Candlestick charts are one of the most widely used tools in technical analysis, and for good reason—they provide powerful visual signals that help traders make smarter decisions.

Among the many patterns traders look for, the Red Hammer candlestick stands out as a potential indicator of a bullish reversal. But what does this pattern tell you? How reliable is it? And how should traders incorporate it into their strategies?

In this detailed guide, we'll cover everything you need to know about the Red Hammer candlestick, including its formation, pros and cons, real-world examples, and trading strategies.

What Is a Red Hammer Candlestick?

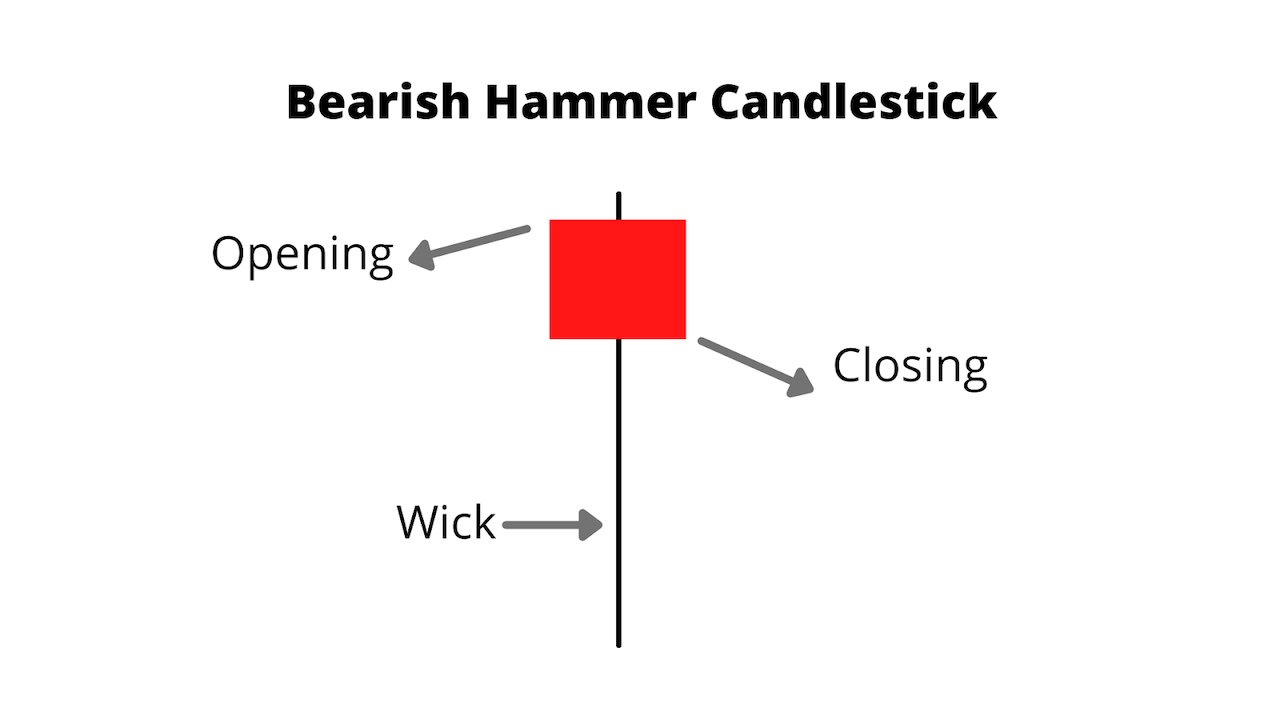

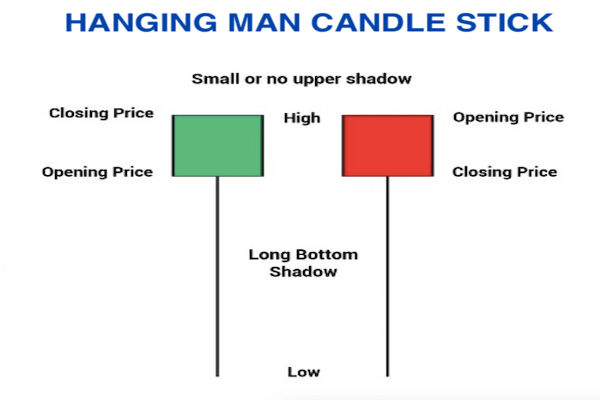

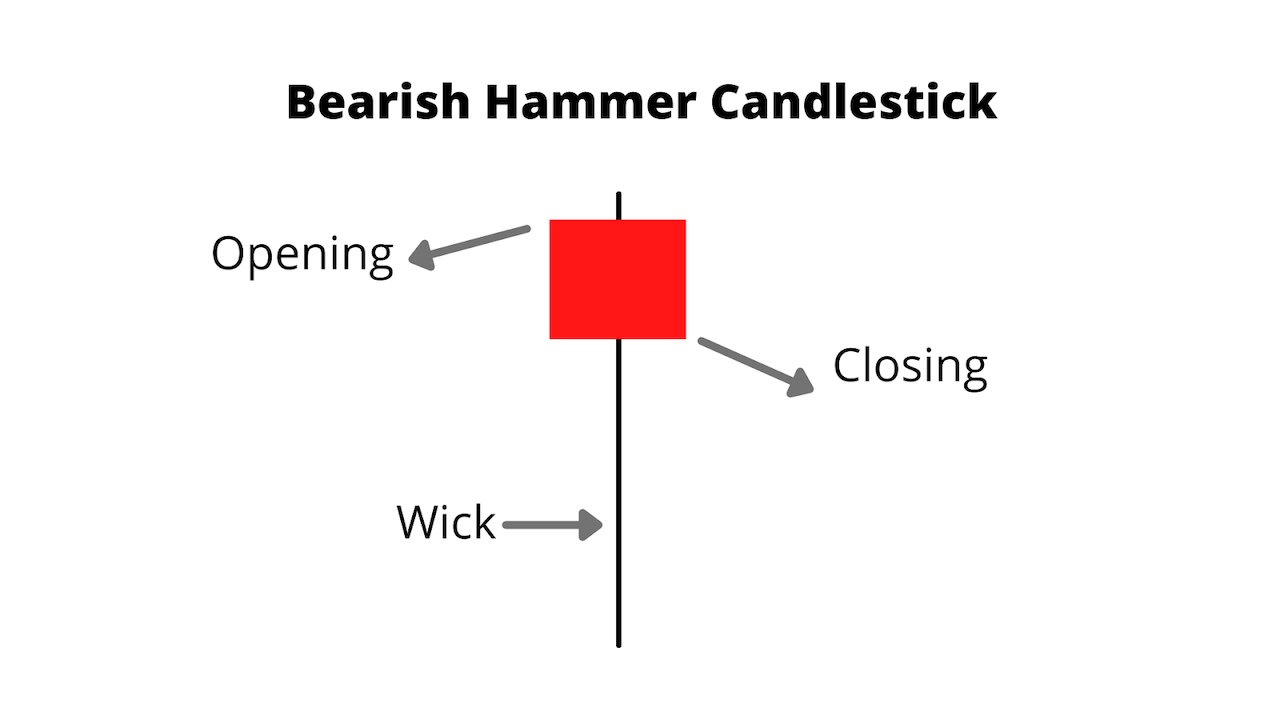

The Red Hammer is a type of hammer candlestick pattern that signals a potential bullish reversal, typically appearing after a downtrend. It gets its name from its appearance and colour:

Hammer-like shape: It has a small body and a long lower wick (or shadow), usually at least twice the height of the body.

Red or bearish close: The candle's body becomes red after it closes below the open.

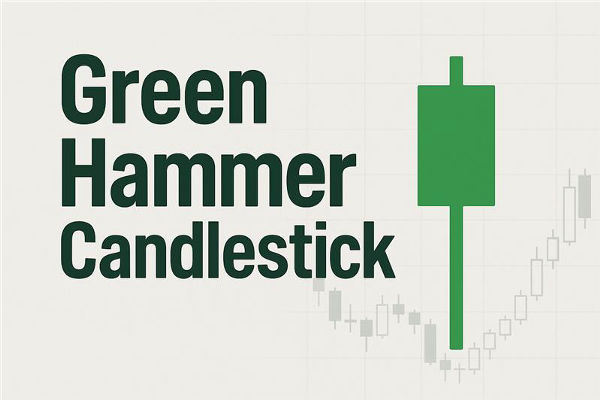

While a Green Hammer (bullish hammer) is often considered a stronger signal, a Red Hammer can still indicate buyer strength—especially if confirmed by subsequent price action.

Characteristics

| Component |

Description |

| Color |

Red (bearish close) |

| Body Size |

Small |

| Lower Wick |

Long—typically 2x or more the size of the body |

| Upper Wick |

Minimal or none |

| Location |

Appears after a downtrend |

What Does It Signal?

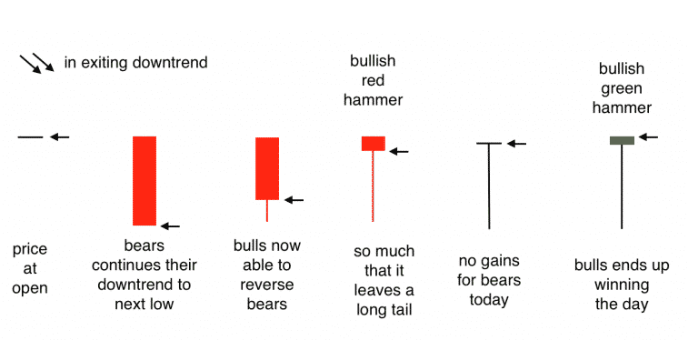

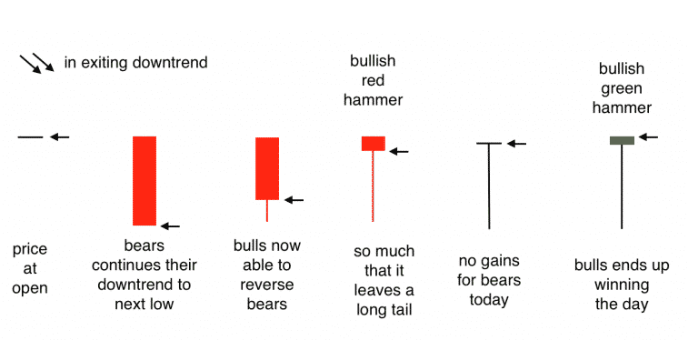

The Red Hammer signals that although sellers initially dominated, buyers entered the market later in the session, pushing prices back up significantly from the low. This shift signals potential bullish momentum.

Key Interpretations:

Buyer interest is emerging

Sellers are losing control

A possible trend reversal may be on the horizon

However, since the candle closes red, it also shows that buyers weren't strong enough to close the session higher. Therefore, it should be considered a weaker bullish signal than a green hammer.

Red Hammer vs Green Hammer: What's the Difference?

| Feature |

Red Hammer |

Green Hammer |

| Closing Price |

Below open (bearish) |

Above open (bullish) |

| Buyer Strength |

Moderate |

Stronger |

| Bullish Reversal Signal |

Weak to moderate |

Moderate to strong |

| Ideal Confirmation |

Strong green candle after |

Immediate follow-through candle |

Pros of Red Hammer

1. Early Signal of Reversal

It often appears before a trend reversal, helping traders enter early.

2. Clear Visual Indicator

The shape is visible on charts, even for beginners.

3. Works Across Timeframes

You can use it on daily, weekly, or even intraday charts such as 5-minute or 1-hour intervals.

4. Effective When Combined with Support

When it appears at a known support zone or Fibonacci retracement, its reliability improves significantly.

5. Reinforces Risk Management

Being a pattern with clear highs and lows, it allows for precise placement for stop-loss.

Cons

1. Requires Confirmation

Since it closes lower, it shows buyer hesitation. A strong follow-up candle is necessary to validate the signal.

2. Can Be a False Signal

Without volume confirmation or appearing in the wrong context (e.g., sideways market), it can lead to false positives.

3. Subjective Interpretation

How long should the wick be? How small should the body be? These questions can vary from trader, leading to inconsistency.

4. Not Standalone

It shouldn't be used in isolation. Successful traders pair it with trend analysis, volume data, and other indicators such as RSI or MACD.

Step-by-Step Guide to Trade the Red Hammer Candlestick

Step 1: Identify the Downtrend

Step 2: Spot the Red Hammer

Step 3: Check for Confluence

Step 4: Wait for Confirmation

Step 5: Enter the Trade

Entry: After confirmation, usually above the high of the Red Hammer.

Stop-loss: Below the low of the Red Hammer.

Target: Recent resistance levels or use risk-to-reward ratios (1:2 or 1:3).

Red Hammer + Technical Indicators

| Indicator |

How It Helps |

| Volume |

Confirms whether buyers are entering strongly |

| RSI |

Oversold conditions make the reversal more likely |

| MACD |

A bullish crossover near a Red Hammer adds confluence |

| Fibonacci |

Pattern at 61.8% retracement zone is highly reliable |

| Bollinger Bands |

A Red Hammer outside lower band signals a likely bounce |

Real-World Example

Example 1: Apple Inc. (AAPL)

In mid-2022, AAPL was in a downtrend when a Red Hammer appeared at the $140 support level. The next day, a bullish engulfing candle confirmed the reversal, and the price rallied to $160.

Example 2: Gold Futures (XAU/USD)

During a dip in early 2023, a Red Hammer formed near a 50% Fibonacci retracement on the 4-hour chart. The following candles confirmed the move, and the price was reversed by over $40.

Example 3: EUR/USD Forex Pair

On a 1-hour chart, EUR/USD printed a Red Hammer near a key horizontal support. With RSI under 30 and MACD preparing to cross, traders entered long. A strong green candle confirmed the bounce.

Conclusion

In conclusion, the Red Hammer candlestick is a valuable early warning that a downtrend may be ending. While not as strong as its green counterpart, it still reflects crucial market psychology and potential reversals—especially when used correctly.

Like any pattern, its success rate depends on context and discipline. When used wisely, the Red Hammer can help you catch turning points before the crowd notices.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.