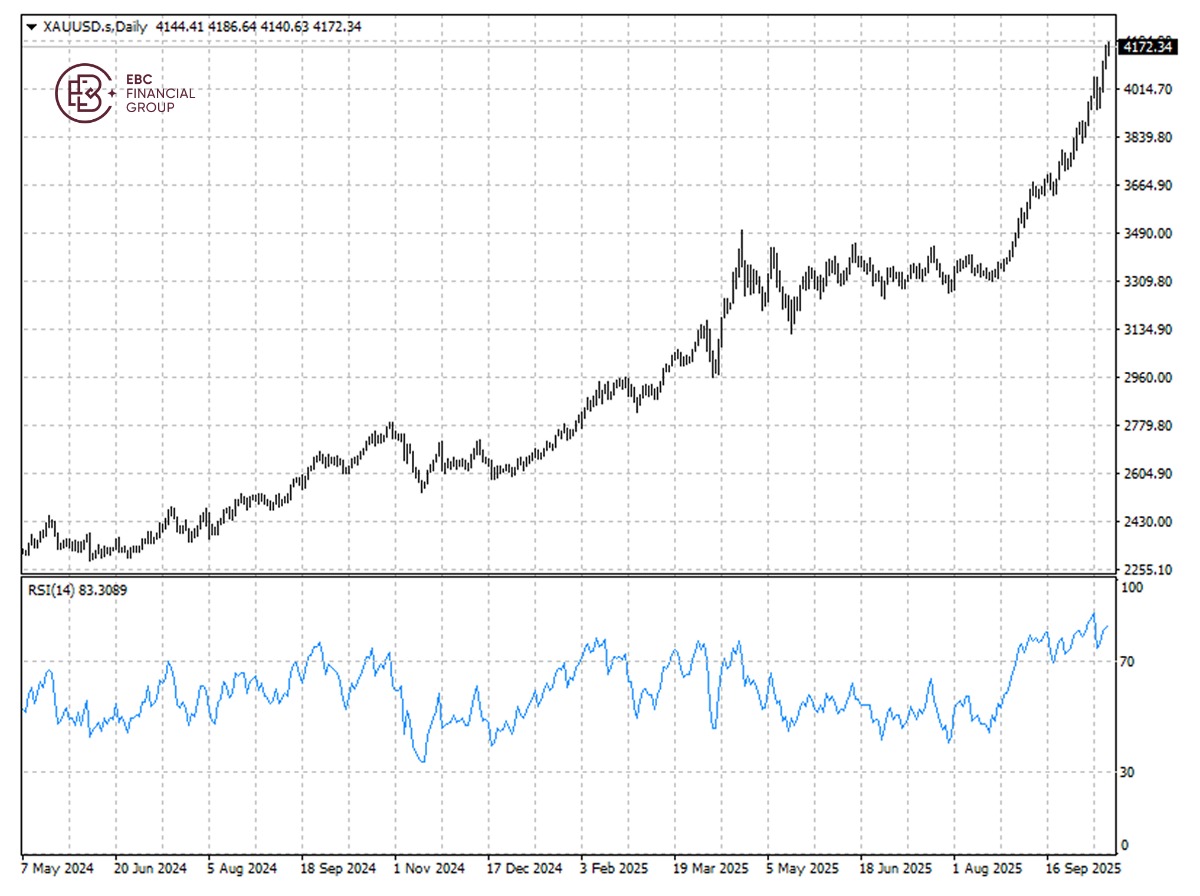

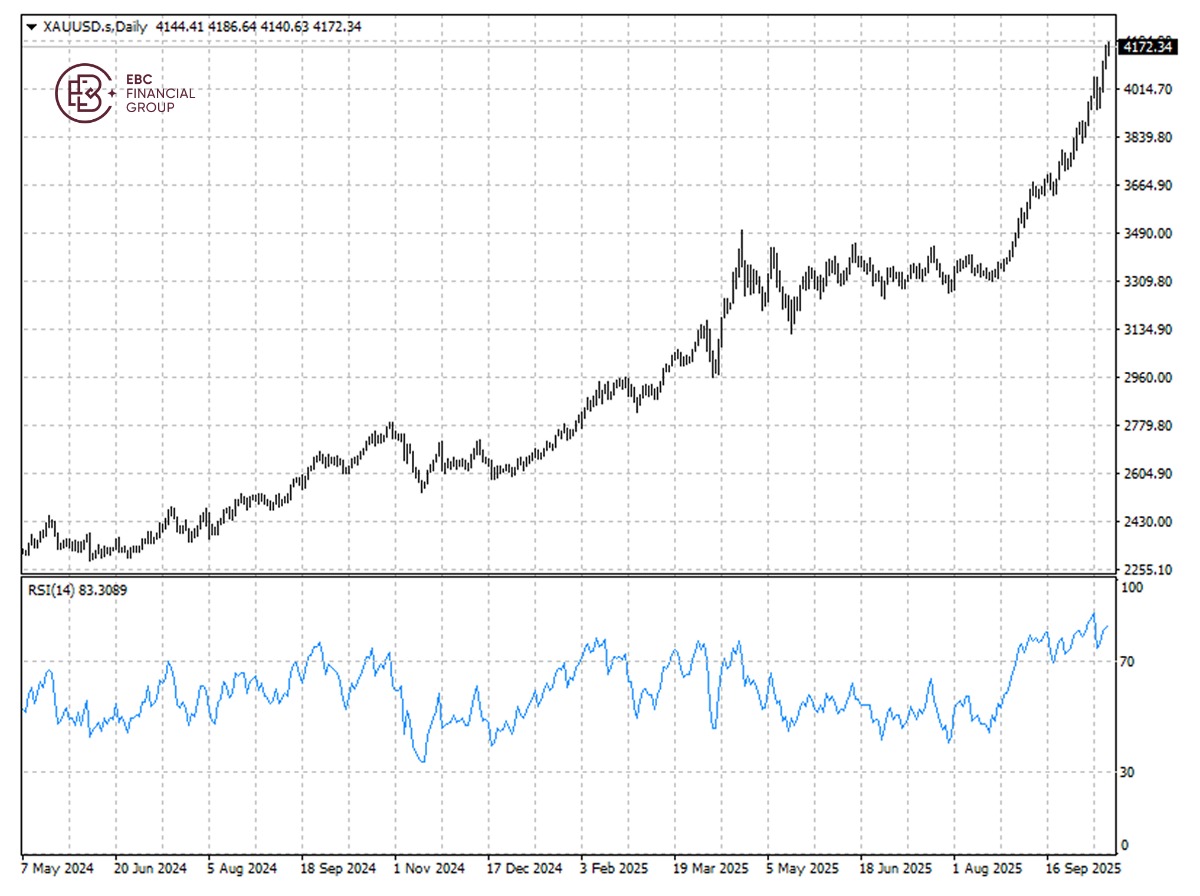

Gold edged towards $4,200 on Wednesday, lifted by expectations of a rate cut

this month by the Fed and an investor flight to safety after a flare-up in trade

tensions between Washington and Beijing.

Trump on Tuesday said his administration is considering "terminating business

with China having to do with Cooking Oil" in retaliation for Beijing refusing to

buy US soybeans.

Beijing has not bought a single American soybean since May. But its soybean

imports remained at historically high levels in August, with companies making

huge purchases from Brazil and other South American growers.

The world's two largest economies have also started charging new port fees on

each other's ships. On top of that Beijing added five US subsidiaries of South

Korean shipbuilder Hanwha Ocean to its sanction list.

Wall St banks give the nod to the bull run. Goldman Sachs raised on Monday

its December 2026 gold price forecast to $4,900 per ounce, citing strong Western

ETF inflows and likely central bank buying.

Bank of America Global Research raised its price forecasts for precious

metals, lifting its 2026 outlook for gold to $5,000 an ounce, with an average of

around $4,400.

Bullion has apparently stayed in the overbought territory for quite a while,

but there are few signs of reversal. The hurdle could lie around $4,180 where

the metal seems prone to a moderate pullback.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.