As we navigate through 2025, investors closely examine the performance of traditional safe-haven assets like gold against equity benchmarks such as the S&P 500. Both have experienced significant movements influenced by economic indicators, geopolitical tensions, and market sentiments.

However, gold vs S&P 500: Which asset performed better in 2025 and may offer superior returns moving forward?

This comprehensive analysis delves into the latest data to assess which asset class might offer better investment prospects this year and beyond.

Gold's Performance Overview in 2025

Gold has demonstrated remarkable resilience and growth in 2025. As of April 30, 2025, gold prices have surged to approximately $3,307 per ounce, reflecting investor concerns over economic uncertainties and inflationary pressures.

Goldman Sachs has raised its year-end forecast to $3,700 per ounce, citing increased demand from central banks and investors seeking safe-haven assets.

Key Drivers:

Inflation Hedge: Persistent inflation has led investors to seek assets that preserve purchasing power, with gold being a traditional choice.

Geopolitical Tensions: Ongoing global conflicts and trade disputes have heightened market volatility, making gold an attractive option for risk-averse investors.

Central Bank Purchases: Central banks, particularly in emerging markets, have increased their gold reserves, contributing to price support.

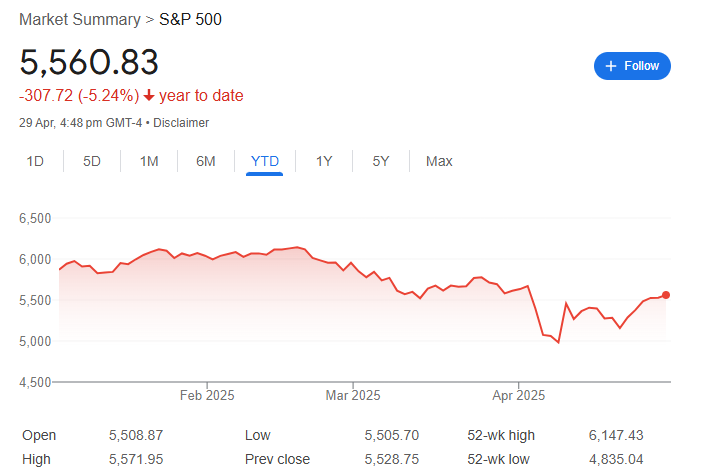

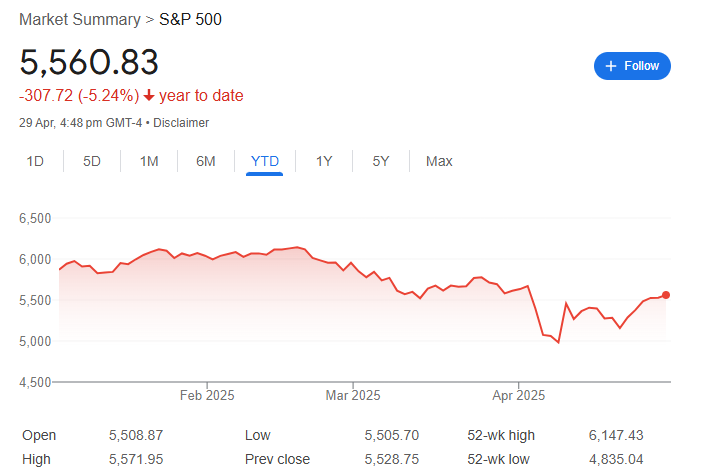

S&P 500's Performance Overview in 2025

The S&P 500 has faced challenges in 2025, with the index experiencing a year-to-date decline of approximately 5.5% as of April 29.

HSBC has revised its year-end target for the S&P 500 to 5,600, down from 6,700, citing slower U.S. economic growth and pressures on corporate earnings due to ongoing tariff policies.

Key Challenges:

Economic Slowdown: Concerns over decelerating economic growth have impacted investor confidence.

Inflationary Pressures: Persistent inflation has affected corporate profit margins and consumer spending.

Policy Uncertainty: Changes in trade policies and regulatory frameworks have introduced additional market uncertainties.

Comparative Analysis: Gold vs S&P 500

1. Historical Performance

Gold: Historically, gold has served as a store of value, particularly during periods of economic uncertainty.

S&P 500: Over the long term, the S&P 500 has delivered substantial returns, driven by corporate earnings growth and economic expansion.

2. Volatility and Risk

Gold: Generally exhibits lower volatility than equities, offering stability during market downturns.

S&P 500: Subject to higher volatility, influenced by economic cycles, interest rates, and corporate performance.

3. Income Generation

Gold: Does not generate income; returns are based on price appreciation.

S&P 500: Provides dividend income, contributing to total returns for investors.

4. Inflation Protection

Gold: Traditionally viewed as a hedge against inflation, preserving real value.

S&P 500: Companies may pass higher costs to consumers, potentially maintaining earnings during inflationary periods.

Forecasts Beyond 2025 and Investment Considerations

Gold:

Goldman Sachs projects gold prices could reach $3,700 per ounce by the end of 2025.

Billionaire investor John Paulson anticipates gold approaching $5,000 by 2028, citing central bank demand and geopolitical risks.

S&P 500:

Goldman Sachs forecasts the S&P 500 to rise to 6,500 by the end of 2025, assuming a 10% total return, including dividends.

However, other analysts have expressed caution, with some predicting limited upside potential and increased volatility.

Investment Considerations

Gold:

Pros:

Cons:

S&P 500:

Pros:

Cons:

Conclusion

So far in 2025, gold has outperformed the S&P 500, driven by central bank demand, geopolitical tensions, and inflation concerns. While the S&P 500 offers potential for long-term growth, current economic uncertainties and market volatility present challenges.

Investors should assess their financial goals, risk appetite, and investment horizons before deciding between these asset classes. A diversified approach may offer the most balanced path forward in navigating the complexities of the current financial landscape.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.