The yen held steady on Tuesday, ahead of a parliament vote in Japan that is

almost certain to see hardline conservative Sanae Takaichi become the country's

first female prime minister.

The last thing that an over-indebted Japan struggling with inflation needs is

fiscal dove. Core inflation likely accelerated in September for the first time

in four months on continued increases in living costs, a Reuters poll

showed.

The BOJ must keep monetary policy loose and move very gradually in raising

interest rates as global trade uncertainty clouds the economic outlook, a senior

IMF official said on Wednesday.

Governor Kazuo Ueda said on Thursday the central bank will scrutinise various

data, including information he collects during his stay in Washington, in

deciding whether to raise interest rates in October.

The central bank may next week slightly revise up this year's growth forecast

and maintain its view that the economy is on course for a moderate recovery,

despite headwinds from US tariffs, said sources familiar with its thinking.

Tokyo's top currency diplomat Masato Kanda, who led massive bouts of

yen-buying intervention in 2022 and 2024, urged its G20 peers to be increasingly

vigilant to excessive forex fluctuations driven by speculation.

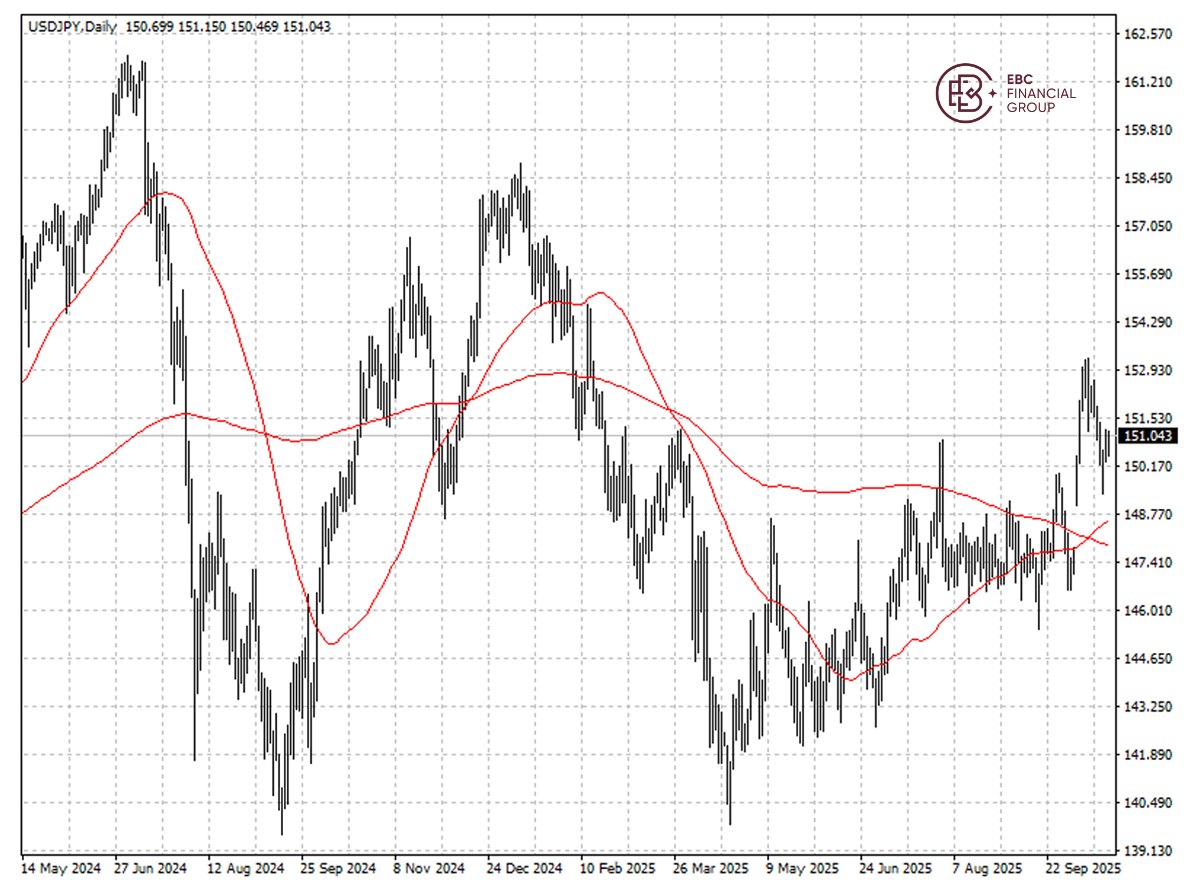

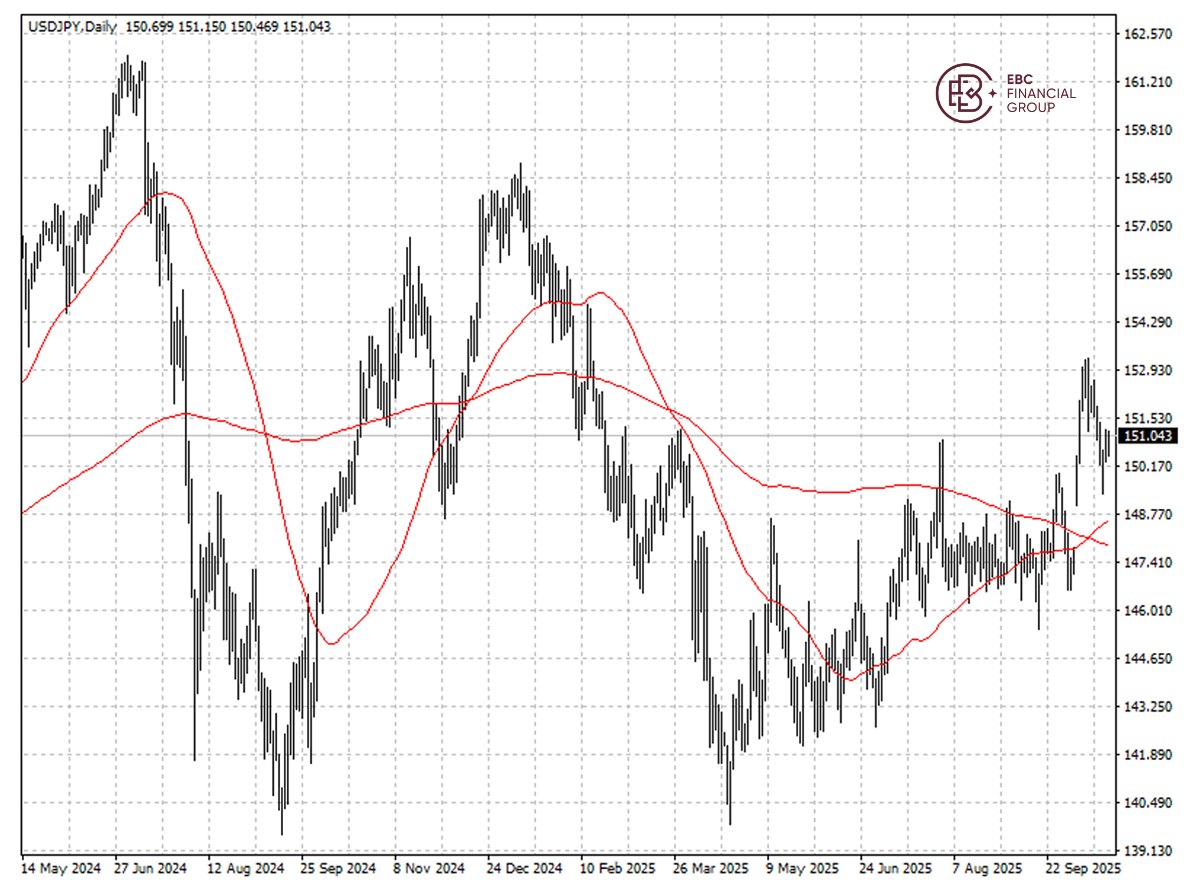

The yen has shown death cross, cementing the bearish bias. We see a retest of

the low of 153 per dollar very likely in the short term.

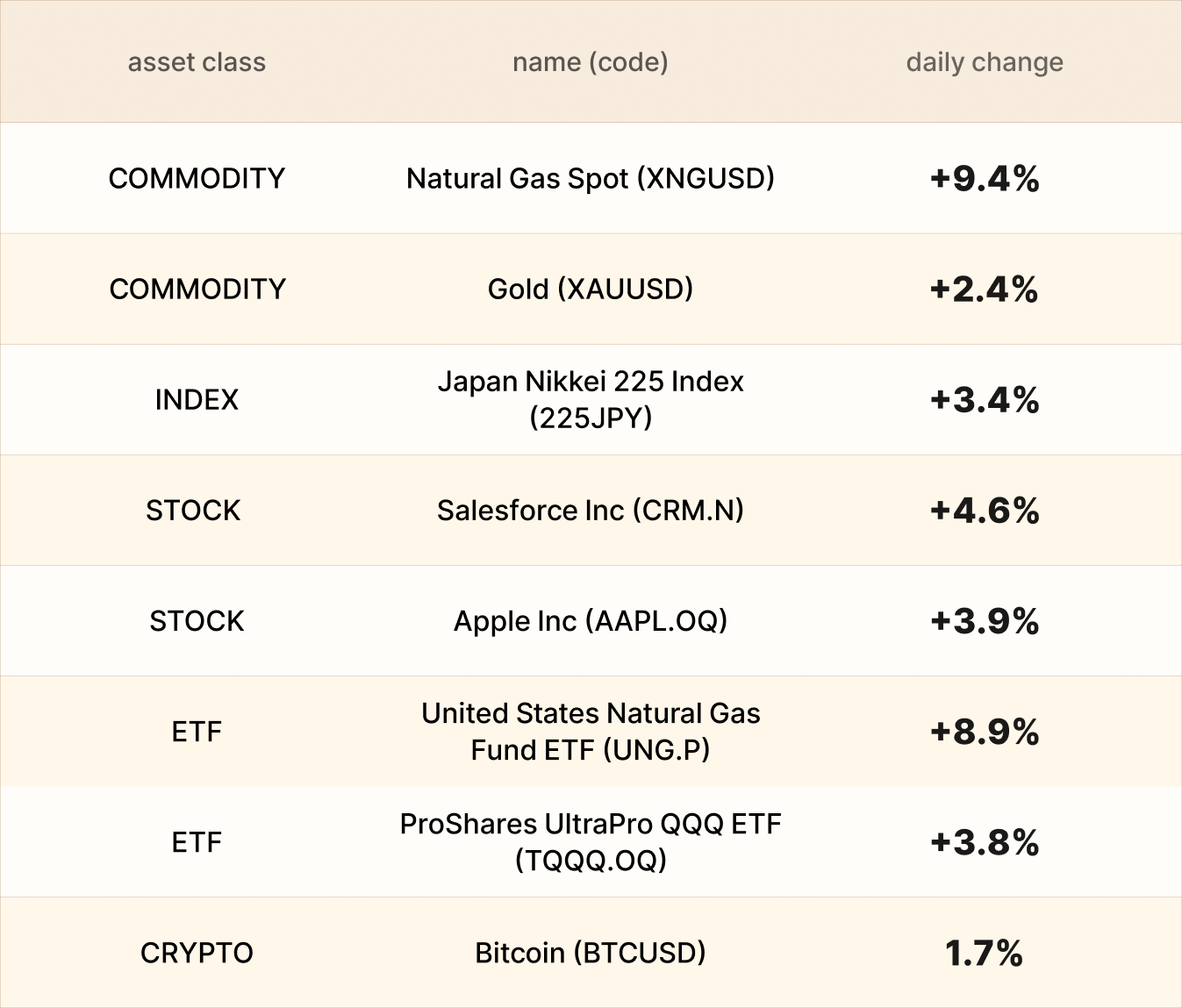

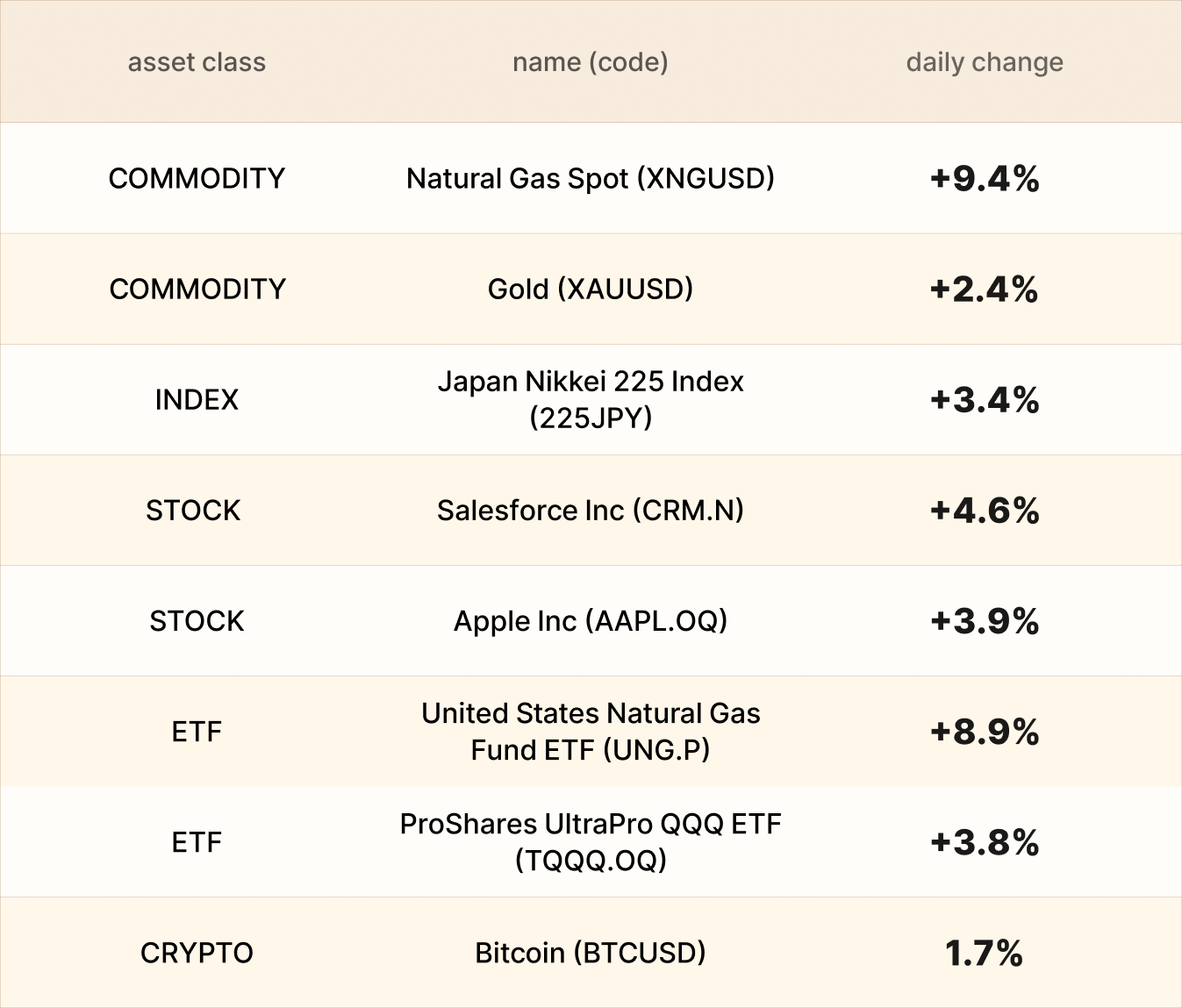

Asset recap

As of market close on 20 October, among EBC products, natural gas led gain as

Trump is now pushing allies to buy US gas.

Salesforce remained volatile, with trajectory to be seen; Apple is close to

becoming another company to hit a $4 trillion market valuation as data showed

strong momentum for the latest iPhone.

The Nikkei 225 surged after the Liberal Democratic Party and the Japan

Innovation Party (JIP) moved closer to forming a coalition, nearly guaranteeing

that Takaichi will become the next PM.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.