Intraday trading, also known as day trading, involves opening and closing positions within the same trading day. This style of trading is fast-paced and requires discipline, precision and strategy.

Many traders are drawn to the potential profits that intraday trading offers, but without a solid plan and experience, the risks can quickly outweigh the rewards. That is where intraday trading tips become crucial for improving decision-making and reducing costly errors.

In this article, we explore the most effective intraday trading tips that can help traders navigate the markets more confidently and efficiently. Whether you are new to intraday trading or looking to refine your approach, these tips provide a foundation for better results and more consistent performance.

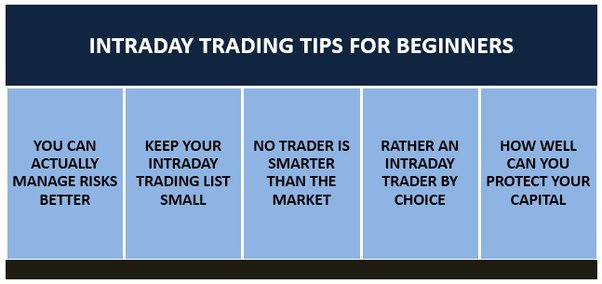

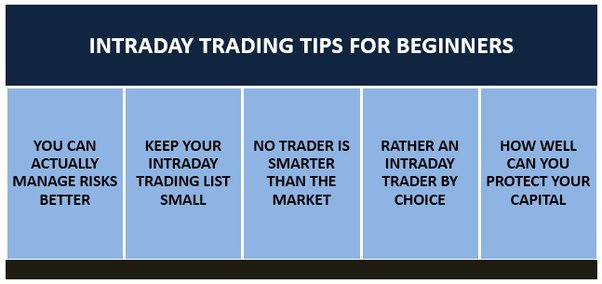

8 Intraday Trading Tips Traders Must Know

1) Understand Market Volatility Before Entering a Trade

One of the most important intraday trading tips is to understand how volatile the market is before placing trades. Volatility measures how much prices are likely to move within a short time. Intraday traders thrive on volatility because it creates opportunities, but unmanaged volatility can lead to unexpected losses.

Before every session, examine volatility indicators and economic calendars to anticipate major events or announcements that could impact prices during the day.

Knowing when markets are likely to be most active can help you time entries and exits more effectively. The opening and closing hours of major markets tend to be the most volatile, making them key periods for intraday trading strategies.

2) Stick to a Defined Trading plan

Discipline is essential in intraday trading. A trading plan outlines your entry and exit rules, position size, maximum risk per trade and overall strategy. Following a plan helps eliminate emotional decisions and impulsive trades, which are common mistakes in day trading. One of the most overlooked intraday trading tips is not just to have a plan, but to follow it strictly, regardless of what the market appears to be doing.

Markets can be unpredictable, and without a plan, it becomes easy to chase losses or abandon logic under pressure. A well-structured plan should be based on tested strategies and backed by your personal risk tolerance and trading goals.

3) Use Stop-Loss Orders to Manage Risk

Risk management is one of the most critical intraday trading tips for any trader, regardless of experience. The use of stop-loss orders is a non-negotiable part of protecting your capital. A stop-loss automatically exits a trade when the price reaches a predetermined level, helping limit losses when trades do not go as expected.

Intraday traders cannot afford to hold losing positions for too long because they need to close all trades by the end of the day. Using stop-losses consistently ensures that you never risk more than you can afford to lose on a single trade.

4) Choose Liquid Stocks and Instruments

Liquidity refers to how easily a security can be bought or sold without significantly affecting its price. For intraday traders, choosing instruments with high liquidity is essential. Liquid markets allow traders to enter and exit positions quickly and with minimal slippage. One of the smartest intraday trading tips is to focus on instruments like major forex pairs, large-cap stocks or popular index CFDs.

Avoid trading assets with low volume or wide spreads, as these can eat into profits or make it difficult to execute trades efficiently. Reviewing the average daily volume of a security is a useful way to assess its liquidity before trading.

5) Keep Emotions in Check

Intraday trading can be mentally taxing due to its fast pace and frequent decision-making. Emotional responses such as fear, greed or frustration can lead to poor choices and costly mistakes. Among the most important intraday trading tips is the need to remain calm and rational throughout the trading session.

Using techniques such as journaling, taking breaks or setting performance limits can help manage emotions and maintain focus. Successful traders treat trading as a disciplined process rather than a gamble or emotional challenge.

6) Avoid Overtrading

Overtrading is a common pitfall for intraday traders. The excitement of quick market movements can tempt traders to take excessive positions or chase trades without proper analysis. One of the classic intraday trading tips is to limit the number of trades per session and ensure each trade has a valid technical or fundamental basis.

Every trade should align with your predefined strategy. Taking more trades does not always increase your chances of profit and can often lead to unnecessary losses or high transaction costs.

7) Keep Learning and Reviewing Your Trades

Markets evolve constantly, and strategies that work today may not work tomorrow. Regular learning and trade review are among the most valuable intraday trading tips. Reviewing your trades helps identify patterns, strengths and areas for improvement.

Using a trading journal to document your trades, reasons for entry and exit, and emotional state can provide insight over time. Continuous learning through market news, webinars and educational content helps you stay informed and adaptable.

8) Do Not Rely on a Single Strategy

One-size-fits-all strategies rarely work in intraday trading. Market conditions can vary significantly from one day to the next. Having a flexible approach and using different tools depending on the scenario is one of the more advanced intraday trading tips.

Some days may suit momentum trading, while others may favour mean reversion or breakout strategies. Testing and understanding multiple strategies allows you to adapt to changing market environments without forcing trades that do not fit the conditions.

Conclusion

Intraday trading offers exciting opportunities but comes with considerable challenges. By applying effective intraday trading tips such as following a clear plan, managing risk, choosing liquid instruments, and keeping emotions under control, traders can improve their chances of long-term success.

The goal is not to win every trade but to manage risk consistently and make rational decisions based on reliable information and tested strategies. With patience, practice and discipline, intraday trading can become a rewarding endeavour for those willing to commit to its learning curve.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.