Wall Street rallied to a higher close on Wednesday and the dollar touched a

six-week high as regional banks surged and negotiations in Washington over

raising the debt ceiling progressed.

All three major U.S. stock indexes rallied to end up more than 1%. Oil prices

settled up about $2 as optimism over oil demand.

Despite gold extended its loss after its first tumble below $2,000 in two

weeks, the yellow metal steered clear of breaking the $1,975 support.

Commodities

The optimism outweighed a crude inventory increase of 5 million barrels in

the week ended May 12 reported by the EIA Analysts polled by Reuters had

expected a 900,000 barrel drop.

However, gasoline stocks drew down by 1.4 million barrels as the four-week

gasoline product supplied rose to its highest level since December 2021.

In China, April industrial output and retail sales growth undershot

forecasts, suggesting the economy lost momentum at the beginning of the second

quarter.

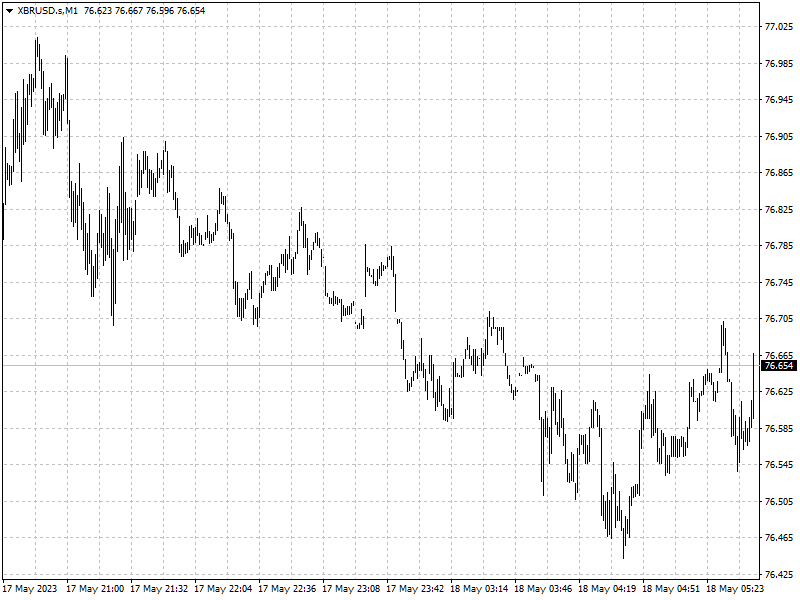

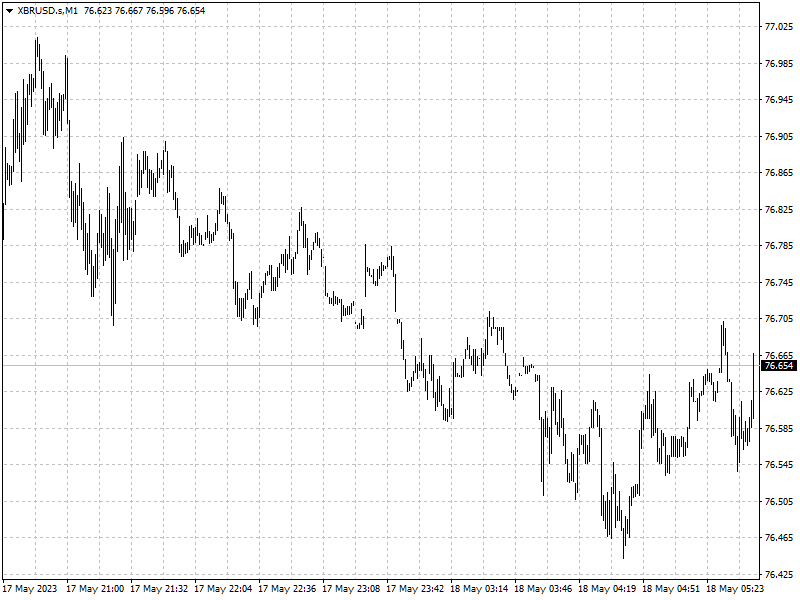

Forex

The dollar index climbed as high as 103.12, its strongest level since late

March, while the euro dropped to a six-week low versus the dollar at $1.0811.

The Swiss franc and the yen also pulled back as traders shrug off economic

headwinds.

U.S. data has been on the whole positive, despite some pockets of slowdown,

backing the view that interest rates will remain higher for longer.

The rate futures market has priced in no chance of a Fed Rate Cut in June,

down from about a 17% probability seen a month ago.

Wednesday's data showed U.S. single-family building permits rose 3.1% to a

seasonally adjusted annual rate of 855,000 units last month, the highest level

since last September.