The US dollar extended its slide to fresh three-year lows on Monday, pressured by mounting expectations for Federal Reserve rate cuts and persistent economic uncertainty ahead of this week's pivotal FOMC meeting.

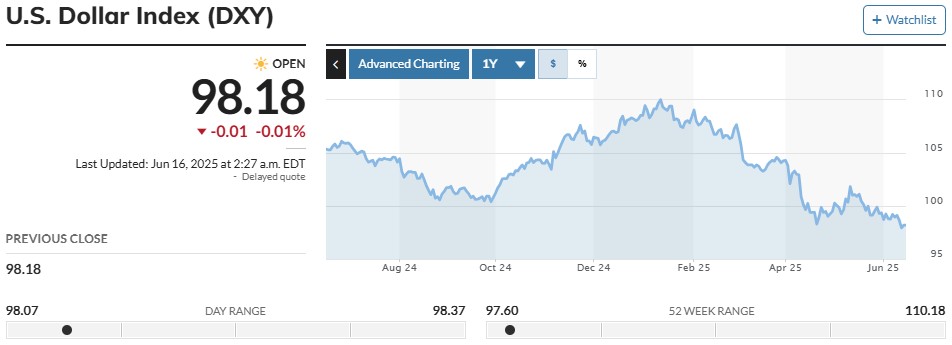

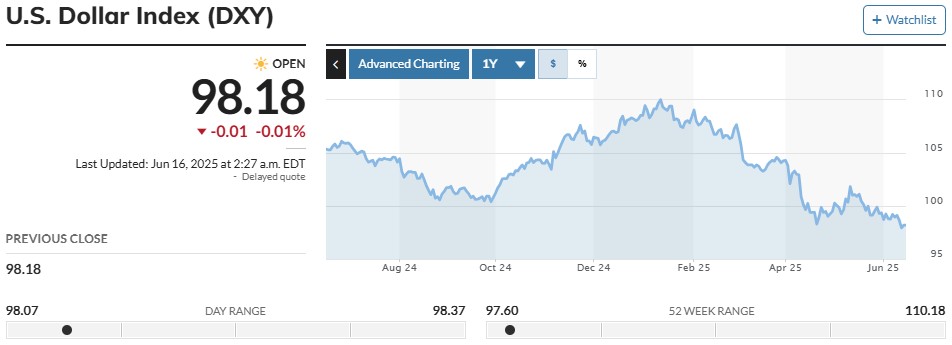

The US dollar index (DXY) dropped as low as 98.6 last Thursday, marking a decline of more than 9% since the start of 2025 and putting the greenback on track for its worst first half-year performance since 2002. The dollar's weakness has been broad-based, with Scandinavian currencies leading gains: the Swedish krona has surged 14% and Norway's krone nearly 12% year-to-date, while the euro is up 11.5% against the dollar.

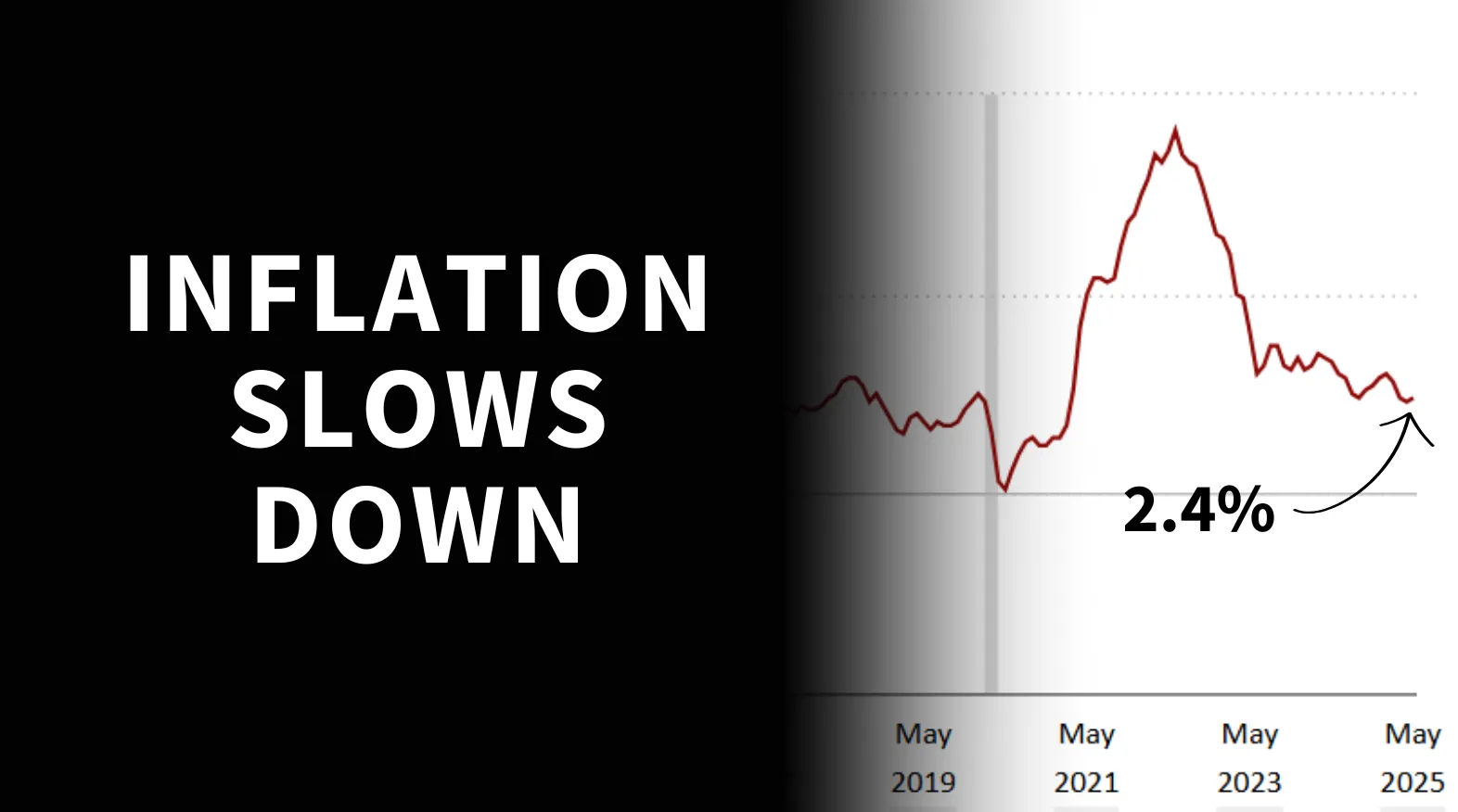

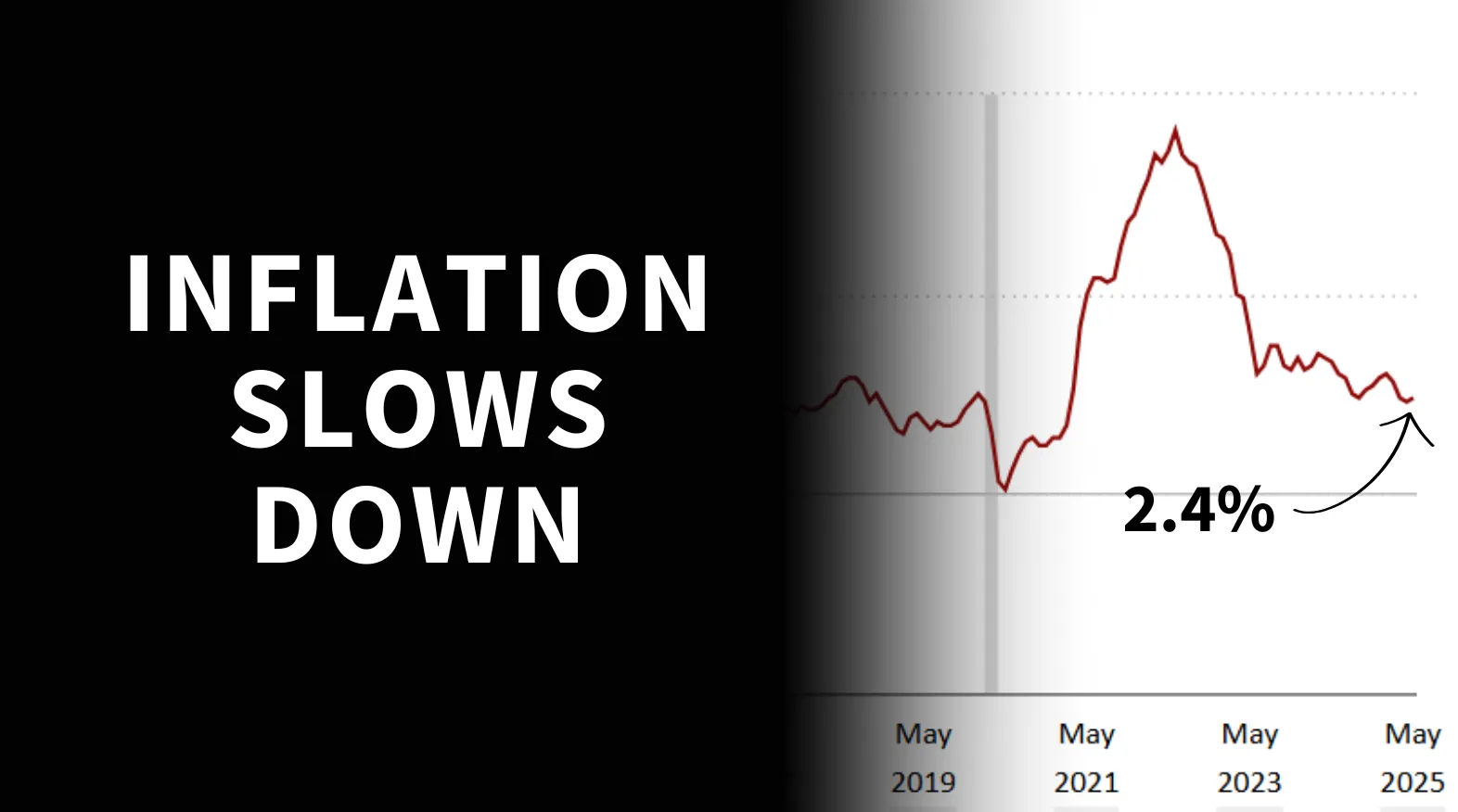

Inflation Data Fuels Rate Cut Bets

The sell-off accelerated after the latest US inflation data reinforced hopes that the Federal Reserve could soon begin easing policy. The Consumer Price Index (CPI) for May showed annual inflation at 2.4%, down from 2.7% in April, while core CPI eased to 2.8%. Producer prices also rose just 0.1% in May, bringing annual PPI inflation to 2.6%—a sign that wholesale price pressures are moderating.

With inflation cooling and the labour market showing early signs of softening, traders are increasingly betting that the Fed will hold rates steady at 4.25%–4.50% at its 18 June meeting, but could deliver its first rate cut as soon as September. Futures markets are now pricing in a 60–70% chance of a September cut, and most analysts expect at least two reductions before year-end.

Uncertainty Adds to Dollar Pressure

The dollar's slide has been exacerbated by ongoing trade policy uncertainty and geopolitical tensions. President Trump's unpredictable tariff decisions and renewed calls for the Fed to cut rates by up to 2 percentage points have unsettled investors and fuelled capital outflows from US assets.

Meanwhile, Moody's recent downgrade of US sovereign credit and a 0.3% GDP contraction in Q1 have added to concerns about the economic outlook.

Outlook

As the FOMC gathers this week, markets will be watching closely for any signals on the timing and pace of future rate cuts. For now, the dollar remains under pressure, with investors seeking clarity from the Fed amid a backdrop of slowing inflation, softer growth, and heightened global uncertainty.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.