary stance.

2. How are hedge funds influencing the AUD?

Hedge funds have increased their bullish positions in AUD, particularly through call options on AUD/USD, AUD/CAD, and AUD/CHF, signalling strong confidence in continued appreciation.

3. How does the AUD perform against other major currencies?

Alongside USD, the AUD has strengthened against the Canadian dollar (CAD) and Swiss franc (CHF), reaching multi-month highs against both.

4. What factors could affect the AUD in the near term?

Key influences include US monetary policy, global commodity prices, economic growth in Australia and trading partners, and market sentiment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.