The dollar set a more than one-week high as traders sought safety after a

series of economic data prompted a reassessment of their outlook for global

monetary policy.

U.S. jobless claims and a modest rise in producer prices suggested a slowing

economy, which pushed Treasury yields lower.

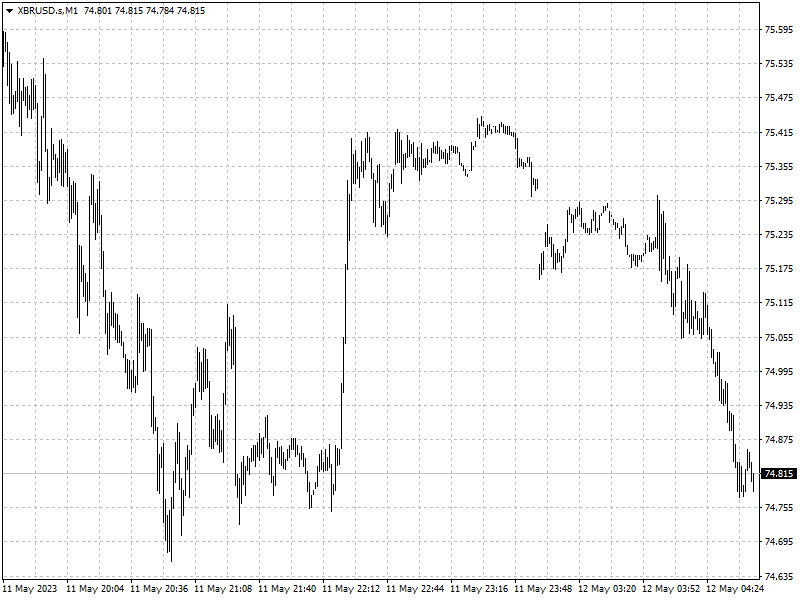

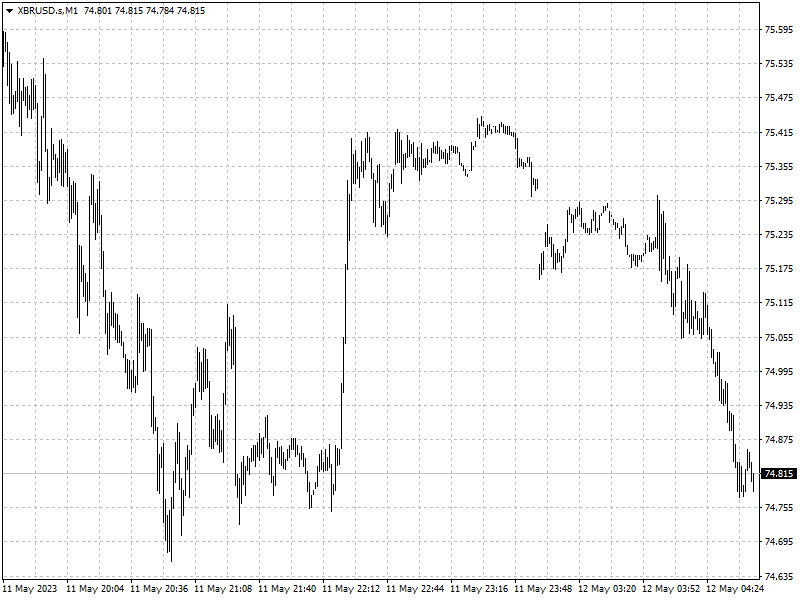

Oil prices fell about 2% to a one-week low as a political standoff over the

U.S. debt ceiling stoked recession jitters in the world's biggest oil

consumer.

Commodities

Gold retreated as the safe-haven dollar advanced and outweighed support for

bullion from lingering economic risk.

The oil market largely ignored the OPEC global oil demand forecast for 2023,

which projected demand in China, the world's biggest oil importer, would

increase.

OPEC, however, said that increase in Chinese demand could be offset by

economic risks elsewhere, including the U.S. debt ceiling battle.

Iraq has sent an official request to Turkey to restart oil exports through a

pipeline running from the Kurdistan Region to the Turkish port of Ceyhan, which

could add 450,000 bpd to global crude flows.

Forex

The number of Americans filing new claims for unemployment benefits jumped to

a 1-1/2-year high last week, pointing to cracks in the labor market as demand

slows.

The producer price index for final demand rose 0.2% last month. In the 12

months through April, the PPI increased 2.3%. That was the smallest year-on-year

rise since January 2021 and followed a 2.7% advance in March.

‘I think the market is starting to rethink the outlook for the Fed cutting

rates after inflation, while lower, remained on the high side. The dollar stands

to gain if markets pull rate cuts off the table, a scenario that would allow it

to retain its yield advantage for longer,’ said Joe Manimbo, senior market

analyst, at Convera in Washington.