Nvidia's stock price has come under renewed scrutiny after China's State Administration for Market Regulation (SAMR) announced a preliminary finding that the company violated Chinese antitrust laws.

This news has unsettled markets, especially given Nvidia's exposure to China and the importance of that market for its data-centre, AI, and semiconductor business lines. Investors are weighing what this development means both for Nvidia's valuation and its future growth prospects.

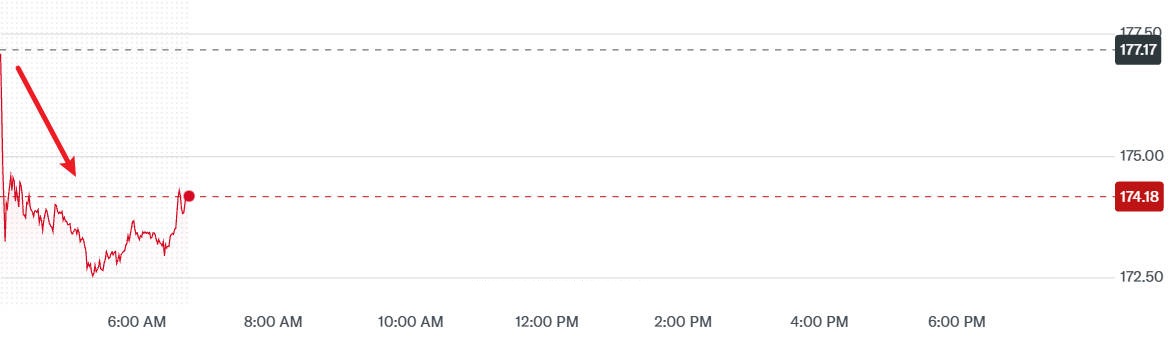

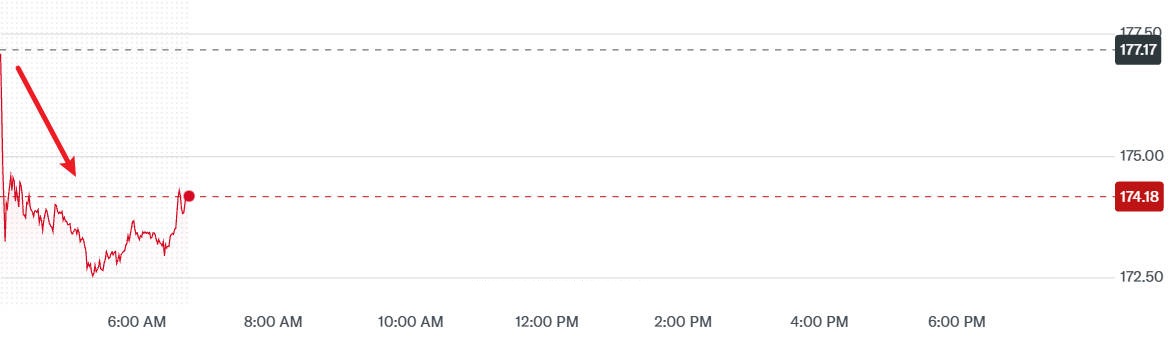

Current Stock Price and Short-Term Movement

As of the latest trading session, Nvidia (NVDA) stock is priced around USD 177.82 on Nasdaq.

The stock has seen some volatility recently. Over the preceding days, it moved between approximately USD 176 to USD 180. with a 52-week trading range spanning from ~USD 86.62 at its low up to ~USD 184.48 at the recent high.

After the SAMR announcement, Nvidia shares dropped around 2 % in pre-market or early trading, reflecting investor concern.

What China's Antitrust Finding Involves

The Chinese regulator's preliminary finding concerns Nvidia's 2020 acquisition of Mellanox Technologies. Among the issues, SAMR alleges that Nvidia may not have fully complied with the conditions imposed when the acquisition was approved in China.

The investigation by SAMR began in December 2024. The regulator has not yet published detailed findings, and a further, more formal investigation is expected.

Under Chinese law, penalties for breach of antitrust rules can range from 1% to 10% of annual revenue. This makes the potential financial risk significant.

Analyst Views and Forecasts

Despite the headwinds, analysts remain generally positive on Nvidia. The consensus price target over 12 months is around USD 208.59. implying potential upside of roughly 17 % from current trading levels (assuming prices remain near the USD 175-180 range).

Among the 57 analysts surveyed, the classifications are heavily weighted toward a "Buy" rating: many recommend buying, few are neutral or negative.

Key Risks and What to Watch

1) Regulatory Penalties and Constraints

Depending on the outcome, Nvidia could face fines, forced modifications to business practices, or restrictions on certain products or operations in China.

2) Revenue Exposure to China

China represents a substantial market. Any limitation on Nvidia's ability to sell to, partner with, or supply hardware/software in China could reduce growth projections. Investors will be watching Nvidia's disclosures for any adjustments to future revenue guidance.

3) Export Controls and Geopolitical Tensions

U.S. export regulations already restrict certain advanced chip sales to China. This antitrust finding adds another layer of uncertainty, especially in how China might respond or counter-regulate.

4) Investor Sentiment & Valuation Pressure

With the stock already priced to reflect steep growth expectations (especially in AI and data centre segments), any negative news can lead to sharp repricing. Valuation metrics (P/E, forward earnings) may come under scrutiny.

Potential Outcomes of China's Antitrust Probe on Nvidia

| Scenario |

What Could Unfold |

Impact on Nvidia Stock Price |

| Mild outcome |

Nvidia reaches a settlement with SAMR, possibly with a modest fine; compliance steps are taken; business largely continues as normal in China. |

Stock might recover quickly from the initial decline; price could stabilize near current levels with modest upside as risk premium eases. |

| Moderate outcome |

More substantial fine; restrictions on certain supply lines; possible delays or regulatory friction in selling advanced chips to China. |

Greater downside risk; investors may revise estimates for revenue growth; pressure on the stock may continue in the medium term. |

| Severe outcome |

Significant limitations imposed by Chinese regulators; major business lines curtailed; possible retaliatory trade or export control responses; broader geopolitical risk escalated. |

Heavy downside potential; sharp drop if multiple negative outcomes align; may see larger capital outflows or reluctance among investors to pay for premium growth. |

Broader Implications

This development is likely to affect not only Nvidia but also other technology and semiconductor companies with substantial exposure to China, whether directly or via supply chains.

It may prompt companies to review their compliance obligations more carefully, especially those tied to conditional approvals, trade agreements, and prior deals.

For global investors, it heightens the importance of factoring regulatory risk into growth stock valuations, especially in sectors where government policy is a major influence (e.g., AI, semiconductors).

Conclusion

China's antitrust probe has weighed on the Nvidia stock price, adding uncertainty despite bullish forecasts. Investors must now watch Nvidia's disclosures, potential guidance shifts in China, U.S.–China trade dynamics, and broader market reactions to regulatory risk.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.