The pound has continued its advance against the yen, with GBP/JPY holding above the 200.50 mark, its highest point in over a year. The move reflects persistent sterling strength alongside a subdued yen, as markets weigh upcoming decisions from the Bank of England (BoE) and the Bank of Japan (BoJ).

Sterling Supported by Policy Expectations

The pound has found steady demand as investors scale back expectations of near-term BoE easing. While the latest UK GDP reading showed stagnation, it was not weak enough to tilt the balance towards early rate cuts. This has kept sterling on firmer ground, with inflation and labour data likely to play a decisive role in shaping the BoE's guidance.

Yen Struggles Amid BoJ Caution

The yen remains under pressure as traders continue to question the pace of BoJ policy normalisation.

Despite speculation that adjustments may come later in the year, the September meeting is widely expected to leave rates unchanged. The lack of imminent action contrasts sharply with the BoE's cautious stance, leaving GBP/JPY tilted upward.

Influence of Broader Market Sentiment

Risk appetite has also supported the cross. Softer expectations for US Federal Reserve tightening have eased global financial conditions, reducing safe-haven flows into the yen. This dynamic has amplified sterling's relative strength, particularly as equity markets remain resilient.

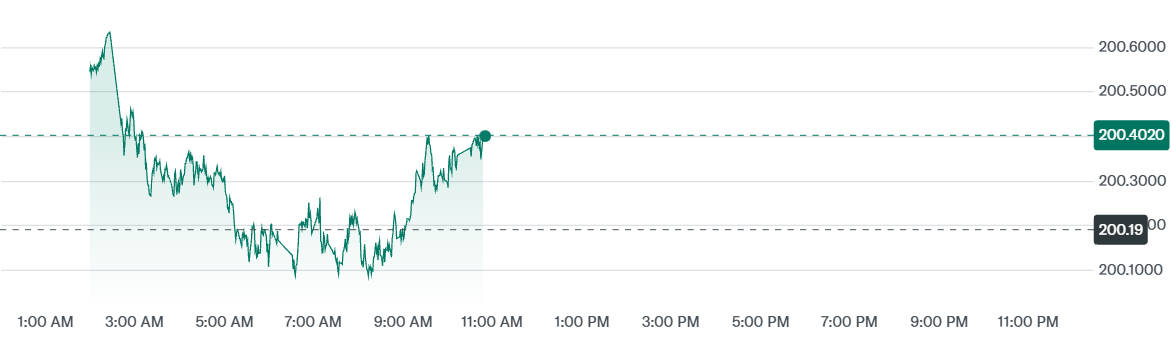

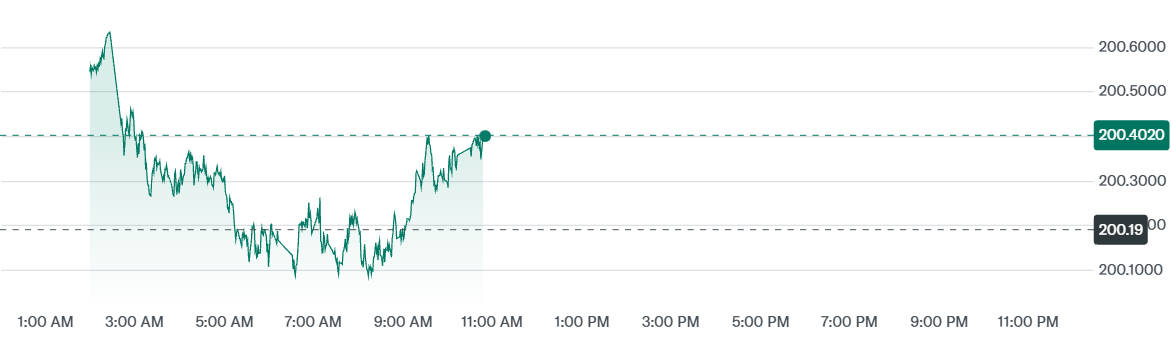

Technical Levels to Watch

GBP/JPY has consolidated above the 200.00 psychological threshold, turning it into a key support zone. Near-term resistance is identified around 200.50. with analysts pointing to a potential move toward 204.00–204.20 if momentum continues.

On the downside, a slide below 199.50 could open the door for a correction towards the 195.00–197.00 range.

Risks That Could Shift the Balance

Several factors could quickly change the picture. Strong UK inflation or jobs data would reinforce expectations that the BoE will maintain higher rates for longer, underpinning sterling.

Conversely, disappointing figures could weaken the pound. On the Japanese side, any unexpected hawkish signal from the BoJ would provide a boost to the yen. Finally, a shift in global risk sentiment—such as a sudden equity sell-off—could revive safe-haven demand for the yen, tempering GBP/JPY's rally.

Outlook

In the near term, GBP/JPY is likely to remain buoyant as long as sterling stays supported and the BoJ avoids surprise policy changes. A break above 200.50 would strengthen the case for further gains towards 204.00. while any signs of dovishness from the BoE or hawkishness from the BoJ could trigger a pullback.

Conclusion

GBP/JPY's climb above 200 marks a significant moment for the pair, reflecting both relative economic performance and diverging monetary policy paths. The direction from here will hinge on data releases and central bank commentary, with traders closely watching whether sterling can maintain its edge over the yen.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.