For traders exposed to Nigerian equities, fixed-income instruments, ETFs, or naira-linked assets, understanding the exact trading sessions and the full national holiday calendar of the Nigerian Exchange is crucial for managing execution risk and timing exposure.

The Nigerian market currently does not offer extended hours, overnight sessions, or weekend trading. Instead, activity is concentrated within a single daily window, punctuated by frequent public holidays tied to Nigeria’s federal calendar.

When Does The Nigerian Stock Market Open And Close

The Nigerian equity market is operated by the Nigerian Exchange Group, which runs a structured and transparent trading framework for equities, ETFs, REITs, and fixed income instruments.

All trading is conducted from Monday to Friday, excluding public holidays.

Daily Trading Schedule (West Africa Time)

During the pre-open session, market participants can enter, amend, or cancel orders. The system performs price discovery, but no trades are executed. The continuous trading session is the only period when orders are matched and executed. The post-trading window finalizes closing prices and market reports.

| Trading Phase |

Approximate Time (WAT) |

Key Notes |

| Pre-Market / Order Entry |

Before 9:30 AM |

Orders can be entered, amended, or cancelled, but no trades are executed. |

| Continuous Trading |

9:30 AM – 2:30 PM |

Main trading session where orders are matched and executed based on price and time priority. |

| Post-Close |

After 2:30 PM |

Market is officially closed; no further executions take place and orders roll into the next trading day. |

Note: There is no after-market trading facility. Any orders placed after 3:00 PM are queued for the next trading day.

Asset Coverage Within Trading Hours

The same trading timetable applies across:

This uniform structure simplifies market access but concentrates liquidity into a narrow daily window.

Nigeria Trading Session and National Holidays: What Traders Must Know

Nigeria follows a single daytime trading session under West Africa Time (WAT), with all regulated market activity concentrated within standard business hours. Trading stops completely on public holidays declared by the federal government, including fixed national holidays, Christian observances, Islamic festivals, and occasional special declarations. Liquidity typically contracts sharply ahead of holidays and reopens with repricing risk, particularly in equities and government bonds.

For Nigerian traders, the most important variables are session timing, pre-open mechanics, and the cumulative impact of holiday clusters on settlement cycles and capital deployment.

FX and Money Market Timing in Nigeria

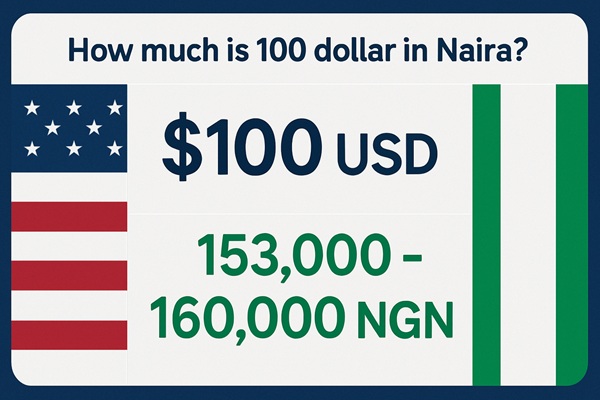

While Nigeria’s FX and money markets are primarily over-the-counter, they generally follow standard banking hours, typically between 9:00 AM and 4:00 PM WAT. Liquidity is most active during the overlap with European trading hours and fades materially in the late afternoon.

FX conditions are particularly sensitive to official interventions, regulatory guidance, and public sector flows. On public holidays, formal FX activity is effectively suspended despite global FX markets remaining open.

Nigeria National Holidays 2026

All Nigerian markets are closed on federally declared public holidays. These closures apply to exchanges, banks, clearing systems, and settlement infrastructure.

| Date |

Holiday |

Market Status |

| January 1 (Thursday) |

New Year’s Day |

Closed |

| March 20 (Friday) |

Eid-el-Fitr (Tentative) |

Closed |

| March 23 (Monday) |

Eid-el-Fitr Holiday (Observed) |

Closed |

| April 3 (Friday) |

Good Friday |

Closed |

| April 6 (Monday) |

Easter Monday |

Closed |

| May 1 (Friday) |

Workers’ Day (May Day) |

Closed |

| May 27 (Wednesday) |

Eid-el-Kabir (Tentative) |

Closed |

| May 28 (Thursday) |

Eid-el-Kabir Holiday |

Closed |

| June 12 (Friday) |

Democracy Day |

Closed |

| August 25 (Tuesday) |

Eid-el-Maulud (Tentative) |

Closed |

| October 1 (Thursday) |

National Day (Independence Day) |

Closed |

| December 25 (Friday) |

Christmas Day |

Closed |

| December 28 (Monday) |

Boxing Day Holiday (Observed) |

Closed |

Special Public Holidays

The federal government may declare additional public holidays for:

These announcements can occur with limited notice, making calendar monitoring essential for active traders.

How Does The Nigerian Holidays Affect Market

What happens to the market during these holidays is:

Pre-holiday liquidity contraction: Trading volumes typically decline ahead of public holidays as institutional investors reduce exposure and defer large orders.

Wider bid-ask spreads: Lower participation during pre-holiday sessions often leads to wider spreads, increasing execution costs for active traders.

Heightened price sensitivity: In thin markets, even modest orders can move prices disproportionately, raising short-term volatility risk.

Post-holiday price gaps: After extended closures, markets frequently reopen with price gaps as accumulated macroeconomic data, corporate announcements, and global developments are priced in at once.

Equities and bonds most affected: These effects are most pronounced in equities and longer-duration bonds, where positioning and liquidity imbalances tend to build during market closures.

Settlement delays: Trades executed just before multi-day holidays may face delayed settlement, increasing funding pressure and counterparty risk during extended non-trading periods.

Trading Strategy Considerations for Nigeria

Pro-Tips for Trading

The "Monday Effect": In Nigeria, the first trading day after a long weekend (common in April and May) often sees high volatility. Traders react to news that broke while the market was closed.

Liquidity Windows: The highest liquidity session on the NGX is usually found between 10:30 AM and 1:00 PM. If you are trading large volumes, aiming for this window helps reduce "slippage" (the difference between expected and actual price).

The 10% Rule: Unlike some global markets that have "circuit breakers" that pause trading, the NGX uses a hard 10% cap. If a stock hits its +10% limit (is "full bid"), you may not be able to buy it until the next day unless a seller emerges.

T+2 Settlement: Remember that Nigeria operates on a T+2 settlement cycle. If you sell shares on a Thursday to get cash for a weekend trip, the funds won't officially settle in your brokerage account until Monday.

Successful participation in Nigerian markets requires adapting strategy design to local market mechanics rather than relying on assumptions drawn from developed markets.

Final Checklist for Traders

System Check: Ensure your broker’s app is synced with WAT (West Africa Time).

Holiday Buffer: Always check the news 48 hours before a tentative Islamic holiday; the government usually announces the official "work-free days" via the Ministry of Interior.

Order Duration: Use "Day Orders" if you don't want your unfilled orders to carry over into the next session's auction.

How One Can Trade Within Nigerian Hours

To participate in financial markets within Nigeria’s official trading hours, traders must use a regulated brokerage that supports access to both domestic and international products. The Nigerian Exchange operates strictly between 9:30 AM and 2:30 PM WAT on business days, and no after-hours trading is offered on NGX itself.

Traders can log into their brokerage accounts ahead of these sessions to enter, amend, or cancel orders before liquidity arrives, and then wait for execution once the session opens.

EBC Financial Group is one such platform that allows traders in Nigeria and globally to access a wide range of markets through one verified account and online trading interface.

Examples of Stocks/Products Available to Trade on EBC

Apple (AAPL) Stock CFD - A globally liquid technology stock offering exposure to one of the largest companies by market cap.

Tesla (TSLA) Stock CFD - Electric vehicle and energy solutions company with high volume and volatility appeal.

SPDR S&P 500 ETF CFD - A broadly diversified ETF instrument that tracks the U.S. equity market, allowing sector-wide exposure.

Frequently Asked Questions (FAQ)

1. What time zone does Nigeria use for trading?

Nigeria trades on West Africa Time (WAT), which is UTC+1 throughout the year. There is no daylight saving time, so trading hours remain consistent year-round.

2. What are the official trading hours on the Nigerian Exchange (NGX)?

The NGX operates Monday to Friday, with continuous trading from 10:00 AM to 2:20 PM WAT. Pre-open and pre-close sessions are used for order placement and price discovery, but no trading occurs outside the official timetable.

3. Is there after-hours or weekend trading on the NGX?

No. The Nigerian Exchange does not offer after-hours or weekend trading. Any orders placed after the market closes are carried forward to the next trading day.

4. What happens to trades during Nigerian public holidays?

All NGX markets are fully closed on federally declared public holidays. No trading, clearing, or settlement takes place, and pending orders resume when the market reopens.

5. Does the FX market in Nigeria follow the same trading hours as NGX?

No. Nigeria’s FX market is over-the-counter and generally operates during banking hours, typically between 9:00 AM and 4:00 PM WAT. However, FX liquidity is significantly reduced on public holidays.

Conclusion

Nigeria’s exchange trading sessions and national holiday calendar define how liquidity, volatility, and execution risk behave across the market. With no after-hours trading and a high number of public holidays, activity is compressed into narrow windows where timing, order placement, and discipline matter as much as market direction.

For traders, understanding NGX session mechanics, holiday-driven closures, and settlement timing is not a procedural detail but a strategic advantage.

Those who plan around Nigeria’s trading structure, anticipate liquidity shifts, and respect calendar risks are better equipped to trade efficiently, manage exposure, and operate consistently in a market where precision determines outcomes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.