Currency plays a critical role in shaping a country's economy, influencing trade, investment, and market stability. In the case of Pakistan, the official currency is the Pakistani Rupee (PKR), which has experienced significant volatility and devaluation in recent years. For those trading in forex or investing in emerging markets, the PKR presents both risks and opportunities.

This article examines the historical background, framework, economic environment, and trading approaches related to the Pakistani Rupee, particularly highlighting essential information for traders in 2025.

What Is the Currency of Pakistan?

The Pakistani Rupee (PKR) is the official currency of Pakistan and is issued by the State Bank of Pakistan (SBP), the country's central bank. Its currency symbol is ₨, and the ISO code is PKR. The Rupee is subdivided into 100 paisa, although due to inflation, paisa coins are now rarely used in day-to-day transactions.

As of 2025, the Rupee is considered an emerging market currency, often characterised by volatility and susceptibility to both domestic and external pressures. The PKR is not freely convertible on global forex markets and is subject to regulations, including capital controls and intervention by the State Bank to stabilise the exchange rate.

Brief History of the Pakistani Rupee

The Pakistani Rupee was introduced in 1947, following the country's independence from British India. Initially, Pakistan used indian currency with an overstamp, before issuing its own currency in 1948. The Rupee was initially pegged to the British Pound, and later to the U.S. Dollar.

Nevertheless, during the 1980s and 1990s, economic and political turmoil resulted in the liberalisation of exchange rates, causing the Rupee to become a managed float currency. It suggests that the PKR's exchange rate is affected by market conditions, yet the central bank can intervene to prevent substantial fluctuations.

In the last twenty years, the Rupee has experienced a steady decline in value driven by inflation, trade deficits, and increasing debt. As a result, it has become one of the weaker currencies in the South Asian region.

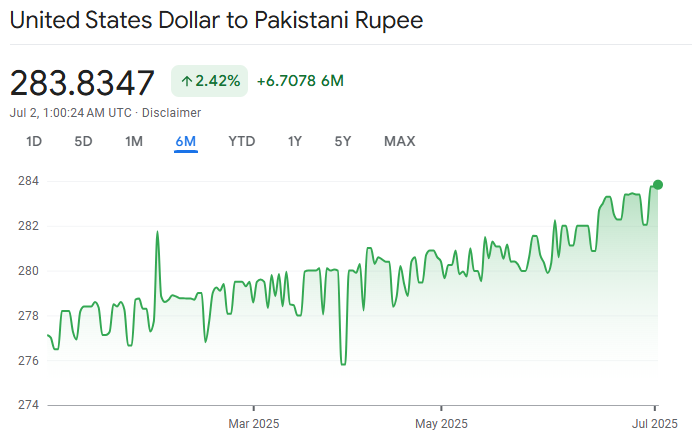

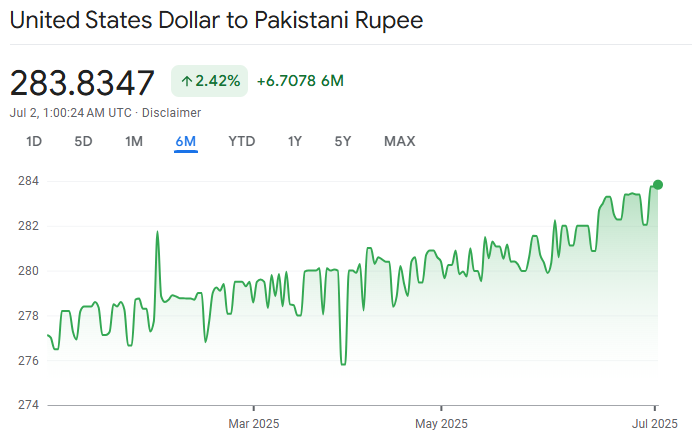

Exchange Rate: PKR Performance in 2025

On July 1, 2025, USD to PKR was valued at approximately 283.75, reflecting a minor decline of about 0.4% from the last day of June. This range reflects continued weakness in the PKR, with fluctuations between 283.6 and 285.05 in the final week of June.

For additional context, the Rupee has remained broadly within a 278.5 to 293.3 zone throughout 2025. The highest level occurred in early January (~278.48), whereas the lowest point was in March (~293.34).

On average, the exchange rate has hovered around 280.7, with a year-to-date depreciation of 1.9%.

Trend Drivers Behind the PKR's Performance in 2025

1) Managed Depreciation Policy

Pakistan's central bank, guided by IMF agreements and fiscal pressures, has gradually allowed PKR to weaken. Experts projected rates near 285 by June 2025, rising to 295 by mid-2026.

2) Current Account and Reserves

Despite the weaker currency, Pakistan posted a $1.86 billion current account surplus in the first nine months of FY25, compared to a $1.65 billion deficit last year. However, FX reserves have dwindled, hovering near $10–10.6 billion by June 2025.

3) Inflation, Interest Rates & Monetary Policy

With inflation cooling to 0.3% YoY in April 2025, the central bank paused rate cuts at 12%, citing concerns about currency stability, despite expectations of future easing.

4) External Borrowing & Sovereign Risk

Pakistan remains highly reliant on external financing. A recent rollover of $3.4 billion in loans from China briefly strengthened its FX reserves, but it raises concerns about long-term debt.

5) Geopolitical Events

While geopolitics primarily impacts regional currencies like INR, PKR exhibits relative insulation. Pakistani inflation, rupee stability, and interbank rates show limited sensitivity to India–Pakistan tensions.

How to Trade the Pakistani Rupee in Forex Markets

While the PKR is not as widely traded as majors like USD, EUR, or JPY, it can be accessed through exotic currency pairs on some trading platforms. The most commonly traded pair is USD/PKR, where the U.S. Dollar is the base currency, and the Pakistani Rupee is the quote currency.

Trading PKR pairs comes with higher spreads and lower liquidity compared to major or even minor pairs. As a result, they are generally suited for more advanced traders or those specifically focused on emerging markets.

Key Tips for Trading PKR

Monitor central bank decisions and inflation reports closely.

Follow geopolitical developments that may impact stability.

Use technical analysis with caution due to low liquidity.

Apply conservative leverage and strong risk management.

Understand the economic calendar for Pakistan (CPI, GDP, trade balance).

Opportunities and Risks to Consider

| Opportunities |

Risks |

|

Interest Rate Arbitrage: High interest rates create potential for carry trades. |

High Volatility: PKR is prone to sudden devaluations due to economic shocks. |

|

Emerging Market Growth: Long-term potential if Pakistan implements reforms. |

Liquidity Constraints: Wider bid-ask spreads and lower trading volume. |

|

momentum trading: Short-term gains possible from news-based volatility. |

Regulatory Risk: Currency controls or government restrictions may apply. |

|

Remittance Inflows: Strong inflows support PKR and create predictable demand cycles. |

Political Instability: Government changes or civil unrest can spook investors. |

|

Export Competitiveness: Weaker PKR helps boost exports. |

Debt Dependency: Reliance on IMF loans and aid makes PKR sensitive to global conditions. |

|

Digital Finance Growth: Fintech adoption and Raast may strengthen infrastructure. |

Inflation Pressure: Persistent inflation weakens purchasing power and investor trust. |

Year-End Outlook for the Pakistani Rupee

The Pakistani Rupee (PKR) faces a cautiously managed depreciation path through the remainder of 2025 and into 2026, driven by macroeconomic headwinds, external financing requirements, and strategic policy alignment with IMF benchmarks.

Most expert forecasts suggest the Rupee will weaken moderately over the next six months, ending 2025 between PKR 285 and PKR 290 per USD, under a "managed float" regime rather than a fully market-driven rate. This reflects several structural and tactical considerations:

Analysts project PKR will settle at 285/USD by June 2025, with further softening to 295 by mid-2026. They consider Pakistan's need to maintain a competitive exchange rate for export support, while keeping FX reserves from falling too sharply.

Other algorithmic models align with a year-end forecast of around 287.50, assuming stable crude oil prices, no major defaults, and modest dollar strength.

IMF Framework: The Rupee's flexibility is part of the broader economic reforms outlined under the IMF's standby agreements. Authorities are incentivised to avoid artificially supporting the Rupee to preserve reserve buffers, especially as debt servicing and import bills increase heading into 2026.

Conclusion

In conclusion, the Pakistani Rupee offers a window into the complex interplay between politics, economics, and global finance in an emerging market.

While a currency crisis appears unlikely for now, sustained reserve adequacy, credible policy, and inflation control are essential to maintaining the current gradual depreciation path.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.