Forex trading strategies are essential for navigating the fast-paced world of currency markets. With daily volumes exceeding $7 trillion, the forex market offers opportunities for all types of traders—from short-term speculators to long-term investors.

But what are the most effective forex trading strategies, and how do they work in practice? This guide explores popular approaches and explains how traders can use them to pursue consistent results.

Why Forex Trading Strategies Matter

A trading strategy is a structured plan that guides when to enter and exit trades, how much to risk, and what signals to follow. By using a clear strategy, traders avoid emotional decisions and instead rely on logic, data, and discipline.

The right strategy can help traders adapt to different market conditions and manage risk effectively.

Top 7 Forex Trading Strategies

1. Swing Trading

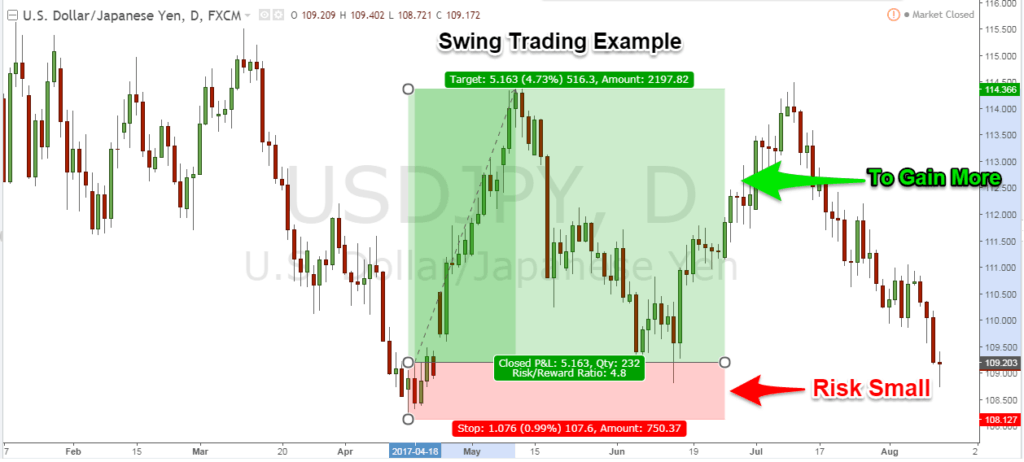

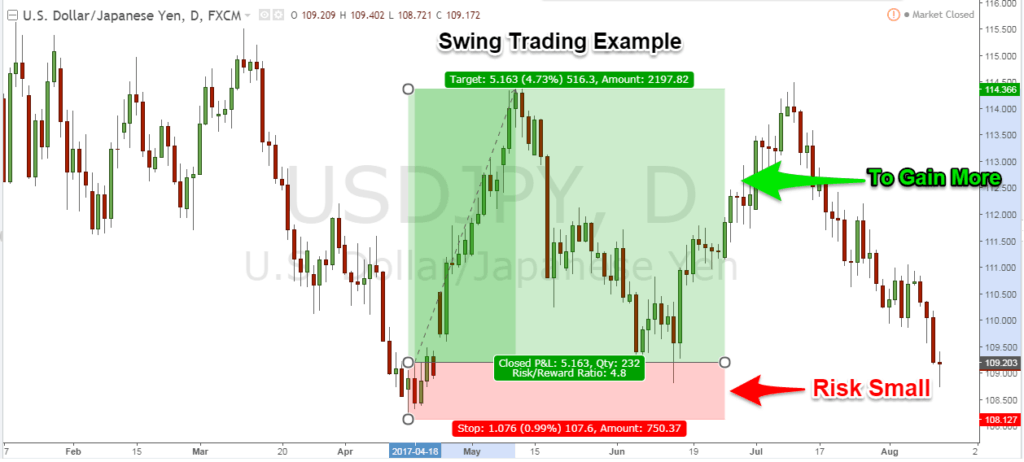

Swing trading aims to capture medium-term price moves, holding positions for several days or weeks. Traders look for “swings” within a trend—buying before an upward move or selling before a downward move. This strategy requires patience and the ability to withstand short-term volatility.

Key features:

Fewer trades; less time-intensive

Positions held overnight or longer

Suitable for those who can handle some uncertainty

Swing traders often use technical analysis, such as support and resistance levels, moving averages, and candlestick patterns, to spot trade opportunities.

2. News Trading

News trading involves reacting to market-moving events—like central bank decisions, economic data releases, or geopolitical headlines. Traders monitor calendars for high-impact events and enter trades based on expected volatility.

Key features:

Simple to understand; used by all experience levels

Requires quick decision-making

High volatility can mean rapid gains or losses

To succeed, news traders must keep up with global developments and use risk controls, such as stop-loss orders, to protect against unexpected moves.

3. Day Trading

Day trading is the practice of opening and closing trades within the same day, avoiding overnight risk. Day traders seek to profit from small price movements and market volatility during active sessions.

Key features:

Day traders often rely on technical indicators, Chart Patterns, and real-time news to make fast decisions. This strategy can be demanding but offers flexibility and control.

4. Position Trading

Position trading is a long-term approach, holding trades for weeks, months, or even years. Traders focus on major economic trends and fundamental analysis, ignoring short-term fluctuations.

Key features:

Long-term, “buy and hold” style

Requires strong discipline and capital

Sensitive to macroeconomic shifts

Position traders must be prepared for periods of drawdown and ensure they have enough capital to withstand market swings.

5. Range Trading

Range trading works best in sideways markets, where prices bounce between support and resistance. Traders buy near support and sell near resistance, profiting from repeated reversals.

Key features:

Effective in consolidating markets

Involves both long and short trades

Needs good chart-reading skills

This approach requires careful monitoring, as breakouts from the range can lead to losses if not managed properly.

6. Trend Trading

Trend trading focuses on identifying and trading in the direction of the prevailing market trend. Traders use tools like moving averages, the Relative Strength Index (RSI), and momentum indicators to confirm trends.

Key features:

Follows the market's main direction

Can be combined with breakout or momentum strategies

Requires skill in spotting trend reversals

Trend trading works well in strong, directional markets and is a staple for many successful forex traders.

7. Scalping

Scalping is a high-frequency strategy that targets very small price changes, often holding positions for just seconds or minutes. Scalpers make dozens or hundreds of trades per day.

Key features:

Fast-paced; requires focus

Small profits per trade, but many trades

Works best with low spreads and high liquidity

Scalping is not recommended for beginners, as it demands quick decision-making and strict discipline.

Risk Management: The Foundation of Every Strategy

No strategy guarantees success. Effective risk management is crucial for long-term profitability:

Use stop-loss orders to limit potential losses.

Risk only a small portion of your capital per trade (often 1–2%).

Diversify across currency pairs and strategies.

Review and adapt your approach as market conditions change.

Conclusion

Forex trading strategies provide a roadmap for navigating the world's largest financial market. Whether you prefer swing, news, day, trend, or range trading, the key is to choose a strategy that suits your goals and risk tolerance—and to manage risk at every step.

With discipline, practice, and a clear plan, traders can pursue consistent results in the ever-evolving forex market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.