Meta Platforms, Inc. (META), the tech giant behind Facebook, Instagram, and WhatsApp, continues to captivate traders with its role in social media and digital innovation.

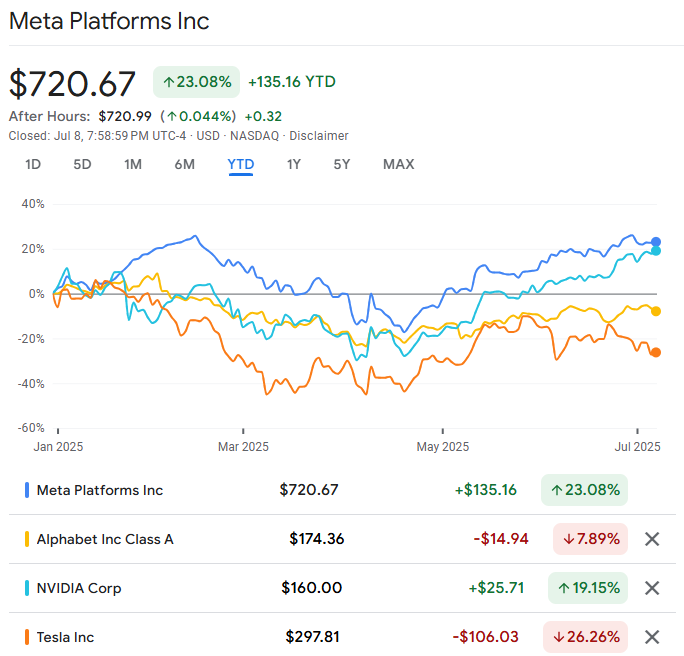

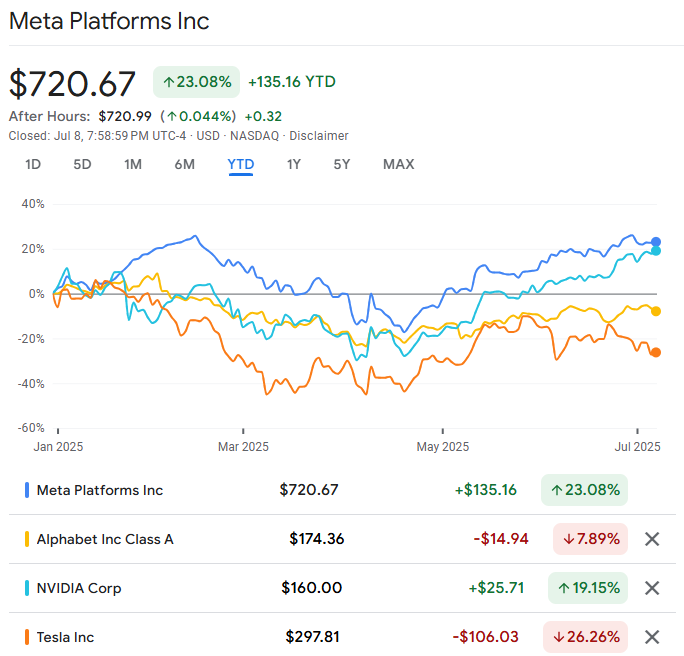

With a current stock price of around $720.67 as of July 8, 2025, and frequent volatility driven by market sentiment, regulatory challenges, and tech advancements, the big question remains: is now the time to buy in?

Let's break down the latest Meta stock forecast, looking at financial performance, market trends, and strategic factors to guide your trading decisions.

Understanding Meta's Current Market Position

Meta Platforms holds a dominant spot in the social media and digital advertising arena, boasting over 3 billion monthly active users across its platforms as of mid-2025. Advertising revenue remains the core driver of its financials, though it faces stiff competition from TikTok and increasing privacy regulations that hinder ad targeting.

Moreover, Meta's bold push into the metaverse and AI technologies sparks both excitement and concern among investors due to high costs and uncertain outcomes.

For traders, Meta's stock offers a mix of growth potential and notable risk. It often reflects broader tech sector trends, acting as a market sentiment indicator. Yet, with regulatory pressures and heavy investments in uncharted territories, crafting a forecast demands a careful, balanced perspective.

Recent Financial Performance

Meta's latest financial results are a crucial foundation for any stock forecast. Based on the most recent quarterly data up to Q1 2025:

-

Revenue Growth: Meta achieved a year-over-year revenue increase of 16%, reaching $42.31 billion, fueled by robust ad sales and user engagement.

-

Earnings Per Share (EPS): EPS hit $6.43, surpassing analyst expectations, which highlights improved operational efficiency.

-

Profit Margins: Operating margin rose to 41%, up from 38% last year, despite significant spending on Reality Labs (metaverse division).

Cash Flow: Free cash flow stood at $10.33 billion, ensuring strong liquidity for dividends, buybacks, and R&D investments.

However, the Reality Labs segment reported losses exceeding $4 billion in Q1 2025, casting doubt on the sustainability of Meta's metaverse ambitions. Traders need to balance these impressive core metrics against speculative expenditures when eyeing entry points. The upcoming Q2 2025 earnings, set for release on July 30, 2025, could provide further insight.

Meta Stock Forecast: Key Drivers

Bullish Factors Supporting a Buy

-

Advertising Strength: Meta's ad business is thriving, with a 16% revenue jump in Q1 2025, driven by AI-enhanced tools that improve advertiser ROI.

-

User Base Growth: Expansion in emerging markets like Asia-Pacific and Africa supports long-term revenue potential, even as developed markets plateau.

-

AI Investments: Meta's focus on AI for content moderation and ad optimisation, with Meta AI nearing 1 billion monthly actives, cements its role as a tech innovator.

Share Buybacks: The company's confidence is evident in its stock repurchases, supporting EPS growth and potentially boosting share value.

Bearish Factors Urging Caution

-

Metaverse Losses: Reality Labs' ongoing losses, over $4 billion in Q1 2025, raise concerns about the viability of the metaverse strategy.

-

Regulatory Challenges: Antitrust lawsuits and privacy laws in the EU and US could curb data usage, directly impacting ad revenue.

-

Competition: Platforms like TikTok threaten Meta's market share, particularly among younger users, posing risks to long-term growth.

Macro Pressures: High interest rates and potential economic slowdowns could cut ad spending, hitting Meta's primary income source.

Technical Analysis: Current Trends at $720.67

With Meta's stock closing at $720.67 on July 8, 2025, let's examine the technical indicators for near-term movements:

-

Price Trends: META traded between a low of $714.81 and a high of $722.91 on July 8, closing at $720.67, showing stability around the $720 mark.

-

Moving Averages: The stock is well above its 50-day simple moving average of $654.15 and 200-day SMA of $615.25, signaling a strong bullish trend in the short-to-medium term.

-

RSI (Relative Strength Index): At 52.11, the 14-day RSI indicates the stock is neither overbought nor oversold, with room for upward movement if positive catalysts appear.

Support and Resistance: Key support is around $700, with resistance near $740. A breakout above $740 could be a strong buy signal, while a drop below $700 might suggest a pullback.

Traders should keep an eye on volume trends and the upcoming Q2 earnings on July 30, 2025, for confirmation of momentum or potential reversals.

Analyst Consensus and Price Targets for 2025

Here's the latest from analysts on Meta stock as of July 2025, offering a wider forecast view:

-

Average Price Target: Analysts' average 12-month target is $724.98, indicating a modest upside of about 0.6% from the current $720.67 price.

-

Range of Targets: Targets span from a conservative $729.55 to an optimistic high of $935.00 for 2025.

Ratings Breakdown: About 65% of analysts rate META as a “Buy”, 30% as “Hold”, and 5% as “Sell”, showing a generally bullish but cautious outlook due to metaverse and regulatory concerns.

The limited immediate upside in the average target implies that much of Meta's current growth might already be reflected in the $720.67 price. Positive catalysts like strong Q2 results or AI breakthroughs could, however, drive the stock higher.

Should Traders Buy In at $720.67? Key Considerations

Deciding whether to buy Meta stock at around $720.67 depends on your trading style and risk tolerance. Here are insights for different trader profiles:

For Long-Term Investors

Meta remains a solid long-term play at $720.67 due to its advertising dominance and vast user base. The bullish technical trend and strong Q1 financials support holding for future growth. Be prepared for volatility from metaverse losses and regulatory news, and consider dollar-cost averaging to spread entry points over time.

For Swing Traders

Swing traders can target short-term gains by entering near support levels (around $700) and aiming for resistance near $740. The upcoming Q2 earnings on July 30, 2025, could trigger significant price swings, so plan trades around this event with tight stop-losses to manage risk.

For Day Traders

Day traders should leverage Meta's intraday volatility, especially with the stock trading in a tight range ($714.81–$722.91 on July 8). Use indicators like Bollinger Bands to spot overbought or oversold conditions, and avoid low-volume periods to prevent slippage. Monitor tech sector news, as Meta often moves with peers like Apple and Alphabet.

Risk Management Tips

-

Position Sizing: Limit exposure to 2-5% of your portfolio to manage potential downside.

-

Stop-Loss Orders: Set stops below key support at $700 to protect against sudden drops.

-

Diversification: Balance Meta with non-tech assets to mitigate sector-specific risks.

Stay Updated: Keep track of regulatory developments and the Q2 earnings release for unexpected shifts.

Broader Market Context for Meta Stock in July 2025

Meta's forecast is intertwined with the broader tech landscape. As of July 2025, several macro factors are in play:

-

Interest Rates: Persistent high rates could continue to pressure growth stock valuations like Meta's, especially if economic slowdowns emerge.

-

Ad Spending Trends: Any global reduction in ad budgets due to economic uncertainty would directly impact Meta's revenue.

Innovation Competition: Success in AI and metaverse tech could set Meta apart, but delays or increased spending could weigh on sentiment.

Traders should balance these macro risks with Meta's company-specific strengths. A diversified portfolio can help cushion against tech sector downturns that might disproportionately affect Meta at its current $720.67 price point.

Conclusion

So, should traders buy into Meta stock at around $720.67? It depends on your strategy and risk tolerance. Meta Platforms presents a compelling case for long-term growth with its strong Q1 2025 financials—$42.31 billion in revenue and EPS of $6.43—and advertising dominance.

Technical indicators show a bullish trend with the stock above key moving averages, though the modest analyst upside (average target $724.98) suggests limited immediate gains. Risks from metaverse losses, regulatory scrutiny, and macro pressures remain significant.

Whether you're in for the long haul or eyeing short-term trades, ensure robust risk management and stay tuned for the Q2 earnings on July 30, 2025, which could shift the landscape. Meta is a dynamic opportunity at $720.67, but proceed with caution in today's complex market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.