Portfolio trading is a protocol that executes a basket of securities as a single trade to achieve materially lower transaction costs and materially faster execution than trading each security individually — especially in less liquid fixed-income markets.

This is no longer an experimental niche: portfolio trades now account for a non-trivial share of corporate-bond flow and research shows they can cut transaction costs by roughly 40% for the least-liquid instruments.

This article explains why portfolio trading matters, how it works end-to-end, the empirical evidence for its benefits, the associated risks and governance requirements, and a practical implementation playbook for asset managers and trading desks.

Why portfolio trading matters

In short: for large, multi-security flows (rebalancing, index adjustments, liability management), portfolio trading turns a logistical headache into a single negotiated solution — provided the desk has the scale, analytics and counterparty relationships to execute it well.

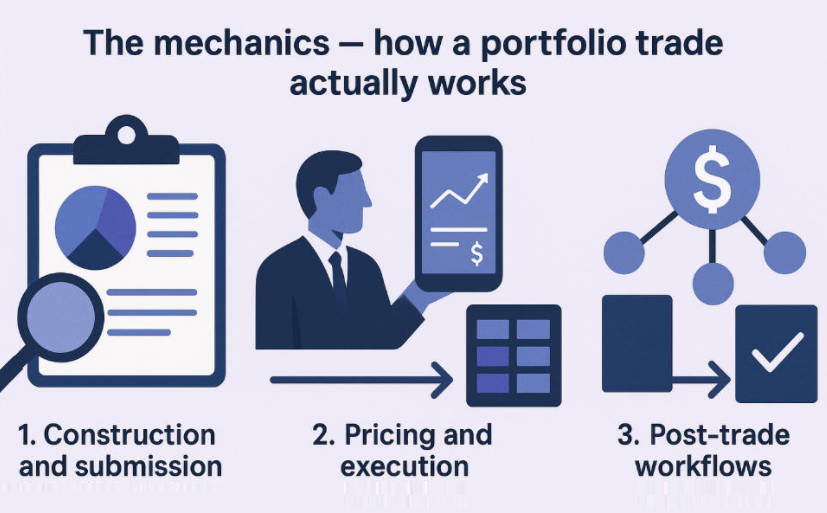

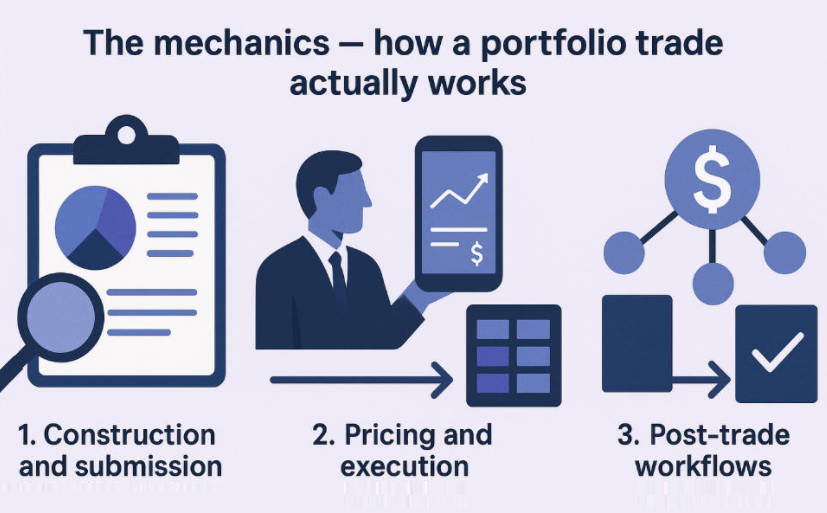

The mechanics — how a portfolio trade actually works

1. Construction and submission

Portfolio design:

The buy-side selects the universe and target weights, filtering by liquidity, eligibility, and hedging intent.

Submission:

The portfolio is submitted as a single RFQ (request for quote) or via an electronic portfolio-trading venue.

Dealer response:

One or more dealers price the net risk of the basket and return an all-in spread or cash figure for the whole portfolio.

2. Pricing and execution

All-in pricing:

Dealers convert the basket into a single price (or a spread) that reflects net risk, hedging costs and expected residual positions.

Single-line settlement:

Once accepted, the portfolio is executed as a package and then netted/allocated into individual line items for settlement and reporting.

3. Post-trade workflows

Empirical evidence — what the data says

Two strands of evidence are central:

Key findings

Academic and industry studies find portfolio trades can reduce transaction costs by over 40% in aggregate, with the largest gains accruing to the least liquid bonds.

Platform data show rapid adoption:

Tradeweb reported portfolio trading accounted for ≈11.4% of overall trading in December 2024. and client usage rose materially in 2024.

Market-level metrics confirm continued electronification:

Average daily trade counts and average trade sizes have changed as e-trading and portfolio flows reshape intraday patterns.

Coalition Greenwich/CRISIL observed larger daily trade counts and a modest increase in average trade size in 2024.

Portfolio Trading Adoption and Performance Metrics

| Metric |

Value / Change |

| Portfolio trading share (Dec 2024) |

11.4% of platform volumes (Tradeweb) |

| Cost reduction (portfolio vs single-name) |

≈40% average reduction (larger for illiquid bonds) |

| Corporate bond average daily trades (2024) |

~125,700 trades/day; avg trade size ≈ $382k |

Notes: figures above are drawn from platform and research reports. Individual desk outcomes will vary by market, basket composition and timing.

How portfolio trading becomes a competitive edge

1. Asset managers deploy portfolio trading for distinct strategic purposes:

Large rebalancing or index tracking: achieves target exposures quickly with less slippage.

Risk rotation: rapid sector/credit quality shifts are implemented as basket trades to avoid front-running and limit signalling.

Liquidity harvesting: converting illiquid legacy holdings into cash or hedgeable positions via a dealer that internalises or hedges net risk.

ETF hedging loop: portfolio trades interact with ETF creation/redemption and secondary market dynamics, reinforcing liquidity cycles.

2. Practical rule of thumb:

Use portfolio trading when notional and complexity are large enough that aggregation yields observable cost and time savings.

Avoid when the basket is dominated by highly liquid, homogeneous securities — there is little to gain.

Risk and regulatory considerations

Portfolio trading concentrates several risk vectors into one transaction; risk management must be proportionate.

Principal risks

Counterparty concentration:

a single dealer may take on a sizeable net risk for the entire bundle.

Liquidity mismatch:

The portfolio may contain assets that behave differently in stress, causing hedging/mark-to-market friction.

Model/operational risk:

Algorithmic basket construction, matching and allocation require robust data governance and controls.

Market transparency & reporting issues:

Large portfolio trades may contain sensitive order flow; dealers and investors have pushed for nuanced reporting regimes.

Recent debate surfaced when Goldman Sachs proposed delayed public reporting for very large portfolio trades to avoid disruptive signalling.

Regulatory context

Implementation playbook — governance, tech and people

Below is a concise checklist and a second table that operationalises the playbook.

1. Pre-trade (governance & analytics)

Define eligibility criteria (size, liquidity thresholds, account treatment).

Run pre-trade analytics: expected execution cost, liquidity footprint, correlation stress-tests.

Identify preferred dealers and venues; confirm capacity and hedging pathways.

2. Execution (protocol)

Submit portfolio via preferred electronic venue or RFQ; consider multi-dealer vs single-dealer strategies.

Negotiate all-in pricing and clear allocation rules upfront.

Capture execution telemetry for later TCA (transaction cost analysis).

3. Post-trade (control & review)

Perform TCA vs benchmark and adjust policy where necessary.

Maintain an execution committee to review large or unusual baskets.

Refresh dealer panels and technology periodically.

Portfolio Execution Control Checklist

| Area |

Must-have elements |

KPI examples |

| Governance |

Written portfolio-trading policy; execution committee |

% trades pre-approved; policy breaches |

| Analytics |

Liquidity scoring, stress scenarios, TCA platform |

Expected vs realised cost |

| Counterparty |

Dealer capacity confirmation; negotiated terms |

Fill rate; hedging cost |

| Tech |

Electronic RFQ support, straight-through processing |

Time from RFQ to confirm |

| Compliance |

Reporting templates; audit trail |

On-time reporting % |

Common objections and rebuttals

"Portfolio trading reduces transparency."

Rebuttal: portfolio protocols improve execution for large, illiquid items while regulatory frameworks (and industry proposals) seek to balance timely reporting with market stability.

The debate centres on windowing and thresholds, not on eliminating reporting.

"It's only for the very largest managers."

Rebuttal: while the greatest absolute benefits accrue to large cheques, platform roll-outs and improved electronic liquidity mean midsized managers can increasingly participate via pooled or delegated workflows.

The future — technology, venues and market structure

Conclusion

Portfolio trading has moved from an innovation to a mainstream toolkit in fixed income and large-scale portfolio execution.

For asset managers with sizeable, complex flows, portfolio trading is not merely an execution technique — it is a strategic lever that, when marshalled with care, improves implementation outcomes and preserves optionality in stressed markets.

Frequently Asked Questions

Q1. How much cost improvement is typical?

Around 30–40% lower transaction costs versus single-name RFQs, especially for less liquid bonds.

Q2. Which asset classes gain the most?

Mainly corporate bonds, with growing use in multi-asset and hybrid baskets.

Q3. How should performance be measured?

Track execution cost vs pre-trade estimates, fill rates, and time efficiency through a TCA dashboard.

Q4. Single-dealer or multi-dealer workflow?

Single-dealer suits speed and size; multi-dealer offers better price discovery. Choice depends on basket complexity and dealer depth.

Q5. Will delayed trade reporting become standard?

It's under discussion, but needs regulatory approval and safeguards to maintain transparency.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.