Hedge funds added bullish bets on Chinese stocks last week on hopes of

progress in US-China trade talks, according to Morgan Stanley. China's A50 index

has gained 4.5% this month, more than reversing its losses in April.

The bank said US-based funds were absorbing both Chinese shares traded home

and domestic A-shares. In comparison, hedge funds reduced positions in most

other Asian regions, led by India and Australia, etc.

"The risk-return gets so appealing," said Michael Dyer, an investment

director for M&G Investments' long-short multi-asset strategy, referring to

global investors' extremely low positions and the cheap valuation of Chinese

equities.

However, hedge funds' exposure to China is still well below peak levels. It

is widely seen as more of a tactical play in that structural challenges remain,

especially tepid consumption and housing market woes.

Retail sales rose 5.1% from a year earlier in April, missing analysts'

estimates of 5.5%. Fixed-asset investment for the first four months this year

rose 4.0%, slightly lower than expectations for 4.2%.

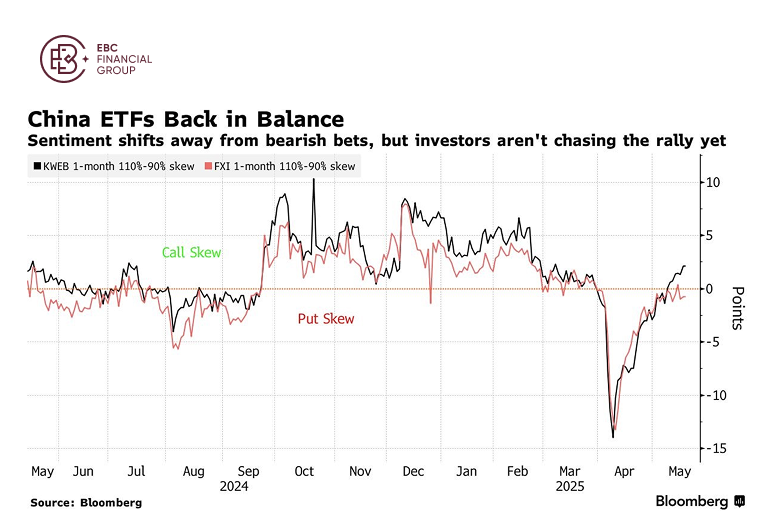

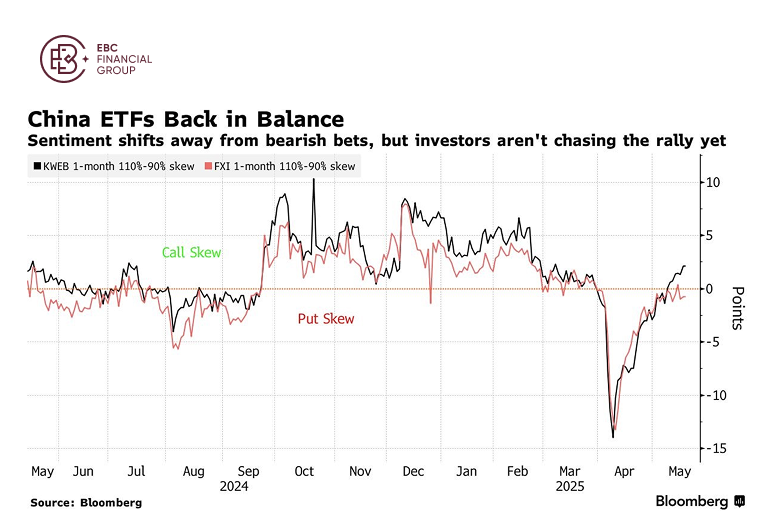

When the market surged last year on stimulus hopes, traders chasing the rally

sent a gauge tracking China Enterprises Index options prices spiking. By

contrast, that measure ended last week at its lowest level since January.

In a note last week, JPMorgan strategists wrote that the options market shows

a more balanced outlook now, after the de-escalation of trade war brought some

relief to the market.

A brittle deal

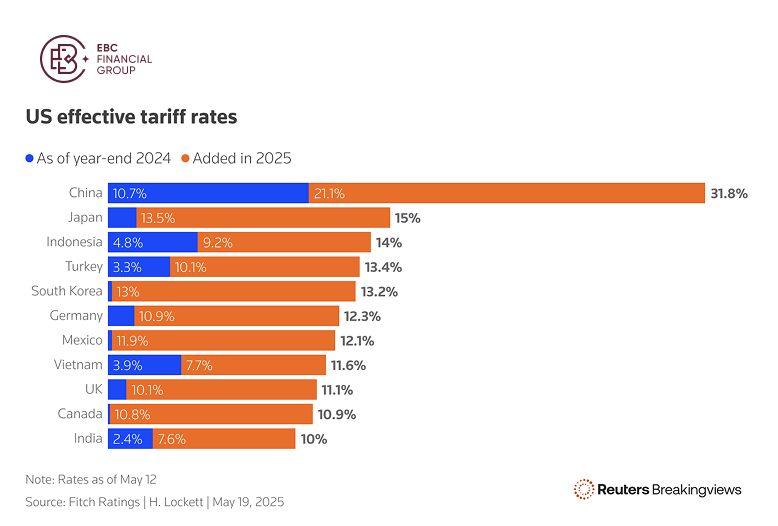

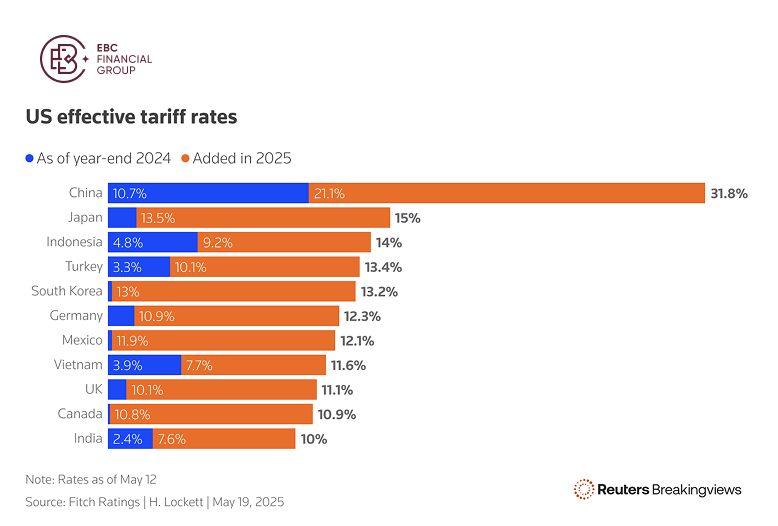

The effective US tariff rate on imports from China currently stands at 31.8%,

according to a report from ratings agency Fitch. Some are sceptical whether the

two sides can finally retain the status quo.

There is little indication that US discussions with its trading partners are

yielding much real progress ahead of their 90-day deadline in early July. The

only deal with the UK is also considered limited.

Worse, the electronics carve-out on was followed by a national security probe

into semiconductor imports. If that ends up revoking the exemption, it will

complicate already fraught trade talks.

On the other hand, Beijing appears to maintain tight control over its rare

earth exports. Its dominance in the processing stage has forced the US to build

its own supply chain and invest in projects in Brazil.

China will not compromise on key parts of its economic and political system,

including how SOEs are run, the Institute of Economics at the CASS noted,

meaning Trump could yet hike them again.

The country's exports surged in April on the back of a jump in shipments to

Southeast asian countries, partly due to transhipment. The figures came on the

heels of a fresh stimulus package.

The 7-day reverse repurchase rate has been cut by 10 bps to 1.4%, and the

reserve requirement ratio lowered by 50 bps. Besides, measures to support the

private sector are in the making.

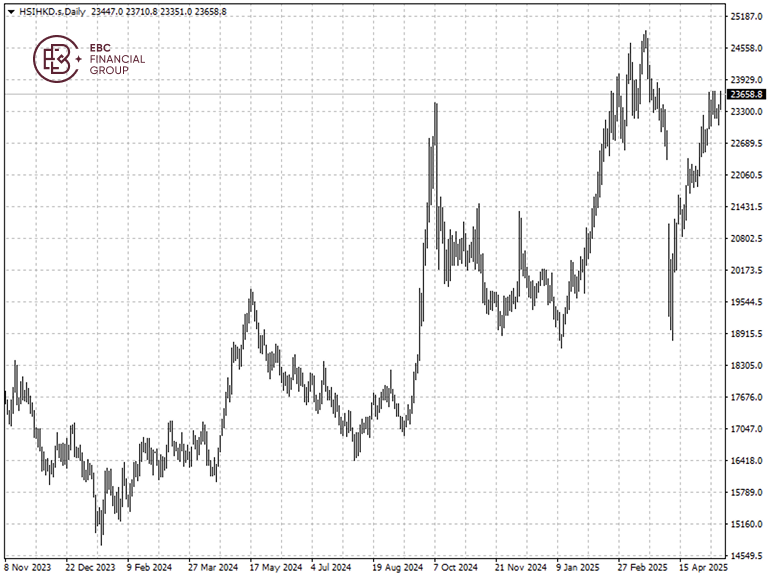

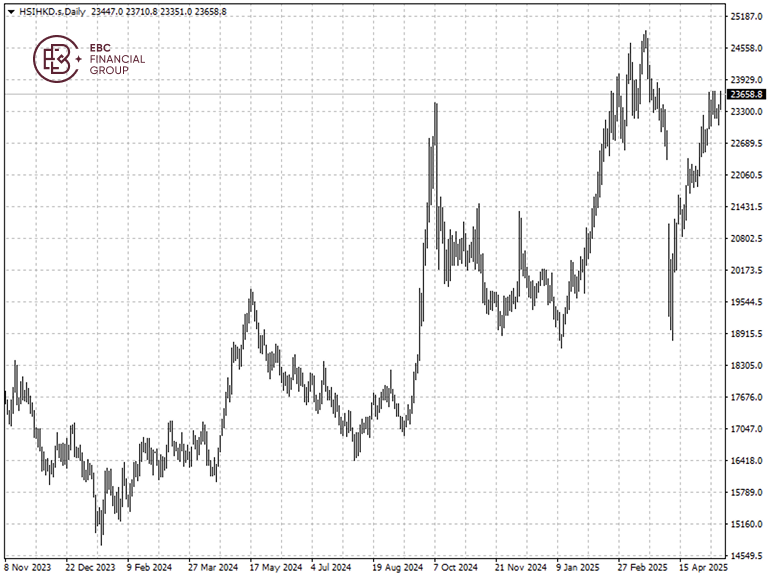

H-shares outperform

Hong Kong shares have outperformed their mainland peers by the largest margin

in nearly two decades. The Hang Seng index was up 18%, extending its rally from

last year, thanks to the rise of DeepSeek.

The index's heavy weighting towards technology and finance has allowed it to

capitalise on the Fed's dovish pivot and renewed appetite for Chinese tech

stocks, said Wei Li, head of multi-asset investments for China at BNPP.

It is heading for a sixth straight weekly gain – a sign of complacency.

Without a reversal later this week, historical data suggests a pullback is very

likely to take place soon.

Chinese tech giants such as Tencent and Alibaba are mostly listed in Hong

Kong. The market also benefited from outflow from US equities as it is easier

for overseas investors to access than A-shares.

However, UBs analyst say international money flowing into Hong Kong appears

to be from shorter-term investors, such as hedge funds, rather than longer-term

market participants such as pension funds.

The latest financial reports ring alarm bells. Alibaba shares plunged their

most in more than a month Friday after revenue miss disappointed investors who

deem it the frontrunners in local AI boom.

Elsewhere a cutthroat battle in retail is heating up. JD has declared war on

Meituan and Alibaba in food delivery, which could erode profit margin in the

sector.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.