Bitcoin has surged past $125.8 touching a fresh all-time high, powered by robust ETF inflows, institutional demand and macro tailwinds — fueling speculation that a new bull cycle may be underway.

Yet, whether this new high leads to sustained upside depends on whether capital flows, momentum and policy support hold firm.

In this article, we will examine the recent price performance and metrics, the key drivers behind the breakout, technical and structural factors, major risks to the rally, and the outlook ahead.

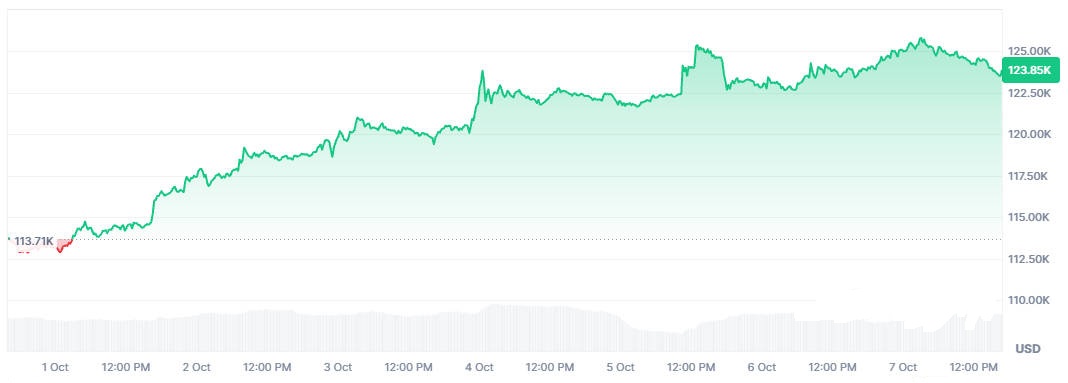

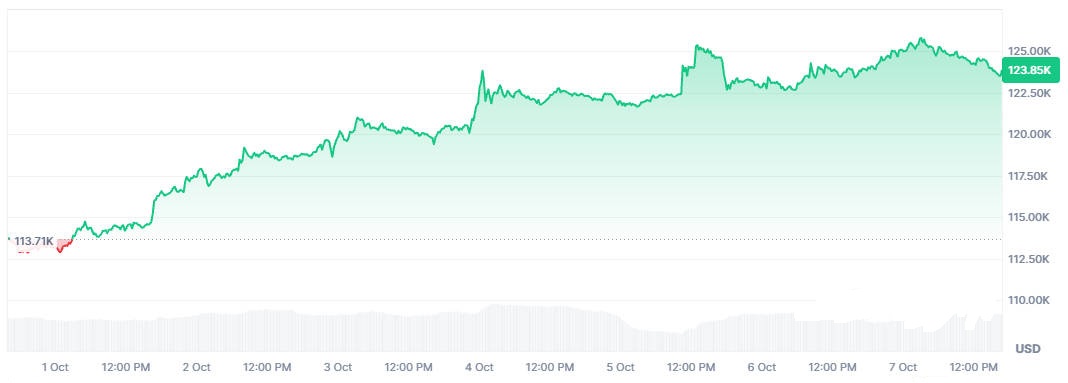

Price context and recent performance

The headline fact. Bitcoin cleared the $125.000 mark in early October 2025 and printed fresh records in the $125k–$126k band during the move.

Year-to-date performance. The asset has gained roughly one-third year-to-date, a strong advance versus most traditional risk assets.

Volume and liquidity. Trading volumes rose around the move; 24-hour volumes were in the tens of billions of USD on the largest sessions.

Key metrics at the previous high vs the new high

| Metric |

Previous high (mid-Aug 2025) |

New high (early Oct 2025) |

Note / source |

| Peak price |

≈ $124,480 |

≈ $125,650–$126,200 |

New record printed during Oct 5–6, 2025. |

| Year-to-date gain |

≈ +30% (mid-Aug) |

≈ +33–34% (early Oct) |

Momentum picked up into October. |

| 24h trading volume (peak days) |

~$40B (varies by day) |

Tens of billions; active sessions >$20B |

Exchange and on-chain volumes spiked on the breakout. |

Macro and market drivers behind the breakout

Below are the principal drivers that, together, explain why BTC pushed to fresh records.

1) Spot-ETF inflows and product adoption (primary driver).

Large net purchases into US and global spot Bitcoin ETFs have supplied steady, fungible demand for BTC.

In the week surrounding the breakout, spot-ETF inflows were reported at roughly $3.2 billion (week-aggregate), with several days showing large daily net flows.

2) Institutional treasuries and corporate accumulation.

Some corporate treasuries and institutional holders increased allocations to BTC, adding natural bid and long-term buy pressure on spot markets. Treasury and corporate accumulation stories were cited by market outlets as complementary to ETF demand.

3) Macro tailwinds — dollar dynamics and "debasement" flows.

A weaker US dollar and concern about fiscal stress and monetary policy have driven part of the allocation into hard assets, of which Bitcoin is now a common retail and institutional choice.

Analysts have described some flows as part of a broader "debasement" trade.

4) Cross-asset momentum and risk appetite.

Equities and risk assets rallying on positive sentiment can amplify crypto inflows, while geopolitical or policy uncertainty sometimes prompts portfolio re-balancing into non-sovereign stores of value.

Technical and structural factors supporting the breakout

1) Technical breakout and momentum confirmation.

Price action broke above a recent consolidation / descending channel; momentum indicators registered bullish confirmations on the breakout, suggesting room for further upside in the near term.

Analysts highlighted specific breakout patterns that preceded the new high.

2) Supply constraints and coins off exchanges.

A significant portion of circulating BTC is now held in long-term addresses or in custody for ETFs and institutions, reducing available sell-side liquidity on exchanges and amplifying price moves when demand surges.

3) Derivatives positioning and funding rates.

Elevated call-option open interest and positive futures funding rates indicate optimistic leverage and hedging positioning; these conditions can accelerate rallies but also amplify short-term corrections.

Technical levels and indicators to monitor

| Area |

Level / indicator |

Why it matters |

| Near-term support |

$107,000 (initial); $92,000 (secondary) |

Analysts cited these as support zones to watch after the breakout. |

| Short-term resistance |

$140,000–$160,000 (psychological / projection) |

Momentum targets and trend extensions point to higher brackets if demand persists. |

| On-chain supply |

% of supply on exchanges |

Low exchange supply supports tighter markets and larger moves on inflows. |

Why ETFs matter for Bitcoin price

1) Direct spot demand:

Spot ETFs buy actual BTC to back shares; this creates sustained, mechanical net demand whenever new ETF capital arrives.

2) Broadening investor base:

ETFs make Bitcoin accessible to traditional asset allocators and retirement vehicles, increasing the potential buyer pool.

3) Liquidity transformation:

ETF purchases shift BTC from retail order books into custody, reducing the pool of coins that can be sold quickly.

Risks and countervailing forces behind Bitcoin price

Practical outlook — what to watch next

Serialised checklist for traders and investors:

ETF flow data (daily): continuing inflows are the clearest bullish structural signal.

Macro calendar: central-bank comments, US employment / CPI prints and any fiscal shocks that affect the dollar.

On-chain accumulation: net withdrawals from exchanges and long-term holder metrics.

Derivatives signals: funding rates, open interest and options skew (risk of short squeezes or gamma squeezes).

Key technical supports: $107k, $92k (illustrative) — a break of these would reduce the odds of an immediate continuation.

Frequently asked questions

Q1: Is this the start of a new multi-year bull market?

It is possible: the structural element of sustained ETF demand plus institutional accumulation makes the scenario plausible.

That said, market cycles require continued capital flows and supportive macro fundamentals; a single peak is necessary but not sufficient.

Q2: How important are ETF inflows to the price move?

Very important. Spot ETF purchases create direct, recurring demand for BTC and have been a primary driver of the recent advance.

Q3: Should retail investors buy after an all-time high?

Buying at a fresh ATH increases short-term risk of a pullback. Consider dollar-cost averaging, position sizing and clear stop rules rather than large lump-sum entries.

Q4: What macro signals could invalidate the rally?

A resilient US dollar, unexpected rate hikes, or a quick reversal in ETF flows would be among the clearest negative signals.

Q5: Which indicators are most useful to follow now?

ETF daily flows, net exchange flows (withdrawals), futures funding rates, open interest and the $107k / $92k support bands highlighted by analysts.

Conclusion

Bitcoin's new all-time high reflects a convergence of structural demand (notably spot-ETF inflows and institutional accumulation), macro drivers (dollar dynamics and risk appetite) and technical momentum.

Those elements make a renewed bull market plausible, but they do not eliminate common market risks: corrections, policy shocks and liquidity events remain very real.

Investors should combine macro awareness, flow monitoring and prudent risk management rather than assuming the new peak alone guarantees a long-term uptrend.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.