The forex market operates 24 hours a day, 5 days a week, encompassing several overlapping sessions across various time zones. For traders in Pakistan, understanding how local time converts to major international trading sessions is crucial.

Knowing session hours helps you align trades with periods of high liquidity and volatility, during London and New York session overlaps.

This guide explains Forex market hours in Pakistan, the significance of timing, and how newcomers can leverage this information to gain an edge.

Forex Trading Hours: Global Market Overview

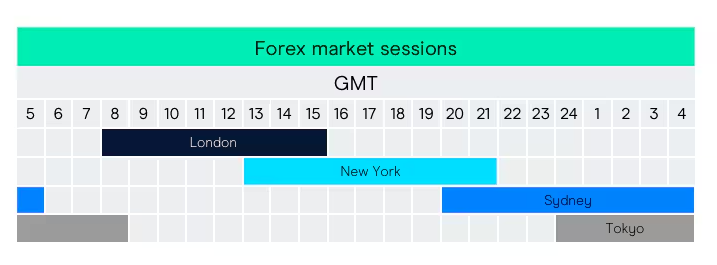

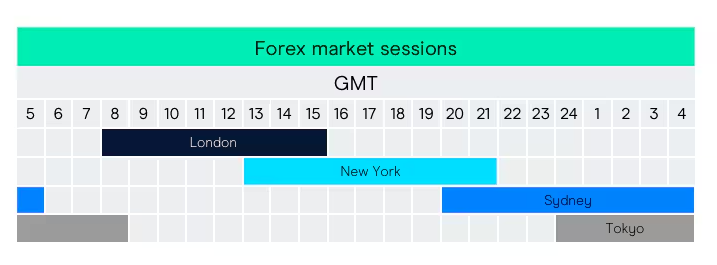

The Forex market officially begins on Sunday at 5:00 p.m. Eastern Time (ET) and remains open until Friday at 5:00 p.m. ET, providing ongoing worldwide access. It's divided into four major trading sessions—Sydney, Tokyo, London, and New York—each with distinct characteristics and activity levels.

The Four Major Sessions (UTC)

Sydney: 10:00 p.m. to 7:00 a.m. GMT

Tokyo: 12:00 a.m. to 9:00 a.m. GMT

London: 8:00 a.m. to 5:00 p.m. GMT

New York: 1:00 p.m. to 10:00 p.m. GMT

Since Pakistan follows Pakistan Standard Time (PKT, UTC+5), these sessions correspond to local times that are significant for traders in Pakistan.

Forex Market Opening Time in Pakistan

Based on UTC to PKT conversion, here's how global sessions land in Pakistan:

Sydney Session: Opens 03:00 a.m. PKT, closes 12:00 p.m. PKT

Tokyo Session: Opens 04:00 a.m. PKT, closes 01:00 p.m. PKT

London Session: Opens 01:00 p.m. PKT, closes 09:00 p.m. PKT

New York Session: Opens 06:00 p.m. PKT, continues until 03:00 a.m. PKT (Tuesday)

Because the Forex market operates continuously Monday through Friday, Pakistani traders can access markets throughout these windows.

When Are Trading Conditions Best in Pakistan?

London-New York Overlap: Peak Liquidity

The most active Forex hours in Pakistan lie between 05:00 p.m. and 09:00 p.m. PKT, when London and New York markets overlap. Volume surges, spreads tighten, and volatility increases.

This overlap period typically provides the most efficient conditions for scalping, day trading, and breakout strategies.

London-Tokyo Overlap: Moderate Activity

Between approximately 08:00 a.m. and 09:00 a.m. PKT, the London and Tokyo sessions overlap briefly.

This period offers moderate liquidity, especially useful for brokers quoting Asian/European currency pairs.

Quiet Hours and Lower Activity

Early morning hours (03:00 a.m.–04:00 a.m.) during the Sydney and early Tokyo windows typically see lower trading activity, wider spreads, and slower price movement, less ideal for active strategies but sometimes suited to longer-term technical positioning.

Strategic Trading Timeframes for Traders

| Session |

Local PKT Hours |

Liquidity & Volatility |

| Sydney |

03:00 a.m. – 12:00 p.m. |

Low activity; best for longer-term traders |

| Tokyo |

04:00 a.m. – 01:00 p.m. |

Moderate; Asian pairs show movement |

| London |

01:00 p.m. – 09:00 p.m. |

High; key session for EUR, GBP pairs |

| New York |

06:00 p.m. – 03:00 a.m. |

High; overlaps with London for major liquidity |

| London–New York Overlap |

05:00 p.m. – 09:00 p.m. |

Peak liquidity; ideal for intraday strategies |

Optimal Times to Trade

Pakistani traders typically aim for peak activity windows:

These times provide the optimal combination of volume and volatility for short-term strategies.

When to Be Cautious

Avoid trading during low-liquidity hours such as 03:00 a.m.–04:00 a.m. PKT, or shortly before weekends (Friday overnight PKT), when spreads may widen and liquidity dips.

Tips to Create a Pakistan-Friendly Trading Schedule

1) Plan Around Overlaps

Align your live trading routine with the London-New York overlap whenever possible. Set alerts before key news events and prepare setups during quieter morning hours.

2) Use an Economic Calendar in PKT

Track global news releases and data in PKT to avoid surprises and plan rest periods during high-volatility events you don't wish to trade.

3) Leverage Demo Accounts

Practice timing strategies by using demo accounts to simulate trading across sessions in PKT, particularly for strategy testing in real market hours.

4) Adjust for Seasonal Time Shifts

Pakistan doesn't observe Daylight Saving Time, but the US and EU regions do. Monitor GMT/UTC shifts in summer and fall, which affect session overlap timing and adjust your schedule accordingly.

Example: Ideal Trading Day in Pakistan

A Pakistani trader begins at 12:00 p.m. PKT, prepping charts and news ahead of the London open. At 1:00 p.m. PKT, the London session commences and liquidity starts to increase.

Key data arrives around 09:00 a.m. ET (1:00 p.m. PKT), triggering volatility. At 05:00 p.m. PKT, New York opens, and session overlap increases liquidity dramatically. The trader executes scalps and trend trades until 09:00 p.m. PKT, then closes all positions and logs trades.

Common Mistakes to Avoid

Avoid these pitfalls as a Pakistan-based trader:

Trading outside liquid session windows without strategy adjustment.

Ignoring expanding spreads in off-peak hours.

Mixing session activity with economic events not aligned with PKT timing.

Overtrading in low liquidity periods, thinking the price will behave as it does during overlap windows.

Conclusion

In conclusion, for Forex traders based in Pakistan, mastering session timing in PKT is essential.

By focusing activity during London and New York overlaps (05:00 p.m.–09:00 p.m. PKT), aligning trades with high liquidity and volatility, and respecting market dynamics in quieter hours, you can enhance trade execution, risk management, and strategic planning.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.