Candlestick patterns are powerful tools in technical analysis to predict potential market reversals and trend continuations. Among the many patterns traders rely on, the hanging man candle stands out as a reliable indicator of bearish reversal at the end of an uptrend.

It indicates that the bullish momentum may be fading, suggesting sellers could soon gain market control.

In this article, we'll explore the hanging man candle, how it forms, and how you can incorporate it into your trading strategy. We'll also provide practical examples and offer insights into validating this signal using other technical indicators.

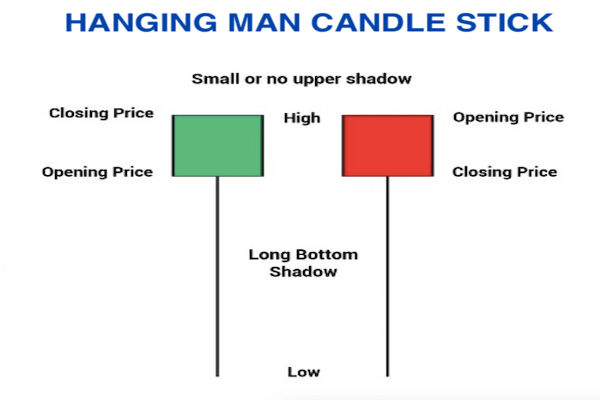

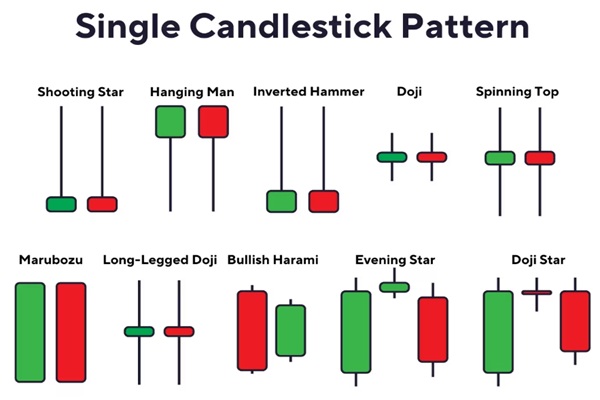

The Hanging Man is a single-candle bearish reversal pattern that appears after an uptrend. It resembles the Hammer pattern, but unlike the Hammer, the Hanging Man occurs at the top of an uptrend and signals a potential reversal to the downside.

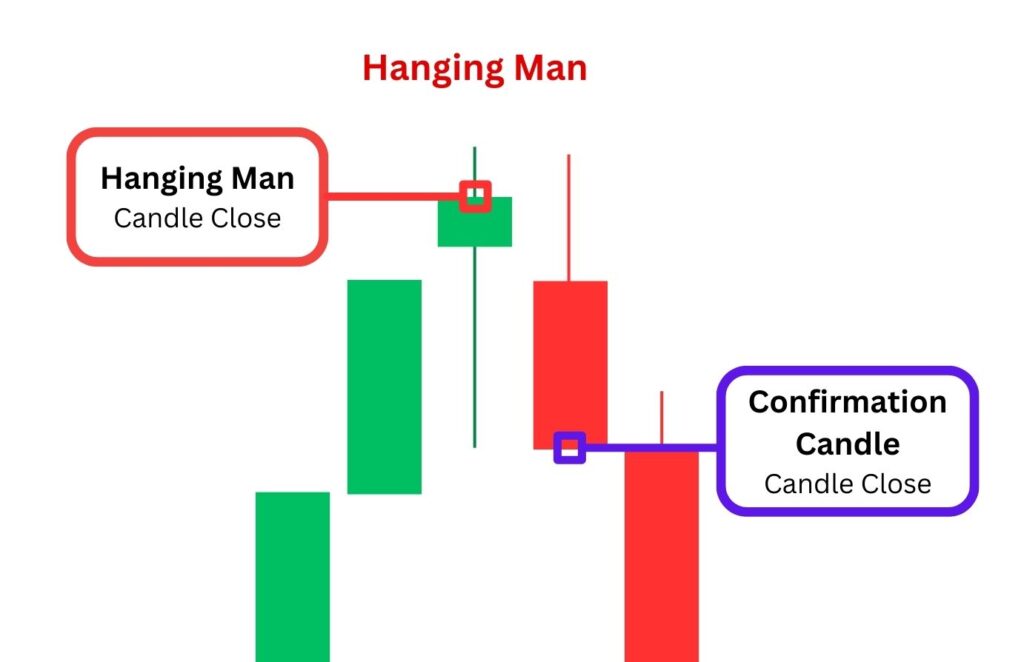

The candle has a small real body near the top of the trading range and a long lower shadow, usually at least twice the length of the body. There is little to no upper shadow. This shape indicates that sellers will drive prices down during the session, but buyers pushed the price back up near the open by the close. Despite the recovery, the long lower wick suggests that the bullish strength might be faltering, and bears are beginning to exert pressure.

It's called the "Hanging Man" because it looks like a person hanging from a rope, with the body at the top and the leg (lower shadow) dangling below. The psychological implications behind the pattern make it an essential warning sign for traders long in the market.

How to Interpret and Confirm

To accurately identify a Hanging Man candle, it must satisfy specific visual criteria:

It forms after a recognisable uptrend

The body is small and located near the top of the candle

The lower shadow is at least twice the length of the body

There is little to no upper shadow

It ideally appears with a higher volume to indicate stronger selling interest

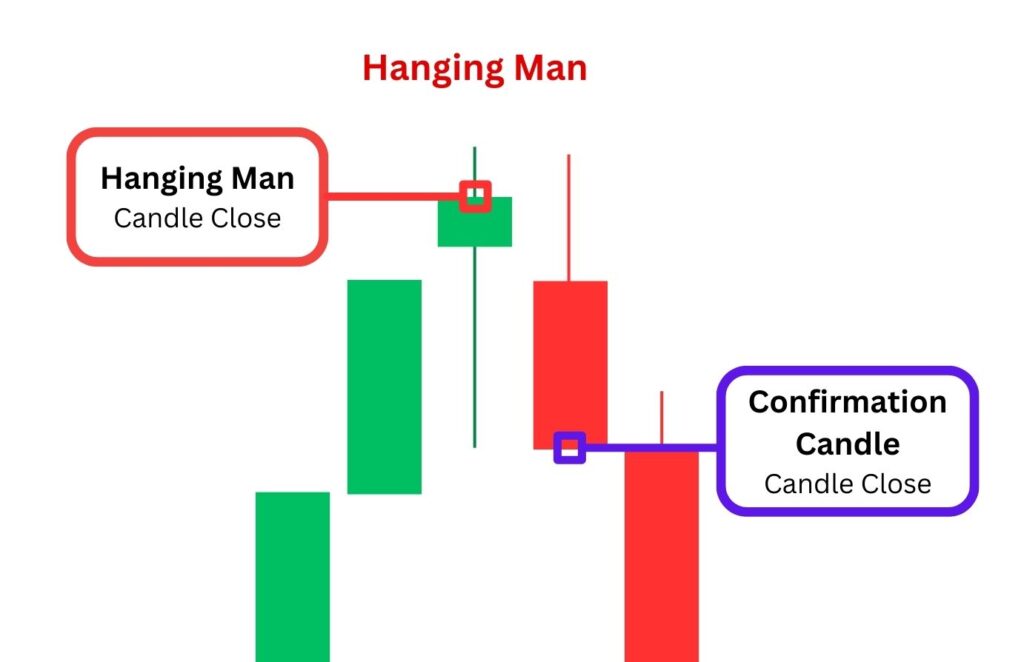

To strengthen its predictive value, traders should look for confirmation in the form of:

A bearish candle on the following day

A gap down or strong selling volume

Break of a nearby support level

When a Hanging Man follows a strong bearish candle (such as a long red candlestick), it reinforces the bearish sentiment and increases the likelihood of a downward reversal. Volume is also critical; high trading volume on the day the Hanging Man forms, or on the confirmation day, lends credibility to the pattern.

Without confirmation, the Hanging Man might be a one-day anomaly in an otherwise strong uptrend. Consequently, disciplined traders wait for a clear bearish signal before taking action.

Best Timeframes for the Hanging Man

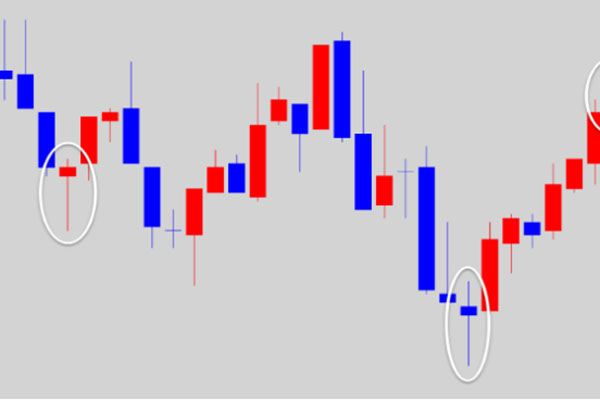

The Hanging Man candlestick pattern can appear on any timeframe, but its reliability increases with higher timeframes. The pattern tends to be more significant when observed on daily, weekly, or even 4-hour charts. In contrast, on very short timeframes, such as 1-minute or 5-minute charts, the pattern may produce more noise and generate false signals.

For swing and position traders, the daily chart is often the most practical and reliable timeframe for identifying Hanging Man setups. Day traders may look for the pattern on 15-minute to 1-hour charts, but should be especially cautious with confirmation.

Hanging Man Candle Trading Strategies

Strategy 1: Exit Long Positions

One of the most straightforward applications of the Hanging Man candle is to signal an exit from existing long positions. If you are riding an uptrend and a Hanging Man forms, it could be an early warning that the trend is losing strength. You may tighten your stop-loss or exit partially or fully from the trade, especially if confirmation follows the next day.

This approach allows you to protect profits and avoid getting caught in a potential reversal.

Strategy 2: Enter Short Positions

More aggressive traders may use the Hanging Man as a signal to initiate a short position, but only after confirmation. Waiting for a bearish candlestick on the next trading day helps confirm that the sellers are taking control.

This short strategy often includes placing a stop-loss above the high of the Hanging Man and targeting nearby support zones for profit-taking. Risk-reward ratios should be carefully calculated to manage exposure.

Strategy 3: Combine with Indicators

The effectiveness of the Hanging Man pattern can be enhanced by combining it with other technical tools. Some of the most common indicators used include:

Relative Strength Index (RSI): A high RSI reading (above 70) combined with a Hanging Man may indicate an overbought market ready to reverse.

Moving Averages: If the Hanging Man appears near a moving average (like the 200-day MA), and the price fails to break above it, this could reinforce the reversal signal.

Fibonacci Retracement: A Hanging Man near a key Fibonacci level (like the 61.8% retracement) often suggests strong resistance and potential for a pullback.

Using these tools together improves the reliability of your trading decisions and reduces false signals.

Real-World Examples

Example 1: Apple Inc. (AAPL)

In an uptrend during late 2022, AAPL experienced several days of bullish momentum. Near the end of the rally, a Hanging Man candle appeared on the daily chart. The candle had a small body at the top, a long lower shadow, and occurred on increased volume. The next day, a large red candle closed below the low of the Hanging Man, confirming the bearish reversal.

Traders who acted on this confirmation could have exited long positions near the top and avoided the subsequent pullback.

Example 2: EUR/USD Forex Pair

In a currency uptrend, EUR/USD printed a Hanging Man pattern on the 4-hour chart after several bullish candles. Though initially it seemed like a minor retracement, the following candle opened with a gap down and closed well below the pattern's low. This confirmation provided an opportunity for a short trade targeting a nearby support level.

The trade delivered a favourable Risk-Reward Ratio, with the stop placed above the high of the Hanging Man and the target near previous consolidation levels.

Common Mistakes to Know

Ignoring the trend context: The Hanging Man is only valid after an uptrend. Seeing a similar candle in a downtrend is likely a different pattern altogether.

Failing to wait for confirmation: Acting on the Hanging Man alone without waiting for bearish confirmation increases the risk of false signals.

Misidentifying similar patterns: The Hanging Man and the Hammer look alike, but their location in the trend makes all the difference. Always consider the surrounding price action.

Overemphasising the signal: Like all technical tools, the Hanging Man is not infallible. Use it as part of a broader analysis rather than as the sole basis for your trade.

Conclusion

In conclusion, the Hanging Man candlestick pattern is a valuable tool for identifying potential bearish reversals at the end of an uptrend. By examining the candle's structure, volume, and context, traders can use it to anticipate shifts in market sentiment and adjust their positions accordingly.

With practice and proper analysis, this simple yet powerful pattern can become integral in your technical trading toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.