The London Forex session, one of the most active and liquid trading periods in the world, opens at 1:00 PM Pakistan Standard Time (PKT) and closes at 9:00 PM PKT, taking into account daylight saving in London.

For traders in Pakistan, this session is crucial as it coincides with other international markets, particularly the New York session, resulting in substantial price fluctuations and trading prospects.

This article will explain the precise timings of the London session in Pakistan, its significance for forex traders, its features, methods, and advice to optimise this trading opportunity in 2025.

When Is the London Session Forex Time in Pakistan and Why Is It Important?

The London session generally runs from 8:00 AM GMT to 5:00 PM GMT. When converted to Pakistan Standard Time (PKT):

As to its importance, the London session is often referred to as the "powerhouse" of forex trading because:

Major currency pairs, particularly those that include the euro (EUR), British pound (GBP), and U.S. dollar (USD), undergo substantial price fluctuations.

This timing is ideal for Pakistani traders, as it coincides with the afternoon and evening hours, making it accessible to both part-time and full-time traders.

What Are the Characteristics of the London Session in Trading?

Several factors make the London session stand out for traders in Pakistan:

1. High Liquidity

The London market attracts significant involvement from banks, hedge funds, and retail traders, guaranteeing that buy and sell orders are processed swiftly with little slippage.

2. Increased Volatility

Compared to the Asian session, the London session experiences higher volatility, which means larger price movements and more profit opportunities.

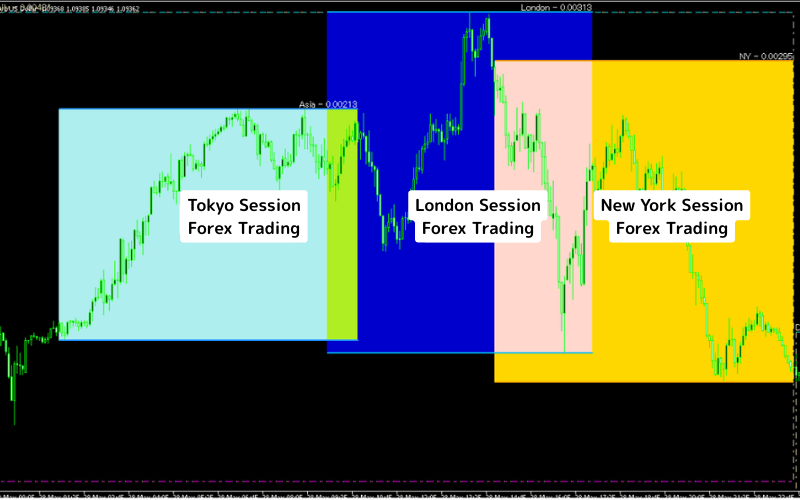

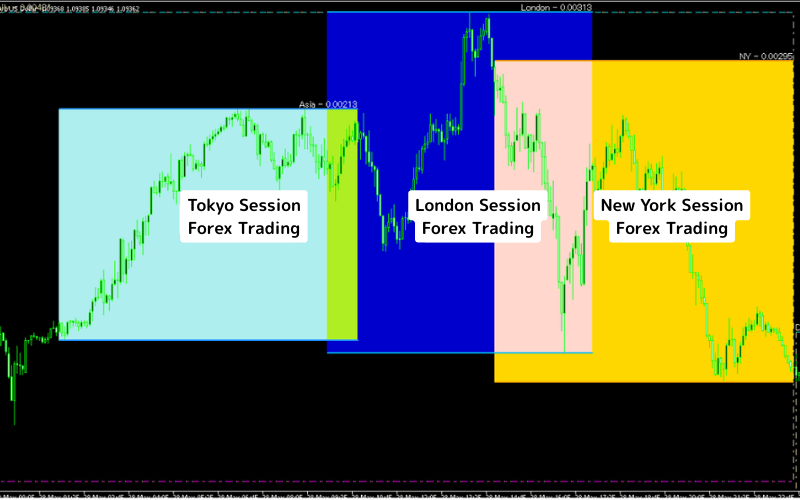

3. Overlap with Other Sessions

These overlaps make certain hours particularly profitable, especially the London–New York overlap.

London Session vs Other Forex Sessions in Pakistan

| Session |

Start Time (PKT) |

End Time (PKT) |

| Sydney |

3:00 AM |

12:00 PM |

| Tokyo |

4:00 AM |

1:00 PM |

| London |

1:00 PM |

9:00 PM |

| New York |

6:00 PM |

3:00 AM (next day) |

Best Time to Trade the London Session in Pakistan

While the London session lasts nine hours, not all hours are equally profitable. For Pakistani traders:

3:00 PM to 5:00 PM PKT: Stable movement with technical setups forming.

5:00 PM to 9:00 PM PKT (London–New York overlap): Best time for high volatility and breakout strategies, especially with USD, GBP, and EUR pairs.

What Are the Currency Pairs Most Active During the London Session?

Pakistani traders need to understand that different currency pairs do not all react in the same manner. The most active and liquid pairs during the London session include:

EUR/USD: The world's most traded pair.

GBP/USD: Known for volatility and trading opportunities.

USD/CHF: It's popular as a safe-haven pair.

USD/JPY: Highly active due to overlapping with the Tokyo session.

EUR/JPY and GBP/JPY: Volatile cross pairs.

What Trading Strategies Work Best for the London Session?

1. Breakout Strategy

As the London market opens, price often breaks out of ranges established during the Asian session. Traders can place buy/sell stop orders above or below support/resistance levels.

2. Trend-Following Strategy

Strong trends often form during the overlap of the London and New York sessions. Traders can utilise moving averages and RSI indicators to ride these trends.

3. Scalping

Due to high liquidity and tight spreads, scalpers can execute quick trades within seconds or minutes, particularly on pairs such as EUR/USD and GBP/USD.

4. News Trading

During this time, agencies often release economic reports from the UK, EU, and the U.S. Market responses to GDP, CPI, interest rates, and employment statistics can influence traders in Pakistan to engage in trading.

What Are the Advantages and Risks for Pakistan Traders in the London Session?

| Advantages |

Risks |

| High liquidity makes it easier to enter and exit trades quickly. |

Sudden price swings can cause unexpected losses if risk management is weak. |

| Strong volatility provides more trading opportunities and profit potential. |

Increased volatility also raises the risk of slippage during order execution. |

| Overlap with New York session (5 PM to 9 PM PKT) creates the most active market hours. |

News releases (especially UK, EU, and US data) can cause sharp unpredictable moves. |

| Wide range of tradable pairs like EUR/USD, GBP/USD, and USD/JPY show strong movement. |

Beginners may overtrade due to constant price action, leading to poor discipline. |

| Convenient timing for Pakistani traders (1 PM to 9 PM PKT), even for part-timers. |

Longer hours of activity can cause fatigue and emotional trading if not managed well. |

| Opportunity to trade both breakouts and trend continuations. |

Market reversals can happen suddenly, trapping traders in false breakouts. |

Frequently Asked Questions

1. What Time Does the London Forex Session Open in Pakistan?

The London Forex session opens at 1:00 PM Pakistan Standard Time (PKT) and runs until 9:00 PM PKT.

2. What Is the Best Time to Trade During the London Session in Pakistan?

The London–New York overlap (5:00 PM to 9:00 PM PKT) is considered the best time, as it offers the highest volatility and best breakout opportunities.

3. Can Part-Time Traders in Pakistan Benefit From the London Session?

Yes, since the session runs from afternoon to evening (12:00 PM to 9:00 PM PKT), even part-time traders in Pakistan can participate without adjusting their sleep schedule.

4. What Risks Should Pakistani Traders Consider When Trading the London Session?

The main risks include sudden price swings during high volatility, slippage during news events, and the temptation to overtrade due to constant market movement.

Conclusion

In conclusion, the London Forex session takes place from 12:00 PM to 9:00 PM in Pakistan, establishing it as the key trading period for local traders. It offers high liquidity, strong volatility, and numerous trading opportunities, especially during overlaps with the Tokyo and New York sessions.

For Pakistani traders in 2025, focusing on EUR/USD and GBP/USD, applying proper strategies, and managing risks effectively can turn the London session into a profitable trading period.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.