Fibonacci trading is a widely used approach in technical analysis, often praised for its ability to pinpoint potential market reversals. Based on ratios derived from the Fibonacci sequence, this method involves identifying retracement and extension levels on price charts.

These levels are commonly used to forecast areas of support and resistance in trending markets. However, despite its popularity, fibonacci trading is frequently misunderstood. Numerous myths have emerged that mislead traders and result in poor decision-making.

Understanding the truth behind fibonacci trading is essential for anyone looking to use it effectively. By identifying and discarding the myths surrounding this method, traders can apply it more realistically and responsibly in their strategies.

7 Myths About Fibonacci Trading to Stop Believing

Myth 1: Fibonacci Trading Predicts Exact Reversal Points

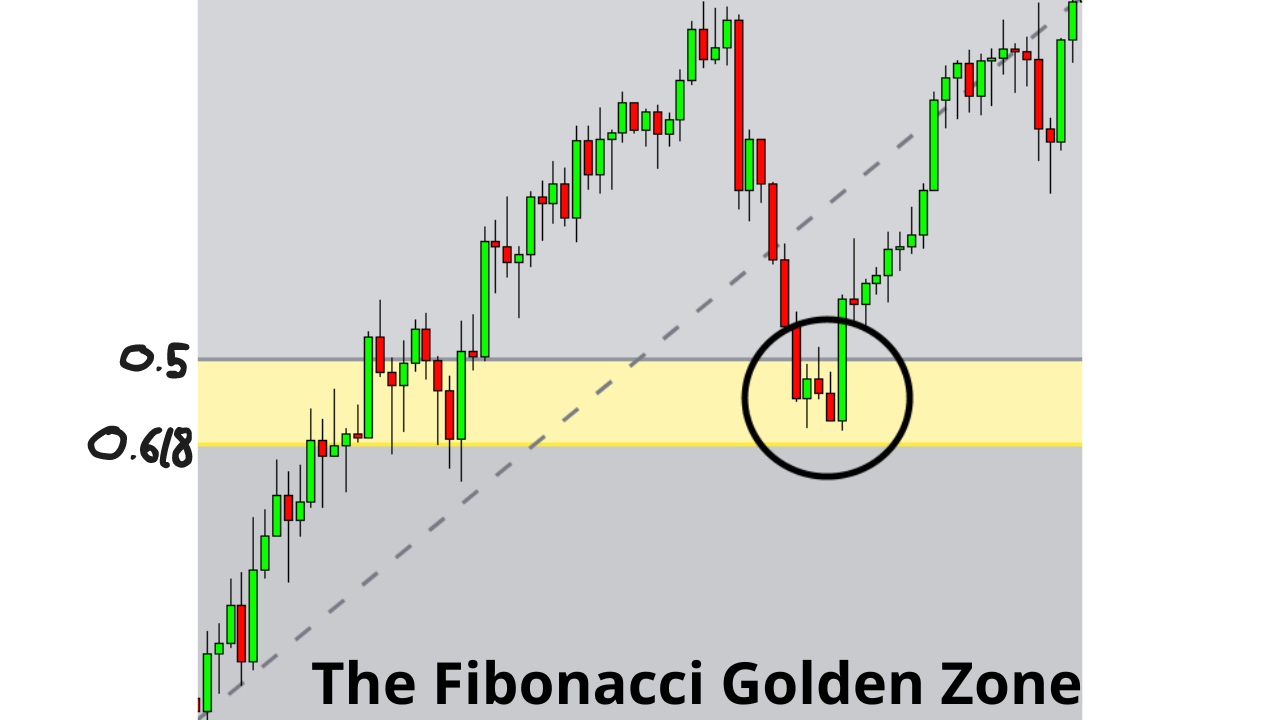

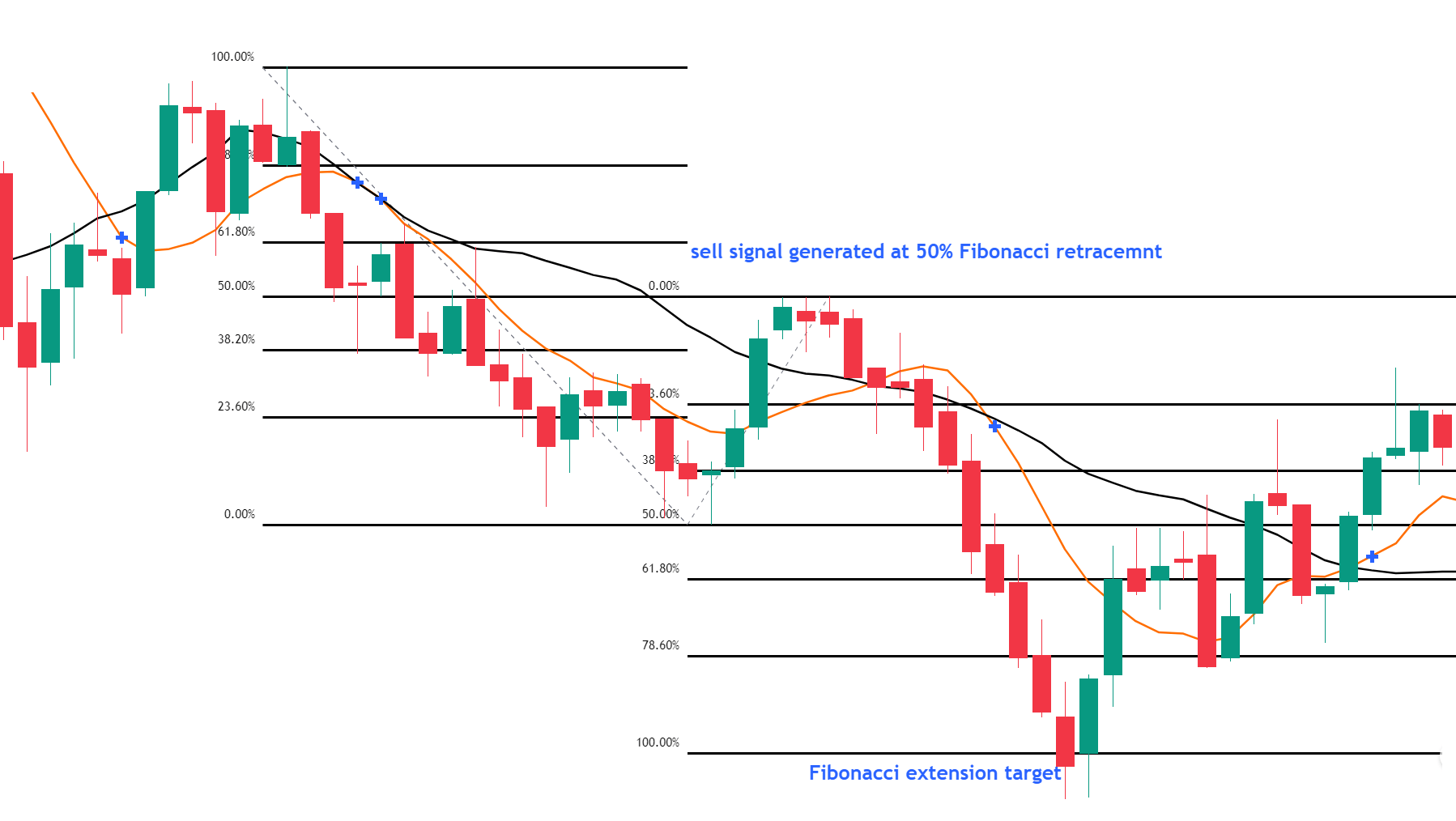

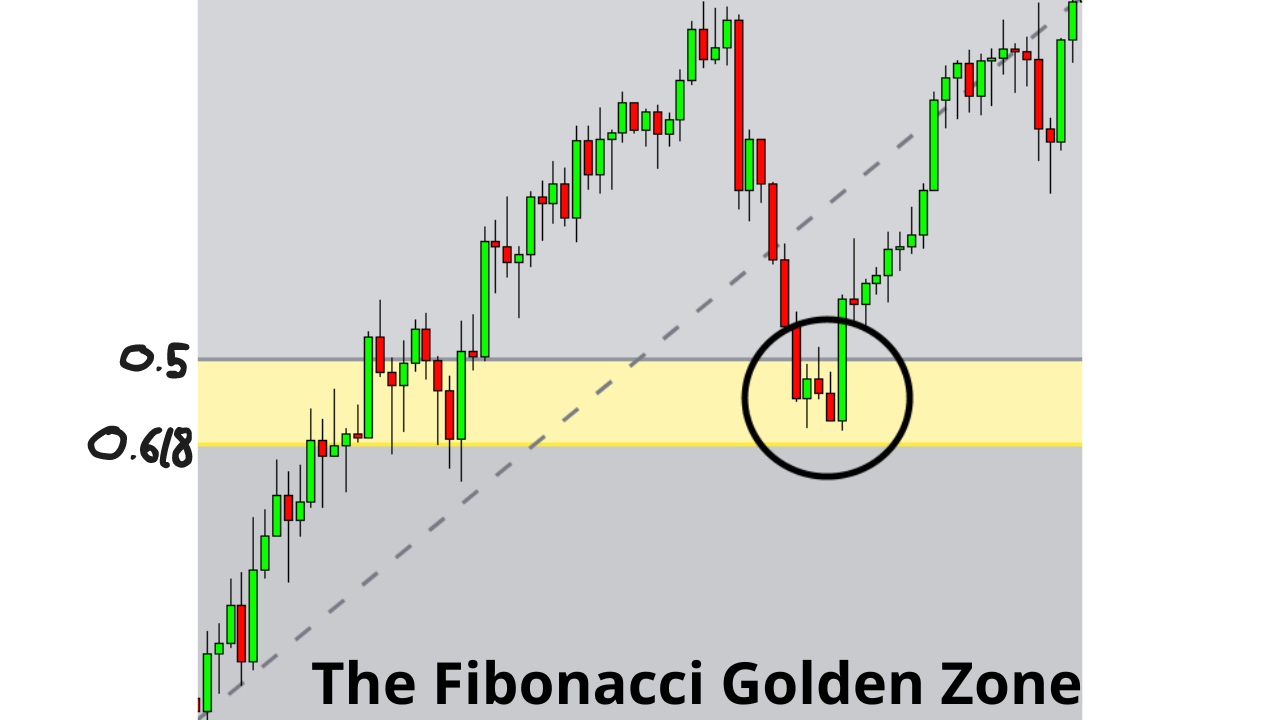

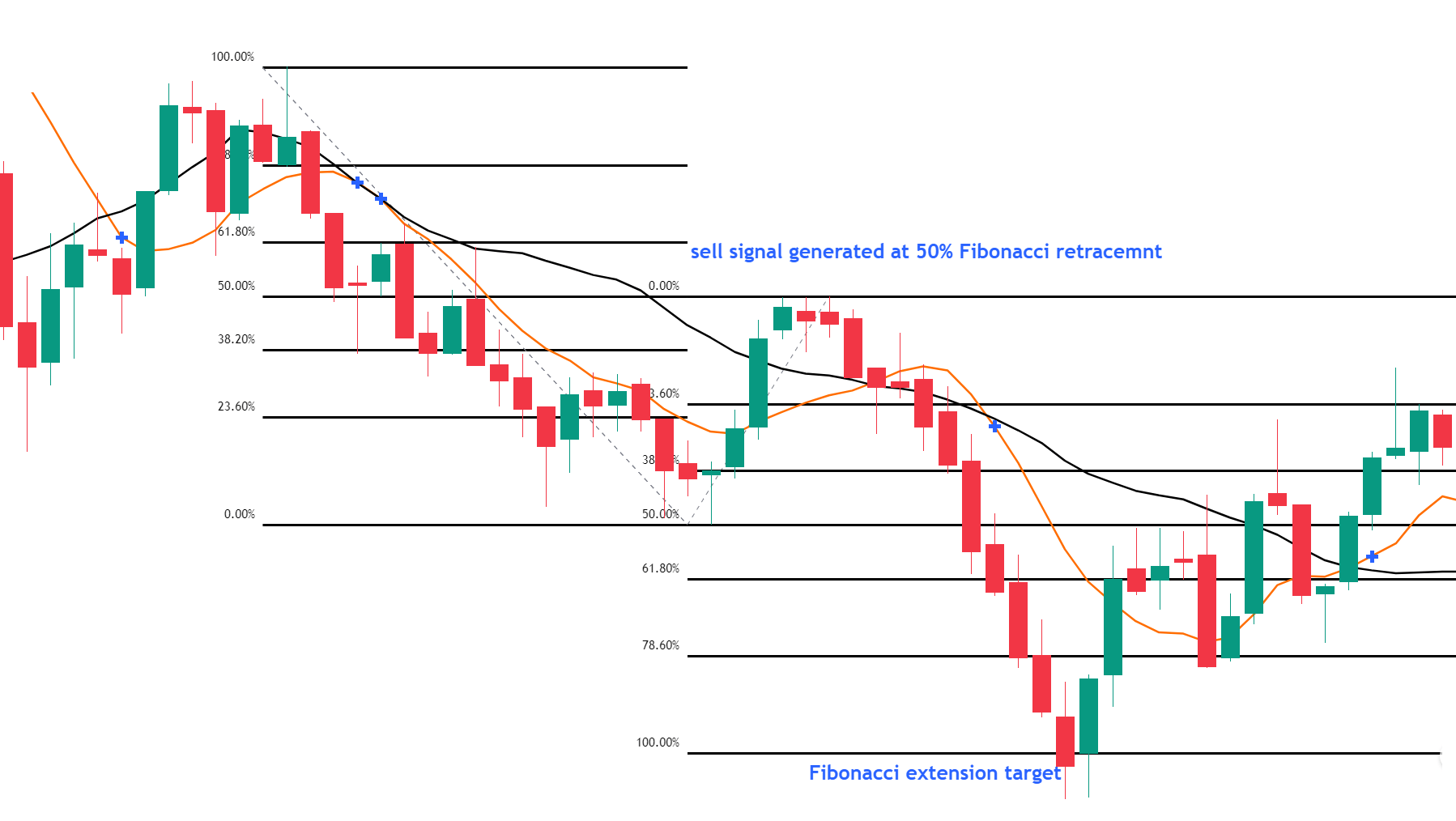

Many traders mistakenly believe that fibonacci trading can identify precise reversal points in the market. While fibonacci retracement and extension levels often coincide with areas where price reacts, these levels do not guarantee reversals. Instead, they highlight zones of potential interest where reversals might occur.

In reality, no technical indicator can forecast exact price turns with absolute accuracy. Successful traders use fibonacci trading as a guide rather than a prediction tool. When paired with other forms of analysis such as support and resistance or candlestick patterns, it can increase the probability of successful trades.

Myth 2: All Traders Use Fibonacci the Same Way

Another common misconception is that fibonacci trading works because all traders see and use the same levels. This is not true. Fibonacci levels are highly subjective. Traders may draw retracement tools from different swing highs and lows or apply them on different timeframes. As a result, the levels vary from one trader to another.

Expecting price to react at a certain fibonacci level because it appears on your chart assumes that the rest of the market sees the same thing. In reality, fibonacci trading works best when it is part of a broader strategy that considers trend context and technical confluence.

Myth 3: Fibonacci Only Works in Trending Markets

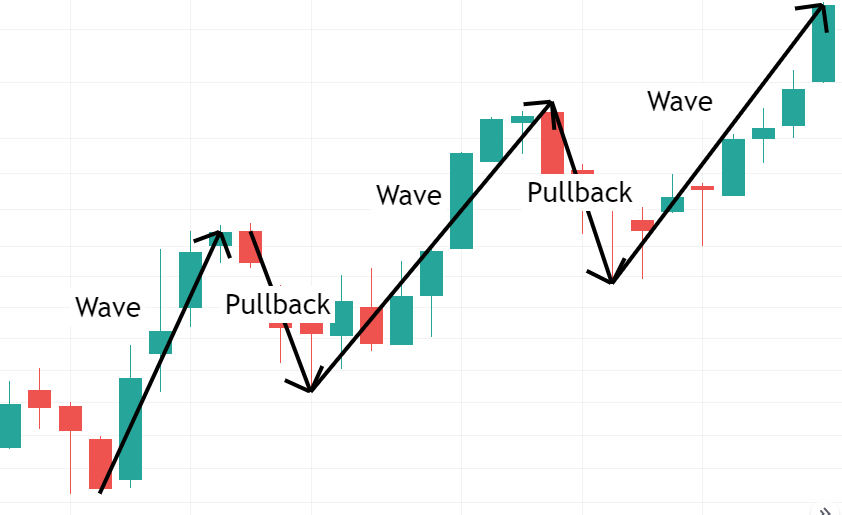

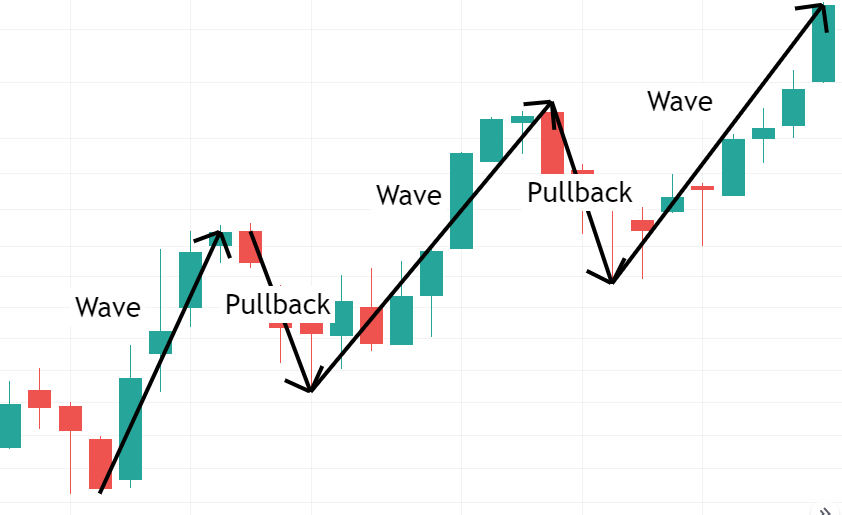

It is often said that fibonacci trading is useful only during strong trends. While it is true that fibonacci retracement tools are commonly applied to measure pullbacks in trending markets, they can also be valuable during consolidations or corrections.

Fibonacci trading can help identify potential continuation points after a corrective move. When a market moves sideways or retraces temporarily, fibonacci levels can highlight where the trend may resume. This flexibility makes it applicable across different market conditions, not just clear trends.

Myth 4: More Fibonacci Levels Improve Accuracy

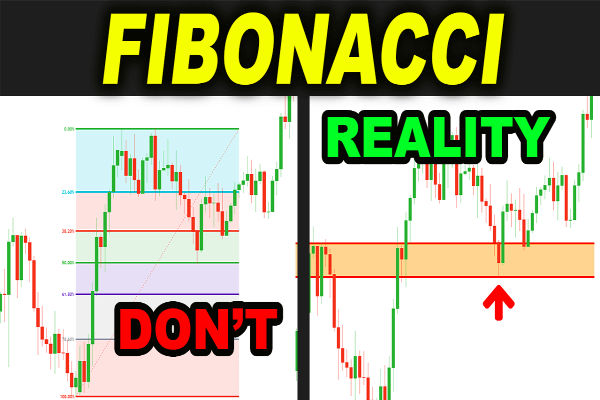

Some traders believe that drawing multiple fibonacci retracements across various timeframes or swing points will yield more precise results. In fact, this can lead to a cluttered chart and analysis paralysis. Too many overlapping fibonacci levels can create confusion and false signals.

Effective fibonacci trading relies on clarity and focus. Identifying the most relevant swings and choosing key levels such as 38.2%, 50%, and 61.8% is often more helpful than crowding a chart with unnecessary complexity. A clean chart supports more objective decision-making.

Myth 5: Fibonacci Trading Guarantees Winning Trades

One of the most dangerous myths is the idea that fibonacci trading ensures profitable outcomes. This belief encourages overconfidence and neglect of risk management. No tool in trading offers guaranteed results, and fibonacci levels are no exception.

Fibonacci trading should be viewed as one element of a comprehensive Trading plan. It can provide insights into where price may react, but trade success depends on factors such as entry timing, stop-loss placement, and money management. Risk control remains essential in all market conditions.

Myth 6: Fibonacci Numbers Have Special Powers

Some traders are drawn to fibonacci trading because they believe the fibonacci sequence holds mystical or universal powers. While fibonacci numbers do appear in nature, the effectiveness of fibonacci trading is based more on human psychology and market behaviour than on mathematical magic.

Fibonacci levels work in trading because enough market participants believe in them and act accordingly. This collective behaviour creates a self-fulfilling cycle, where price tends to react at commonly watched levels. The success of fibonacci trading lies in psychology, not supernatural forces.

Myth 7: Fibonacci Is Too Advanced for Beginners

A final myth is that fibonacci trading is too complicated for new traders. While advanced applications can involve extensions and multiple timeframes, the basic use of fibonacci retracement is straightforward. Beginners can start by learning to identify major swing highs and lows and applying the retracement tool to highlight key price levels.

With consistent practice and clear charting rules, fibonacci trading becomes a useful part of a beginner’s toolkit. Over time, traders can incorporate more complex techniques, but even the simplest applications can offer valuable insights into market structure.

How to Use Fibonacci Trading Properly

The best way to approach fibonacci trading is with balance and realism. It should not be used in isolation. Combining fibonacci levels with price action, moving averages, volume analysis, or trendlines often produces more reliable signals. Looking for confluence between fibonacci levels and other technical tools increases the chances of identifying meaningful setups.

Furthermore, risk management must never be ignored. Even when a fibonacci level appears strong, traders should always use stop-loss orders and proper position sizing. No level is guaranteed to hold, and preserving capital is more important than any single trade.

Conclusion

Fibonacci trading remains a popular and powerful method of technical analysis, but it is not a miracle solution. Believing the common myths about fibonacci trading can hinder your progress and lead to poor trading decisions. By understanding its real strengths and limitations, traders can integrate fibonacci tools into their strategies more effectively.

Ultimately, fibonacci trading works best when combined with sound analysis, a disciplined approach, and a clear risk management plan. With the myths out of the way, traders can focus on using fibonacci tools as intended — to guide decisions, not dictate them.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.