What are SPY and SPX?

SPY is an exchange‑traded fund that holds the S&P 500's stocks and trades like a share, which makes it easy to buy, sell, and build positions with small ticket sizes.

SPX is the S&P 500 index itself, which cannot be bought directly, so traders use index options or related derivatives to get exposure at the index level.

Most traders and investors will find SPY simpler for core S&P 500 exposure, dividends, and small sizing, while SPX is best used via index options for cash settlement, European exercise, precise hedging, and capital efficiency at larger notionals.

At‑a‑glance Comparison

| Topic |

SPY (ETF) |

SPX (Index options) |

| Access |

Buy or sell ETF shares in a brokerage account |

Use index options for exposure and hedging |

| Option style |

American, share deliverable |

European, cash settled |

| Dividends |

Quarterly distributions are paid to holders |

None, options settle on the index level |

| Expense ratio |

Yes, fund fee applies |

No fund fee, options spreads, or fees apply |

| Contract size |

100 shares per option contract |

$100 multiplier on index, larger notional |

| Hours |

Regular plus extended sessions |

Cboe Global Trading Hours available |

| Typical use |

Core exposure, income, and smaller sizing |

Precise hedging, overlays, and large sizing |

How do You Access Exposure: Shares, Options, or Both?

For SPY, traders can buy or sell shares for straightforward exposure, or use SPY options for income and protection around the position.

For SPX, exposure comes through index options that reference the index level and settle in cash, which is popular for hedging and tactical overlays.

Key access points

-

SPY options for covered calls, protective puts, and spread strategies.

-

SPX index options for cash settlement and fine hedging of index risk.

Global Trading Hours on SPX options for risk control around overnight events.

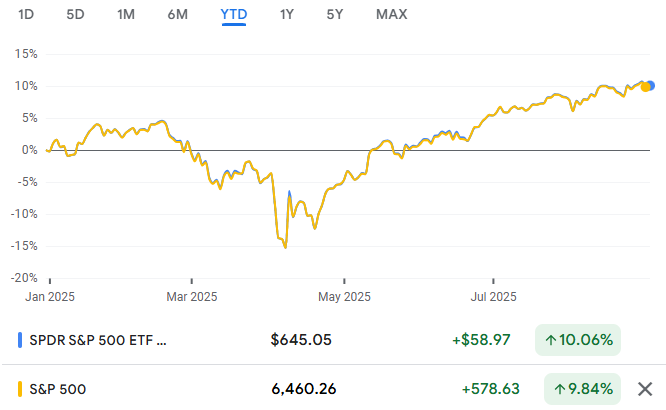

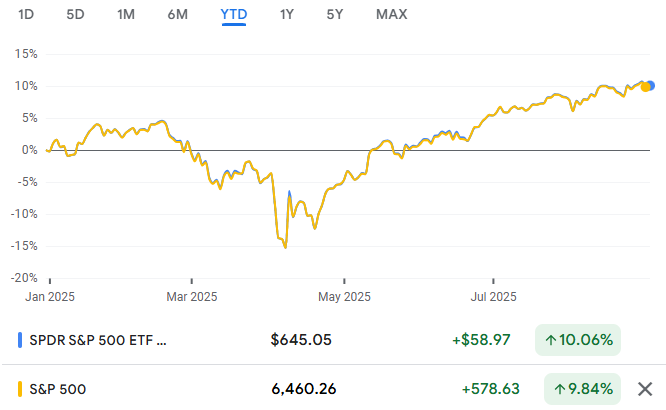

SPY vs SPX options: settlement, exercise, contract size

-

Settlement: SPY options deliver or receive 100 shares per contract on assignment, while SPX options settle in cash with no share delivery.

-

Exercise style: SPY options are typically American style and can be exercised early; SPX options are European style and only exercise at expiry.

-

Contract size: One SPY option controls 100 ETF shares, one SPX option uses a $100 multiplier on the index, and is roughly ten times the notional of SPY.

-

Smaller index sizing: Mini SPX (XSP) is one-tenth of SPX, offering index‑option features with smaller notional.

Dividend effects: SPY options can face early call assignment risk around ex‑dividend dates; SPX avoids dividend assignment risk because it settles to the index level in cash.

Costs and tracking: expense ratio, spreads, and fills

-

SPY has a published expense ratio, tight tracking to the S&P 500, and deep share liquidity.

-

SPY options often have many strikes and tight spreads for small ticket trading.

-

SPX has no fund expense ratio; however, traders pay option spreads, exchange fees, and commissions.

-

SPX options usually require fewer contracts for the same notional, which can reduce ticket count but can widen per‑contract spreads.

Execution quality varies with time of day, volatility, and event risk, so order type and patience matter.

Dividends and total return: who gets paid?

SPY pays quarterly distributions that reflect the underlying index dividends, which contribute to total return over time. SPX does not pay dividends because it is a benchmark, and index options settle to the index level only. Traders focused on income often prefer SPY, while SPX options users typically prioritise precision and cash settlement over distributions.

Trading hours and flexibility: when can you adjust risk?

-

SPY trades during regular hours and commonly in extended sessions, which can help with small position adjustments when the cash market is shut.

-

SPY extended hours liquidity can be thin, so spreads may widen outside regular hours.

SPX index options also trade in a dedicated global session, allowing adjustments around overnight macro events and cross‑asset shocks.

Capital efficiency and sizing: which is more efficient?

SPX options can be capital‑efficient for larger accounts due to contract notional and the ability to hedge at the index level in one trade. SPY scales cleanly by the share and is friendlier to smaller accounts or precise cash management.

Sizing notes

-

SPX standard contracts are roughly ten times the notional of SPY options, which reduces contract count for big hedges.

XSP offers index‑option features at one-tenth SPX, useful for mid‑sized accounts or tight risk brackets.

0DTE Use-Cases: Event Hedges and Intraday Tactics

-

Expiry timing: SPX PM‑settled options stop trading at the close of the cash session on expiry day, while SPY options typically trade slightly later in the options session.

-

Cash settlement: SPX reduces share delivery risk at expiry, which can simplify intraday hedging and event protection.

-

Strike depth and spacing: SPY often has denser strike listings that can help scalpers and spread traders in small sizes.

-

Pin risk: American‑style SPY options can introduce share exposure if assigned at expiry near the strike, while cash‑settled SPX avoids that outcome.

Event targeting: Traders often choose A.M. versus P.M. settlement on the index to match risk to specific release windows such as CPI or FOMC.

Which Should Traders Pick for Common Goals?

Think about the job to be done, then match the tool to it. For a simple, low‑friction way to own the S&P 500 with income potential, SPY usually fits. For precise hedges, cash settlement, and index‑level overlays, SPX options tend to be stronger.

A Clear Example of Cash Versus Share Settlement

A trader short a SPY 500 put that expires in the money receives 100 SPY shares per contract at the strike price, which creates or increases share exposure. A trader short an SPX put at a similar level receives or pays the cash difference at expiry only, with no share delivery, which avoids inventory risk after expiration.

Common Mistakes to Avoid

-

Ignoring ex‑dividend dates with SPY call positions that can face early assignment.

-

Underestimating SPX contract notional can make P and L swing larger than expected.

-

Mismatching expiry to event risk, for example, using the wrong A.M. or P.M. settlement for a specific macro release window.

-

Overusing market orders in thin liquidity periods can lead to poor fills.

Neglecting order type tools like limits, brackets, and spreads to control risk and execution.

Bottom Line

Choose SPY for straightforward share‑based access to the S&P 500, quarterly income potential, and simple scaling in small tickets. Choose SPX options for cash‑settled, European‑style index exposure, precise hedging, and efficient notional control. Many traders blend both, using SPY for core holdings and SPX options for tactical overlays and risk management around events.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.