U.S. stocks closed lower on Tuesday and benchmark Treasury yields extended

their rise as mixed economic data, weak corporate results and ongoing debt

ceiling negotiations in Washington dampened investor risk appetite.

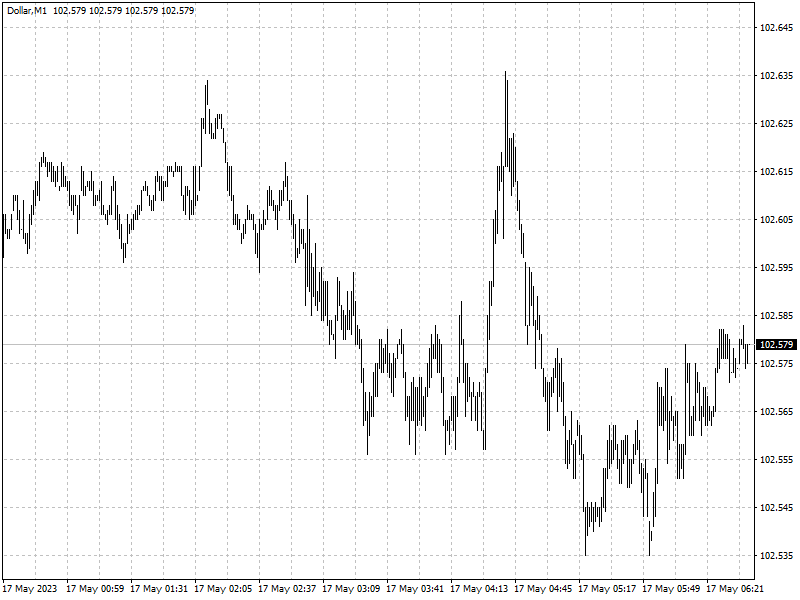

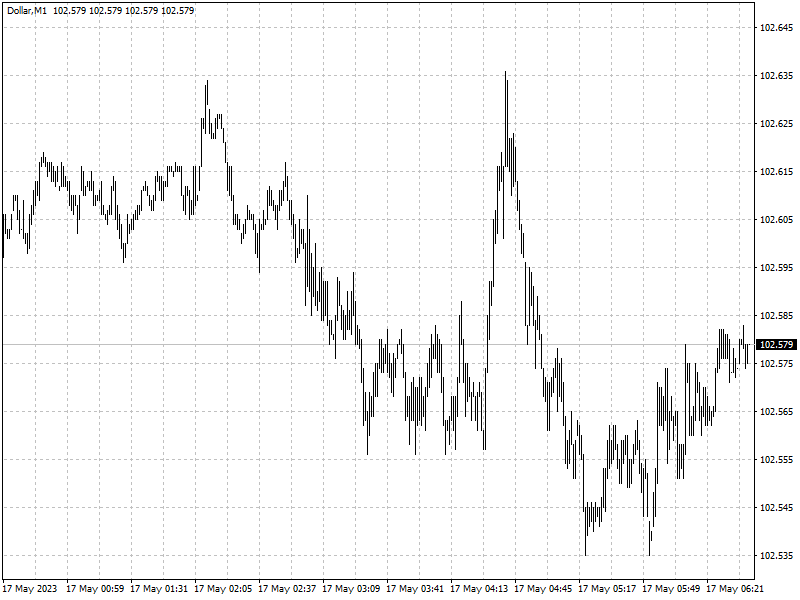

The dollar edged higher in choppy trading, with no clear direction. Gold

prices dropped 1.5% in opposition to the rising dollar.

Oil prices fell for a second day after a surprise rise in U.S. crude

inventories stoked demand concerns on the heels of weaker-than-expected economic

data.

Commodities

U.S. crude stockpiles rose by about 3.6 million barrels in the week ended May

12, according to market sources citing API figures. Seven analysts polled by

Reuters, had expected a 900,000 barrel drawdown.

‘The global economic outlook has too many question marks and that is not

giving energy traders a lot of confidence in buying crude. Right now too much

oil is still available,’ Edward Moya, senior market analyst at OANDA, said in a

note.

G7 is looking to target sanctions evasion involving third countries, aiming

to limit Russia's future energy production and curb trade that supports Russia's

military, officials with direct knowledge of the discussions have said.

Oil prices fell even as the IEA raised its forecast for global oil demand

this year by 200,000 bpd to a record 102 million bpd.

Forex

McCarthy said ‘it is possible to get a deal by the end of the week’ after a

meeting with Biden and other congressional leaders on the debt ceiling.

U.S. retail sales rose less than expected in April, but details showed that

the underlying trend remained solid. This suggested that consumer spending

likely remained strong early in the second quarter.

In line with the generally upbeat economic picture, industrial production

jumped 1% in April, easily topping expectations for a flat reading.

‘While there were some mixed signals in today's various data reports, on net

most were favorable and early in the quarter we're continuing to track some

upside risk to our 1.0% 1Q GDP growth projection,’ wrote Michael Feroli, chief

U.S. economist at J.P. Morgan, in a research note.