When it comes to building a balanced investment portfolio, many investors remain overly focused on U.S. markets. While America hosts some of the world's largest corporations, true diversification requires looking beyond domestic equities. This is where the VEU ETF—the Vanguard FTSE All-World ex-US ETF—plays a crucial role. Offering exposure to thousands of companies across developed and emerging markets outside the United States, the VEU ETF provides investors with a gateway to global opportunities.

Understanding the VEU ETF: Structure and Objectives

The VEU ETF seeks to track the performance of the FTSE All-World ex-US Index, a benchmark covering large- and mid-cap companies across more than 40 countries. The fund is passively managed, meaning it mirrors the index rather than attempting to outperform it. This structure makes it cost-efficient, with one of the lowest expense ratios in its category.

The fund excludes U.S. stocks entirely, focusing on firms listed in Europe, Asia, Latin America, and other regions. Investors benefit from exposure to sectors and industries that may be underrepresented in American markets, such as European banks, Asian technology firms, or multinational consumer brands.

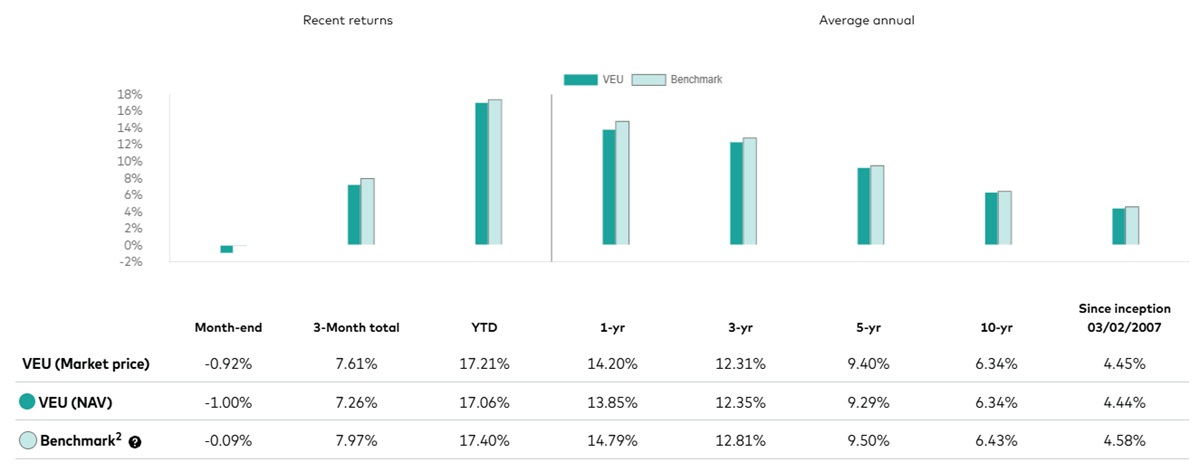

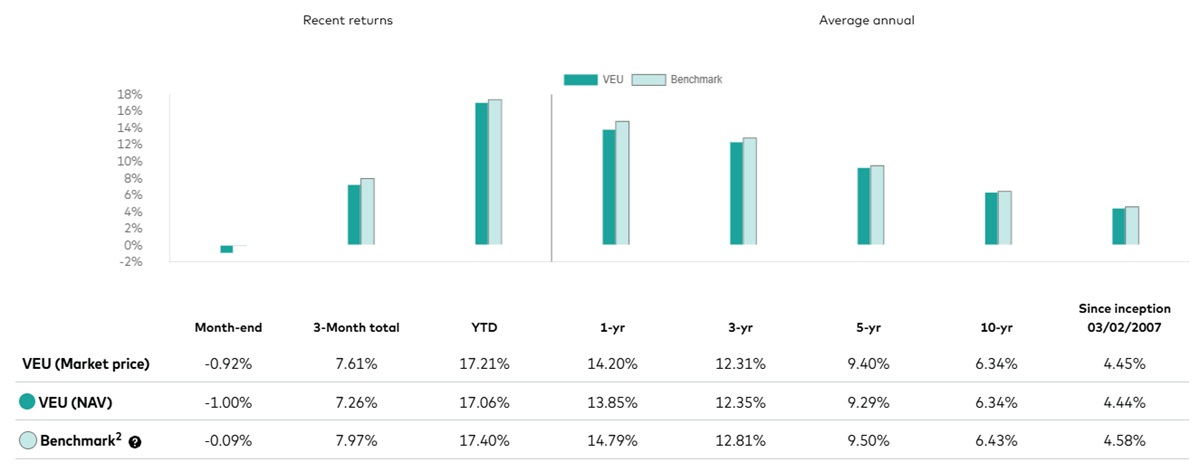

Historical Performance and Market Trends

Over the past decade, the VEU ETF has delivered returns that mirror the uneven performance of international markets. While it has occasionally lagged behind U.S.-centric funds such as the S&P 500 ETFs, the VEU ETF has shone during periods when non-U.S. equities have outpaced the American market. For example, during the early 2000s commodity boom, emerging markets surged, lifting global ex-U.S. funds.

The long-term performance of the VEU ETF reinforces its role as a diversification tool. By smoothing portfolio volatility, it offsets the risks of concentrating solely in U.S. equities. Historical data suggests that when U.S. markets experience corrections, international equities often provide a buffer, though not always in perfect opposition.

Key Holdings and Regional Breakdown

The VEU ETF holds over 3.500 securities, providing broad exposure across global markets. As of the latest data:

Europe accounts for a significant share, with major holdings in companies like Nestlé (Switzerland), Roche (Switzerland), and ASML (Netherlands).

Asia-Pacific exposure is dominated by firms such as Toyota (Japan), Samsung Electronics (South Korea), and Taiwan Semiconductor Manufacturing Company (TSMC).

Emerging markets include stakes in companies like Tencent (China) and Reliance Industries (India).

This diversification ensures that no single company or country dominates the portfolio, reducing idiosyncratic risk.

Costs, Liquidity, and Accessibility of VEU ETF

One of the main attractions of the VEU ETF is its affordability. Vanguard's commitment to low-cost investing is evident in the fund's expense ratio of 0.07%, making it highly competitive compared to similar international funds.

Liquidity is another strong point. With billions in assets under management and robust daily trading volumes, the ETF is easy to buy and sell without significant price slippage. This makes it suitable for both long-term investors and those seeking tactical global exposure.

Risks and Considerations for Investors

Despite its strengths, the VEU ETF is not without risks. Currency fluctuations can have a significant impact on returns, as the fund is unhedged. For example, a strong U.S. dollar can erode gains from international equities. Additionally, political and economic instability in certain regions, particularly emerging markets, may increase volatility.

Another factor is the persistent underperformance of non-U.S. markets in recent years. While the U.S. tech sector has driven American indices higher, many international markets have lagged. Investors must therefore view the VEU ETF as a long-term diversification strategy rather than a short-term outperformance play.

Conclusion: Should You Add the VEU ETF to Your Portfolio?

The VEU ETF offers investors a straightforward and cost-efficient way to access global equity markets outside the United States. Its broad diversification across regions and sectors makes it an excellent complement to U.S.-focused funds. While risks such as currency exposure and uneven performance remain, the ETF's role in reducing portfolio concentration cannot be overstated.

For investors seeking to broaden their horizons and embrace true global diversification, the VEU ETF stands as a practical and well-structured option. In an interconnected world, limiting investments to U.S. equities alone is a risk in itself—one that the VEU ETF helps to mitigate.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.