The dollar weakened in early Asian trade on Wednesday, further away from the

6-month high against the Canadian dollar. PM Carney has confirmed sectoral

tariff deal with the US.

Canada's annual inflation rate increased more than expected to 2.4% in

September, mainly led by a smaller decline in gasoline prices on a yearly basis

and a rise in food prices, data showed on Tuesday.

However, economists said the rise in headline inflation masked signs of

easing price pressures beneath the surface as the overshoot was driven by a few

volatile categories.

The report came before the BOC meets for its next monetary policy decision

later this month. Money markets put a more than 86% probability on a 25-bp cut,

the second in a row.

Businesses' sales outlook remained subdued and recessionary concerns

persisted. Most reported weak demand and abundant capacity, which combined led

persistently soft hiring and investment plans.

Moody's charted the path of the two economies in North America and discovered

a growing gap that it predicts will only get wider. Weak labour productivity in

Canada has been part of the problem.

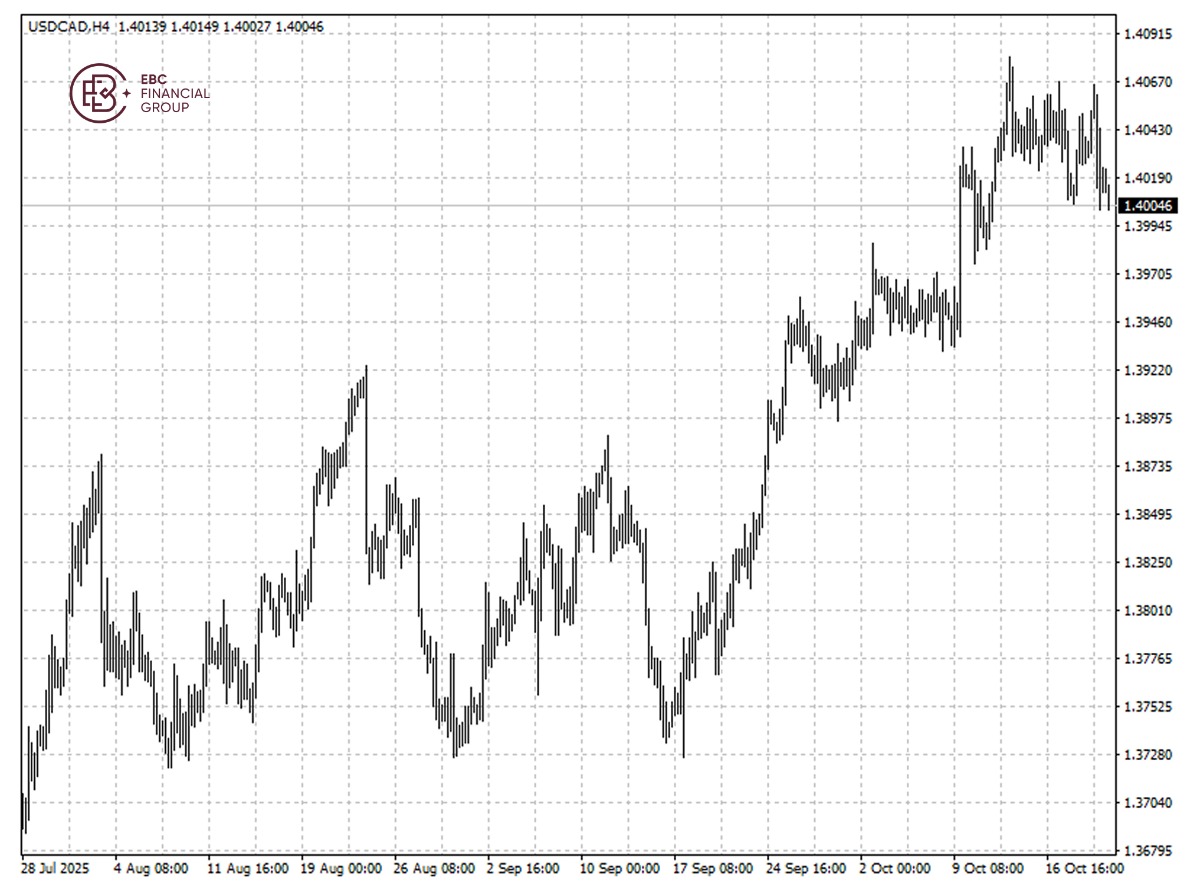

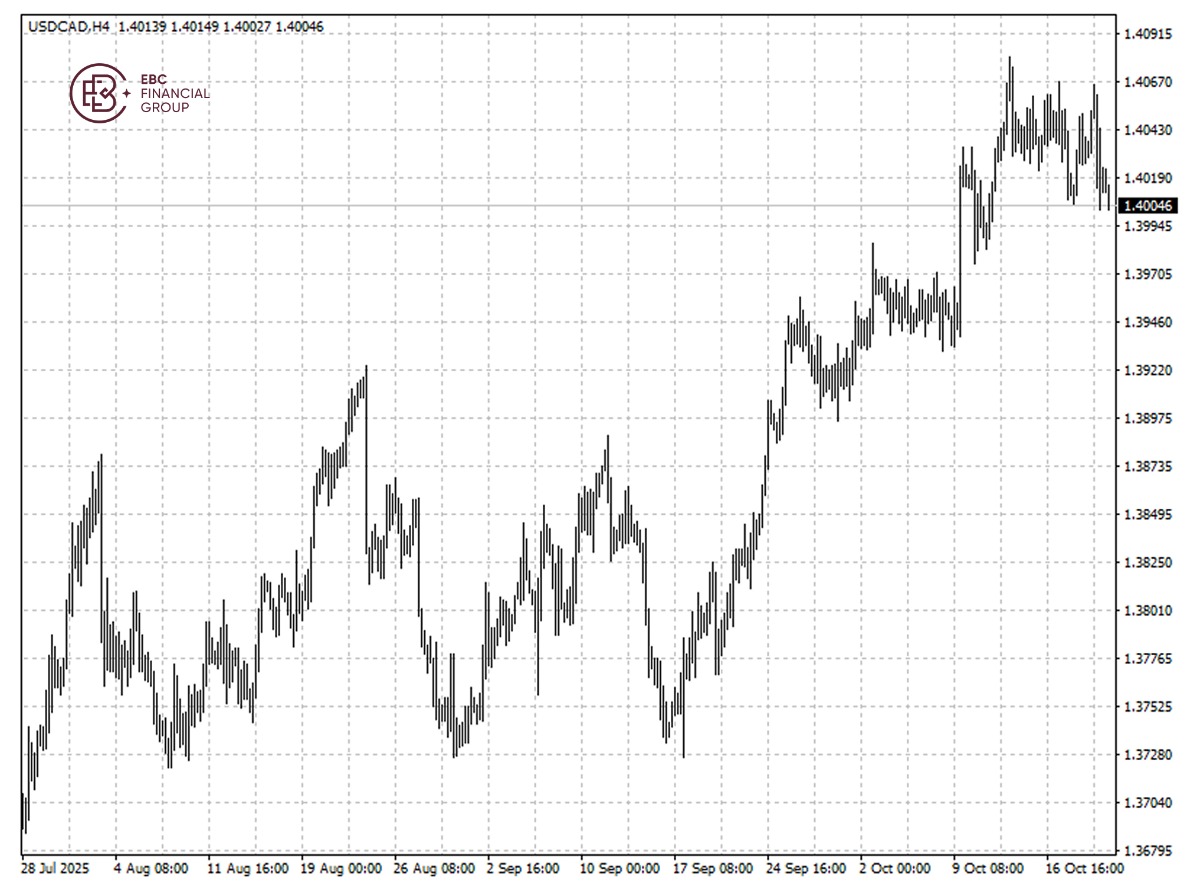

Loonie again got back to the resistance at 1.4000 per dollar. The base

scenario is a retreat will take place from here and lead to 1.4024 per

dollar.

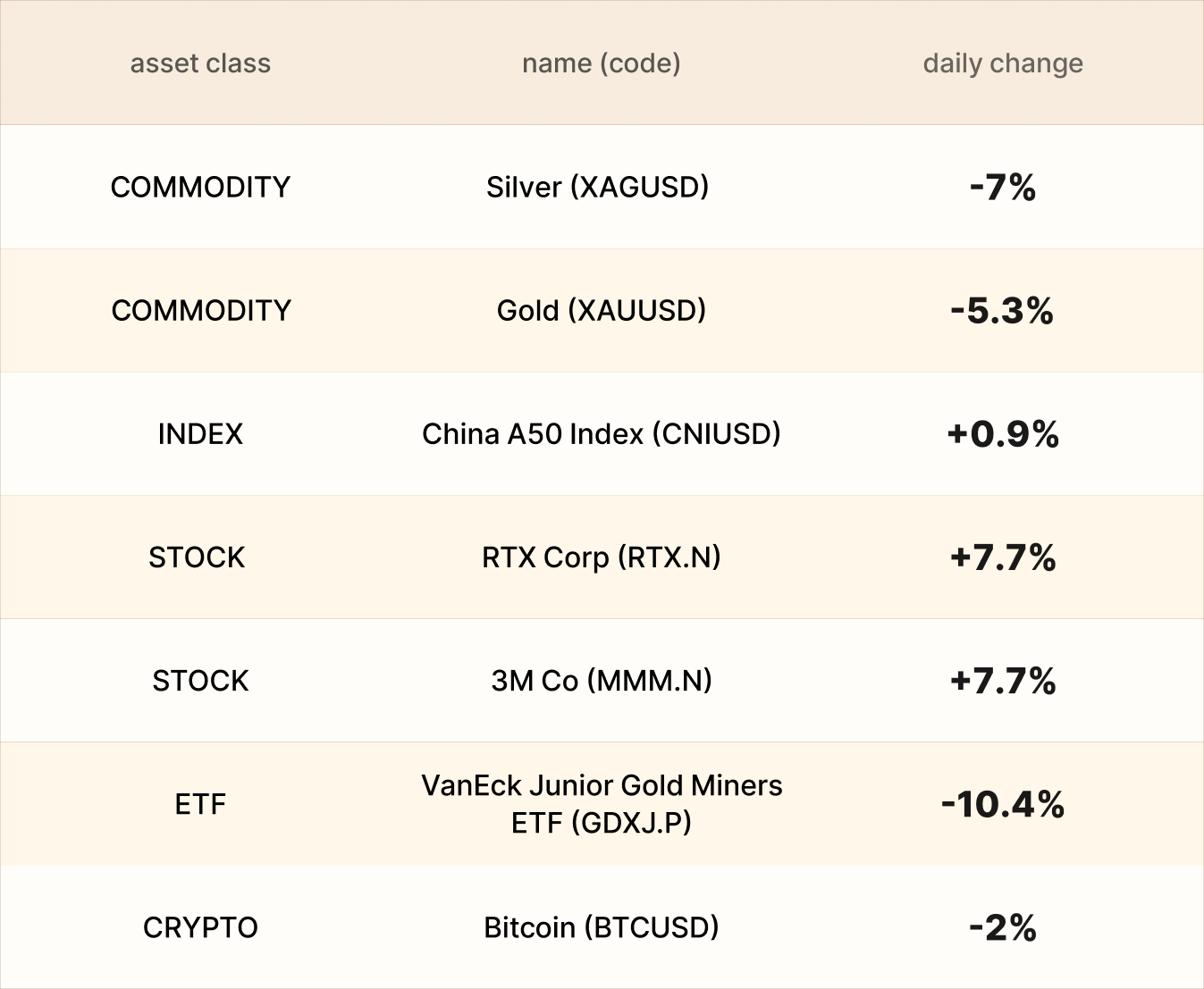

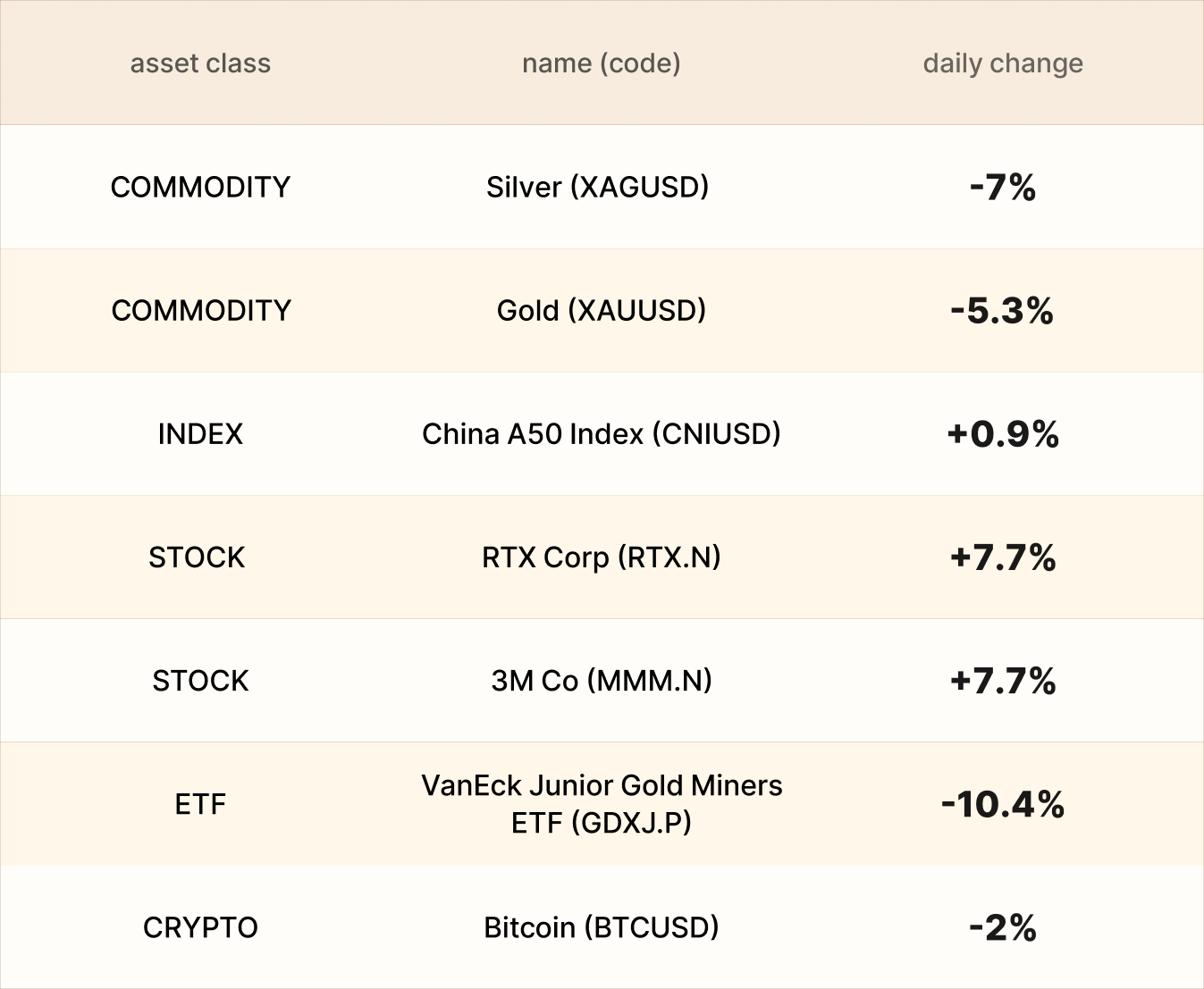

Asset recap

As of market close on 20 October, among EBC products, RTX and 3M led gains.

Wall Street volatility is elevated during Q3 earnings session.

RTX Corp beat Q3 earnings and revenue estimates, with double-digit organic

growth across all segments, and raised its full-year outlook; 3M Co also

surprises to the upside, highlighting turnaround progress.

Metal prices took a nosedive. Although Russia and Ukraine failed to agree on

ceasefire terms, the crowded long positions inevitably triggered a sharp

reversal.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.