US CPI YoY June

12 July

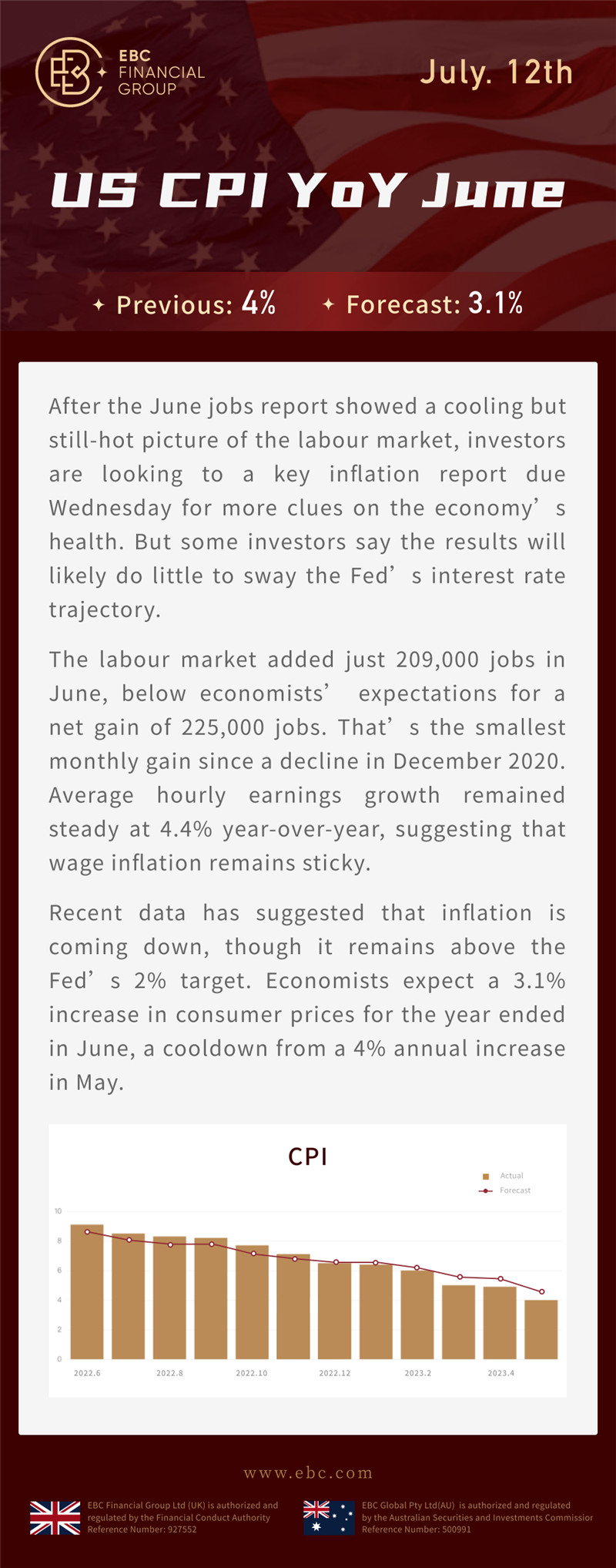

Previous: 4% Forecast: 3.1%

After the June jobs report showed a cooling but still-hot picture of the

labour market, investors are looking to a key inflation report due Wednesday for

more clues on the economy’s health. But some investors say the results will

likely do little to sway the Fed’s interest rate trajectory.

The labour market added just 209,000 jobs in June, below economists’

expectations for a net gain of 225,000 jobs. That’s the smallest monthly gain

since a decline in December 2020. Average hourly earnings growth remained steady

at 4.4% year-over-year, suggesting that wage inflation remains sticky.

Recent data has suggested that inflation is coming down, though it remains

above the Fed’s 2% target. Economists expect a 3.1% increase in consumer prices

for the year ended in June, a cooldown from a 4% annual increase in May.