African currencies vary widely in value. Some are among the strongest globally, others among the weakest. As of June 2025, the Sierra Leonean Leone ranks as the continent's lowest‑valued currency.

Understanding the weakest currencies is essential not just from a numeric standpoint but for economic insight. We'll explore the top ten weakest African currencies, explain their value, examine underlying causes, and discuss implications for citizens and investors.

What Is the lowest currency in Africa? Top 10 List

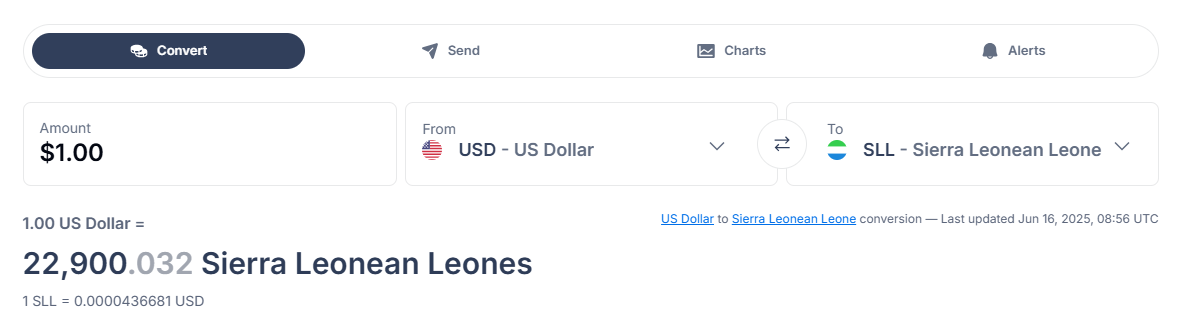

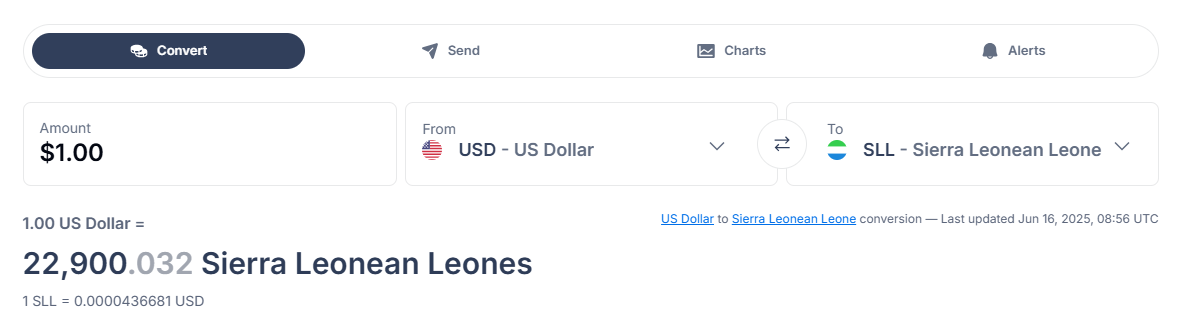

1) Sierra Leonean Leone (SLE)

Despite a 2022 redenomination, the leone continues to depreciate. Inflation, weak institutions, political uncertainty, and a lack of diversified exports — mostly minerals — keep the currency under pressure.

2) São Tomé and Príncipe Dobra (STD)

The dobra is the second lowest currency in Africa due to the country's small, highly import-dependent economy with limited export revenue. Its low foreign currency reserves and heavy reliance on external aid make the dobra extremely fragile.

3) Guinean Franc (GNF)

Guinea's economy depends on mining, especially bauxite. However, corruption, inflation, and political instability make the franc unstable. Investment uncertainty and limited industrial diversification worsen the problem.

4) Malagasy Ariary (MGA)

Madagascar's currency suffers due to an agriculture-heavy economy vulnerable to climate shocks, frequent political turmoil, and underdeveloped infrastructure. The country struggles to generate enough export revenue to support the ariary.

5) Ugandan Shilling (UGX)

The shilling, while more stable than some peers, is weak due to a consistent trade deficit, heavy reliance on imported goods, and modest inflation. External shocks can quickly weaken the currency due to limited reserves.

6) Burundian Franc (BIF)

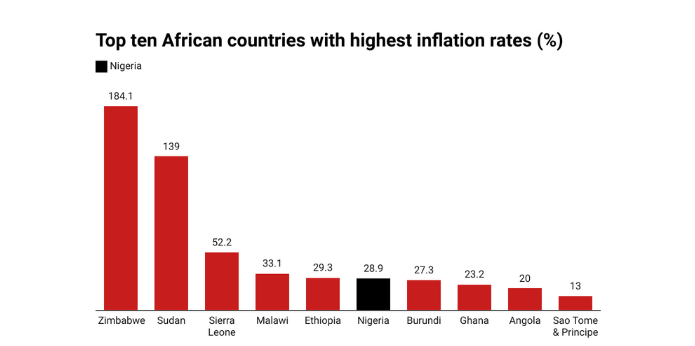

The franc has collapsed under runaway inflation, political instability, sanctions, and a near-total reliance on agriculture. In 2024, inflation approached 40%, driving further devaluation and economic hardship.

7) Congolese Franc (CDF)

The CDF struggles due to prolonged conflict, weak governance, and overdependence on mining exports. The lack of infrastructure, frequent fiscal mismanagement, and low investor trust have kept the currency low for years.

8) Tanzanian Shilling (TZS)

Despite a relatively stable economy, the shilling remains weak due to inflation, poor export diversification, and high import dependency. Structural inefficiencies limit its ability to gain ground against the dollar.

9) Malawian Kwacha (MWK)

The kwacha lost nearly 40% of its value in 2024 after Malawi devalued it to address a forex crisis. The economy relies heavily on tobacco exports, and recurring droughts, inflation, and external debt weigh down the currency.

10) Nigerian Naira (NGN)

The Naira has seen severe devaluation due to declining oil revenue, inconsistent monetary policy, inflation, and a shortage of U.S. dollars. Currency reform efforts and parallel market divergence continue to destabilise it.

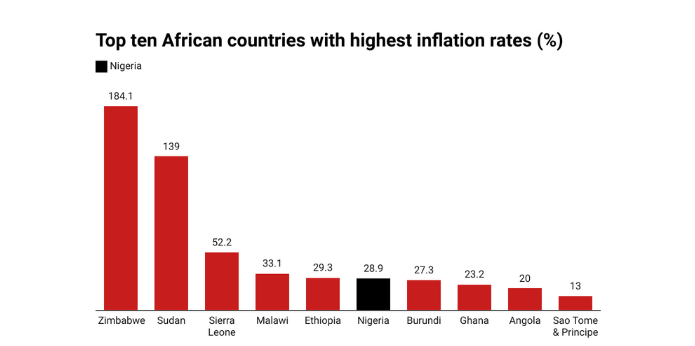

Why These Currencies Are So Weak?

1. Economic Instability & Inflation

High inflation erodes local purchasing power, forcing central banks to print more money in failing attempts to stimulate weak economies. Burundi's inflation near 38% exemplifies this cycle.

2. Political Turbulence & Conflict

Nations like Sierra Leone, DRC, and Guinea suffer from political uncertainty and conflict, deterring investment and undermining currency stability.

3. Commodity Dependence

Many African economies rely on a few exports—minerals, tobacco, oil—subject to price swings. Malawi (~tobacco) and Nigeria (~oil) are classic cases.

4. Weak Trade & Financial Reserves

Persistent trade deficits increased foreign currency demand. Limited reserves—such as in Burundi and Madagascar—make it more challenging to support local currencies.

2025 Trends: Some Hope Amid Weakness

Despite the overall weakness, some countries show signs of stability or modest recovery:

Nigeria's Naira recently gained ~7% since November amid improved bond yields and policy reforms.

The Ugandan Shilling remained stable (3,640–3,660 range) thanks to steady exports and limited import demand.

These improvements highlight how macroeconomic policies, reform, or stabilised export income can temper currency crises even in lagging economies.

Conclusion

In conclusion, the Sierra Leonean leone is the lowest currency in Africa, followed by the São Tomé dobra and others facing structural economic challenges. Underlying drivers include inflation, political instability, commodity dependence, and weak trade earnings.

While a few—such as Nigeria and Uganda—show tentative recovery signs, the majority remain vulnerable.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.