The United Arab Emirates dirham (AED) to US dollar (USD) exchange rate is one of the most stable currency pairs in the global forex market. For traders, investors, and businesses dealing with the Middle East, understanding the dynamics of AED/USD is crucial for effective risk management and strategic decision-making.

Here are the key facts every trader should know about the dirham to USD rate in 2025.

5 Key Facts Traders Should Know About Dirham to USD

1. Dirham to USD Peg: Stability Above All

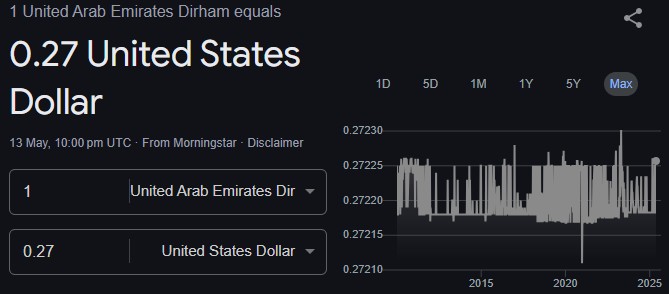

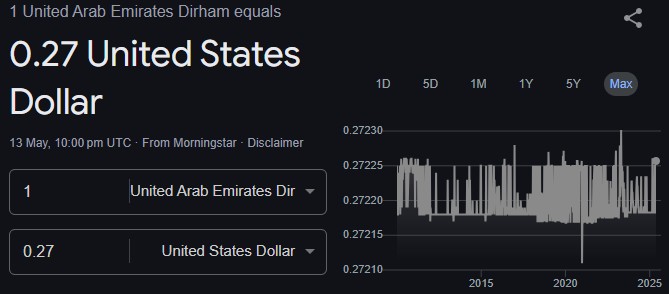

The UAE dirham is firmly pegged to the US dollar at a rate of 1 USD = 3.6725 AED. This peg has been in place for decades and is maintained by the UAE Central Bank to ensure exchange rate stability and economic confidence. As of May 2025, the peg remains robust, with no signs of de-pegging or devaluation on the horizon.

Current rate: 1 AED ≈ 0.2723 USD

Fluctuation: The AED/USD rate typically varies by less than 0.01%, making it one of the least volatile pairs globally.

2. Why Is the Dirham Pegged to the Dollar?

Pegging the dirham to the US dollar provides several benefits:

Trade and Investment Certainty: The US is a major trading partner for the UAE, and the dollar is the world's primary reserve currency.

Financial Stability: The peg helps shield the UAE economy from regional volatility and currency speculation.

Investor Confidence: The fixed rate reassures international investors and supports the UAE's role as a financial hub.

3. What Moves the AED/USD Rate?

While the peg keeps the rate extremely stable, there are still factors traders should monitor:

US Federal Reserve Policy: Changes in US interest rates or monetary policy directly affect AED rates and borrowing costs in the UAE.

UAE Central Bank Reserves: Strong dollar reserves and prudent fiscal management underpin the peg's credibility.

Oil Prices: High oil prices support the UAE's fiscal position and, by extension, the stability of the AED.

Regional Geopolitics: Although the UAE is a regional safe haven, sudden geopolitical events can impact liquidity and capital flows.

4. Trading AED/USD: Opportunities and Limitations

Opportunities

Carry Trade Strategies: The AED's low volatility makes it a useful leg in carry trades, especially when paired with higher-yield, more volatile currencies like the Turkish lira (TRY) or South African rand (ZAR).

Safe Haven for Regional Investors: In times of local or regional currency instability, investors often move capital into AED, increasing liquidity in AED/USD and other AED pairs.

Portfolio Diversification: Exposure to AED can offer a hedge for investors with assets in emerging markets or oil-sensitive sectors.

Limitations

Minimal Volatility: The very stability that makes the AED attractive also limits speculative trading opportunities. Technical analysis and momentum strategies are less effective with AED/USD compared to floating currency pairs.

Liquidity Constraints: While AED is liquid in the Middle East, it is less so globally. Traders outside the region may encounter wider spreads and lower availability of AED pairs.

5. Practical Trading Tips for AED/USD

Monitor US Economic News: Since the AED is pegged to the dollar, US economic data and Fed announcements can indirectly impact UAE markets.

Focus on Cross Pairs: For more movement, consider trading AED cross pairs like EUR/AED or GBP/AED, which may show greater volatility than AED/USD.

Understand Regional Risks: Stay informed about geopolitical developments in the Middle East, as they can affect market liquidity and sentiment.

Leverage UAE's Credit Strength: The UAE boasts a high sovereign credit rating (AA by S&P), supporting the AED's reputation as a stable store of value.

Final Thoughts

The dirham to USD rate is defined by its long-standing peg, offering unmatched stability and predictability for traders and investors. While this limits short-term speculative opportunities, it provides a solid foundation for regional trade, investment, and portfolio diversification.

For those seeking exposure to the Middle East or a safe haven in turbulent times, understanding the AED/USD dynamic is essential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.