If you're actively involved in the stock market, whether as a trader or investor, you've likely heard the term "quad witching." This market phenomenon occurs just four times a year, yet its impact can ripple across equities, options, and futures markets, creating surges in volume and price volatility.

For anyone managing a portfolio, executing options strategies, or trading index futures, understanding quad witching is essential to anticipating market behaviour.

In this detailed guide, we'll break down what quad witching is, Why it matters, the exact quad witching dates for 2025, and How traders can prepare and capitalise on it.

What Is Quadruple Witching?

Quadruple witching refers to the simultaneous expiration of four types of derivative contracts:

Stock Index Futures: Contracts obligating the buyer to purchase, or the seller to sell, a stock index at a predetermined price on a specified future date.

Stock Index Options: Options give the holder the right, but not the obligation, to buy or sell a stock index at a set price before the option expires.

Stock Options: Options granting the right to buy or sell individual stocks at predetermined prices.

Single-Stock Futures: Futures contracts on individual stocks.

The term "quadruple witching" came from the simultaneous expiration of these four contract types, which can lead to significant market activity as traders adjust or close positions.

Market Impact

The convergence of multiple contract expirations can result in

Increased Trading Volume: As traders close or roll over positions, trading activity can surge.

Heightened Volatility: The influx of trades can lead to rapid price movements, especially in the final hour of trading, known as the "witching hour."

Potential Price Distortions: Large institutional trades create temporary imbalances in supply and demand, leading to short-term price anomalies.

Positive Effects:

Liquidity surge improves order execution.

Potential trading opportunities for day traders and scalpers

Market reset as positions are rolled forward.

Negative Effects:

Whipsaws in pricing can hit stop-losses

False breakouts due to institutional rebalancing

Sudden end-of-day reversals

Quadruple Witching Examples

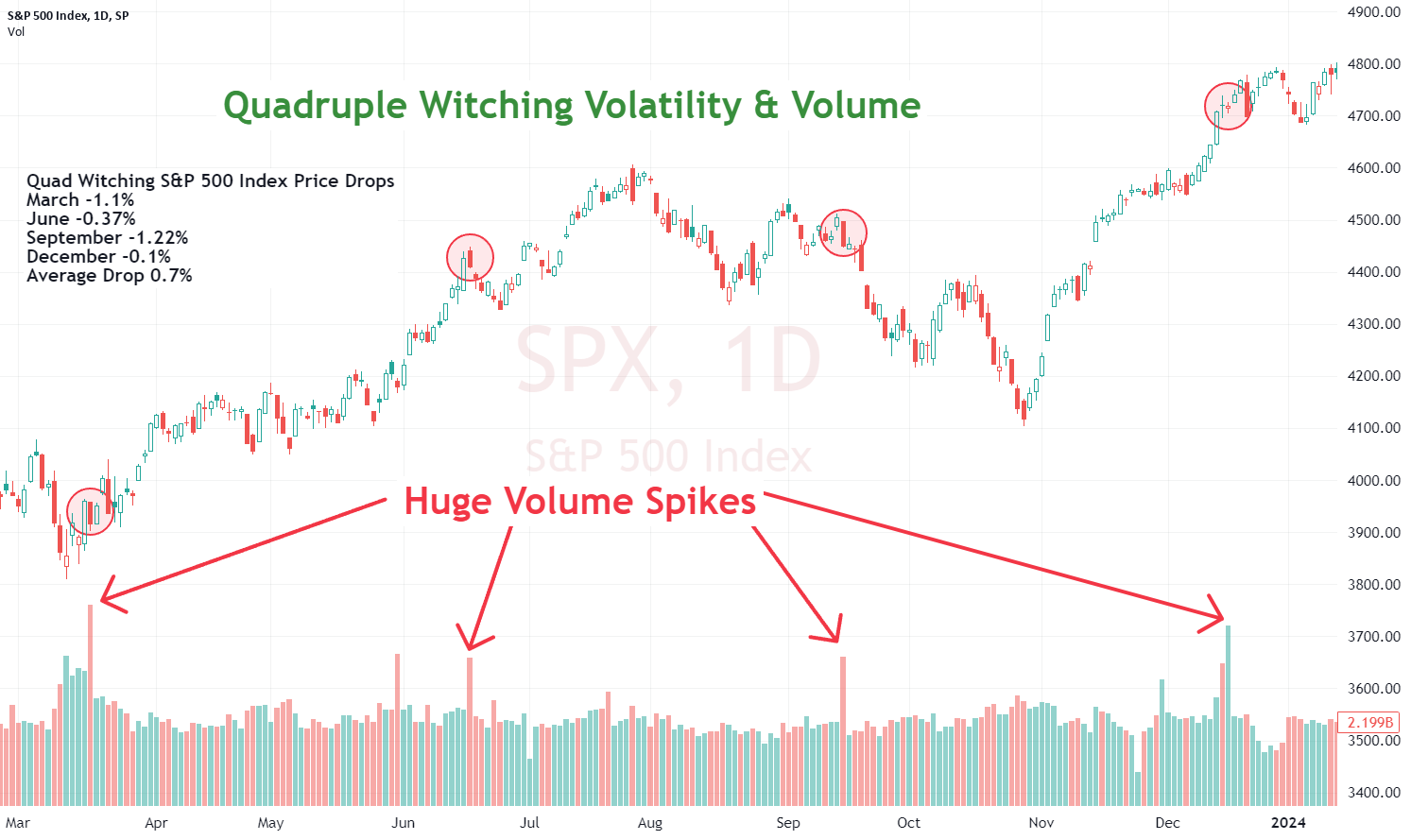

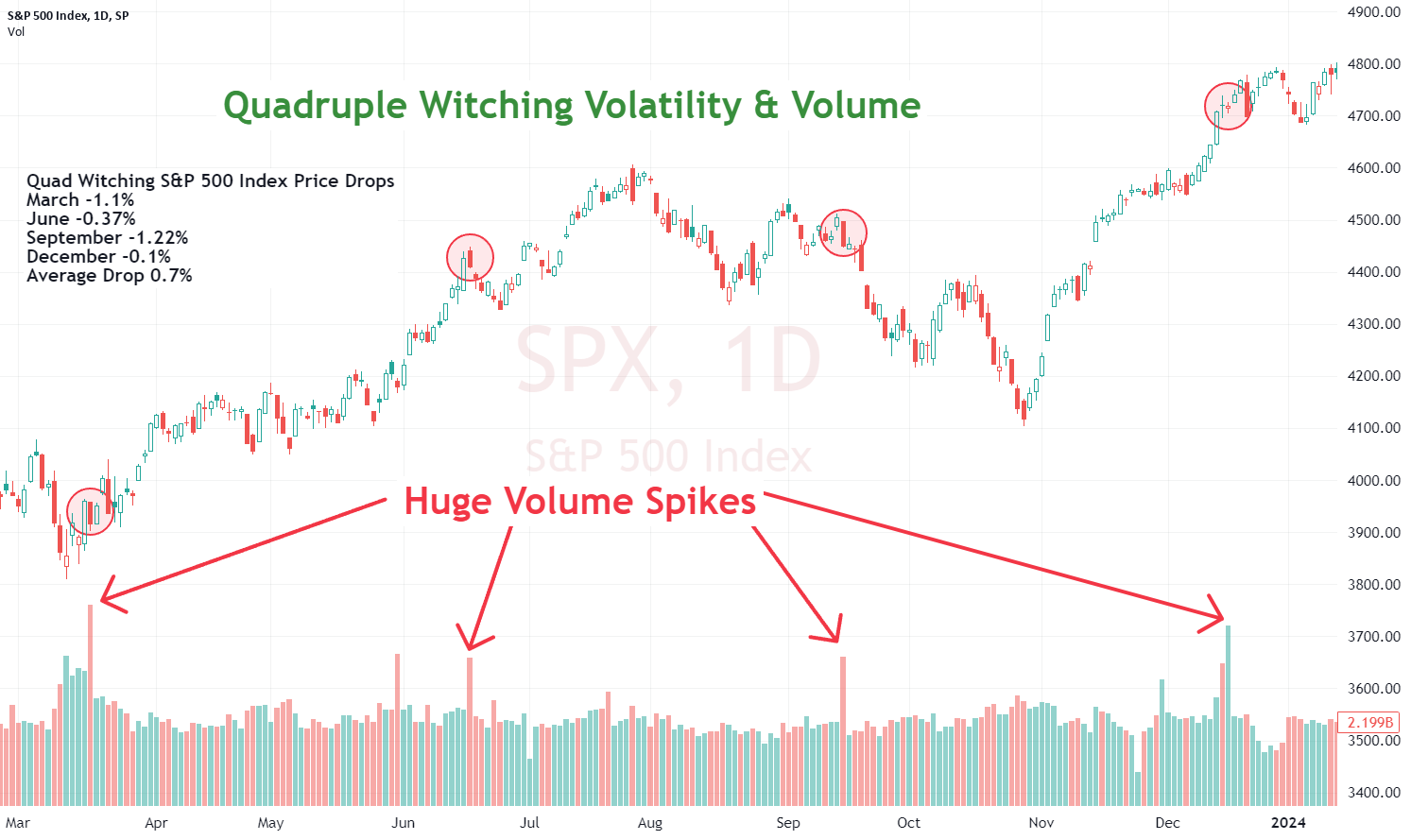

Historically, quad witching days have not always led to major up or down trends, but they do show significant intraday volatility.

On average, S&P 500 volume surges 2x compared to regular Fridays.

In volatile years like 2020 or 2008, these days showed dramatic swings.

In calmer years, price movement may be muted but still choppy near the close.

In March 2020, the quad witching day coincided with the COVID-19 crash, amplifying existing volatility as traders adjusted their portfolios in response to panic.

Quad Witching Dates for 2025

| Quarter |

Date |

| Q1 – March |

March 21, 2025 |

| Q2 – June |

June 20, 2025 |

| Q3 – September |

September 19, 2025 |

| Q4 – December |

December 19, 2025 |

Strategies for Navigating Quad Witching

To manage the challenges and opportunities presented by quad witching days:

Plan Ahead: Review and adjust positions in the days leading up to expiration to avoid last-minute volatility.

Use Limit Orders: To gain better control over trade execution prices during volatile periods.

Monitor Market Indicators: Keep an eye on trading volumes and price movements to gauge market sentiment.

Stay Informed: Be aware of macroeconomic news and events that could exacerbate market movements on quad witching days.

Implementing these strategies can help mitigate risks and capitalise on potential opportunities during these high-activity trading sessions.

How to Trade Quad Witching Days for the Rest of 2025

Here are some effective strategies for trading quad witching days:

Volatility and liquidity can present great opportunities for scalpers.

Tip: Trade the open or the "witching hour" with strict stop-losses.

2. Options Rollovers

Watch for rollovers in front-month contracts—especially in SPY, QQQ, and index futures. These are key moments for building a position.

3. Fade the Move

A common intraday pattern: the price surges in one direction during the witching hour—then reverses sharply. This fade strategy can be profitable.

4. Stay in Cash (if unsure)

If you're new or unsure, it's perfectly okay to stay on the sidelines. Observing the market action during quad witching is often more valuable than forced trades.

Conclusion

In conclusion, quad witching days are notable events in the trading calendar, marked by the simultaneous expiration of multiple derivative contracts.

Although it may not always generate significant headlines, the internal mechanics influence liquidity, volume, and price fluctuations. By understanding the mechanics of quad witching and employing strategic approaches, traders and investors can better navigate these complex trading sessions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.