In today's Nigeria, the value of foreign currency—especially the US dollar—holds increasing significance for both individuals and businesses. With inflation steadily rising and the naira undergoing repeated devaluations, even a simple question like how much $100 is worth can reveal a great deal about the country's economic condition. The dollar-to-naira exchange rate has become a closely watched indicator of financial health, policy effectiveness, and the pressures facing Africa's largest economy.

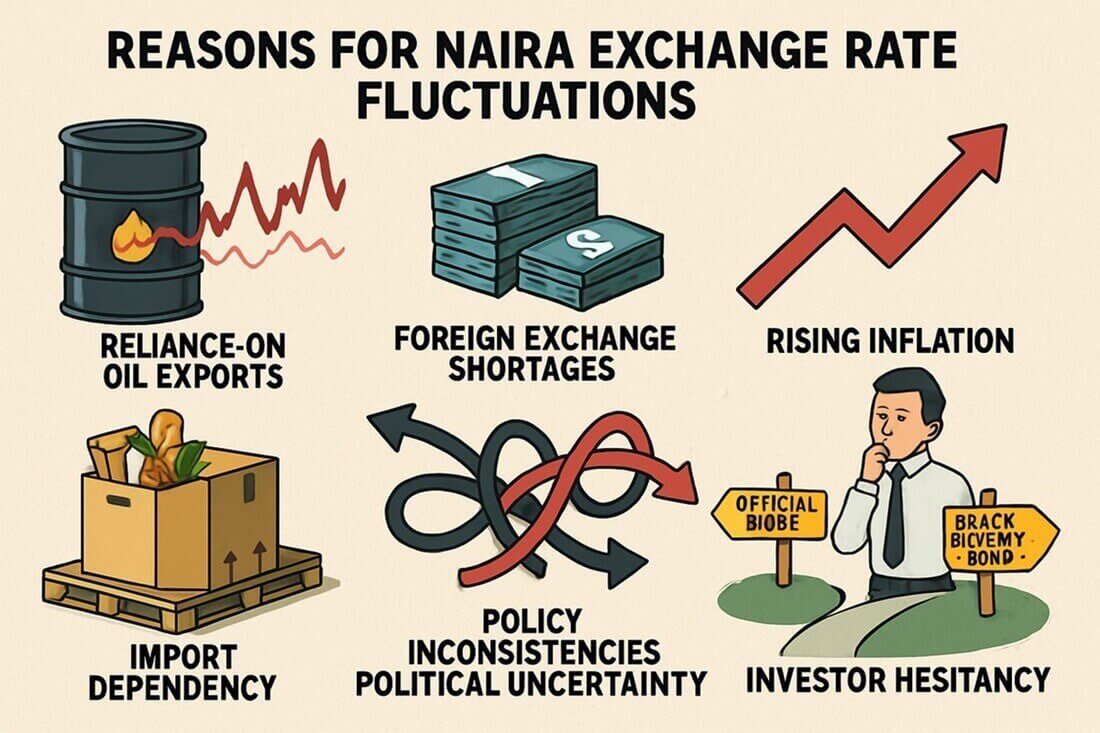

Why the Naira Exchange Rate Has Fluctuated Rapidly

Over the past decade, the naira has experienced significant devaluation, driven by both internal and external economic pressures. A heavy reliance on crude oil exports—which account for over 90% of Nigeria's foreign exchange earnings—means the naira is extremely vulnerable to global oil price fluctuations.

Over the past decade, the naira has experienced significant devaluation, driven by both internal and external economic pressures. A heavy reliance on crude oil exports—which account for over 90% of Nigeria's foreign exchange earnings—means the naira is extremely vulnerable to global oil price fluctuations.

Additionally, structural challenges such as foreign exchange shortages, rising inflation, import dependency, and policy inconsistencies have collectively weakened the currency. Political uncertainty and investor hesitancy have further contributed to volatility in the foreign exchange market.

The exchange rate is also influenced by two parallel systems:

The official rate, set by the Central Bank of Nigeria (CBN)

The black market (parallel market) rate, which often reflects more realistic supply-demand dynamics

This dual structure leads to a wide divergence in values depending on the source of conversion.

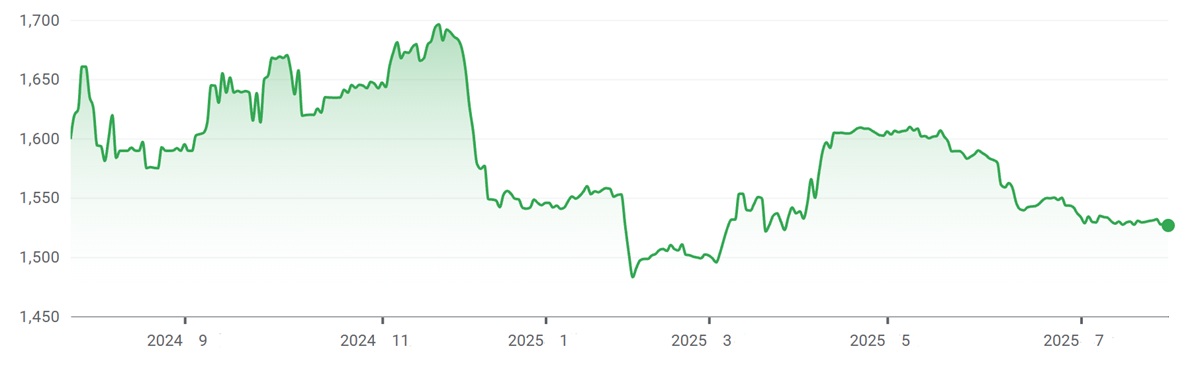

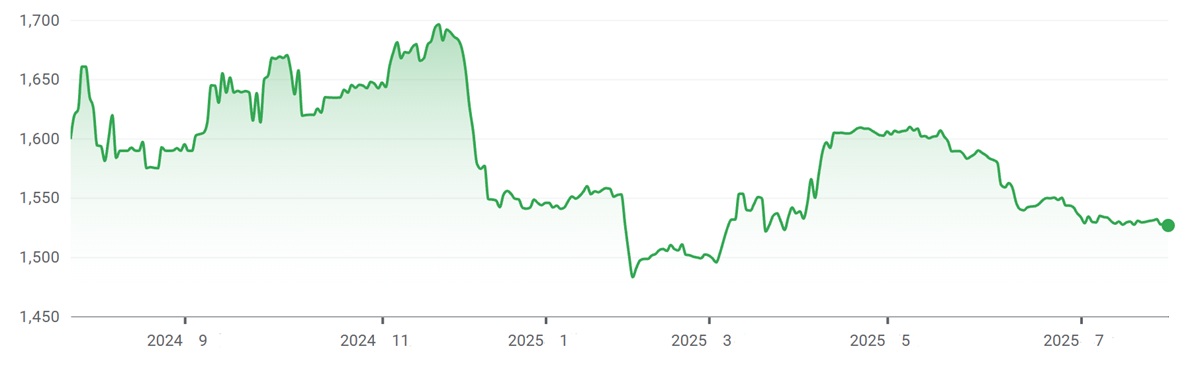

Historical Milestones: Devaluations in 2023–2025

In mid-2023. the Nigerian government introduced reforms to unify the multiple exchange rates, leading to a dramatic devaluation of the naira. At the time, the currency fell from around ₦460/$1 to ₦750/$1 within days of the new policy.

By early 2024. the naira weakened further, reaching ₦1.300–₦1.400/$1. and continued its descent in response to persistent economic headwinds. Inflation soared, interest rates rose, and pressure on the CBN to maintain foreign reserves mounted.

In 2025. the naira continued to trade in the range of ₦1.480–₦1.600/$1. depending on the source. Although the CBN attempted to stabilise the exchange through interventions and a floating regime, the demand for dollars—particularly for imports and remittances—remained high.

Recent Rate Snapshot: Mid-Market Exchange Rate Today

As of late July 2025. the mid-market rate (often used by platforms like Wise or Google Finance) for USD/NGN hovers around:

As of late July 2025. the mid-market rate (often used by platforms like Wise or Google Finance) for USD/NGN hovers around:

1 USD ≈ ₦1.539.76

100 USD ≈ ₦153.976

This is the average of the buy and sell rates in the open market and serves as a benchmark for fair currency conversion. However, this is not necessarily the rate available to consumers when exchanging currency through banks, bureaux de change, or international transfer services.

Value of $100 at Different Timepoints (Past Year)

Let's take a look at how much ₦100 would have converted to in the last 12–18 months using approximate mid-market rates:

USD to Naira Exchange Rate: Yearly Snapshot

| Date |

1 USD ≈ NGN |

$100 = NGN |

| Jan-23 |

₦460 |

₦46,000 |

| Jun-23 |

₦750 |

₦75,000 |

| Jan-24 |

₦1,300 |

₦130,000 |

| Jul-24 |

₦1,450 |

₦145,000 |

| Jan-25 |

₦1,520 |

₦152,000 |

| Jul-25 |

₦1,540 |

₦154,000 |

This data underscores the dramatic depreciation of the naira over just two years. While $100 may have once been a modest sum, it now commands over triple the naira it did in early 2023.

What Affects These Rates: Inflation, Policy, Black Market

Several key factors continue to drive fluctuations in the naira's value:

Inflation: Nigeria's inflation rate remains elevated, often exceeding 25%, eroding the real value of the naira and discouraging naira holdings.

Foreign exchange reserves: The CBN's ability to defend the naira depends heavily on its foreign currency reserves. When reserves fall, the naira tends to weaken.

Black market pressure: The parallel market (also known as the "black market") often offers a more accessible rate for individuals and businesses. As of July 2025. rates in the black market hover around ₦1.555–₦1.580/$1. slightly higher than official platforms.

Capital controls and FX rationing: Limited access to official forex from banks pushes people to seek dollars elsewhere, creating a two-tiered market.

Remittances and imports: A high volume of remittances into Nigeria (often converted at black market rates) and Nigeria's heavy reliance on imported goods also create significant demand for USD.

Conclusion: What $100 Still Buys in Nigeria's Economy

At the current rate of ₦1.540 per USD, $100 is worth about ₦154.000. While this seems like a large sum in nominal terms, the purchasing power of the naira has declined substantially due to inflation and economic instability.

At the current rate of ₦1.540 per USD, $100 is worth about ₦154.000. While this seems like a large sum in nominal terms, the purchasing power of the naira has declined substantially due to inflation and economic instability.

In early 2023. ₦154.000 might have been considered a decent monthly income. As of mid-2025. however, it may cover only essential expenses such as groceries for a small family, a short domestic trip, or a month's rent in lower-income areas.

For Nigerians with dollar access—through remittances, online work, or dollar savings—the exchange rate fluctuation represents both a risk and an opportunity. While local expenses rise in naira terms, dollar income can provide a cushion against inflation and devaluation.

In summary, the value of 100 dollars in naira has changed dramatically in recent years, reflecting broader trends in Nigeria's macroeconomic environment. Today, it is worth approximately ₦154.000. but this figure is only part of the picture. Understanding why the exchange rate has changed—and what it means in real terms—is essential for making informed decisions in Nigeria's fast-evolving financial landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Over the past decade, the naira has experienced significant devaluation, driven by both internal and external economic pressures. A heavy reliance on crude oil exports—which account for over 90% of Nigeria's foreign exchange earnings—means the naira is extremely vulnerable to global oil price fluctuations.

Over the past decade, the naira has experienced significant devaluation, driven by both internal and external economic pressures. A heavy reliance on crude oil exports—which account for over 90% of Nigeria's foreign exchange earnings—means the naira is extremely vulnerable to global oil price fluctuations.