AI exchange-traded funds (AI ETFs) provide diversified exposure to companies that develop, enable, or apply artificial intelligence, offering investors an efficient way to participate in the AI megatrend.

However, careful selection is necessary due to concentration, valuation, and thematic-drift risks.

Below, the article will unpack what AI ETFs are, how they are constructed, leading funds and comparison metrics, the principal risks, and practical implementation strategies for investors.

Why AI is an investible theme

1. Structural drivers

Exponential growth in data creation and storage requirements.

Rising demand for high-performance compute, including GPUs and specialised accelerators, to train and deploy large AI models.

Enterprise adoption of AI tools across productivity, automation, healthcare, manufacturing, and finance.

2. Thematic appeal

3. Flows and investor interest

The AI-ETF landscape: classification and representative funds

1. Classification of AI ETFs

1) Pure-play AI ETFs:

Target companies primarily engaged in AI research, products, and services.

2) Broader tech/AI hybrid ETFs:

Include AI-focused firms within a wider technology index.

3) Robotics & automation ETFs with AI exposure:

Focus on robotics and automation while integrating AI as a core element.

4) Active AI ETFs:

Manager-run ETFs selecting AI leaders based on fundamental research.

Representative AI ETF

| Ticker |

Fund name |

Focus / Index |

Net assets (approx.) |

Expense ratio |

| AIQ |

Global X Artificial Intelligence & Technology ETF |

Indxx Artificial Intelligence & Big Data Index, broad AI and data exposure |

~$6.6bn |

0.68% |

| BOTZ |

Global X Robotics & Artificial Intelligence ETF |

Indxx Global Robotics & AI Thematic Index, robotics and AI industrial focus |

~$3.1bn |

0.68% |

| ARTY |

iShares Future AI & Tech ETF |

Morningstar Global Artificial Intelligence Select Index, broad AI and future tech |

~$1.9bn |

0.47% |

| IVES |

Dan Ives Wedbush AI Revolution ETF |

Analyst-curated list focused on leading AI beneficiaries |

Launch flows; expense ~0.75% |

0.75% |

Notes:

Net asset values fluctuate daily; figures are rounded and representative as of October 2025. Expense ratios and index descriptions are fund-reported. Refer to issuer pages for the latest fund sheets.

How AI ETFs are constructed

1. Index methodology

Many AI ETFs track specialist indices screening companies by AI-related revenue, product activity (chips, cloud, AI software), or R&D intensity.

Proprietary indices from providers like Indxx and Morningstar are common.

2. Typical sector and market-cap composition

3. Concentration and overlap

4. Turnover and tracking

The investment case for AI ETFs

1. Reasons to consider AI ETFs

Diversified exposure to the AI ecosystem with a single trade.

Access to niche mid-cap companies and non-US firms that are difficult for individual investors to assemble.

Professional index construction or active management that screens for AI relevance.

2. Portfolio integration

3. Time horizon

AI is a multi-year structural theme; a horizon of 5+ years is recommended to navigate volatility and product cycles.

Principal risks and mitigants

1. Principal risks

Valuation risk:

Many AI companies trade at elevated multiples reflecting high growth expectations.

Concentration risk:

Funds may be heavily weighted in a few mega-caps.

Thematic drift:

Index rules may change, broadening fund exposure beyond AI.

Regulatory/geopolitical risk:

Export controls, privacy rules, and AI governance proposals can affect parts of the AI value chain.

Technology obsolescence:

Rapid innovation can displace current leaders.

2. Mitigants

Select funds with transparent methodology and broad diversification.

Limit portfolio allocation sizes and rebalance regularly.

Consider combining passive AI ETFs with active funds to capture unique opportunities while managing concentration.

Evaluating and selecting an AI ETF: practical checklist

Criteria to consider:

Expense ratio:

Lower is generally preferable, but weigh against index quality and active management.

AUM and liquidity:

Sufficient AUM and daily volume reduce tracking error and bid-ask costs.

Holdings and concentration:

Number of holdings, top-10 weight, sector breakdown.

Index methodology:

Does it capture true AI exposure? Are inclusion/exclusion rules transparent?

Performance metrics:

Multi-period returns, volatility, beta vs. benchmark.

Domicile/tax considerations:

US vs UCITS or local listings.

Manager reputation:

Experience with thematic ETFs and operational robustness.

Additional costs:

Bid-ask spread, tracking difference, tax inefficiencies.

Key Metrics for Evaluating AI ETFs

| Criterion |

Why it matters |

Good threshold |

| Expense ratio |

Reduces returns |

<0.6% preferred for passive; <0.8% reasonable for niche themes |

| AUM |

Liquidity and fund longevity |

>$500m considered healthier; >$1bn preferred |

| Top-10 weight |

Concentration risk |

<50% preferable |

| Turnover |

Trading costs, tax drag |

Lower turnover is better |

| Index transparency |

Understand holdings |

Clear methodology publicly available |

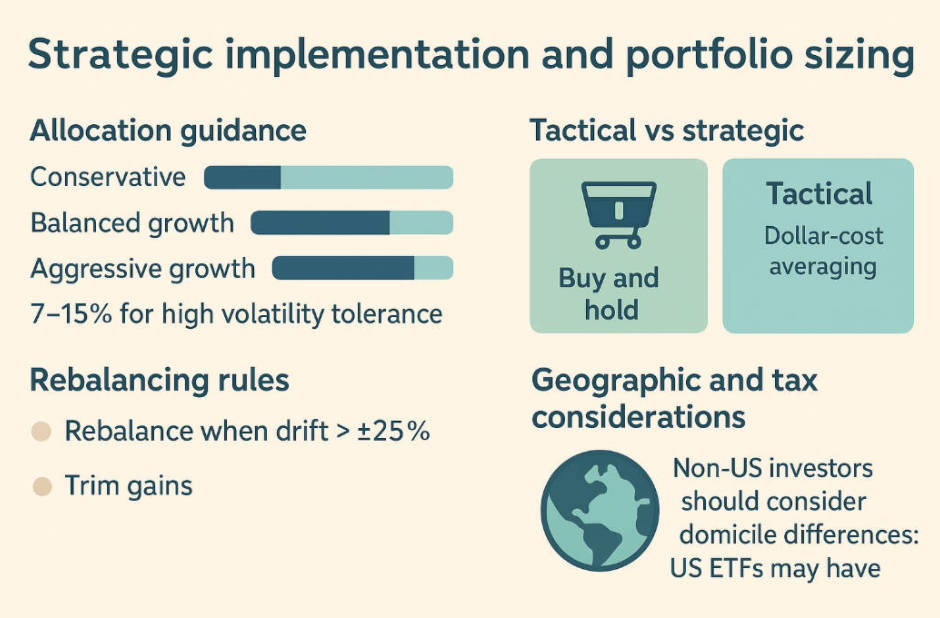

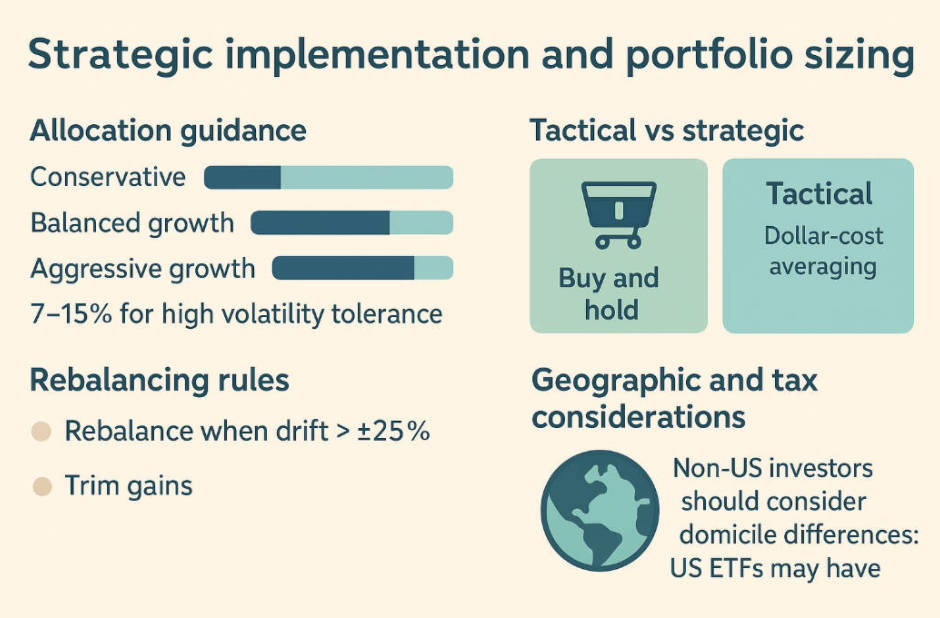

Strategic implementation and portfolio sizing

1. Allocation guidance

2. Tactical vs strategic

3. Rebalancing rules

Rebalance when allocations drift beyond chosen thresholds (e.g., ±25%)

Use rebalancing to trim gains and manage risk

4. Geographic and tax considerations

Case studies and recent trends

1. Performance snapshot

2.New entrants and active products

3. Investor flows

AI ETF Outlook

1. Short to medium-term catalysts

2. Regulatory developments

3. Valuation and breadth

Practical next steps for an investor

Define your objective: growth, diversification, or concentrated thematic exposure

Use the checklist in Section 7 to shortlist ETFs

Review issuer fact sheets and holdings

Decide allocation and approach: lump-sum or phased purchases

Implement risk controls: position size limits, rebalancing, and periodic reassessment

Frequently Asked Questions

Q1: What is an AI ETF?

An exchange-traded fund providing exposure to companies involved in AI, from chips and infrastructure to AI software and applications.

Q2: Which metrics matter most?

Expense ratio, AUM/liquidity, index methodology, holdings concentration, and domicile/tax implications.

Q3: Are AI ETFs risky?

Yes, they carry valuation, concentration, and thematic risks. Treat them as satellite allocations.

Q4: How much of my portfolio should be in AI ETFs?

Typically 1–3% for tactical positions or up to ~10% for aggressive investors.

Q5: Do AI ETFs only hold US companies?

No, many include global holdings. Check the regional breakdown in the fund factsheet.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.