Quantum computing is no longer science fiction; it's becoming a transformative technology that could redefine industries from finance to pharmaceuticals. With the market expected to reach $65 billion by 2030, investors are seeking exposure through thematic funds.

However, in contrast to AI or robotics ETFs, pure quantum computing ETFs are uncommon, and numerous funds labelled as "quantum" typically integrate wider themes such as semiconductors, AI, or advanced computing.

This article highlights the top quantum computing ETFs of 2025, breaking down dedicated companies, hybrid tech funds, and new entrants such as VanEck's QNTM in Europe. We compare fees, performance, and risk to help investors decide which options fit their portfolios.

What Are the Best Quantum Computing ETFs by Categories?

1. Pure Play Quantum Computing ETFs (Direct Exposure)

These funds focus on companies primarily involved in quantum research, hardware, or software.

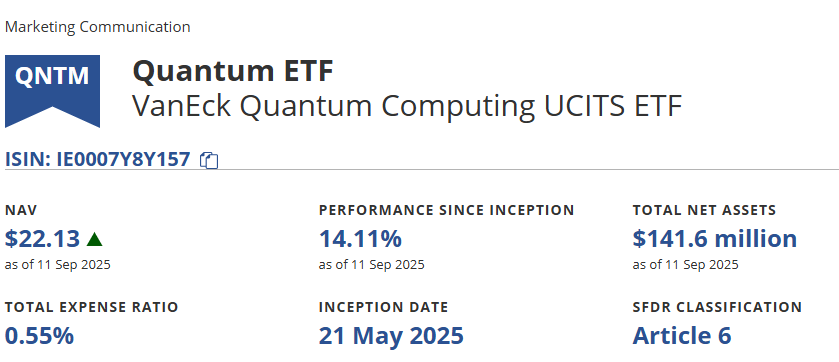

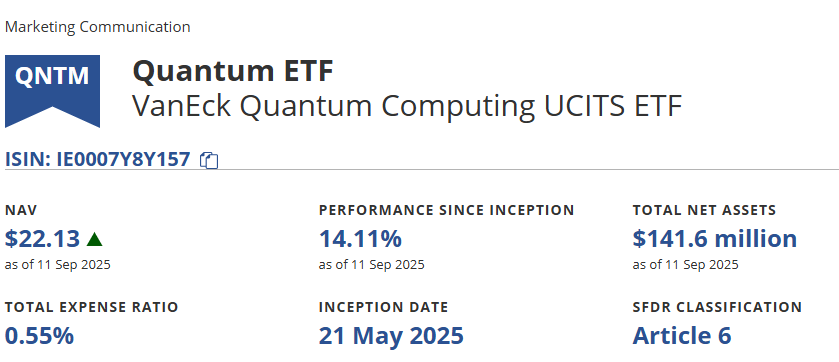

VanEck Quantum Computing UCITS ETF (Europe, launched 2025)

Focus: First and only European ETF dedicated exclusively to quantum computing.

AUM: ~€250 million (as of Sept 2025).

Expense Ratio: 0.49%.

Performance: New fund, initiated in mid-2025; demonstrating initial favourable inflows.

Why it matters: The only true pure play ETF available, giving investors concentrated exposure. [1]

2. Quantum + Emerging Tech ETFs (Hybrid Exposure)

Funds here invest in companies involved in quantum computing alongside AI, robotics, and semiconductors.

Defiance Quantum ETF (QTUM, US)

AUM: $2.1 billion (Sept 2025).

Expense Ratio: 0.40%.

Performance: +18% YTD, +52% over 3 years.

Top Holdings: Nvidia, IBM, IonQ, Honeywell. [2]

2. WisdomTree Artificial Intelligence & Innovation Fund (WTAI, US)

3. Broad Tech ETFs with Quantum Exposure (Indirect Play)

| ETF Name |

Region |

AUM (2025) |

Expense Ratio |

YTD Return |

3Y Return |

Focus Level |

| VanEck QNTM (UCITS) |

EU |

€250M |

0.49% |

N/A |

N/A |

Pure Play |

| Defiance QTUM |

US |

$2.1B |

0.40% |

+18% |

+52% |

Hybrid |

| WisdomTree WTAI |

US |

$1.3B |

0.45% |

+15% |

+40% |

Hybrid |

| iShares XT |

US |

$4.6B |

0.47% |

+12% |

+35% |

Broad Tech |

These ETFs are not dedicated to quantum computing but hold significant stakes in companies leading the field.

iShares Exponential Technologies ETF (XT, US)

AUM: $4.6 billion.

Expense Ratio: 0.47%.

Performance: +12% YTD.

Quantum Exposure: Includes Alphabet (Google), Microsoft, and Intel, all heavily investing in quantum R&D.

Why Invest in Quantum Computing ETFs in 2025 and What Are the Risks?

Growth Forecast: The quantum computing market is expected to surpass $90 billion by the year 2040. [3]

Institutional Interest: Companies such as Microsoft, IBM, and Alphabet are investing billions in quantum research and development.

Diversification: ETFs offer safer access to this volatile sector compared to individual quantum stocks.

What Are the Risks of Quantum Computing ETFs?

1) Niche Exposure

Few companies are pure quantum, so most ETFs are hybrids.

2) High Volatility

Emerging tech = unpredictable performance.

3) Fees

Thematic ETFs tend to have higher fees than S&P 500 or Nasdaq trackers.

4) Liquidity

Newer ETFs may have lower volume and wider spreads.

Frequently Asked Questions

1. What's the Difference Between a Pure Quantum ETF and a Hybrid ETF?

Pure ETFs (like VanEck's Quantum Computing UCITS ETF) focus solely on quantum companies, while hybrids (like QTUM) mix quantum with AI, robotics, and semiconductors.

2. Which Is the Best Quantum ETF in 2025?

QTUM leads in scale and performance, while QNTM is notable as the first pure-play UCITS option in Europe.

3. Are Quantum ETFs Profitable Yet?

Many remain uncertain; QTUM has demonstrated solid returns (+18% YTD 2025), yet sustained growth relies on the pace of commercialisation.

4. How Do Quantum ETFs Differ From AI or Semiconductor ETFs?

Quantum ETFs target companies focused on next-gen computing, while AI/semiconductor ETFs may include them only as part of a broader theme.

Conclusion

In conclusion, quantum computing remains a developing field; however, ETFs such as QTUM and QNTM provide investors with diverse exposure without the need to choose specific winners. In 2025, the best strategy is blending pure plays with hybrid tech ETFs for balanced exposure.

For future-focused investors, quantum ETFs represent both risk and opportunity. Positioning early could prove rewarding as the technology scales over the next decade.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.etf.com/sections/news/vaneck-launches-europes-first-only-quantum-computing-etf

[2] https://thequantuminsider.com/2025/09/04/defiances-quantum-computing-etf-surpasses-2-billion-aum/

[3] https://www.bcg.com/press/18july2024-quantum-computing-create-up-to-850-billion-of-economic-value-2040