Scalping is a fast-paced and high-intensity trading method that seeks to capitalise on small price movements across highly liquid financial instruments. Unlike swing or position trading, which may hold positions for days or weeks, scalpers operate on very short timeframes—often mere minutes or even seconds. The goal is to accumulate many small gains that can add up to significant profits over the course of a trading session.

A technical indicator–based approach to scalping combines precision with consistency, enabling traders to make rapid decisions using tools designed to analyse market patterns in real time. In this article, we explore how scalpers use technical indicators to navigate short-term price action, while maintaining strong risk control and execution discipline.

Preferred Markets & Timeframes

Scalping thrives in liquid markets where tight spreads and rapid order execution are the norm. The most commonly traded markets among scalpers include:

Scalping thrives in liquid markets where tight spreads and rapid order execution are the norm. The most commonly traded markets among scalpers include:

Forex pairs like EUR/USD, GBP/USD, and USD/JPY

Index CFDs such as the S&P 500. DAX, or FTSE 100

Highly liquid stocks like Apple, Tesla, or Nvidia

Cryptocurrencies such as BTC/USDT or ETH/USDT during peak volatility

The chosen timeframe is equally crucial. Scalpers usually operate on 1-minute (M1) or 5-minute (M5) charts, allowing them to catch short-lived trends or micro-reversals. Some advanced traders may even use tick charts, which plot a new candle based on transaction count rather than time, offering higher responsiveness during busy trading periods.

Markets with low volatility or high spreads are generally avoided, as they reduce the profitability of small pip movements.

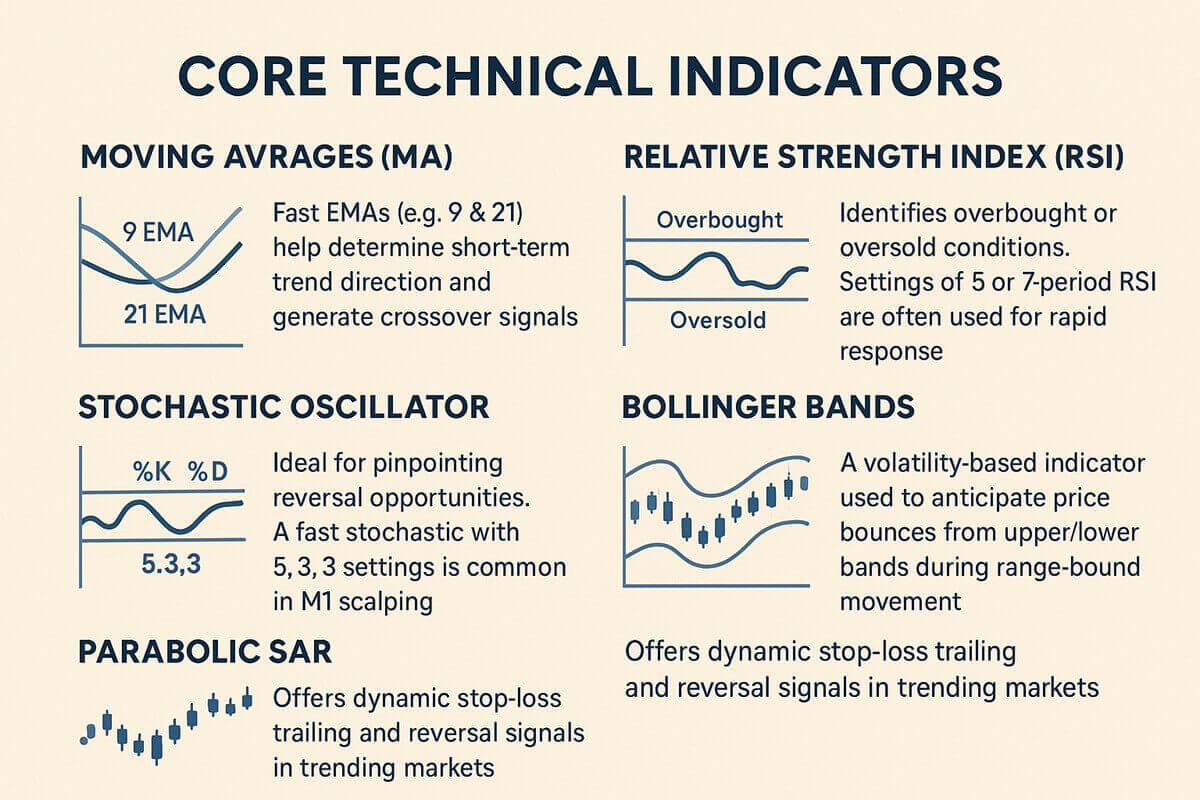

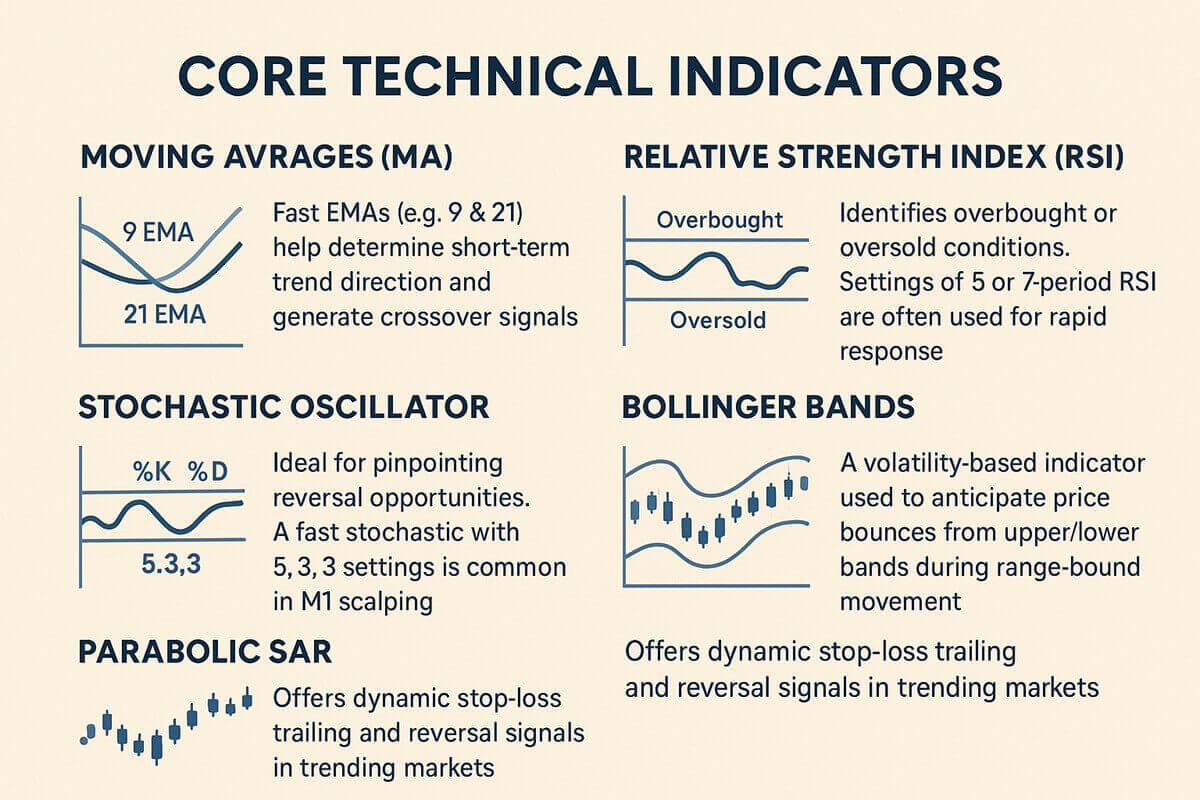

Core Technical Indicators

Scalpers rely heavily on technical indicators to make quick, data-driven decisions. While many indicators exist, the following are particularly well-suited for scalping strategies:

Scalpers rely heavily on technical indicators to make quick, data-driven decisions. While many indicators exist, the following are particularly well-suited for scalping strategies:

Fast EMAs (e.g. 9 & 21) help determine short-term trend direction and generate crossover signals.

Identifies overbought or oversold conditions. Settings of 5 or 7-period RSI are often used for rapid response.

Ideal for pinpointing reversal opportunities. A fast stochastic with 5. 3. 3 settings is common in M1 scalping.

A volatility-based indicator used to anticipate price bounces from upper/lower bands during range-bound movement.

Offers dynamic stop-loss trailing and reversal signals in trending markets.

These tools, when combined, help traders define trend direction, momentum, entry triggers, and risk thresholds within seconds—critical for scalp trading.

Entry & Exit Rules

One of the defining features of scalping is the rigid discipline around trade entries and exits. A typical technical scalping strategy might use:

Entry Criteria:

Price above both the 9 & 21 EMAs

RSI between 60–80 (bullish) or 20–40 (bearish)

Stochastic confirming momentum direction

Break of a recent high/low or bounce from Bollinger Band

Exit Criteria:

Fixed profit target (e.g. 5–15 pips for forex or 0.2–0.5% for stocks)

Stop-loss 1–2 pips beyond recent swing high/low

Signal reversal in RSI or stochastic crossover

Price hits opposite Bollinger Band or trendline

Using automated alerts, hotkeys, or one-click trade panels can improve precision. Scalpers avoid lingering in the market; they take small wins and move on, preserving energy and avoiding emotional traps.

Risk & Trade Management

In scalping, risk management is paramount, because the frequency of trades increases the potential for losses to accumulate quickly. Key risk management rules include:

Never risk more than 1–2% of total capital per trade. Due to the small pip targets, scalpers often use higher lot sizes—but still adhere to a fixed risk percentage.

Always set a stop-loss based on technical levels, not emotions. A typical stop-loss might be 3–6 pips for major forex pairs.

While many scalpers settle for a 1:1 ratio, using a 1:2 setup (e.g. risking 5 pips to gain 10) can yield more consistent returns.

Limit the number of trades per day (e.g. 10–20 maximum) to avoid fatigue and overtrading.

By capping daily losses and staying within a structured system, scalpers can maintain consistency and protect their capital in a highly active environment.

Execution & Broker Setup

Because scalping relies on rapid entries and exits, a trader's technical setup plays a critical role in profitability. Ideal execution conditions include:

Choose ECN or STP brokers with tight spreads, fast execution, and no dealing desk intervention.

Look for spreads

MetaTrader 4/5. cTrader, or NinjaTrader with VPS hosting are popular platforms among scalpers.

Low latency (ping

Additionally, access to a Level II order book or Depth of Market (DOM) display can offer an edge in spotting liquidity clusters and anticipating price reactions.

Mental Discipline & Psychology

Perhaps the most underestimated aspect of scalping is the psychological pressure it places on traders. The fast pace, combined with frequent decision-making and slim margins, can easily lead to emotional decision-making. To combat this:

Follow predefined entry/exit rules. Do not improvise mid-trade.

Scalping requires total attention. Minimise distractions and avoid multitasking.

Losses are inevitable. Do not attempt to win back losses with impulsive trades.

Frequent breaks help maintain clarity. Many scalpers trade in "sessions" of 30–60 minutes with planned pauses.

Log every trade with details about why it was entered, how it played out, and what could be improved. Reflection breeds refinement.

Ultimately, consistent scalping is not about hitting big winners—it's about managing risk, maintaining focus, and letting the edge play out over time.

Conclusion

Scalping with technical indicators is a demanding but rewarding trading style that suits those who thrive on precision, speed, and structure. While the gains per trade may be small, they add up significantly when applied with discipline and consistency.

Success lies in the details—understanding your market, choosing the right indicators, applying strict risk control, and developing the mental fortitude to remain calm and consistent amid market noise. With the right preparation and practice, scalping can offer a powerful edge for traders willing to master its mechanics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.