Exchange-traded funds, or ETFs, have become increasingly popular with investors of all kinds, from first-timers to seasoned professionals. But not all ETFs are the same. One of the most common distinctions you'll come across is between active and passive ETFs. While both aim to give you exposure to various assets like stocks or bonds, the way they're managed, and the results they deliver, can be quite different. Understanding these differences is crucial if you want to make informed decisions about where to put your money.

How Active and Passive ETFs Differ in Management Style

The main difference between active and passive ETFs lies in how they're managed. Passive ETFs are designed to follow an index. They don't try to beat the market, they try to mirror it. For example, a passive ETF might track the FTSE 100. holding the same companies in the same proportions as the index itself. It's a straightforward, rules-based approach with minimal human intervention.

Active ETFs, on the other hand, are run by fund managers who make day-to-day decisions about what to buy and sell. Their aim is to outperform the market, not just follow it. That might sound more appealing, after all, who wouldn't want better returns? But this approach involves more analysis, more trading, and, as we'll see, higher costs.

So, the key distinction boils down to this: passive ETFs follow a fixed strategy with limited management, while active ETFs rely on the skills (and decisions) of professionals who are trying to beat the benchmark.

Historical Returns of Active vs. Passive ETFs

When it comes to performance, you might assume that active ETFs consistently come out ahead. After all, they're managed by experts trying to spot opportunities and avoid losses. But surprisingly, the data doesn't always support that idea.

Over the long term, many passive ETFs have outperformed their active counterparts, especially after accounting for fees. One reason is that passive ETFs don't carry the cost of active management. Another is that beating the market consistently is extremely difficult, even for experienced professionals. In fact, multiple studies (including SPIVA reports) have shown that most actively managed funds fail to outperform their benchmarks over 10 years.

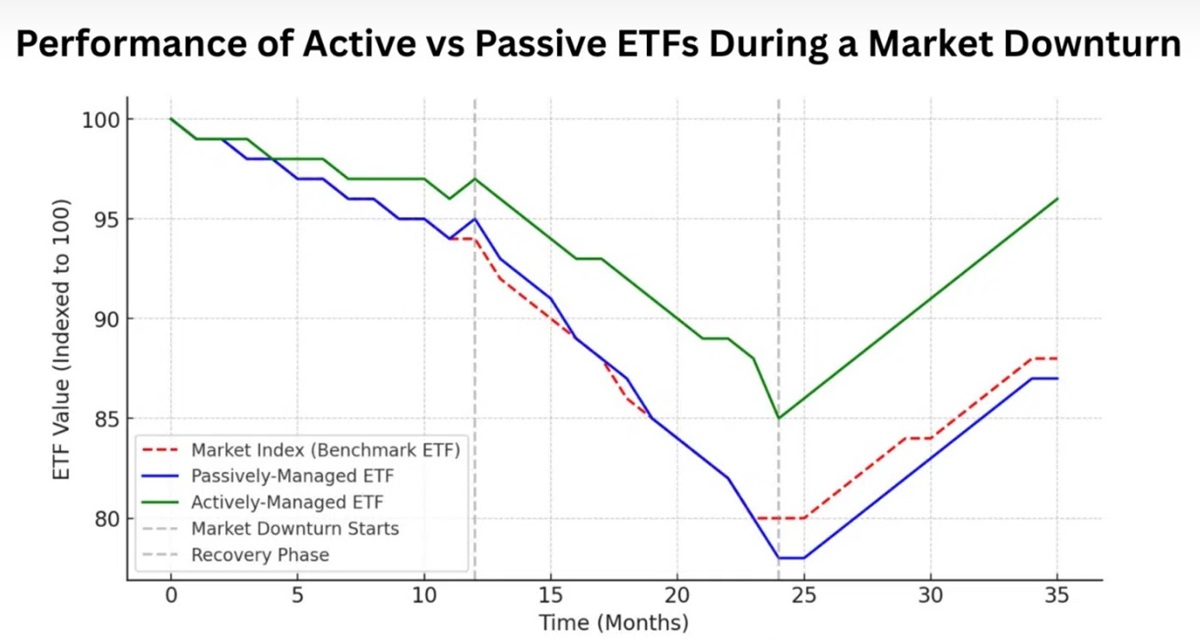

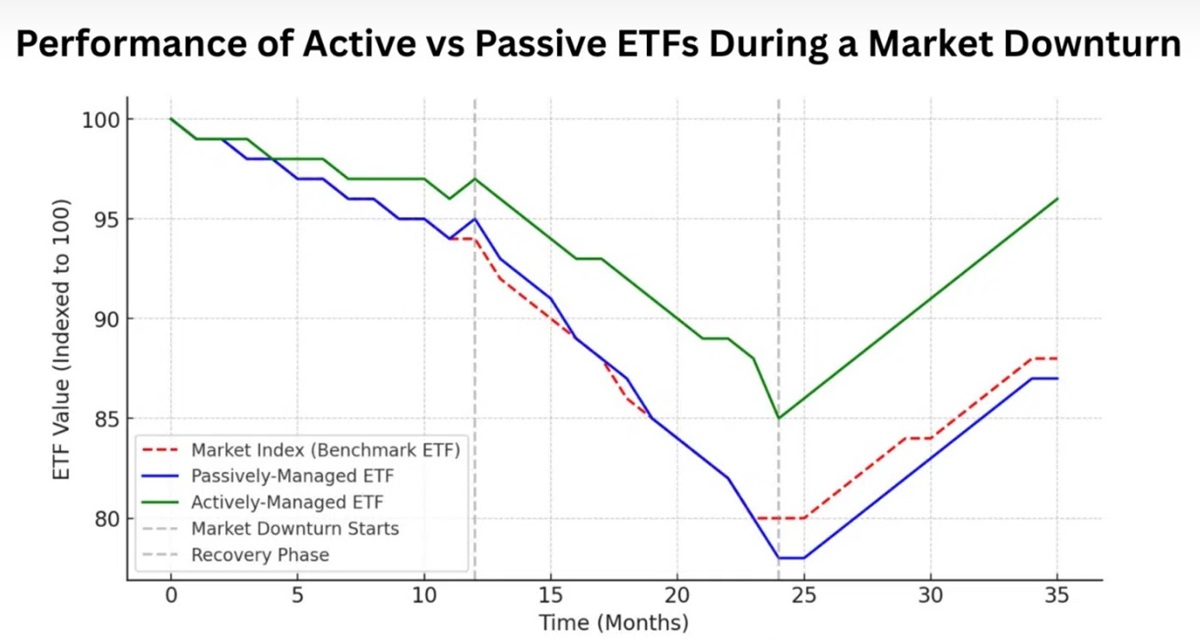

That's not to say active ETFs never do well. Some have outperformed in certain sectors or during specific market conditions. For example, in volatile or bear markets, skilled managers can sometimes navigate better than an index fund that has no choice but to follow the market down.

Why Passive ETFs Usually Have Lower Fees

One of the clearest advantages of passive ETFs is their cost. Because they follow a fixed index, there's no need to pay fund managers or teams of analysts to make decisions. This means lower expense ratios, often under 0.1% per year for popular funds. Vanguard and iShares, for instance, offer a wide range of passive ETFs at extremely low cost.

Active ETFs, by contrast, charge more, often between 0.5% and 1% annually. That may not sound like much, but over time, these fees can eat into your returns, especially if the fund isn't consistently outperforming the market.

In short, unless you have a strong reason to believe a particular active ETF can deliver superior performance, the cost difference alone makes passive ETFs more attractive to long-term investors.

Which Type Is More Stable or Aggressive

The level of risk you take on also differs between active and passive ETFs. Passive ETFs tend to be more stable because they simply track an index. You know what you're getting: broad exposure to a basket of stocks or bonds, with relatively low turnover.

Active ETFs are often more aggressive. Since fund managers are actively buying and selling in response to market conditions or forecasts, their portfolios can change significantly over time. That can lead to greater volatility, especially if the manager is taking concentrated positions or betting on specific themes.

It's also worth noting that no active strategy is immune to human error. A bad call or unexpected market move can lead to underperformance. On the flip side, active ETFs may offer downside protection in rough markets if the manager is skilled at reducing exposure or switching to defensive assets.

So, if you're looking for predictability and lower risk, passive might be your best bet. But if you're comfortable with a bit more uncertainty, and believe in the fund manager's strategy, active ETFs could offer higher rewards.

When to Choose Active vs. Passive ETFs for Your Portfolio

Deciding between active and passive ETFs often comes down to your investment goals, risk tolerance, and how hands-on you want to be. If you're investing for the long term, say, building a pension pot or saving for a house deposit, passive ETFs offer a low-cost, low-effort way to grow your wealth over time. They're ideal for buy-and-hold investors who don't want to worry about short-term market noise.

Active ETFs, however, might suit those who want more flexibility or exposure to niche sectors. For example, if you're interested in emerging technologies, disruptive innovation, or undervalued companies, you may find active funds that specifically target those opportunities. Active ETFs can also be useful in volatile markets, where professional oversight might help protect your capital better than a fixed index could.

Many investors find value in combining both. You might build a core portfolio with passive ETFs for stability and cost-efficiency, while using a few active ETFs to target higher-growth or thematic opportunities.

Conclusion

Active and passive ETFs each bring something different to the table. Passive funds are simple, cost-effective, and often hard to beat. Active ETFs offer the potential for higher returns and more strategic flexibility, but come with higher fees and greater risk. By understanding the differences, and how each type fits into your broader investment goals, you'll be far better equipped to make confident, informed choices. Whether you lean towards passive peace of mind or the potential upside of active management, the key is knowing what you're getting and why it works for you.

Active ETFs vs Passive ETFs: Quick Comparison

| Aspect |

Active ETFs |

Passive ETFs |

| Management |

Actively managed |

Follows an index |

| Objective |

Beat the market |

Match the market |

| Fees |

Higher |

Lower |

| Trading |

Frequent |

Minimal |

| Performance |

Can outperform or underperform |

Matches index performance |

| Transparency |

Less frequent disclosures |

Highly transparent |

| Risk |

Higher volatility possible |

Generally more stable |

| Tax Efficiency |

Lower |

Higher |

| Best For |

Short-term or niche strategies |

Long-term, low-cost investing |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.