The pound digested last session's gains on Tuesday after Britain agreed a

major trade and defence reset with the EU. The dollar remained broadly weak with

focus shifting to ongoing trade talks.

It marks the biggest reboot since the UK officially left the EU in 2020. The

Labour government said the deal would make it easier for food and drink to be

imported and exported by reducing paperwork and checks.

In return, the UK will give the EU access to its fishing waters until 2038 -

a 12-year extension of arrangements already in place. A security pact was also

under discussion amid geopolitical tension.

It is agreed that UK will participate in the EU's proposed new £150bn defence

fund which is driven by Russia's invasion into Ukraine. That opens up

opportunities for arms firms in the country to bid for defence contracts.

Earlier this month the UK signed a "historic" free trade deal with India that

has some of the world's highest tariffs on imports. Under the deal, India will

cut levies on 90% of British products sold domestically.

Consumer prices index are expected to have increased by 3% year over year in

April, a sharp increase from the 2.6% recorded for March. But trade deals will

help bring inflation back to the 2% target.

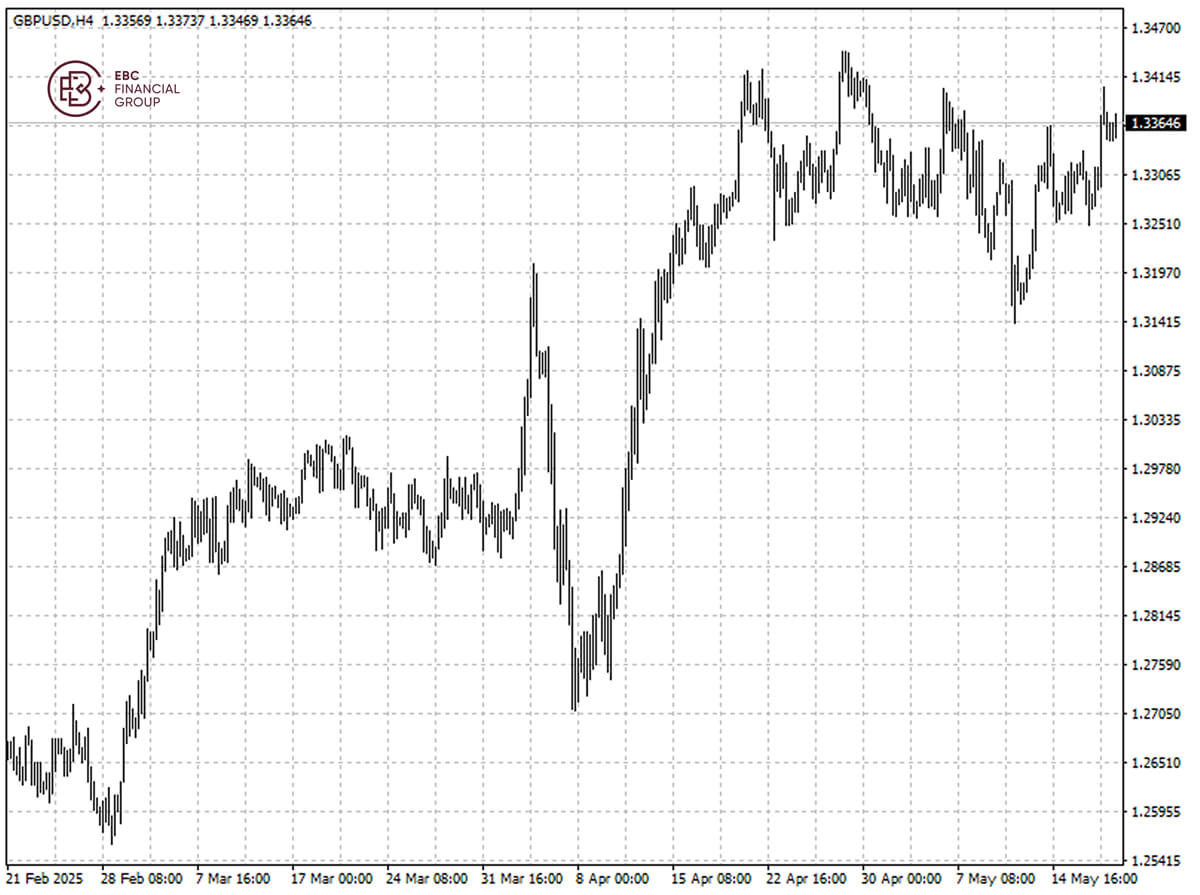

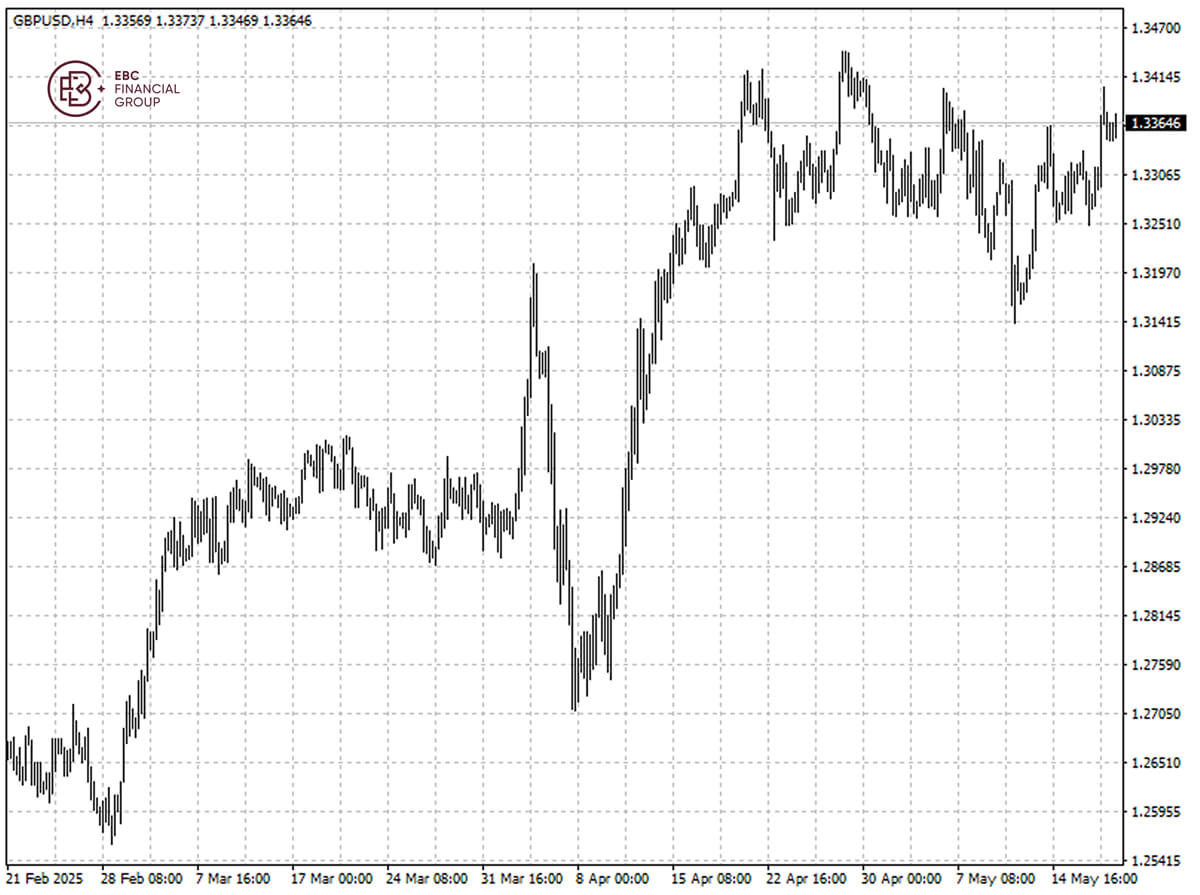

Sterling is trading near the high of 1.34 hit on 6 May. Without fresh

catalyst to spur a breakout, the currency could move lower towards 1.3345.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.