U.S. stocks rose on Monday on expectations corporate earnings will exceed

forecasts, but global shares and the dollar traded little changed after data

showed the Chinese economy grew slower than anticipated.

Second-quarter earnings are expected to decline 8.1%, according to Refinitiv

data, down further than the 5.7% decline expected at the start of the month.

S&P 500 index is trading at a relatively high 19.7 times forward

earnings.

Gold prices were little changed, with bullion traders still doubtful about

whether the Fed may soon signal an end to its monetary tightening path. Oil

dropped by more than 1% after the weaker than expected Chinese economic

growth.

Commodities

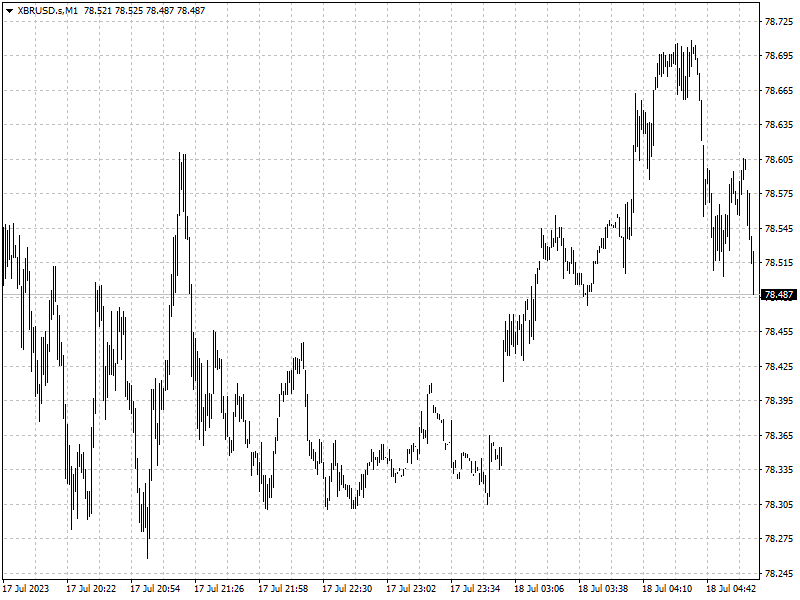

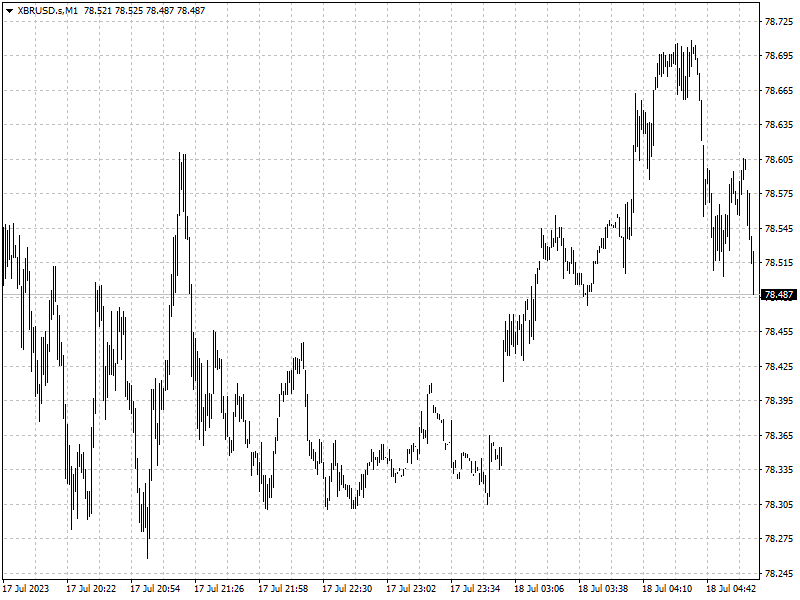

U.S. shale oil production is projected to fall to nearly 9.40 million bpd in

August, which would be the first monthly decline since December 2022, data from

the EIA showed.

Still, global supplies could see a boost from the resumption of output at two

of three Libyan fields that were shut last week. Output had been halted by a

protest against the abduction of a former finance minister.

Forex

The dollar dipped on after last week suffering its largest weekly decline

this year as Treasury yields tumbled, but held above more than one-year lows

reached on Friday with no major catalysts to drive market direction.

U.S. Treasury yields fell sharply last week as slowing consumer and producer

price inflation in June increased expectations that prices pressures will

continue to moderate, and in turn lead to more dovish monetary policy.

The German Bundesbank said that the euro zone's largest economy may shrink

this year by more than the 0.3% decline expected only a few weeks ago, despite a

small bounce in the second quarter.