The CAC 40 Index, meaning "Cotation Assistée en Continu," is the leading benchmark in France as it holds 40 of the largest and most liquid companies traded on Euronext Paris.

Regarded as an indicator of both European and global economic well-being, the CAC 40 showcases patterns in various sectors, including luxury, energy, finance, and industrials.

This article demystifies the CAC 40, breaks down its components and sector weightings, explores its role in global investing, and offers insights into how to use it in your portfolio.

What Is the CAC 40 Index?

The CAC 40 index is market-capitalisation-weighted, meaning larger companies exert more influence on its movements. Constituents are selected and assessed quarterly according to market capitalisation and daily liquidity, including free-float trading volume.

Euronext also applies a maximum constituent weighting rule, preventing any single stock from exceeding 15% at rebalance time.

Components are updated in March, June, September, and December to guarantee the index showcases the most active and largest companies. This rolling review maintains broad market representation and adjusts for corporate changes such as mergers or delistings.

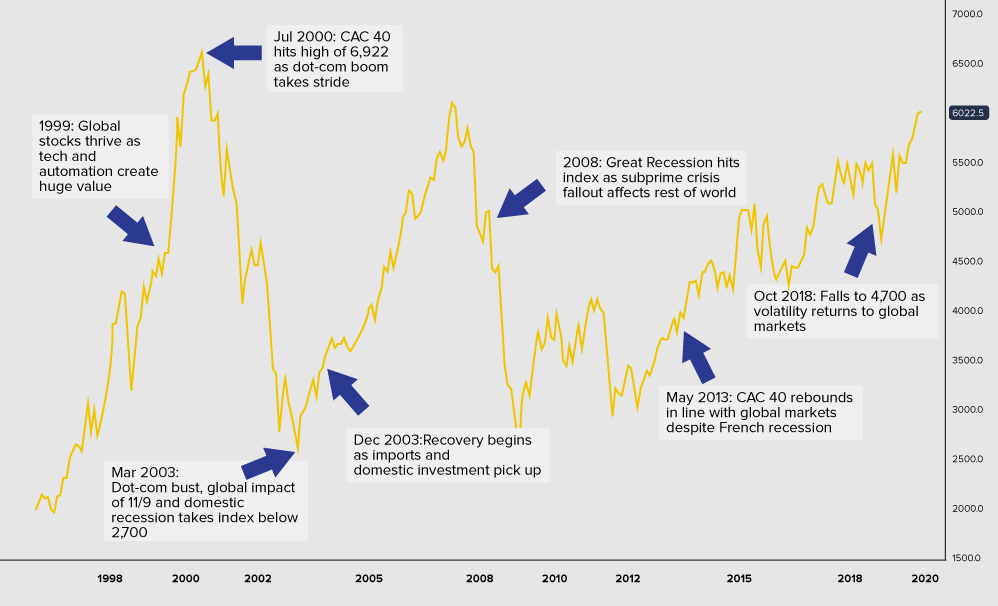

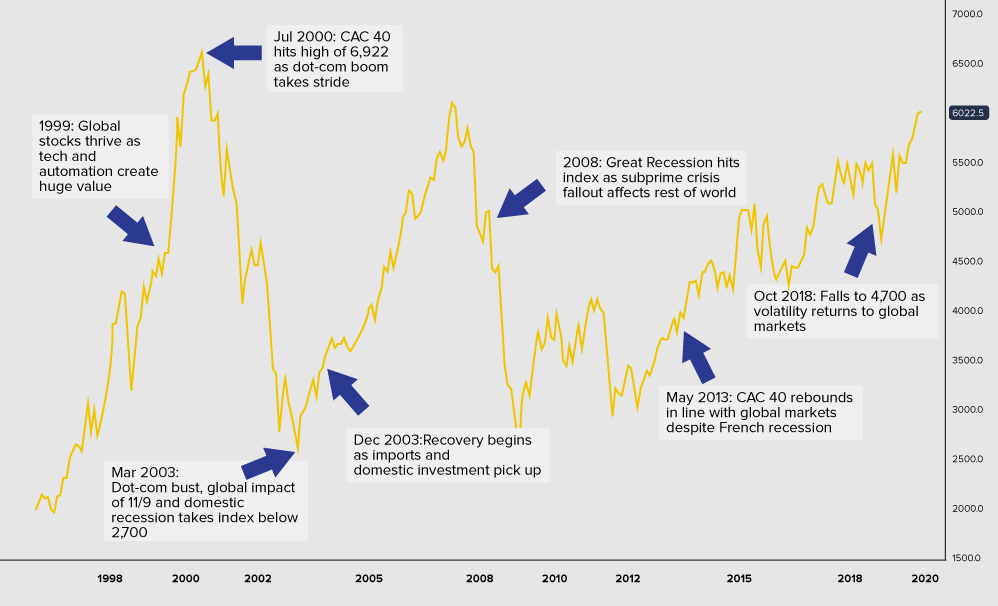

CAC 40 History and Evolution

Launched on December 31, 1987, the CAC 40 replaced earlier French stock indices and was designed to mirror real-time equity performance in France. Its continuous calculation model provides intraday quotes, echoing France's dynamic business environment.

Throughout the years, the CAC 40 has endured significant events, including the dot-com bubble burst, the 2008 financial meltdown, the European debt crisis, the pandemic, and the worldwide surge in ESG investing. Today, it represents a diversified mix of traditional blue-chip and innovative companies, marking France's central position in industry and finance.

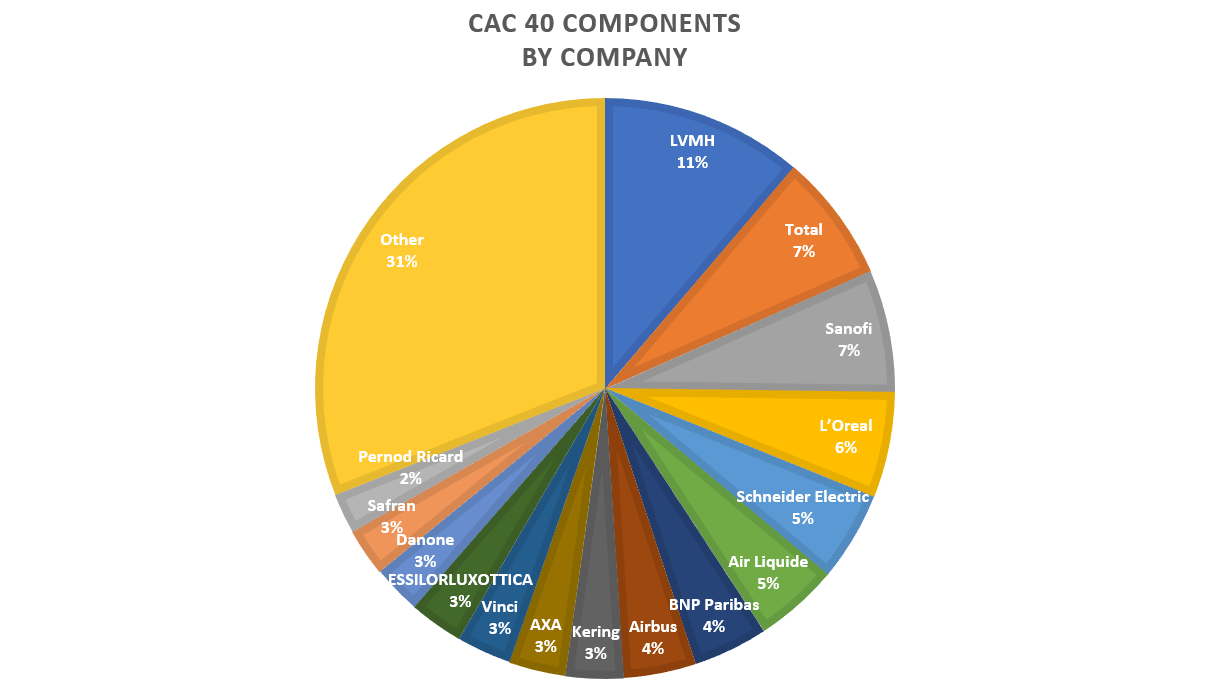

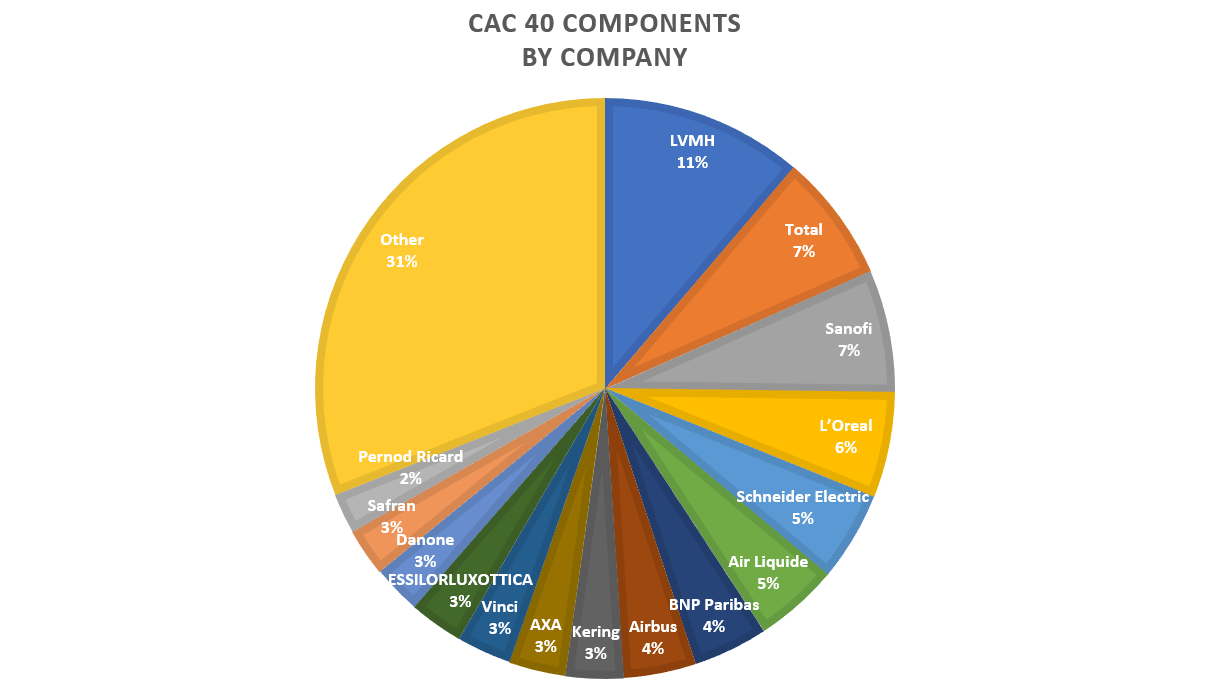

Major Components of the CAC 40

Below are several of the CAC 40's prominent members as of mid‑2025:

LVMH (Luxury Goods)

Sanofi (Pharmaceuticals)

TotalEnergies (Oil & Gas)

Airbus (Aerospace & Defence)

BNP Paribas (Banking & Financial Services)

Schneider Electric (Energy Management)

L'Oréal (Cosmetics)

These companies reflect sectors critical to France's economy. LVMH and L'Oréal showcase the nation's power in luxury and consumer exports.

Energy and industrial giants such as TotalEnergies and Airbus provide exposure to global commodity markets and infrastructure sectors. Pharmaceutical leaders like Sanofi bolster stability and dividends.

Sector Allocations within the CAC 40 Index

Although the CAC 40 covers 40 stocks, its sector exposure is concentrated. In 2025:

Consumer & Luxury: ~25%—led by LVMH, L’Oréal, Kering

Industry & Construction: ~15%—Airbus, Vinci, Saint‑Gobain

Energy & Utilities: ~15%—TotalEnergies, Engie, Veolia

Financials: ~15%—BNP Paribas, Société Générale, AXA

Health & Pharmaceuticals: ~10%—Sanofi, bioMérieux

Technology & Telecom: ~10%—Capgemini, Atos, Orange

Basic Materials & Mining: ~5%—ArcelorMittal, Air Liquide

The index's largest sectors—consumer and luxury, and financials—define its volatility and sensitivity to global demand, trade flows, and cyclical economic performance.

CAC 40 vs Other Global Equity Benchmarks

| Index |

Country |

Market Cap |

Main Strengths |

Key Differences |

| CAC 40 |

France |

~$1.8 trillion |

Luxury, energy, industrials |

Less tech exposure than U.S. indices |

| S&P 500 |

USA |

~$41 trillion |

Broad tech and consumer names |

Global dominant but highly tech-heavy |

| FTSE 100 |

UK |

~$2.9 trillion |

Energy and finance |

Strong energy weighting, fewer luxury names |

| DAX 40 |

Germany |

~$2.6 trillion |

Automobiles, industrials |

Germany’s engine for export-led growth |

In contrast with indices like the S&P 500, the CAC 40 lags in technology representation but compensates with France's core strengths: luxury, energy, and industrial exports.

Future Outlook

Bull Case

Global growth picks up, luxury demand recovers, energy prices remain stable, and European policy supports digital and green infrastructure. Estimated forward P/E rises and dividend yield holds steady around 2.5–3%, potentially offering 6–8% annual total returns through 2027.

Base Case

Gradual but consistent economic recovery, interest rate adjustments, and a mild equity upturn yielding 4–6% yearly returns.

Bear Case

Worldwide deceleration, euro's robustness impacting exporters, high inflation leading to ECB tightening—returns remain flat or fall within the low-single-digit spectrum.

How to Invest in the CAC 40

There are several accessible methods:

Index ETFs: iShares CAC 40 UCITS ETF (Euronext), Amundi ETFs track the index directly.

Index Futures: CAC 40 futures on Euronext for hedging or leveraging views.

CFDs and Derivatives: Retail exposure to CAC 40 by CFD brokers, such as EBC, often with margin.

European Equity Funds: Active or passive funds with heavy French allocation.

U.S. investors often access it via ADRs for French stocks or global ETFs with CAC 40 exposure. Always validate tracking errors, currency risks, and charges.

Strategies for Trading and Investing

A variety of strategies suit different investor profiles:

Long-term Core Exposure: Incorporate a CAC 40 ETF into a diversified portfolio for access to European equities.

Thematic Plays: Focus on luxury names (LVMH, Kering) for global consumer upside or play sovereign bond yield cycles via bankers like BNP Paribas.

Tactical Allocation: Rotate into industrials before earnings or enter energy names ahead of OPEC decisions.

Pairs Trading: Go long on Airbus while shorting U.S. aerospace firms to exploit relative regional performance.

Conclusion

In conclusion, the CAC 40 Index is a strong representation of France's economic landscape. For global investors seeking Eurozone exposure, cyclical diversification, and blue-chip income potential, it offers compelling value.

While it carries structural risks such as currency dynamics, slower tech growth, and EU-specific policies, its long-term potential remains attractive.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.