Crypto spot markets and on-chain networks never sleep as you can buy, sell or move crypto 24/7, 365 days a year. However, INR deposits and withdrawals through bank transfers must comply with Indian banking regulations.

Thus, so fiat on-ramps and off-ramps are constrained by bank operational timings and rules. Taxes (30% on gains and 1% TDS on trades) and regulatory compliance remain crucial practical constraints for India-based traders.

Below is a complete guide explaining how crypto market hours work, what's always open vs what's not, the best trading windows in IST, and practical tips (including tax and settlement implications) for traders and investors in 2025.

What Are the Best Crypto Market Timings in India?

Although markets are always open, liquidity tends to gather during specific overlaps of global sessions. Indian traders often target these IST windows for better spreads and higher volumes:

Why evening? Most major crypto liquidity originates in U.S. and European time zones; global institutional desks, OTC desks and macro traders are most active then, producing larger moves and tighter order books.

How U.S. Macro Events and Indian Hours Interplay

Major macro events (Fed decisions, US CPI/NFP) often hit during Indian evening hours, which overlap with the prime liquidity window for crypto. That means:

Anticipate fluctuations and rapid shifts when U.S. prints are released (typically 6:30 PM to 8:30 PM IST).

If you hold leveraged positions through these prints, account for volatility and margin risk.

Successful intraday crypto traders in India coordinate trading plans around the U.S. data calendar and major token/chain governance events.

Taxes and TDS Are Timing Traders Cannot Avoid

India's cryptocurrency tax regulations, established in the 2022 budget, remain fundamental for trading feasibility. To provide context, a fixed 30% tax on profits from VDAs and a 1% TDS on sales transactions were introduced and continue to apply.

TDS is collected at the time of sale on Indian exchanges, affecting net proceeds and effective intraday cash flows.

Exchanges implement TDS at the point of transaction, meaning your fiat withdrawal is lower by the TDS collected, which impacts how you time converting crypto to INR, especially if you make many small trades.

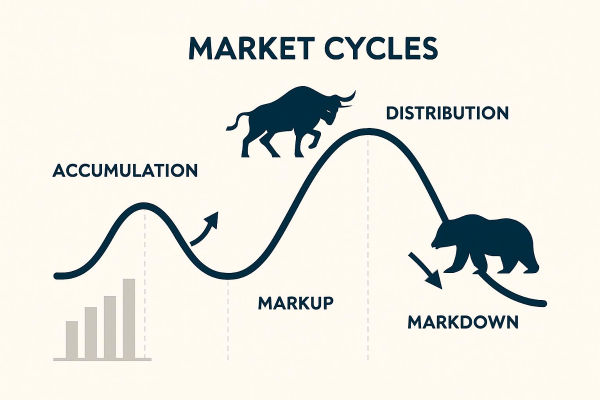

Why Market Timing Matters for Crypto Traders in India?

As mentioned above, crypto markets are global and continuous, as price moves can happen at any hour because liquidity globally never fully pauses. For Indian traders, that matters for three reasons:

Execution Windows: While you can place market orders at any hour, execution quality varies across global session overlaps.

Fiat On/Off Ramps: Converting INR to crypto depends on bank hours and exchange payment rails; these create practical windows for entering or exiting to rupees.

Compliance and Taxes: Each trade can trigger tax/TDS reporting; settlement and reporting timelines affect cash flows and recordkeeping.

Understanding the distinction between "crypto market is always open" and "your INR bank transfer isn't" is the core of good planning for Indian users.

The Constrained Layer: INR Deposits, Withdrawals and Banking Rails

Continuing from above, while crypto trading is continuous, fiat movement (INR) is not. Most Indian exchanges rely on banks and UPI rails for INR deposits and withdrawals. That means:

1) INR Deposit/Withdrawal Availability

It is subject to bank working hours, policies and exchange settlement windows. Recent updates to rules (2025) altered operational specifics regarding ID management and P2P restrictions, potentially affecting the speed of INR payment clears and the usability of specific collect/receive functions for crypto on-ramps.

2) Night-Time INR Transfers

It may succeed via some bank flows depending on the counterparty bank's processing windows. However, exchanges often schedule fiat crediting/refund cycles during business hours to comply with banking settlement and KYC checks.

3) P2P and Third-Party Routing

Some users use P2P, UPI collect or escrow services to move INR off exchanges outside bank hours. It increases convenience but carries counterparty and compliance risk; exchanges usually document allowed methods and limits.

Ultimately, you can trade crypto around the clock. However, if you need INR on the same night, anticipate possible delays.

Trading Strategies Tied to Crypto Timing

Frequently Asked Questions

Q1. Is the Crypto Market Open 24/7 in India?

Yes. The cryptocurrency market operates 24 hours a day, 7 days a week, allowing you to trade at any time in India without limitations.

Q2. What Is the Best Time to Trade Cryptocurrency in India?

The most active trading hours in India are typically between 5:30 PM and 2:30 AM IST, when U.S. and European markets are open, leading to higher liquidity and volatility.

Q3. Is Weekend Trading Different From Weekday Trading in Crypto?

While the market is open on weekends, liquidity and volatility may vary. On weekends, trading volume tends to be somewhat lower than during weekdays when institutional trading is more prominent.

Conclusion

In conclusion, while the crypto market in India is always open, INR transactions are limited. That means you can capture overnight moves, react to international news and trade around the clock. However, getting INR in your bank account, paying taxes, and moving funds between fiat and crypto require planning around banking hours.

Therefore, combine the always-open market advantage with disciplined timing, robust risk management and careful tax/recordkeeping to trade crypto effectively from India.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.