As of 25 November 2025, at least 20 countries still have currencies weaker than the Indian Rupee (INR), meaning 1 INR is worth more than 1 unit of their local currency, for example, the Iranian Rial (~ 477 IRR), Vietnamese Dong (~ 300 VND), and Indonesian Rupiah (~ 187 IDR).

Unsurprisingly, the Indian Rupee serves as a benchmark for many investors when comparing economic strength across nations. In 2025, due to global inflation trends, geopolitical shifts, and monetary‑policy changes, several currencies have depreciated significantly, some now trading at rates far weaker than the INR.

This article examines the 25 countries with the most depreciated currencies relative to the Indian Rupee in 2025, discusses the reasons behind their devaluation, and their implications for forex traders and global investors based in India.

Which Country Currency Is Lower than India in 2025? Top 25 List

| Rank |

Country |

Currency (Code) |

Exchange Rate (1 INR → Local) |

Reason for Weakness |

| 1 |

Lebanon |

Lebanese Pound (LBP) |

1 INR = 1,004.44 LBP |

Economic crisis, debt defaults |

| 2 |

Zimbabwe |

ZiG (New Zimbabwe Dollar) |

1 INR = 3.5960 ZiG |

Hyperinflation, currency resets |

| 3 |

Iran |

Iranian Rial (IRR) |

1 INR = 472.73 IRR |

Sanctions, unstable oil exports |

| 4 |

Vietnam |

Vietnamese Dong (VND) |

1 INR = 295.99VND |

Managed depreciation to aid exports |

| 5 |

Sierra Leone |

Leone (SLL) |

1 INR = 0.26 SLL |

Political unrest, weak economy |

| 6 |

Laos |

Laotian Kip (LAK) |

1 INR = 243.58 LAK |

Inflation, limited foreign exchange reserves |

| 7 |

Indonesia |

Rupiah (IDR) |

1 INR = 186.81 IDR |

Weak growth, high foreign debt |

| 8 |

Uzbekistan |

Som (UZS) |

1 INR = 134.84 UZS |

Reform impact, weak FX reserves |

| 9 |

Guinea |

Guinean Franc (GNF) |

1 INR = 97.53 GNF |

Resource dependency, weak governance |

| 10 |

Paraguay |

Guarani (PYG) |

1 INR = 78.54 PYG |

Limited diversification |

| 11 |

Madagascar |

Ariary (MGA) |

1 INR = 50.33 MGA |

Infrastructure deficits, political risks |

| 12 |

Cambodia |

Riel (KHR) |

1 INR = 45.05 KHR |

Dollarised economy, weak monetary tools |

| 13 |

Burundi |

Franc (BIF) |

1 INR = 33.27 BIF |

Economic isolation, internal instability |

| 14 |

Congo (DRC) |

Franc (CDF) |

1 INR = 28.54 CDF |

War-related damage, economic mismanagement |

| 15 |

Tanzania |

Shilling (TZS) |

1 INR = 27.71 TZS |

Budget deficit, external dependency |

| 16 |

Myanmar |

Kyat (MMK) |

1 INR = 23.56 MMK |

Political turmoil, currency fluctuation |

| 17 |

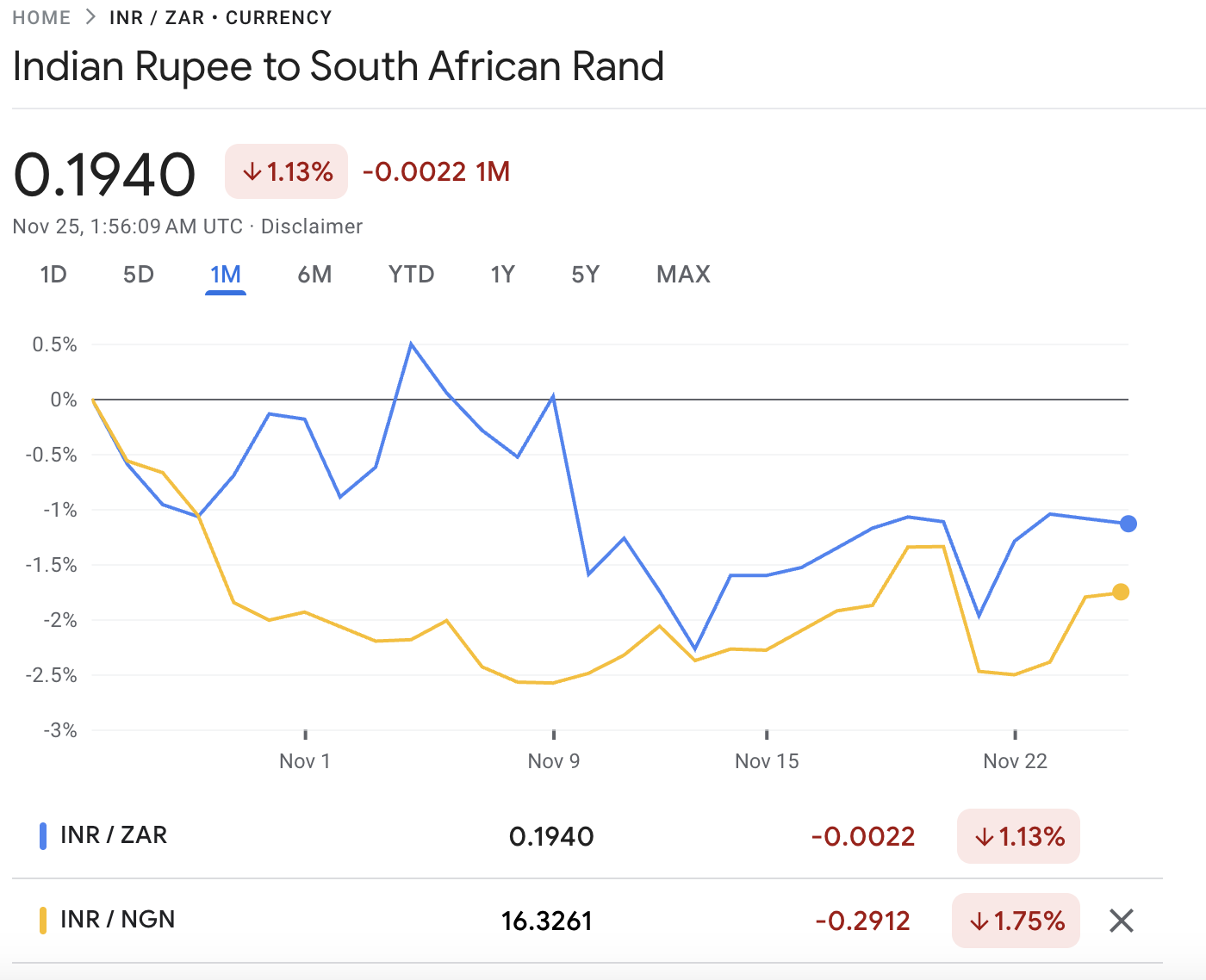

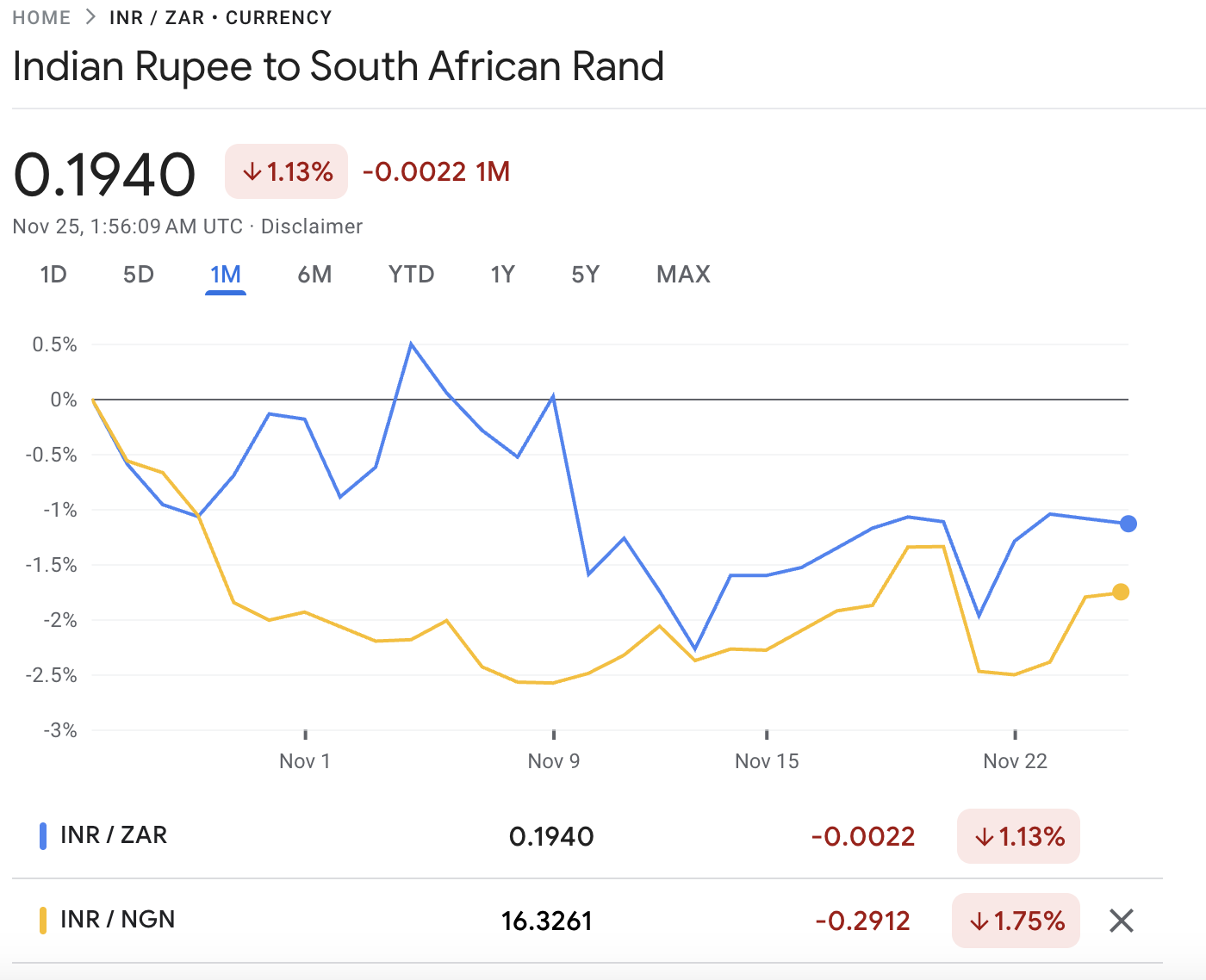

Nigeria |

Naira (NGN) |

1 INR = 16.33 NGN |

Devaluation, oil sector volatility |

| 18 |

Rwanda |

Franc (RWF) |

1 INR = 16.29 RWF |

Narrow export base |

| 19 |

Iraq |

Dinar (IQD) |

1 INR = 14.70 IQD |

Budget reliance on oil |

| 20 |

Argentina |

Peso (ARS) |

1 INR = 15.97 ARS |

Hyperinflation, IMF debt issues |

| 21 |

Nepal |

Rupee (NPR) |

1 INR = 1.60 NPR |

Pegged but still weaker |

| 22 |

Pakistan |

Rupee (PKR) |

1 INR = 3.15 PKR |

Debt burden, trade deficit |

| 23 |

Sri Lanka |

Rupee (LKR) |

1 INR = 3.46 LKR |

Crisis recovery, import restrictions |

| 24 |

Bangladesh |

Taka (BDT) |

1 INR = 1.37 BDT |

Current account imbalance |

| 25 |

Belarus |

Belarusian Ruble (BYN) |

1 INR = 0.038 BYN |

Russian influence, inflation pressures |

Are Weaker Currencies a Good Investment Opportunity?

Not necessarily. While a depreciated currency may appear cheap, it often reflects deeper structural issues. Investors should assess:

For example, Argentina has high inflation and frequent defaults, while Vietnam has a relatively controlled depreciation and stronger trade fundamentals.

Nevertheless, there are still opportunities for forex trading as currency arbitrage traders and forex investors often keep an eye on volatile or devalued currencies. However, these trades carry high risk and should only be pursued with a well-planned strategy.

How Does the Indian Rupee Compare Globally in 2025?

As of end-2025, the INR has remained relatively stable, aided by:

Controlled inflation (well below 5%): CPI inflation hit ~3.34% in March 2025.

Strong GDP momentum: The economy grew 7.4% in the Jan-Mar 2025 quarter.

Rising foreign-exchange reserves (~US$ 676.3 billion as of April 2025).

Robust exports, especially in services: Services exports reached US$ 387.5 billion in FY 2024-25.

The rupee performs better than most regional currencies, especially in South Asia and Africa.

You can monitor live exchange rates using:

For serious traders, broker platforms offer live forex charts and alerts.

Frequently Asked Questions (FAQ)

1. Which countries have currencies weaker than the INR in 2025?

At least 25 countries, including Lebanon, Zimbabwe, Indonesia, Nigeria, and Pakistan, have currencies trading below 1 INR.

2. Does a weaker currency mean a good investment?

Not necessarily; it often reflects economic instability, high inflation, or debt issues, so investments carry high risk.

3. Why is the Indian Rupee relatively strong in 2025?

Due to low inflation (~4.7%), strong GDP growth (~7.4%), high foreign exchange reserves, and robust export performance.

Conclusion

In conclusion, the Indian Rupee is stronger than the currencies of over 25 countries, signalling a relatively healthy Indian economy amid global uncertainty in 2025.

For forex traders or investors, deeper research into economic indicators is essential before capitalising on weaker currencies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.