Trump declared the trade war with China "done" Wednesday, while Commerce

Secretary Howard Lutnick said tariffs on Chinese goods will be locked in at the

current 55% rate without additional increases.

China pledged to speed up shipments of rare earths to the US, while

Washington agreed to ease some of its own export controls. But Markets offers

few cheers to the announcement.

Strategists at Deutsche Bank refer to difficulty in resolving key issues in

2018. They add that the agreement skipped over fentanyl-related tariffs that

Trump implemented earlier this year.

US importers told CNBC the 55% rate is still way too high to resume full

orders. The latest data released showed a smaller-than-expected increase in

prices, though a spike is in the cards in the new few months.

The ISM Manufacturing PMI in the US fell to 48.5 in May, below market

expectations of 49.5. This marks a third consecutive month of contraction in the

sector – a heavy blow to the protectionist administration.

Recurring applications for unemployment benefits rose to the highest since

the end of 2021 in the week ended 31 May, suggesting that out-of-work people are

struggling to find employment.

Scott Wren at the Wells Fargo Investment Institute said there were still

plenty of risks in equities, such as additional trade negotiations, rising

inflation and growth slowing noticeably.

Feeble king dollar

Speculative traders held some $12.2 billion of short position the greenback,

according to CFTC data. Wall Street has been warning that the dollar has more

room to fall amid recession jitters.

Strategists at Pictet said they expect more weakness in the dollar over

"flip-flops" on tariffs as well as policies that could lead to a wider deficit.

They forecast gains in currencies from other developed economies going

forward.

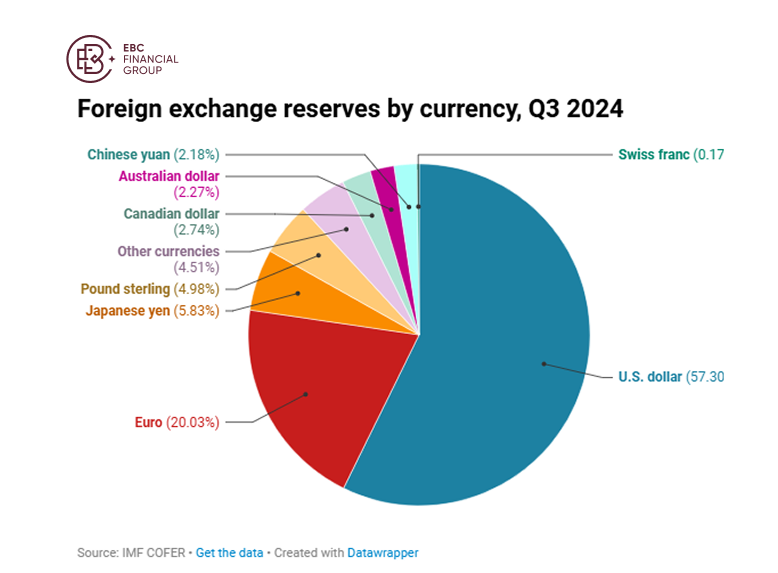

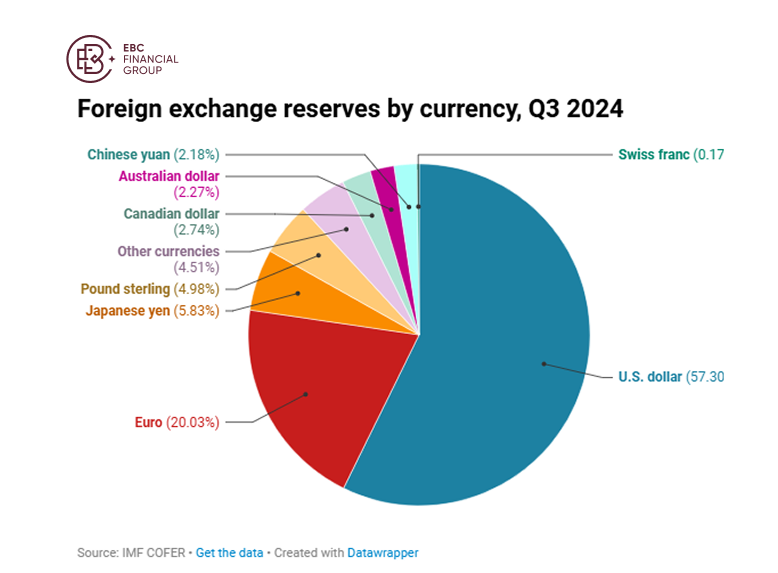

The share of the dollar in global foreign exchange reserves declining from

over 70% in 2000 to 57.8% in 2024. The shift is more pronounced in Asia as local

currencies are gaining popularity given FX risks.

Countries like China, Japan and Singapore own a large share of foreign

assets, giving them the greatest potential to repatriate their foreign earnings

or assets back home, according to Barclays.

Recently, the ASEAN showed commitment to boosting the use of local currencies

in trade and investment as part of its newly released Economic Community

Strategic Plan for 2026 to 2030.

Gold appears to be the biggest winner. It has overtaken the euro as the

world's second most important reserve asset for central banks, driven by record

purchases and soaring prices, according to the ECB.

The stock of gold held in official reserves worldwide is approaching the

historic highs of the postwar Bretton Woods era, though it seems challenging to

dethrone the greenback's position as the number one reserve asset.

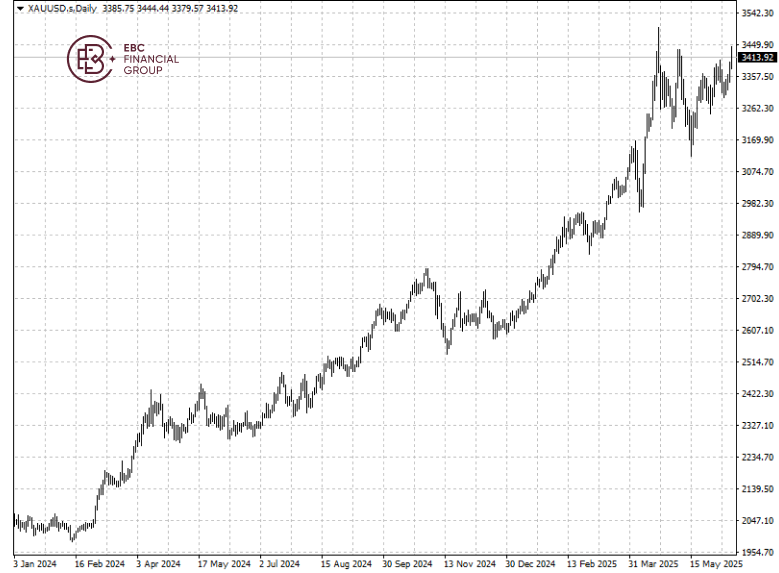

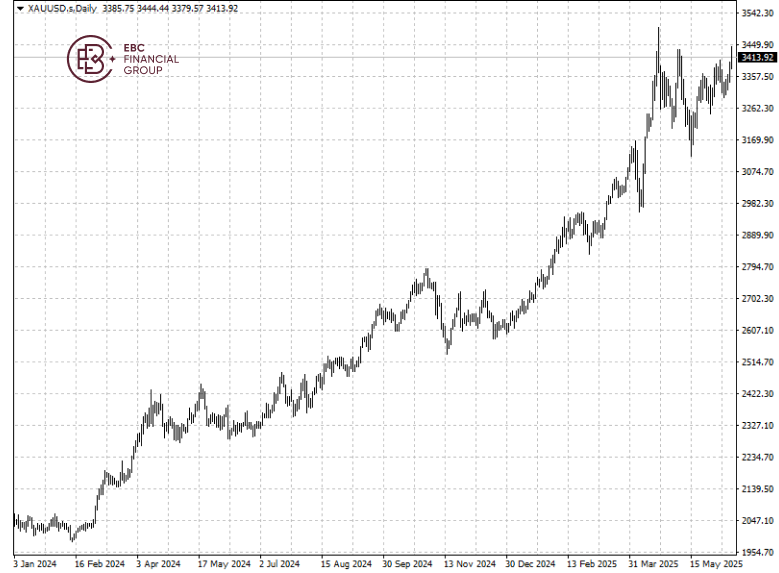

Gold rush

Gold prices climbed to their highest point in nearly two months on Friday as

Israel's strike on Iran heightened Middle East tensions. Meanwhile, the dollar

fell to its weakest level in three years.

A 30% rise in the gold price last year was one factor behind the latest gold

rush. Since the start of the year, the gold price has surged by another 27%,

hitting a historic high of $3,500.

Bullion is seen as the ultimate safe asset that is highly liquid, and neither

exposed to counterparty risk nor sanctions. The characteristics has captured

more attention after the US increasingly weaponized its currency.

Long-standing correlation between gold and real Treasury yields has broken

down since early 2022 in that the metal is now more used as a hedge against

political risk more than as a hedge against inflation.

White House envoy Steve Witkoff privately warned top Senate Republicans last

week that Iran could unleash a mass casualty response if Israel bombs their

nuclear facilities, according a source with direct knowledge.

That came when UN member nations voted overwhelmingly to demand an

unrestricted access for the delivery of desperately needed food to Gaza. Israel

insisted that aid is not being block.

Elsewhere Russia is slipping into dire stagflation with 1.4% GDP growth and

8.2% inflation rate in Q1. Kremlin may feel more tempted to ramps up attacks on

Ukraine to hasten the end of the lasting war.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.