How Do Currency Pairs Influence Each Other in the Forex Market?

Pairs influence one another through shared currencies, economic links, and market sentiment—so movements in one pair often ripple across others with the same base or quote currency.

Forex correlation measures how currency pairs move in relation to each other.

Understanding correlation is not merely an academic exercise. For traders, it is a powerful tool for identifying hidden risks, refining strategies, and even uncovering opportunities that would otherwise remain unseen.

This article breaks down what forex correlation is, why it matters, how to measure it, and the ways traders can use it to their advantage.

Highlights

Forex correlation measures how currency pairs move in relation to each other, revealing whether they move together or in opposite directions.

Understanding correlations helps traders manage risk, diversify effectively, and spot hidden trading opportunities.

Major correlations include EUR/USD & GBP/USD (positive), EUR/USD & USD/CHF (negative), commodity currencies like AUD, CAD, and NZD, and safe-haven currencies such as JPY and CHF.

Correlations are dynamic and influenced by economic events, market sentiment, and commodity cycles, so traders must monitor them regularly across multiple timeframes.

Understanding the Mechanics of Correlation

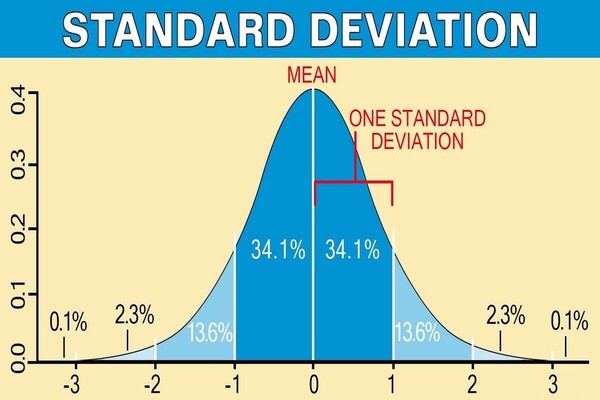

At the heart of forex correlation lies a simple but vital measure: the correlation coefficient. This statistical value ranges from −1 to +1. or -100% to +100%:

+1 indicates a perfect positive correlation — the two pairs move in the same direction at all times.

−1 indicates a perfect negative correlation — when one pair rises, the other falls.

0 suggests no meaningful relationship — their movements are largely independent.

In practice, correlations are rarely perfect. A coefficient of +0.80 still implies a strong tendency to move together, while −0.70 points to a fairly reliable inverse relationship. Importantly, correlation is dynamic. What is true over one timeframe may not hold in another, and relationships often evolve with market conditions.

Major Relationships in the Forex Market

Some correlations are so enduring that they form part of traders' collective knowledge.

Commodity currencies such as the Australian dollar (AUD), Canadian dollar (CAD), and New Zealand dollar (NZD) often display strong links to commodity prices. The CAD is heavily influenced by oil, while the AUD tends to track gold and industrial metals.

These recurring relationships give traders useful frameworks, but they are never absolute.

Mapping and Measuring Forex Correlation

To harness correlation, traders must first measure it. A range of tools makes this possible:

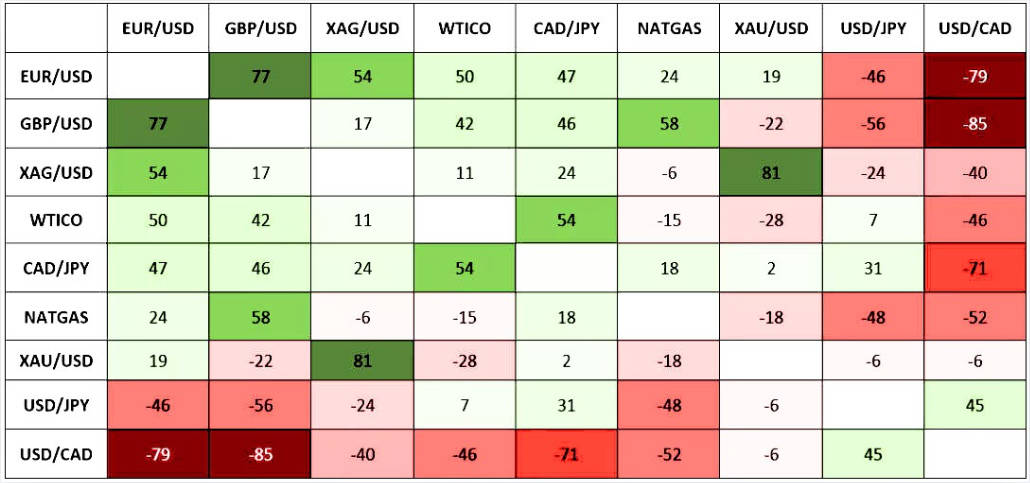

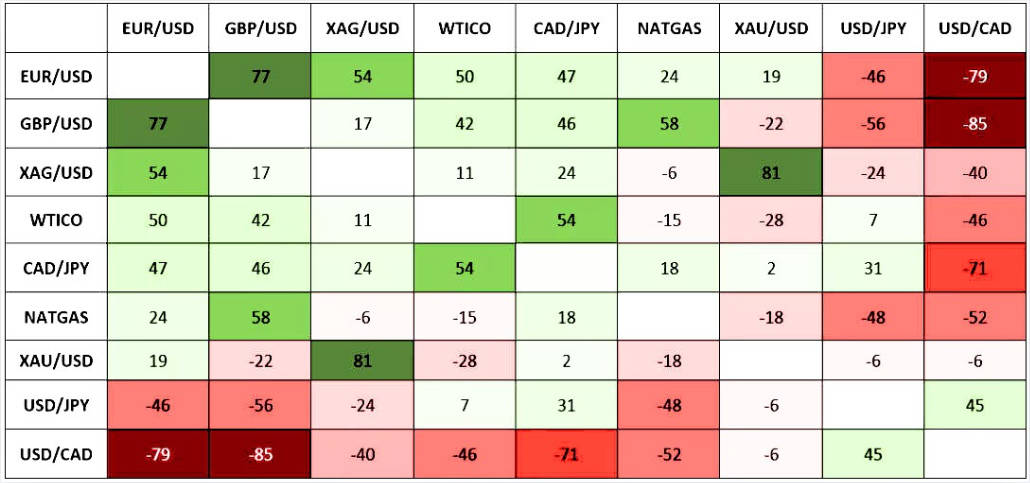

Correlation matrices present numerical relationships between pairs, often colour-coded to highlight strength and direction.

Heat maps offer a visual summary of correlations across multiple pairs.

Statistical software and custom spreadsheets allow for more advanced analysis, including cross-correlation over varying lags.

Timeframes are critical. A pair may be highly correlated on a monthly basis but weakly correlated on a daily or hourly scale.

Professional traders therefore monitor correlation across horizons to understand both the long-term structure and short-term fluctuations.

Practical Applications in Trading and Risk Management

Correlation plays a direct role in portfolio design and day-to-day trade management:

1) Diversification

Traders who hold several positions often believe they are spreading their risk, yet correlated pairs may simply duplicate exposure. Monitoring correlation ensures genuine diversification.

2) Hedging

Negatively correlated pairs can offset each other, protecting against adverse moves. For instance, long EUR/USD and long USD/CHF positions often balance risk.

3) Pair trading

Traders may exploit temporary divergences between strongly correlated pairs, anticipating that they will eventually realign.

4) Signal confirmation

Shifts in correlation can serve as early warnings that sentiment or market drivers are changing.

What Drives Correlations to Evolve

Currency relationships are never static. Several factors shape and reshape them over time:

Monetary policy – Diverging interest rate paths often cause correlations to weaken or invert.

Geopolitical events – Wars, elections, and trade disputes can alter long-standing ties.

Commodity cycles – Oil shocks, gold rallies, and agricultural price swings influence commodity-linked currencies.

Market regimes – In times of crisis, correlations tend to converge as risk sentiment drives flows across the board.

Being alert to these forces allows traders to adjust before correlations shift dramatically.

Risks and Limitations of Relying on Correlation

While invaluable, correlation analysis has its pitfalls:

Correlation is not causation – Just because pairs move together does not mean one drives the other.

Breakdowns are inevitable – Sudden shifts can catch traders unprepared if they assume stability.

Historical bias – Past relationships may not hold under new market conditions.

Over-diversification – Attempting to balance too many correlated trades can dilute returns without reducing risk effectively.

Prudent traders treat correlation as one tool among many, not a standalone system.

Case Studies – Correlation in Action

EUR/USD vs USD/CHF – During the eurozone debt crisis, the franc surged as investors sought safety, reinforcing the pair's negative correlation.

CAD and crude oil – Canada's oil exports link the CAD to global energy prices. Sharp falls in oil often weigh heavily on the CAD.

Global stress events – In the 2008 financial crisis and during the pandemic shock of 2020. correlations across major pairs spiked as risk aversion dominated.

These examples show both the usefulness and the fragility of correlation.

Best Practices for Traders

To use correlation effectively, traders should:

Review correlations regularly – as relationships shift with time and events.

Select timeframes suited to their style – short-term traders need intraday correlations; long-term traders may prefer weekly or monthly.

Combine with other analyses – technical, fundamental, and sentiment data provide context.

Apply disciplined position sizing – to avoid amplifying risks through overlapping trades.

By integrating correlation thoughtfully, traders create more resilient strategies.

Conclusion – Navigating the Currency Web

Forex correlation is the hidden framework linking global currencies. It exposes unseen risks, offers hedging opportunities, and reveals how the fortunes of nations intertwine in the marketplace.

Yet like all tools, it requires caution: relationships shift, patterns break, and surprises emerge.

For disciplined traders, however, correlation analysis provides not only protection but also insight — turning the tangled web of the currency market into a navigable map.

Correlation-Based Trading Insights

| Correlation Type |

Trading Implication |

| Strong Positive |

Avoid opening multiple trades in highly correlated pairs to prevent overexposure. |

| Strong Negative |

Can hedge positions by trading inversely correlated pairs. |

| Weak or No Correlation |

Pairs can be traded independently; lower risk of overlap. |

Frequently Asked Questions

1. Why do some currencies move together while others move opposite?

It depends on shared economic drivers. Pairs like EUR/USD and GBP/USD often rise and fall in sync, while EUR/USD and USD/CHF usually move in opposite directions because the franc is seen as a safe haven.

2. Can correlation predict future price moves?

Not reliably. Correlation is a guide to relationships, not a forecasting tool. It helps spot risks, hedges, or trading opportunities, but sudden shifts can break past patterns.

3. How can I track correlations easily?

Use online tools like correlation matrices or heat maps (e.g. Myfxbook, Mataf). Check different timeframes—daily, weekly, monthly—to see both stable and changing links.

4. How do I avoid doubling risk on correlated trades?

Know which pairs move alike. Reduce position sizes, diversify across less-correlated assets, or use negatively correlated pairs to hedge. Awareness is your best defence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.