Tax loss harvesting is a smart, legal strategy that can help investors reduce their tax bill and make the most of a challenging year in the markets. As the end of the tax year approaches, understanding how to use tax loss harvesting can unlock valuable savings and improve your portfolio’s after-tax returns.

This guide explains what tax loss harvesting is, how it works, and how you can use it as part of your year-end tax planning in 2025.

What Is Tax Loss Harvesting?

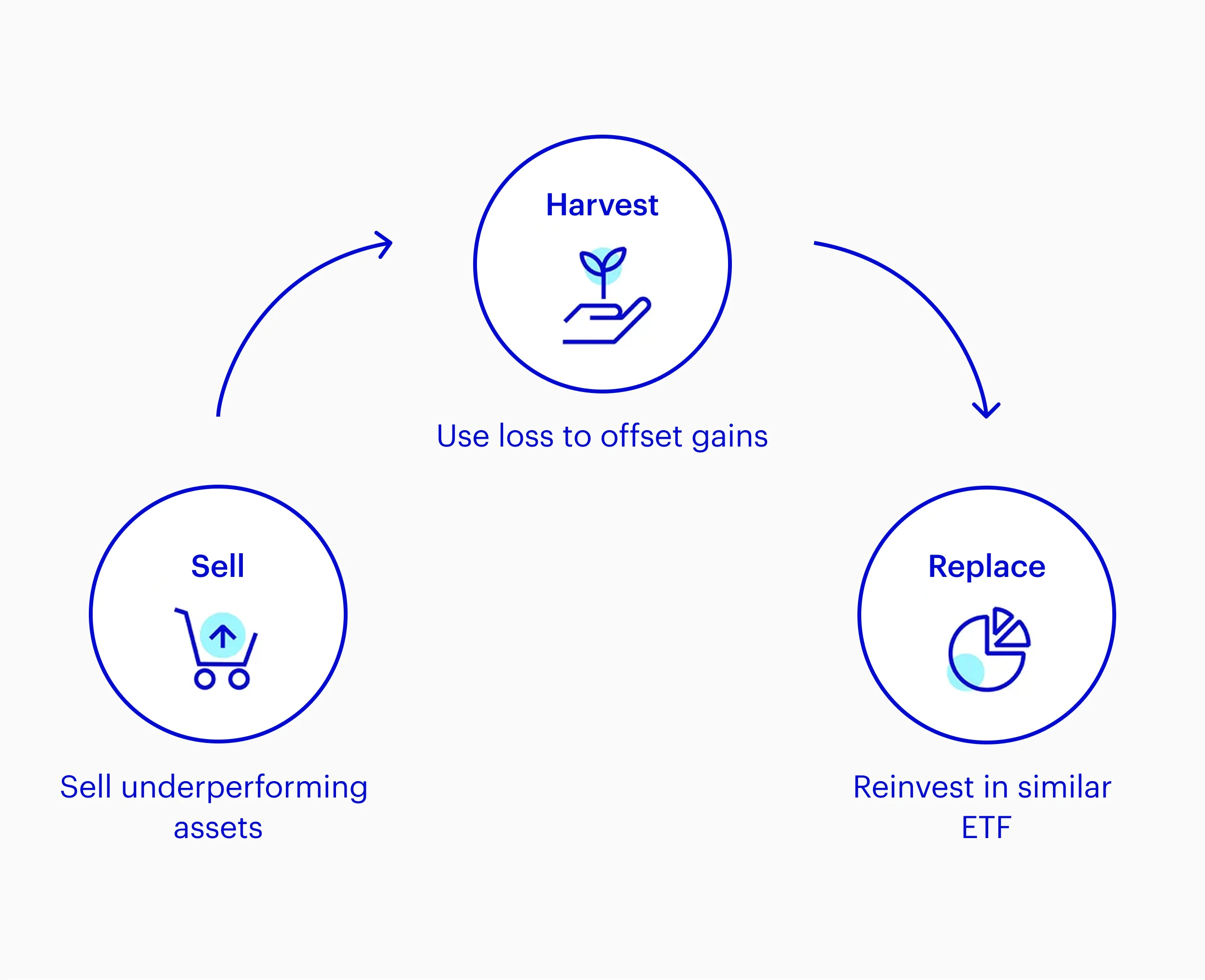

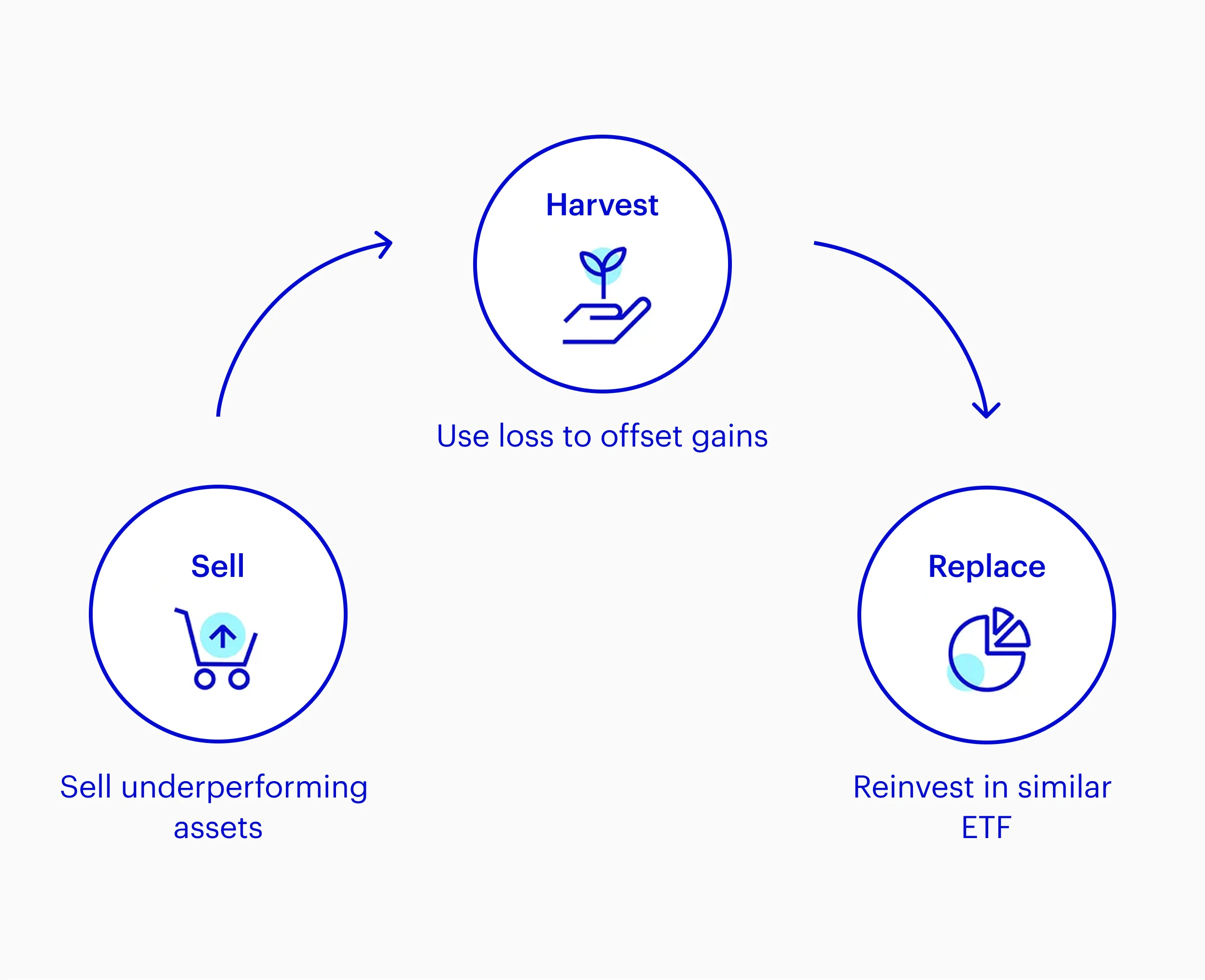

Tax loss harvesting is the process of selling investments that have declined in value in order to realise a capital loss. This realised loss can then be used to offset capital gains from other investments, reducing your overall tax liability for the year.

If your losses exceed your gains, you can use up to $3,000 of those losses to offset ordinary income each year, with any remaining losses carried forward to future years.

How Does Tax Loss Harvesting Work?

Identify Investments With Losses: Review your taxable investment accounts (not retirement accounts like IRAs or 401(k)s) for stocks, ETFs, mutual funds, or even cryptocurrencies that are worth less than what you paid for them.

Sell the Losing Investments: By selling, you “harvest” the loss, which can be used to offset capital gains from other investments you’ve sold at a profit during the year.

Offset Gains and Income: Losses are first used to offset gains of the same type (short-term losses offset short-term gains, long-term losses offset long-term gains). If losses exceed gains, up to $3,000 can offset ordinary income, with the rest carried forward.

Stay Invested: Many investors reinvest the proceeds into similar (but not “substantially identical”) investments to maintain their market exposure and asset allocation.

Example

Suppose you realised $25,000 in gains from selling Investment B, but you also have $30,000 in losses from selling Investment A. You can offset your entire gain, reducing your capital gains tax to zero, and use $3,000 of the remaining loss to lower your ordinary income. The leftover $2,000 loss can be carried forward to future tax years.

Why Use Tax Loss Harvesting at Year-End?

Year-end is the ideal time for tax loss harvesting because you have a clear picture of your gains and losses for the year. By acting before the tax year closes, you can:

Offset gains from earlier in the year

Reduce your taxable income

Rebalance your portfolio for the new year

For high earners or those expecting a lower tax rate in retirement, harvesting losses now can also create additional future savings if you defer gains until you’re in a lower tax bracket.

Key Benefits of Tax Loss Harvesting

Lower Tax Bill: Offsetting gains and reducing ordinary income can lead to significant tax savings.

Improve After-Tax Returns: By keeping more of your investment gains, you can reinvest and potentially grow your wealth faster.

Portfolio Rebalancing: Selling underperforming assets can help you rebalance and strengthen your investment strategy.

Carry Forward Losses: Excess losses can be used in future years, giving you flexibility and ongoing tax benefits.

Important Rules and Considerations

The Wash Sale Rule

The IRS wash sale rule prohibits you from claiming a loss if you buy a “substantially identical” security within 30 days before or after the sale. To avoid this, choose a similar but not identical investment, or wait at least 31 days before repurchasing the same asset.

Eligible Accounts

Tax loss harvesting only applies to taxable accounts. Losses in tax-advantaged accounts like IRAs or 401(k)s do not count for tax purposes.

Asset Types

You can harvest losses from a wide range of assets, including individual stocks, ETFs, mutual funds, and even cryptocurrencies. However, each asset class may have its own nuances and reporting requirements.

Timing and Planning

Don’t harvest losses just for the sake of it. Consider your long-term investment plan, and use tax loss harvesting as a tool to support your portfolio goals and tax efficiency.

Who Should Consider Tax Loss Harvesting?

Investors with realised capital gains: If you’ve sold investments at a profit, harvesting losses can directly reduce your tax bill.

High-income earners: Offsetting gains and reducing ordinary income is especially valuable if you’re in a high tax bracket.

Anyone with a diversified portfolio: Volatile years often create opportunities to harvest losses from some assets while others have gained.

Common Mistakes to Avoid

Violating the wash sale rule: This can disallow your tax deduction.

Selling just to harvest a loss: Always consider your broader investment strategy.

Ignoring transaction costs or fees: These can eat into your tax savings if not managed carefully.

Final Thoughts

Tax loss harvesting is a powerful year-end tax planning strategy that can help you offset gains, reduce your tax bill, and position your portfolio for future growth.

By understanding the rules, timing your sales, and staying invested, you can make the most of this technique and keep your investment plan on track for 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.