The dollar trimmed a four-week gain in early Asian trade on Monday as markets

digested a fresh blow to US assets. April retail sales suggests pre-emptive

buying to get ahead of tariff-related price hikes faded quickly.

Moody's Ratings cut the US' sovereign credit rating down one notch to Aa1

from Aaa, citing the growing burden of financing the federal government's budget

deficit and the rising cost of rolling over existing debt.

All the major credit rating agencies are giving the world's largest economy

their second-highest available rating. That means Treasury yields may need to

rise further to draw investment.

The benchmark 10-year yield edged lower on Friday on disappointing consumer

sentiment reading that showed heightened inflation fears. It hit the 16-year

high of 5% in October 2023 and has fallen about 50 bps ever since.

US levies on Chinese products imposed this year will likely hold at 30%

through late 2025, according to a Bloomberg survey. If the US and China reach a

final trade agreement, the tariffs could come down to 20%.

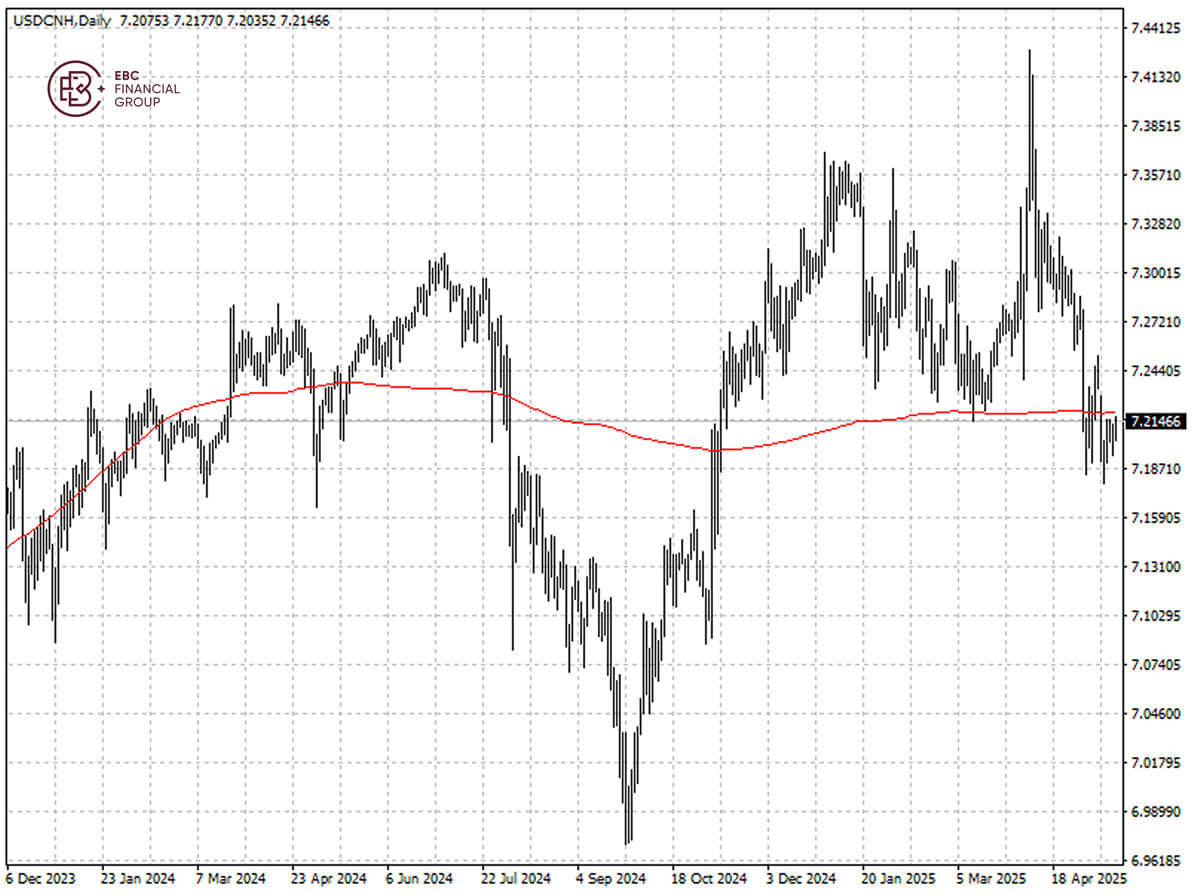

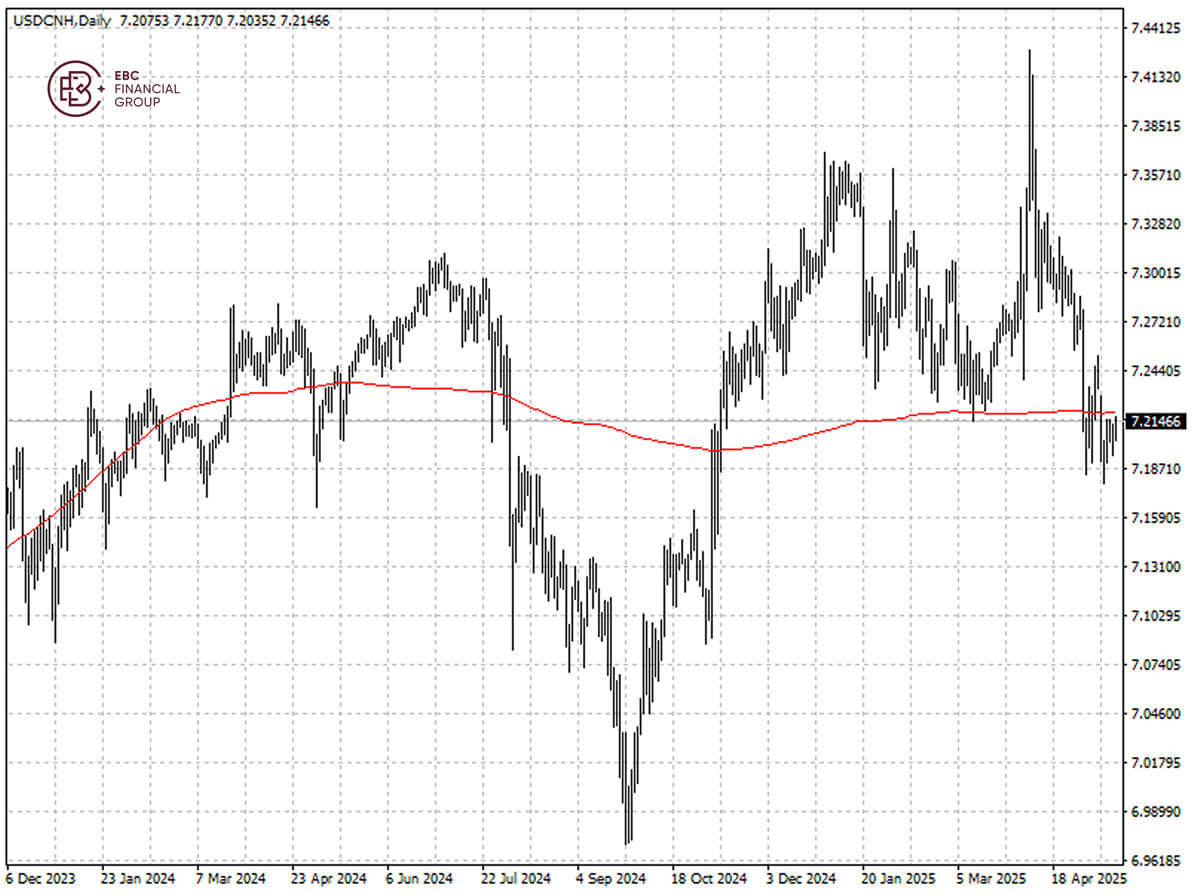

They expect the yuan to hold near 7.2 per dollar by the end of this year.

With speculation about easing, the currency may find an anchor as authorities

are expected to prevent excess fluctuations for financial stability.

The yuan stays above the 200 SMA at 7.22 per dollar, and looks natural now.

If the level does not hold, it could dip to 7.25 per dollar.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.