Key Takeaways

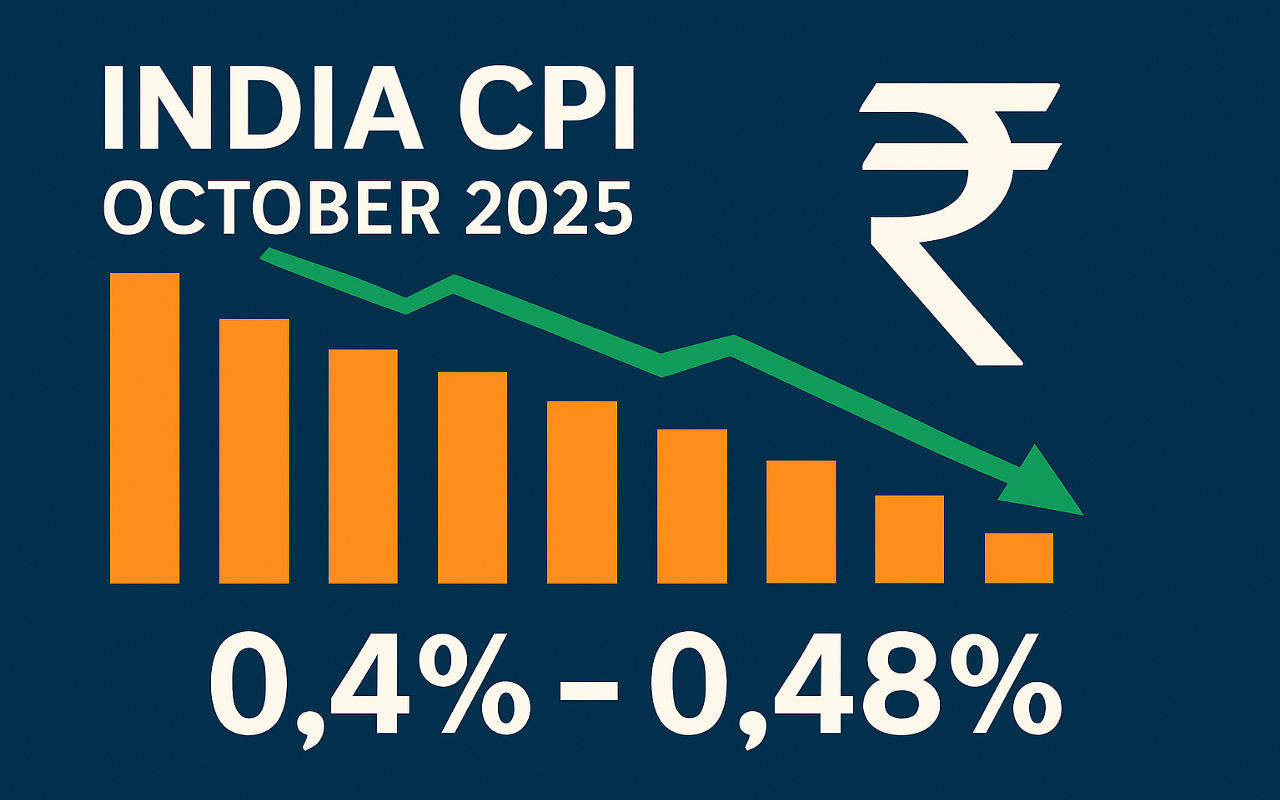

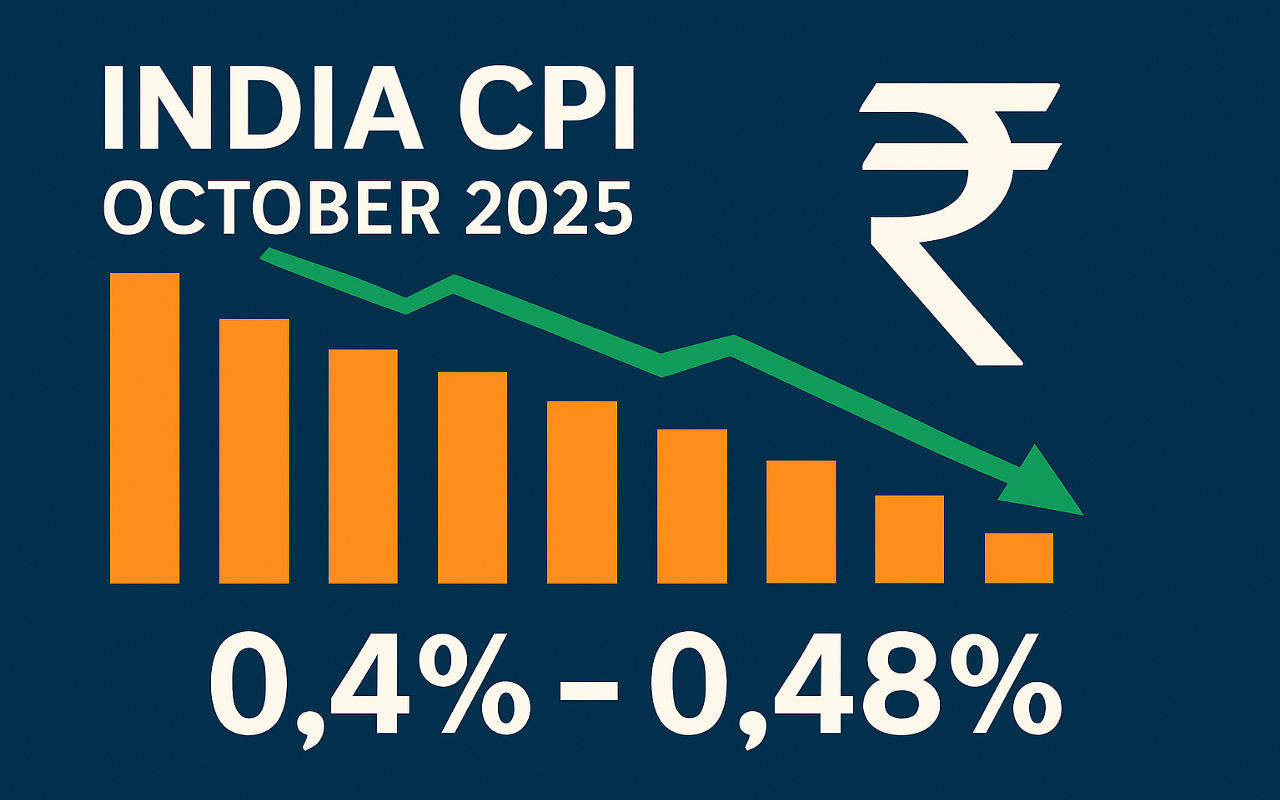

India's inflation is expected to be near 0.4–0.5%, a multi-year low.

The decline is driven by food deflation and favourable base effects.

If the CPI remains below target, the RBI could gain additional room for monetary policy easing..

India's inflation rate has been on a steady decline in 2025, and all eyes are on the consumer price index (CPI) data due out today, November 12, 2025.

Headline consumer inflation in India is likely headed to multi-year lows (≈ 0.48% for October 2025). While a drop toward 0.4% is possible, it would require a massive surprise.

This article examines the context leading up to today's CPI release, the likelihood of an inflation rate drop to 0.4%, key drivers influencing inflation, and what this means for India's economy and markets moving forward.

How Has India's Inflation Changed in 2025?

| Month |

CPI Inflation (YoY%) |

Key Reasons for Inflation Drop |

| January |

4.26 |

Food price stabilisation; moderation in energy prices; RBI’s tight monetary policy. |

| February |

3.61 |

Easing of food inflation (vegetables, edible oils); improved supply chains. |

| March |

3.34 |

Base effects; lower cereal and pulses prices; controlled fuel inflation; cautious RBI stance. |

| April |

3.16 |

GST rationalidation; anchored inflation expectations; moderating core inflation. |

| May |

2.82 |

Decline in transport/communication costs; favorable harvest; weak global demand. |

| June |

2.10 |

Favorable base effects; government stock releases; contained energy inflation. |

| July |

1.61 |

Negative food inflation; slower urban inflation; effective supply management. |

| August |

2.07 |

Slight seasonal uptick; minimal weather-related shocks; steady energy/housing inflation. |

| September |

1.54 |

Lowest since June 2017; negative food inflation; stable housing; moderate transport; lower fuel prices; strong government intervention. |

| October 2025 (estimate) |

~0.48 |

Continued disinflationary trend; likely driven by broad-based moderation in food and fuel prices. |

India's retail inflation has been on a downward trajectory since early 2025, falling from 6.21% in October 2024 to 1.54% in September 2025, marking the lowest level since June 2017.

This steady easing reflects a successful blend of government policy, including GST rate rationalisation, food price controls, and the impact of favourable base effects.

A Reuters poll of economists predicts that October inflation will fall further, to around 0.48%, the lowest in the current series (base 2012). [1]

Hence, a drop to 0.4% is technically possible but would mean inflation nearly halving from September.

What to Monitor in Today's India Inflation Rate Data Release

Analysts expect a headline CPI print of around 0.4% to 0.5% year-on-year inflation, continuing the downward trend from September's 1.54%.

This projected figure represents a multi-decade low, highlighting India's success in controlling inflation despite recent global supply chain disruptions.

Food inflation, a major factor in the Consumer Price Index (CPI), is projected to remain negative, aided by consistent vegetable and edible oil prices, with minimal disruptions from flooding.

Why Is India's Inflation Rate Falling So Fast? 4 Key Drivers

1. Food Inflation Collapse

Vegetables, oils & fats, cereals, pulses have shown falling inflation rates or even deflation in many cases, dragging down headline CPI.

Food accounts for nearly 45% of India's Consumer Price Index (CPI) basket, so significant reductions in food inflation have a disproportionately large impact on overall inflation.

2. Base Effect Dynamics

As noted, last year's high inflation in certain food items makes this year's year-on-year comparison easier, resulting in a lower number. We cited the base effect as a key reason for the steep drop expected.

3. Global Commodity and Tax Inputs

Global commodity prices (crude oil, metals) influence input costs and hence inflation. A moderation helps India. Also, changes in indirect taxes or GST on specific items could reduce consumer-price inflation.

4. Demand and Growth Factors

Despite strong growth, weaker demand or muted inflation expectations keep traction low. If wage or service inflation remains contained, broader inflation will remain low. However, this could represent underlying weakness rather than a benign outlook.

How Falling Inflation Affects India

1. Impact on the Economy

A sharp drop in inflation creates room for the RBI to ease its monetary policy and support growth. Growth has been resilient (~8% Q1 FY26), but downside risks persist.

Lower inflation also contributes to stronger real incomes, higher consumer purchasing power, and a potential uptick in consumption.

2. Monetary Policy Implications

India's inflation target under the monetary policy framework is 4% with a tolerance band of 2-6%.

Should inflation decline to around 0.4–0.5%, it would be significantly below the target and would heavily favour rate reductions or a more accommodative approach by the RBI.

Indeed, the RBI in October 2025 held the policy repo rate at 5.5% citing moderation of inflation among other factors.

3. Currency and External Balance

Lower inflation can support the rupee by reducing inflation-adjusted yields and the attractiveness of foreign capital.

As inflation cools, real returns on rupee assets may improve, potentially stabilising capital flows.

Can India's Inflation Really Drop to 0.4%? Scenarios and Probabilities

Scenario A: Inflation Falls to ~0.4% (Best-Case)

Conditions: Accelerated food deflation, favourable base effect, stable commodity prices, minimal drought or weather shocks. In that case, the October CPI could surprise at around 0.40%-0.50%.

Probability: Moderate. The Reuters poll median is ~0.48%, leaving a small margin for 0.4%.

Scenario B: Inflation ~0.5-0.7%

More likely: The number comes in around 0.5-0.7%, still a historic low but not quite 0.4%. A slight uptick in some food categories could prevent a 0.4% increase.

Probability: High. Slight upside risks remain (weather, input costs).

Scenario C: Inflation Stays Above 1%

Less likely but possible if there are supply disruptions, commodity shocks, or adverse base effects reversing.

Probability: Low given current data, but cannot be ignored.

India's Longer-Term Outlook

If inflation remains near or below 1% for several months, the Reserve Bank of India (RBI) may adopt a more accommodative monetary policy stance.

This will potentially accelerate economic growth, lower real interest rates to support investment, and improve India's overall macroeconomic risk profile. Conversely, too low inflation may point to weak demand or structural issues.

We project an average CPI inflation of ~4% for FY 26, assuming a rebound from these lows. Thus, a very low number now could represent the trough or a temporary dip before inflation normalises.

Frequently Asked Questions

Q1. Has India's Inflation Rate Ever Been This Low?

India hasn't seen CPI inflation below 1.5% since July 2017.

Q2. What Is India's Inflation Target, and How Close Is the Current Inflation to That Target?

The Reserve Bank of India's inflation target is 4% with a tolerance band of 2-6%. Current inflation (around 1.5% or less) is well below the target and even below the lower tolerance bound, giving the RBI room to ease policy.

Q3. What Is the Outlook for Inflation in the Coming Months?

The forecasts for October 2025 are around 0.4% to 0.6% in CPI, assuming current trends continue.

Q4. How Might Inflation Affect the Indian Rupee and Foreign Investment?

Very low inflation can bolster the rupee by improving real returns on rupee assets and making Indian debt/capital markets more attractive. Lower inflation also reduces currency depreciation risk, which is beneficial for foreign investors.

Conclusion

In conclusion, with all indicators pointing to a CPI near 0.4% for October 2025, India is on the cusp of a multi-year inflation trough, highlighting strong policy success and economic resilience.

This data release could affirm investor confidence, influence the RBI's monetary policy decisions, and shape the economic outlook for 2026.

Investors and policymakers must consider not just headline CPI but also the fundamental food, core inflation, and policy measures.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/india/india-cpi-inflation-likely-fell-multi-year-low-048-october-2025-11-07/