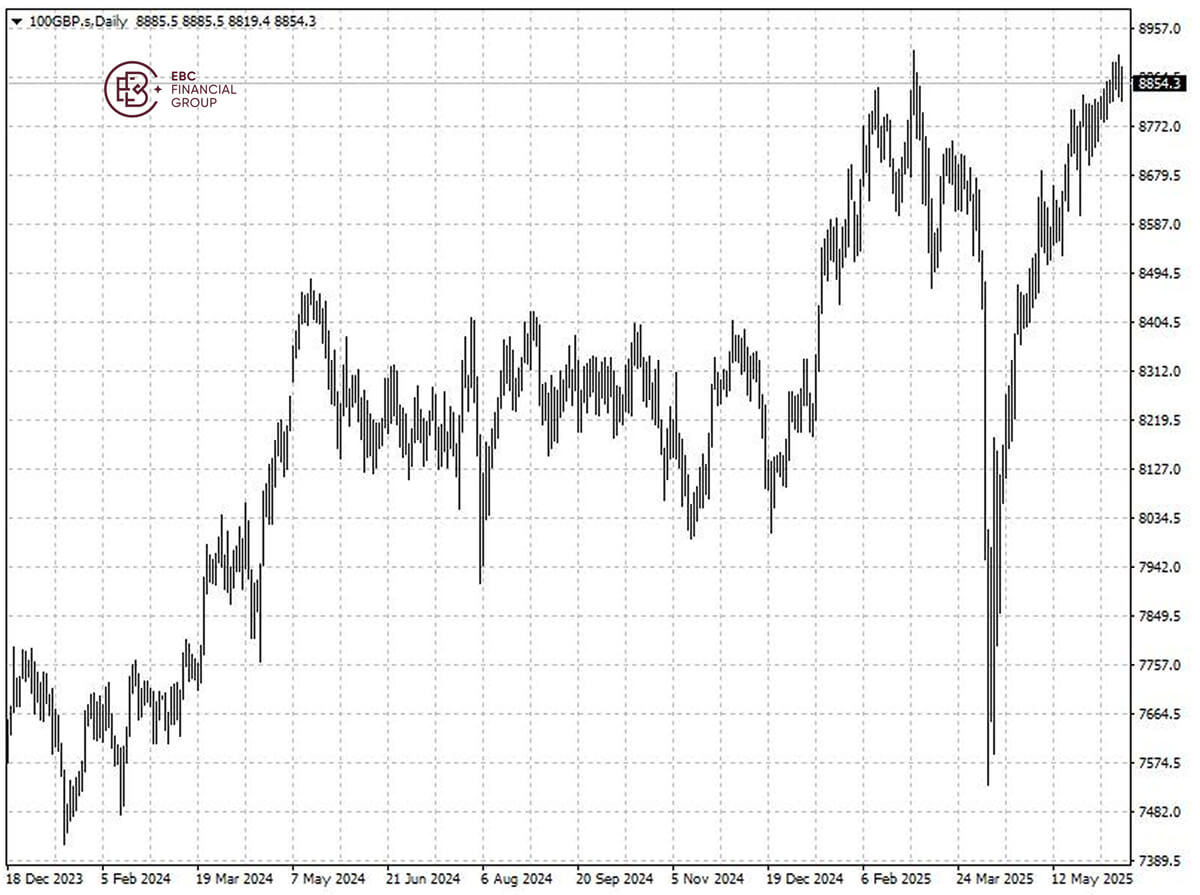

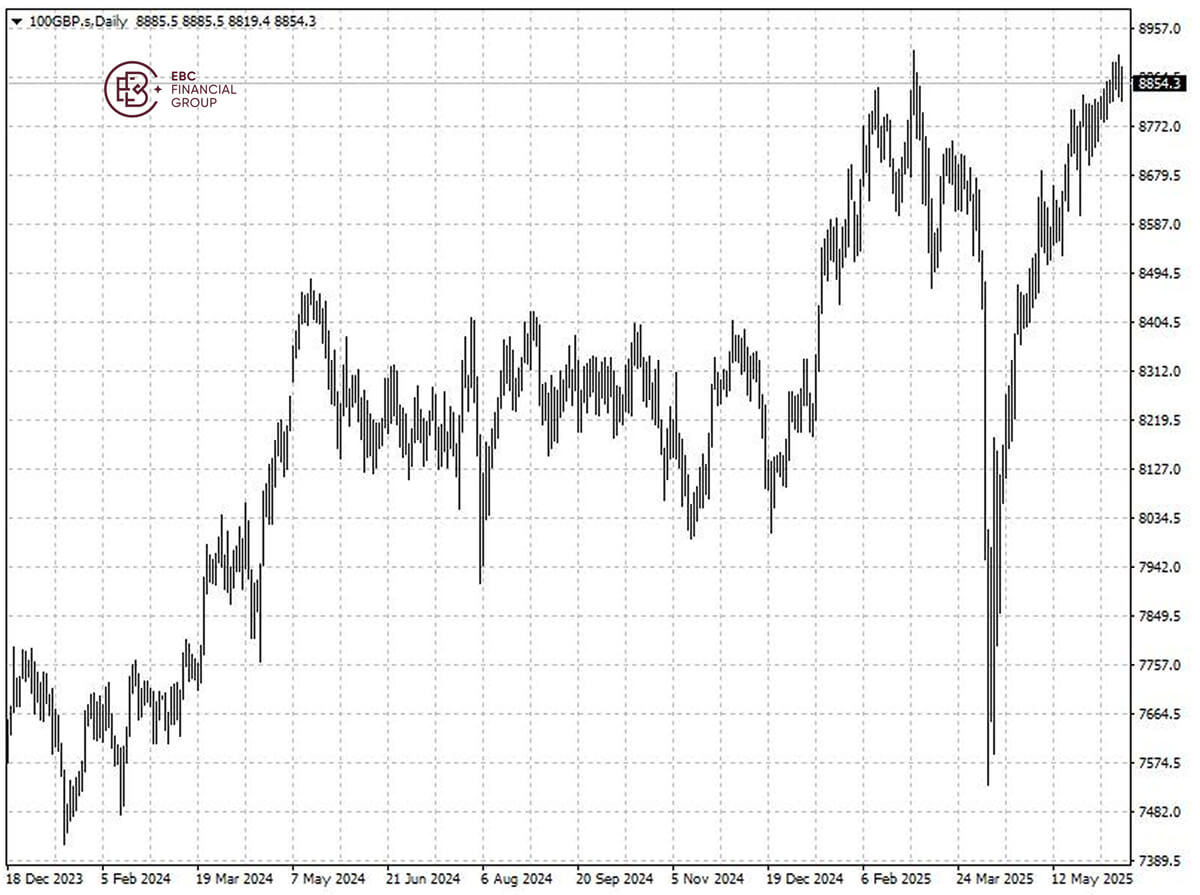

London's FTSE 100 recorded its all-time high close on Thursday, outshining

European peers on a boost from energy shares, though concerns about simmering

geopolitical developments kept gains in check.

Oil prices surge more than 8% after Israel launched a major pre-emptive

strike on Iran, raising fears of broader Middle East conflict. As such the

index's rally is likely to pick up the pace.

More than $10 billion in bids for British companies announced this week,

according to Dealogic data, showed how the market's low valuations and the

stability were attracting large inflow.

So far this year, there have already been 30 bids for UK companies valued at

more than £100 million, more than the double of the amount for 2024. Among those

to announce takeover offers were Qualcomm and L'Oreal.

The discount between the FTSE 100 and the S&P 500 peaked at about 49.5%

in January and is about 41% now. Relative trade certainty also appeals after the

UK stuck a deal with the EU and the US in turn.

Barclays said the pound's strength does not seem a headwind as US capitals

may seek to grab as much as they can "before things get more expensive and

currency tailwinds are still there."

The FTSE 100 has been in a steady uptrend since early April without indicator

showing reversal risk. It may well break above 8,900 again soon and gear up for

a fresh peak.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.