A C-Book broker blends A-Book and B-Book models, balancing fair market access with smart risk management.

Introduction

A C-Book broker is a less common hybrid model that combines features of both A-Book and B-Book systems.

It allows brokers to manage risk dynamically such as routing some trades to external liquidity providers (A-Book style) while keeping others in-house (B-Book style) based on factors like client performance, trade size, or market conditions.

Definition

A C-Book broker uses an adaptive risk management model where trades are categorized and handled differently.

Profitable or high-volume traders may have their orders sent directly to liquidity providers, while smaller or less consistent traders’ positions might be held internally.

This flexible setup helps brokers maintain profitability while offering efficient trade execution to a broad client base.

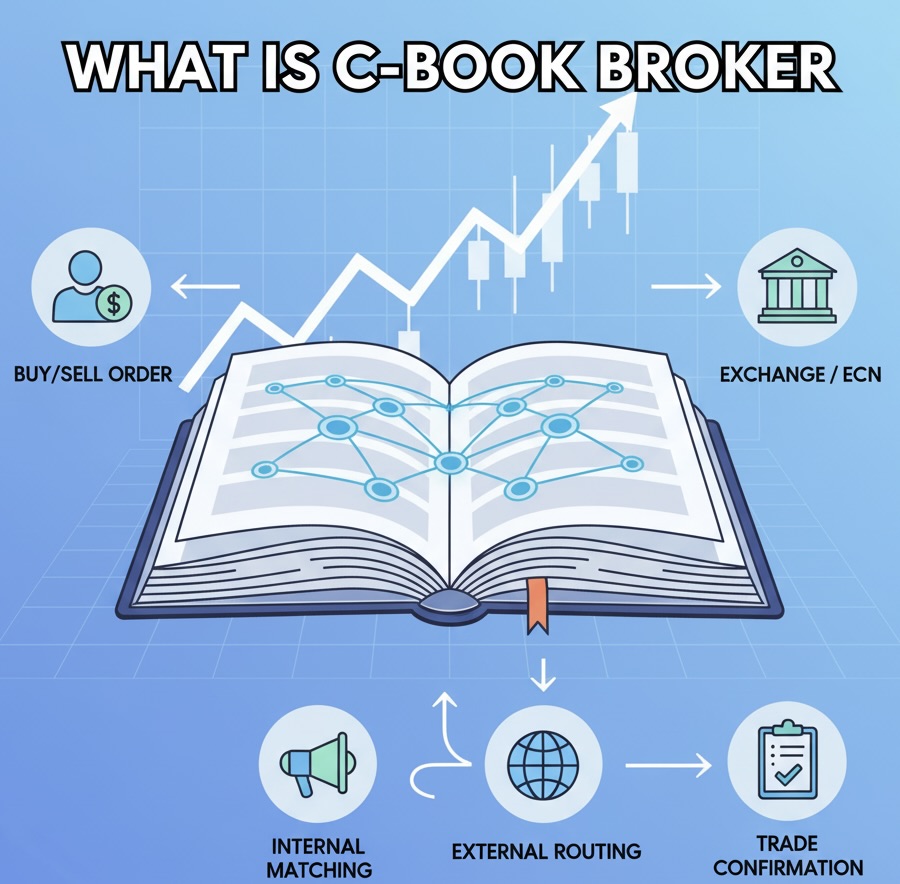

How a C-Book Broker Works

The C-Book model functions as a risk management bridge between A-Book and B-Book execution.

The broker’s system continuously analyzes trader behavior including win rate, trade duration, and volume to decide where to route each order.

For example, traders who consistently profit are often switched to A-Book routing, where trades are passed to the market to avoid broker losses.

Meanwhile, less experienced or infrequent traders may remain on the B-Book side, where their trades are managed internally.

This model gives brokers flexibility to balance exposure and protect their business during volatile periods, while still maintaining competitive pricing.

Example

Imagine a forex broker using a C-Book setup.

A professional trader who regularly profits on EUR/USD trades gets routed through the A-Book path where their orders are sent directly to liquidity providers, ensuring real market execution and transparency.

A newer trader with small positions and irregular trades will stay on the B-Book side, and their orders are filled internally by the broker.

This system allows the broker to hedge selectively and manage risk efficiently across different trader profiles, maintaining profitability while still offering transparency to clients.

Advantages and Risks

| Advantages / Benefits |

Disadvantages / Risks |

| Balances risk between A-Book and B-Book execution |

Can reduce transparency if routing rules aren’t disclosed |

| Offers flexibility during volatile markets |

Traders may not know how their orders are handled |

| Supports both new and professional traders |

Conflicts of interest may still exist for B-Book side |

| Allows brokers to manage exposure dynamically |

Complex structure may confuse beginners |

Related Terms

A-Book Broker: Routes trades directly to liquidity providers for real market execution.

B-Book Broker: Holds client trades internally, potentially profiting from client losses.

Hybrid Model: Combines both A-Book and B-Book methods to optimize risk management.

Liquidity Provider: A bank or institution offering buy/sell quotes to brokers.

Frequently Asked Questions (FAQ)

1. Is a C-Book broker better than A-Book or B-Book?

It depends. A C-Book broker balances the pros and cons of both systems, offering flexibility but sometimes less transparency.

2. How can I tell if my broker uses a C-Book model?

Most brokers don’t advertise this openly, but you can review their execution policy or ask about how they manage client order flow.

3. Why do brokers use a C-Book system?

To manage risk efficiently and routing profitable traders to the market (A-Book) and managing less consistent ones internally (B-Book).

Summary

A C-Book broker blends A-Book and B-Book models to manage risk adaptively. It routes trades based on trader performance and market conditions, balancing transparency and profitability.

While flexible, it’s less straightforward than pure A-Book or B-Book setups and may limit full visibility into trade execution.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.