Day trading is one of the most fast-paced and exciting forms of trading in financial markets. With advancements in technology, AI-driven tools, and real-time access to global markets, more people are exploring day trading as a potential income in 2025. But for beginners, it's crucial to understand the basics, risks, strategies, and tools required to succeed.

This guide will walk you through everything you need to know about day trading in 2025 — from setting up your first Trading Account to mastering winning strategies.

What Is Day Trading?

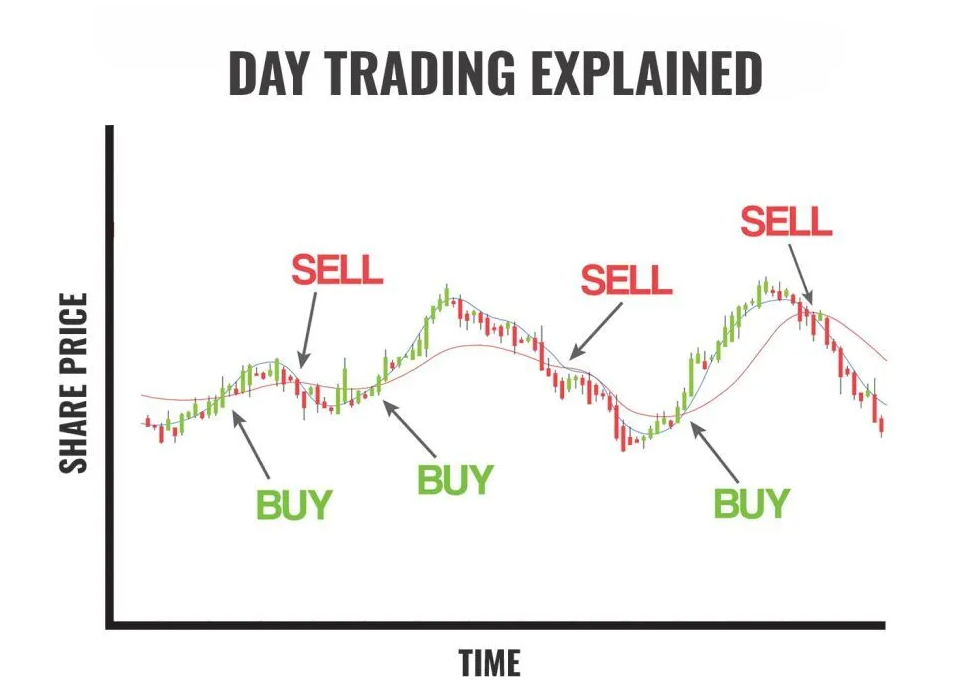

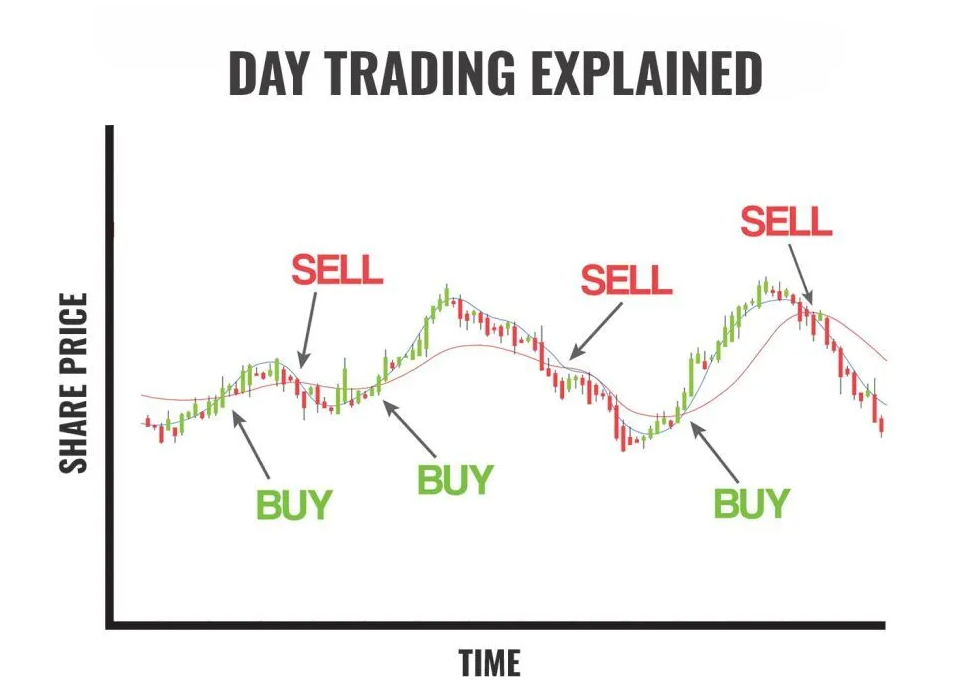

Day trading refers to the practice of buying and selling financial instruments — such as stocks, forex or indices within the same trading day. The goal is to capitalise on short-term price movements, avoiding overnight exposure.

Key Characteristics of Day Trading:

Short timeframes: Trades are opened and closed on the same day.

High frequency: Traders may execute dozens or even hundreds of trades daily.

Leverage usage: Many day traders use leverage to amplify small price movements.

Technical analysis: Trading decisions rely heavily on charts, indicators, and patterns.

Markets You Can Day Trade in 2025

Day traders now have access to more markets than ever before. Some of the most popular choices include:

1. stock market

Trade individual equities such as Tesla, Apple, or Nvidia.

Highly liquid and volatile, especially during earnings seasons.

2. Forex (Foreign Exchange)

Open 24 hours a day, 5 days a week.

Most liquid market globally (e.g., EUR/USD, GBP/JPY).

3. Commodities

Includes gold, crude oil, natural gas, and silver.

Influenced by geopolitical events and economic reports.

4. Indices

Examples: S&P 500, NASDAQ, Dow Jones, and FTSE 100.

Offers exposure to a basket of top-performing stocks.

Day Trading for Beginners: Step-by-Step Guide

Step 1: Get Educated

Before risking real money, learn the fundamentals. Focus on:

Technical analysis (candlestick patterns, chart setups)

Order types (market, limit, stop-loss)

Risk management techniques

Trading psychology

Resources:

Step 2: Choose the Right Broker

In 2025, you'll find plenty of online brokers. Choose one that offers:

Low commissions or zero-fee trades

Real-time charting tools

Mobile & desktop platforms

Strong security and regulatory compliance

Step 3: Set Up Your Trading Platform

Brokers, such as EBC, offer downloadable platforms or web-based tools. Consider integrating:

Top Day Trading Strategies for Beginners

1. Breakout trading

Buy when the price breaks above a resistance level; sell when it breaks below the support.

Tools: Volume spikes, Bollinger Bands

2. Pullback Strategy

Wait for a short-term price retracement before entering in the direction of the trend.

Tools: Fibonacci retracements, Moving Averages

3. momentum trading

Trade assets showing strong upward or downward momentum due to news or high volume.

Tools: RSI, MACD, Volume indicators

4. Scalping

Make dozens of trades per day to capitalise on tiny price moves.

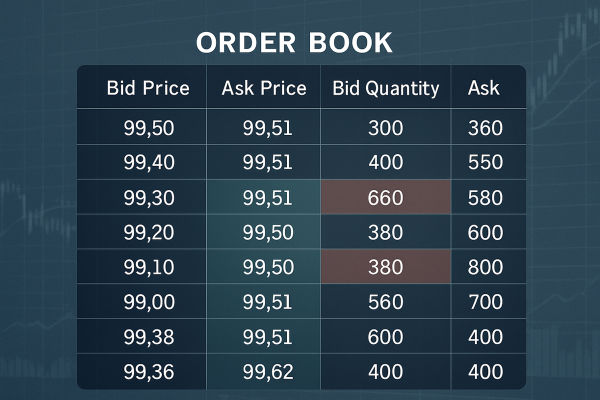

Tools: Level 2 quotes, time and sales data, tight spreads

Is Day Trading Right for You?

Day trading is not for everyone. It requires discipline, emotional control, quick decision-making, and a strong grasp of technical analysis.

Pros:

Cons:

High risk of loss

Emotionally and mentally demanding

Requires constant monitoring

Expensive in terms of fees and tools

10 Tips to Succeed as a Beginner Day Trader

1. Start With a Demo Account

Before risking real money, practice trading using a demo or paper trading. Most brokers offer this feature. Use it to:

2. Focus on One Market at a Time

Don't overwhelm yourself by trading multiple assets. Start with one — such as U.S. stocks or forex — and master its behaviour before diversifying. This helps you:

Recognise patterns unique to that market

Understand its volatility and volume cycles

Develop specific trading strategies

3. Stick to a Trading plan

Create a trading plan that outlines

4. Use Stop-Loss and Take-Profit Orders

These tools are your best friends. They:

Limit your losses on a bad trade

Automatically lock in profits at your desired level

Help you avoid emotional exits

5. Trade During Optimal Times

Focus on times of high market activity:

Avoid trading in illiquid, low-volume hours where price movements can be unpredictable.

6. Keep a Trading Journal

After every trade, record:

7. Continuously Educate Yourself

The markets evolve, and so should your knowledge. Follow:

Market news and economic indicators

Top trading blogs, forums, and YouTube educators

Trading books, newsletters, and courses

Stay up-to-date with trading tools, strategies, and psychological tactics.

8. Protect Your Capital

Think long-term. Your #1 job as a beginner isn't to make big profits — it's to preserve capital so you can stay in the game long enough to learn.

9. Practice Patience and Discipline

Not every market condition is tradable. Avoid forcing trades. Learn to wait for your setups to appear and trust your plan.

10. Join a Trading Community

Engage in online communities, Discord groups, or forums, as you'll benefit from:

Conclusion

In conclusion, day trading in 2025 offers tremendous opportunities — but also substantial risks. For beginners, success lies in education, discipline, and developing a personalised trading edge.

Don't rush the process. With consistent effort, smart risk management, and emotional control, you can navigate the world of day trading with confidence and earn profit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.