Thailand is a key player in Southeast Asia's economic landscape, known for its thriving tourism, growing exports, and evolving financial markets. If you're a forex trader or a global investor, understanding Thailand's currency—the Thai Baht (THB)—is essential to tapping into regional opportunities.

This detailed guide examines Thailand's currency, its significance in international markets, and strategies for trading the THB. We will explore how Thailand's economy affects its currency and what forex traders should understand when trading exotic pairs such as USD/THB or THB/JPY.

What Is the Currency of Thailand?

The official currency of Thailand is the Thai Baht, denoted by the symbol ฿ and represented by the ISO code THB in international markets. The Baht is issued and regulated by the Bank of Thailand (BoT), which acts as the central bank and monetary authority.

Historically, the Thai Baht has been in use for centuries, dating back to the Sukhothai Kingdom, where it was the "Tical." Today, the modern Baht exists in both coin and banknote forms, and it plays a vital role in the country's economy, from local trade to global investment flows.

Thailand utilises a managed float exchange rate system, indicating that market forces affect the value of the Baht. Nonetheless, the central bank can modify when necessary to prevent excessive volatility.

Historical Overview of Thailand's Currency

The Baht's journey has been influenced by Thailand's shifting economic and political landscape. Before the 1997 Asian Financial Crisis, the Baht was pegged to the U.S. dollar. But in July 1997, the Thai government abandoned the peg, allowing the currency to float freely. This move triggered a steep devaluation that sent shockwaves across Asia.

Since then, the Baht has recovered and remained relatively stable, particularly as Thailand rebuilt its financial system and foreign reserves.

Over the past two decades, the THB has shown periods of strength due to Thailand's current account surpluses. However, it also remains vulnerable to external shocks such as rising U.S. interest rates or global risk-off sentiment.

Key Features of the Thai Currency in Forex Trading

As mentioned above, the Thai Baht is categorised as an exotic currency, indicating that it is not traded as extensively as major currencies such as the U.S. dollar, euro, or Japanese yen.

Exotic currencies such as THB typically have lower liquidity and wider spreads, resulting in greater volatility and risk but possibly higher rewards.

The most commonly traded THB pair is USD/THB, followed by pairs like THB/JPY and EUR/THB. Most forex traders use the Thai Baht to gain exposure to Southeast Asian growth or as a diversification tool in their portfolios.

What makes the Baht unique is its sensitivity to several economic indicators, including Thailand's trade balance, tourism revenues, inflation, interest rates, and foreign direct investment (FDI). Understanding these fundamentals helps traders make informed decisions.

Forex Market Behaviour of the Thai Currency

For additional context, as an exotic pair, the Baht exhibits unique trading behaviour. While it can follow global trends, it often reacts independently based on local economic news. Volatility tends to spike during times of uncertainty or policy changes by the Thai government or central bank.

Liquidity is a critical factor. THB pairs are most actively traded during the Asian trading session, especially between 6:00 AM and 2:00 PM Bangkok time. It aligns with market activity in Bangkok, Tokyo, and Singapore, offering better spreads and tighter execution.

However, trading outside of these hours can result in slippage, wider spreads, and slower order execution. For forex traders, being aware of time zones is crucial when dealing with exotic currencies such as the Baht.

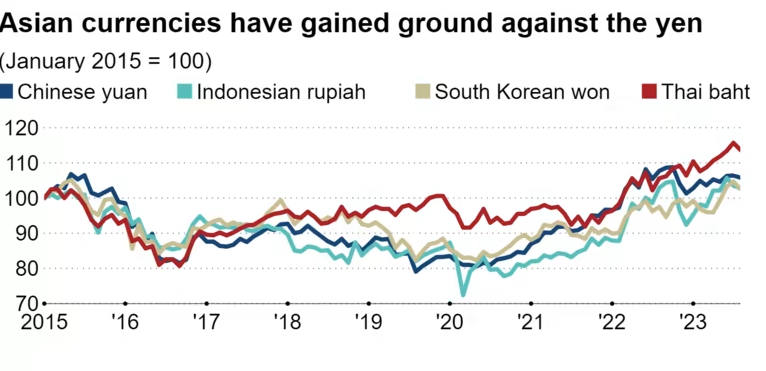

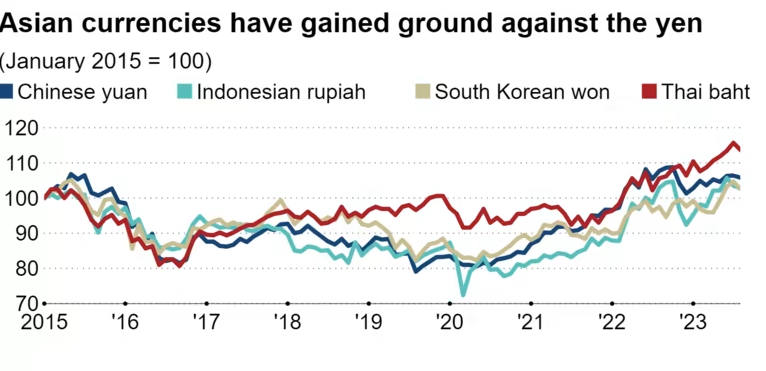

THB vs Other Asian Currencies

In Asia, the Thai Baht is frequently compared to the Malaysian Ringgit (MYR), Indonesian Rupiah (IDR), and Philippine Peso (PHP). Among these, the Baht is often seen as more stable and resilient due to Thailand's strong foreign reserves and relatively balanced macroeconomic policies.

However, it tends to be less liquid than Asian majors such as the Japanese yen (JPY) or Chinese yuan (CNY). Still, the Baht offers unique trading opportunities for those interested in emerging markets, especially when diversifying away from G10 currencies.

How to Trade THB in the Forex Market

Trading the Thai Baht starts with understanding how it is quoted. Most THB forex quotes are presented as USD/THB, where the Baht is the quote currency. If the pair is priced at 36.00, that means one U.S. dollar equals 36 Thai Baht.

Forex brokers typically list the Baht as part of exotic or emerging market currency pairs. Due to its relatively lower trading volume, some brokers may not offer the same leverage or margin requirements for THB as they do for major currencies.

To begin trading:

Select a regulated forex broker that offers access to exotic pairs such as USD/THB.

Analyse economic news related to Thailand, such as BoT rate announcements or tourism figures.

Use both technical and fundamental analysis to identify entry and exit points.

Set stop-loss and take-profit levels due to high volatility.

Monitor U.S. dollar movements, as its strength or weakness heavily influences the USD/THB pair.

Trading Strategies for the Thai Baht

One effective method is news-based trading, especially around Thai central bank meetings or key economic reports. Because the Baht reacts quickly to such developments, traders can enter short-term positions based on anticipated policy moves or unexpected economic data.

Another approach is carry trading, where traders take advantage of interest rate differentials between currencies. If Thailand offers higher interest rates than the U.S. or Japan, holding long positions in THB can result in positive overnight rollover.

Swing trading is also popular due to the currency's trend-following nature. Fibonacci retracements, Bollinger Bands, and RSI can help identify entry and exit opportunities.

Recommend Forex Trading Tips

For investors, the Baht is often used for hedging currency exposure. If a company earns revenue in Baht but reports earnings in U.S. dollars, fluctuations in the exchange rate can impact profitability. Hedging with USD/THB derivatives or options can mitigate this risk.

Retail forex traders can also use the Baht for portfolio diversification, especially when seeking exposure to regional economies or commodities indirectly tied to Thai exports, such as rice or rubber.

Conclusion

In conclusion, the Thai Baht offers traders volatility, opportunity, and regional exposure. While not as widely traded as major currencies, THB can be highly rewarding for those who understand its behaviour and economic drivers.

Whether you're swing trading USD/THB, hedging regional risk, or simply learning about exotic currencies, understanding Thailand's currency is a valuable step toward global trading proficiency.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.