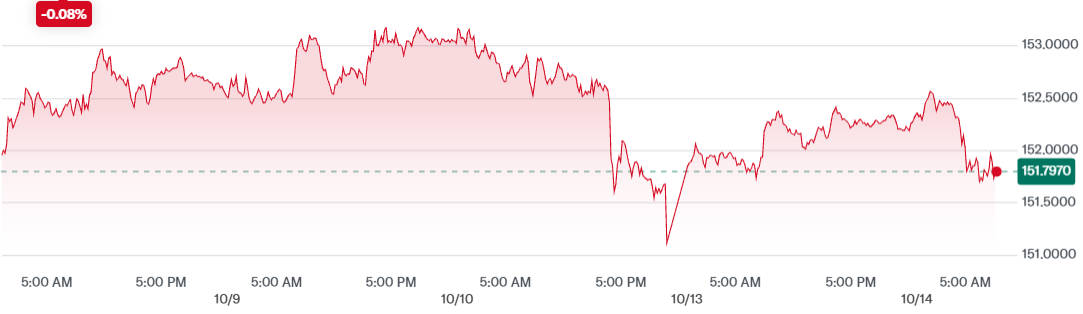

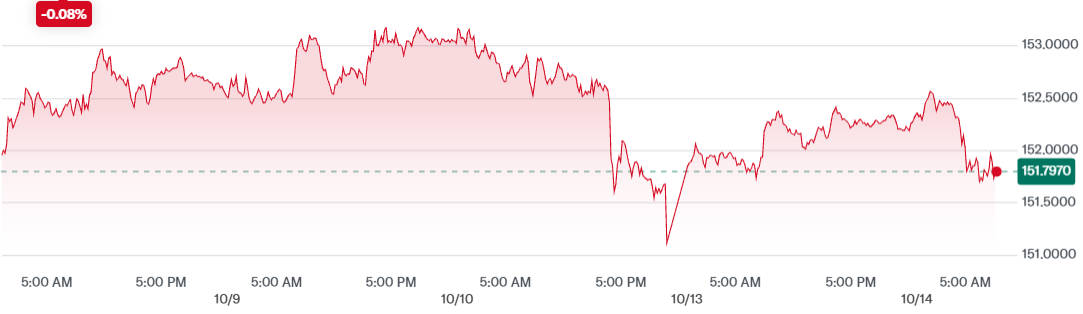

USD/JPY Market Snapshot

Current Exchange Rate: As of October 14. 2025. the USD/JPY pair is trading at approximately 151.78 yen per US dollar.

Recent Highs and Lows: The pair reached a high of 153.07 yen on October 9 and a low of 150.34 yen on October 7.

Market Sentiment: Investor sentiment remains cautious due to geopolitical tensions and domestic political uncertainties in Japan.

Technical Analysis for USD/JPY: Short-Term Trends

Price Movements and Support Levels

| Date |

Opening Price |

Closing Price |

High |

Low |

| Oct 14, 2025 |

152.25 |

151.78 |

152.38 |

151.63 |

| Oct 13, 2025 |

152.06 |

152.06 |

152.44 |

151.74 |

| Oct 12, 2025 |

151.73 |

152.05 |

152.44 |

151.74 |

Support Levels: The 151.50 yen level has been identified as a critical support zone. A breach below this level could lead to further downside towards 150.00 yen.

Resistance Levels: Immediate resistance is observed around 153.00 yen, with a longer-term resistance at 154.50 yen.

Indicators and Momentum

Relative Strength Index (RSI): The RSI is approaching overbought territory, suggesting potential for a pullback if upward momentum wanes.

Exponential Moving Averages (EMA): The pair is trading above the 50-day EMA, indicating a prevailing bullish trend in the short term.

Fundamental Drivers of USD/JPY

1. US Economic Indicators

1) Productivity Growth:

The United States has demonstrated robust productivity growth, outpacing other developed nations. This strength is bolstered by advancements in artificial intelligence and a conducive regulatory environment.

2) Interest Rates:

Despite expectations of Federal Reserve rate cuts, the US dollar remains supported by relatively higher real interest rates compared to other economies.

2. Japanese Economic and Political Landscape

1) Political Instability:

Japan's political environment has become increasingly unstable following the Komeito party's decision to end its 26-year alliance with the ruling Liberal Democratic Party (LDP). This split has introduced uncertainties regarding fiscal and monetary policies.

2) Monetary Policy Outlook:

The Bank of Japan's stance on interest rates remains dovish, with expectations of maintaining accommodative policies amidst domestic challenges.

3.Geopolitical Influences

1) US-China Trade Relations

Trade Tensions: Renewed strains in US-China trade relations have led to market volatility. Recent developments include Beijing's announcement of countermeasures against US-linked subsidiaries and increased port fees, which have undermined risk sentiment and caused the US dollar to retreat.

2) Global Market Reactions

Risk Aversion: The escalation of trade tensions has heightened global risk aversion, leading investors to seek safe-haven assets such as the Japanese yen. However, Japan's political uncertainties have limited the yen's appreciation potential.

Market Outlook and Strategic Considerations

1) Short-Term Forecast

2) Medium-Term Projections

3) Investor Strategy Recommendations

Monitoring Key Levels: Investors should closely monitor the 151.50 and 153.00 yen levels for potential breakout or breakdown signals.

Economic Data Releases: Upcoming US economic data and developments in US-China trade relations will be pivotal in shaping the USD/JPY outlook.

Political Developments in Japan: Ongoing political instability in Japan warrants caution, as it may impact investor confidence and currency flows.

Conclusion

The USD/JPY exchange rate is currently navigating a complex landscape influenced by a confluence of technical factors, economic indicators, and geopolitical events.

While the US dollar exhibits strength supported by economic fundamentals, the Japanese yen faces challenges stemming from domestic political instability.

Investors should remain vigilant, monitoring key support and resistance levels, as well as developments in both the US and Japanese political arenas, to make informed decisions in the evolving market environment.

Frequently Asked Questions

Q1: What is USD/JPY and why is it important?

A1: USD/JPY represents the exchange rate between the US dollar (USD) and the Japanese yen (JPY). It is one of the most traded currency pairs in the forex market and is considered a key indicator of global risk sentiment. Movements in USD/JPY affect import/export costs, investment flows, and international trade.

Q2: Why has USD/JPY been volatile recently?

A2: Recent volatility has been driven by:

US-China trade tensions, which influence market risk appetite.

Potential US government shutdown, affecting confidence in the US economy.

Political instability in Japan, which may impact fiscal and monetary policies.

The Bank of Japan's dovish stance, which affects yen strength relative to the US dollar.

Q3: What are the key support and resistance levels for USD/JPY?

A3:

Q4: How do US and Japanese economic indicators affect USD/JPY?

A4:

Strong US economic indicators, such as GDP growth or high-interest rates, tend to support the USD.

Weakness in Japan's economy, coupled with low interest rates or political uncertainty, can weaken the JPY, pushing USD/JPY higher.

Q5: Should investors trade USD/JPY now?

A5:

Investors should approach USD/JPY cautiously. Monitoring key levels, global geopolitical events, and economic releases is essential. Short-term traders may capitalise on volatility, while long-term investors should focus on macroeconomic trends and policy outlooks.

Q6: How can I stay updated on USD/JPY movements?

A6:

Follow live forex quotes on reliable platforms such as Yahoo Finance

Track economic calendars for US and Japan, noting key announcements like Fed meetings or BOJ statements.

Monitor geopolitical news that may impact risk sentiment and safe-haven flows.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.